From Dockyards to Global Ocean: India’s Shipbuilding Journey

Published on: December 2025

From Dockyards to Global Ocean: India’s Shipbuilding Journey

India has a strong marine base, with over 200 small ports, 12 large ports, and a 7,500-kilometre coastline, all of which promote domestic shipbuilding. India's shipbuilding industry is performing a vital role, with huge opportunities for job development, economic growth, and national defence. Shipbuilding is a capital-intensive sector that generates jobs in industries like electronics, steel, engineering, and marine equipment. A thriving domestic shipbuilding sector can support India's Blue Economy, a significant focal area under the "Make in India" and "Atmanirbhar Bharat" projects. It enhances the nation's trade balance and lessens reliance on imports. Despite these advantages, the country's share of the worldwide shipbuilding market is less than 1%, much below that of South Korea (25%), Japan (18%), and China (47%). India is still struggling to modernise its shipyards, develop its own talents, and become globally competitive.

Why shipbuilding sector booming in India?

India's maritime sector has long been a critical connection connecting the subcontinent to global trade routes, with centuries of seafaring and commerce forming its economic foundation. The shipbuilding tradition in India extends back to the Indus Valley Civilisation, with archaeological evidence from places such as Lothal (in present-day Gujarat) proving the presence of dockyards and marine trade. Lothal's dock is one of the world's oldest known tidal docks. Nowadays, there is a bright future for India's shipbuilding industry is thriving due to strong government policies, strategic geographic advantages, competitive labour prices, and increased worldwide demand for vessel replacements as green shipping evolves.

Check out some related numbers that influence the sail industry in India.

- India's marine sector is essential to its economic growth, with sea routes accounting for 95% of total trade volume.

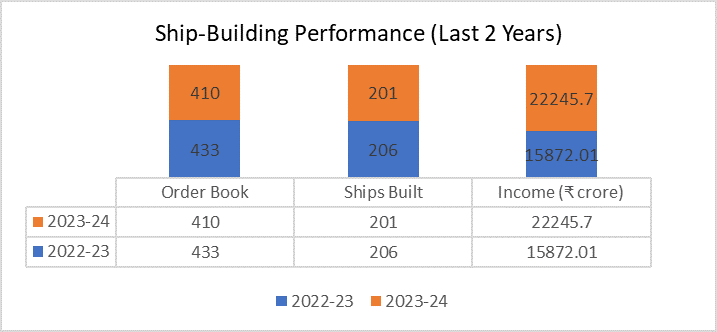

- In 2023-24, state and private industries delivered 201 ships totalling 31.97 thousand DWT.

- A total of 418 ships were repaired by commercial and public sector companies, with 227 and 191, respectively.

Resemble, Rebuild, and Reshape:

India is currently attempting to revitalise its shipbuilding sector so that it can compete on a global level due to its robust history of shipbuilding. Beyond that, India has made significant progress in the production of naval ships over the years, but commercial shipbuilding has struggled to keep up due to budgetary and technological constraints. Further, increased government support, international investment, and technological breakthroughs. Gujarat, Maharashtra, and Bengal were famed for producing large wooden ships for trade and combat. Indian shipbuilders built cutting-edge warships that were in high demand during the Middle Ages. From a strategic standpoint, shipbuilding is crucial to India's defence capabilities and maritime security because of the shifting geopolitical situation in the Indo-Pacific area. India is investing in naval modernisation and the construction of aircraft carriers, submarines, and warships to strengthen its naval fleet. India wishes to safeguard its marine trade routes and maintain a strong presence in regional waterways.

Outlook from various sources that need a strong vessel:

India constructs a diverse range of vessels, including warships, commercial ships, and specialised vessels, demonstrating its expanding shipbuilding skills. Indian shipyards have developed a wide range of ships for the offshore, commercial, and defence markets. The Indian Navy and Coast Guard require advanced warships such as frigates, corvettes, destroyers, and submarines made of indigenous steel and equipped with cutting-edge combat technologies. Concurrently, the commercial sector specialises in the construction of roll-on/roll-off (RoRo) vessels, oil tankers, bulk carriers, and container ships. Moreover, India's growing oil and gas production activities in deep-sea locations there in a greater demand for dredgers, anchor-handling tugs, and offshore support vessels.

Resemble, Rebuild, and Reshape:

Resemble:

Shipbuilding, often known as the "mother of heavy engineering," is critical in terms of job creation, investment attraction, and improving national security and strategic independence. India's shipbuilding business has a significant economic impact; each investment generates 6.4 times more jobs and returns 1.8 times more capital, demonstrating its ability to promote growth and development. This industry holds great promise for producing large-scale jobs in remote, coastal, and rural areas. The advancement of the Atmanirbhar Bharat vision is being fueled in large part by its development and promotion.

