India–UK Comprehensive Economic and Trade Agreement (CETA): A Strategic Turning Point for Bilateral Growth

Published on: December 2025

India–UK Comprehensive Economic and Trade Agreement (CETA): A Strategic Turning Point for Bilateral Growth

The signing of the India–UK Comprehensive Economic and Trade Agreement (CETA) marks a significant milestone in the economic relationship between India and the United Kingdom. After multiple negotiation rounds spanning several years, both nations concluded one of India’s most comprehensive trade agreements with a G-7 economy.

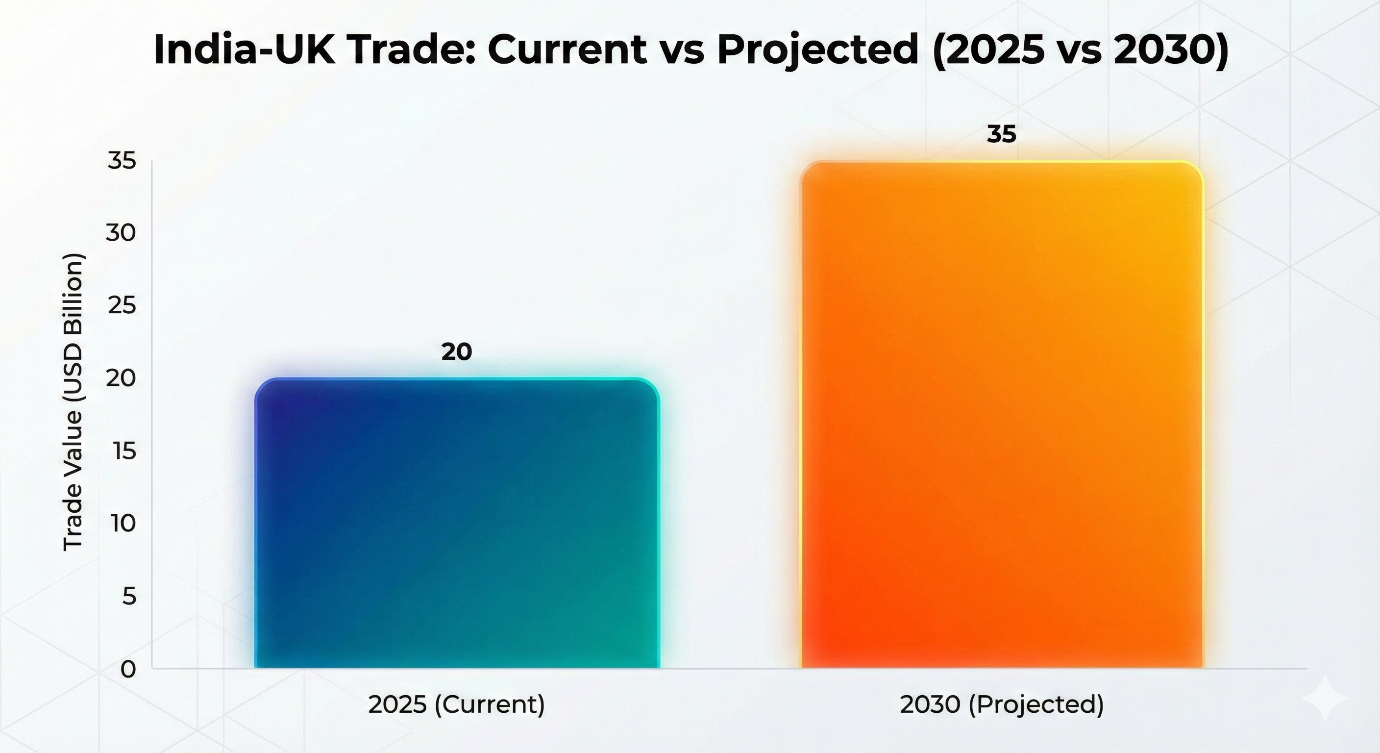