Rebuild:

India's maritime sector is the foundation of its economy. Modernisation and growth are being propelled by the Maritime India Vision 2030. The port's capacity has doubled, and operational efficiency has improved dramatically. Inland waterways and coastal shipping are also expanding significantly. Long-term goals include additional development and cost reduction.

- In September 2025, the Tamil Nadu government unveiled a ₹30,000 crore investment package aimed at transforming the state into a major shipbuilding hub. The initiative is expected to generate over 55,000 jobs, reinforcing India’s Atmanirbhar Bharat vision in maritime infrastructure and industrial growth.

- In January 2025, India and South Korea officially joined forces in shipbuilding, aiming to challenge China’s 14-year dominance in the global market. The partnership combines South Korea’s advanced engineering expertise with India’s scale, port access, and growing demand for commercial and defence vessels.

Reshape:

India's shipbuilding sector has seen recent investments, including a ₹12 lakh crore pledge at India Maritime Week 2025 (nearly 20% or ₹2.4 lakh crore for shipbuilding) and a ₹70,000 crore government package including the ₹25,000 crore Maritime Development Fund, ₹24,736 crore Shipbuilding Assistance Scheme, and ₹20,000 crore Shipbuilding Development Scheme to unlock ₹4.5 lakh crore total and build 2,500+ vessels.

Some big players in this industry:

Shipyards in the public sector

India's public shipyards are largely for defence, but they have recently moved into commercial shipbuilding.

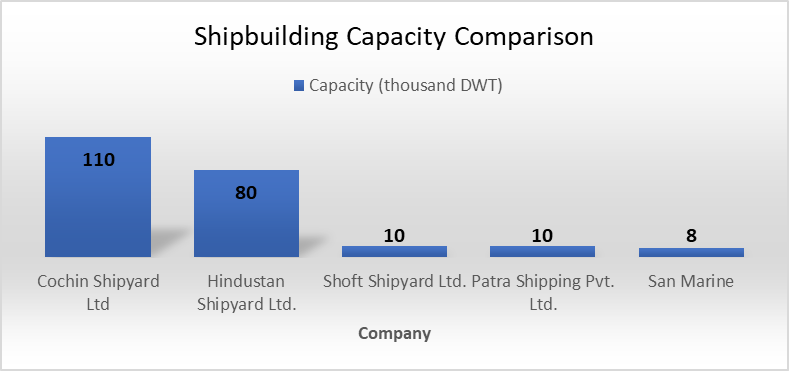

- Cochin Shipyard Limited (CSL): The largest shipyard in India, recognised for constructing commercial ships, defence vessels, and the INS Vikrant, the first indigenous aircraft carrier of India.

- Mazagaon Dock Shipbuilders Limited (MDL): Focuses on building submarines, naval vessels, and offshore patrol boats for the Indian Navy.

- Garden Reach Shipbuilders & Engineers (GRSE): Specialises in frigates, corvettes, and patrol boats, and has constructed vessels for international customers as well.

- Goa Shipyard Limited (GSL): Mainly builds offshore patrol vessels (OPVs), swift patrol boats, and interceptor boats for military services.

- Hindustan Shipyard Limited (HSL): Manages naval support ships, submarines, and repair services for vessels.

Shipyards in the private sector

The commercial shipbuilding, offshore vessels, and naval contracts have seen active participation from the private sector. Main private participants consist of:

- Larsen & Toubro (L&T Shipbuilding): Focuses on high-speed interceptors, military vessels, and offshore support ships.

- Reliance Naval and Engineering Limited (RNEL): Involved in naval and commercial ship construction, though financial challenges have affected operations.

- Shoft Shipyard and ABG Shipyard: Specialise in small boats, tugboats, and auxiliary vessels.

Future track that helps them to reach a new height:

Union Ministry of State for Ports, Shipping, and Waterways revealed India's bold initiative to seize 5% of the worldwide shipbuilding market by 2030, representing a notable advancement from its existing status. This goal will be realised through an extensive shipyard upgrade initiative, targeted investments in automation, digital twin technology, and eco-friendly shipbuilding advancements. The government intends to establish 10 top-tier shipyards by 2030, backed by public-private partnerships and international cooperation to incorporate global best practices in India. A National Shipbuilding Policy is in the works to simplify regulations, offer tax breaks, and establish a 10-year plan for growth, emphasising skill enhancement and research in autonomous and eco-friendly ships. Moreover, India intends to establish a national container shipping line by 2030 and manufacture 50% of all container vessels locally by 2035, decreasing dependence on foreign shipping firms and placing Indian shipyards at the centre of global commerce. The Maritime Development Fund will support these initiatives by financing shipyard upgrades, research and development, and workforce training, aiming to train 50,000 skilled workers by 2030.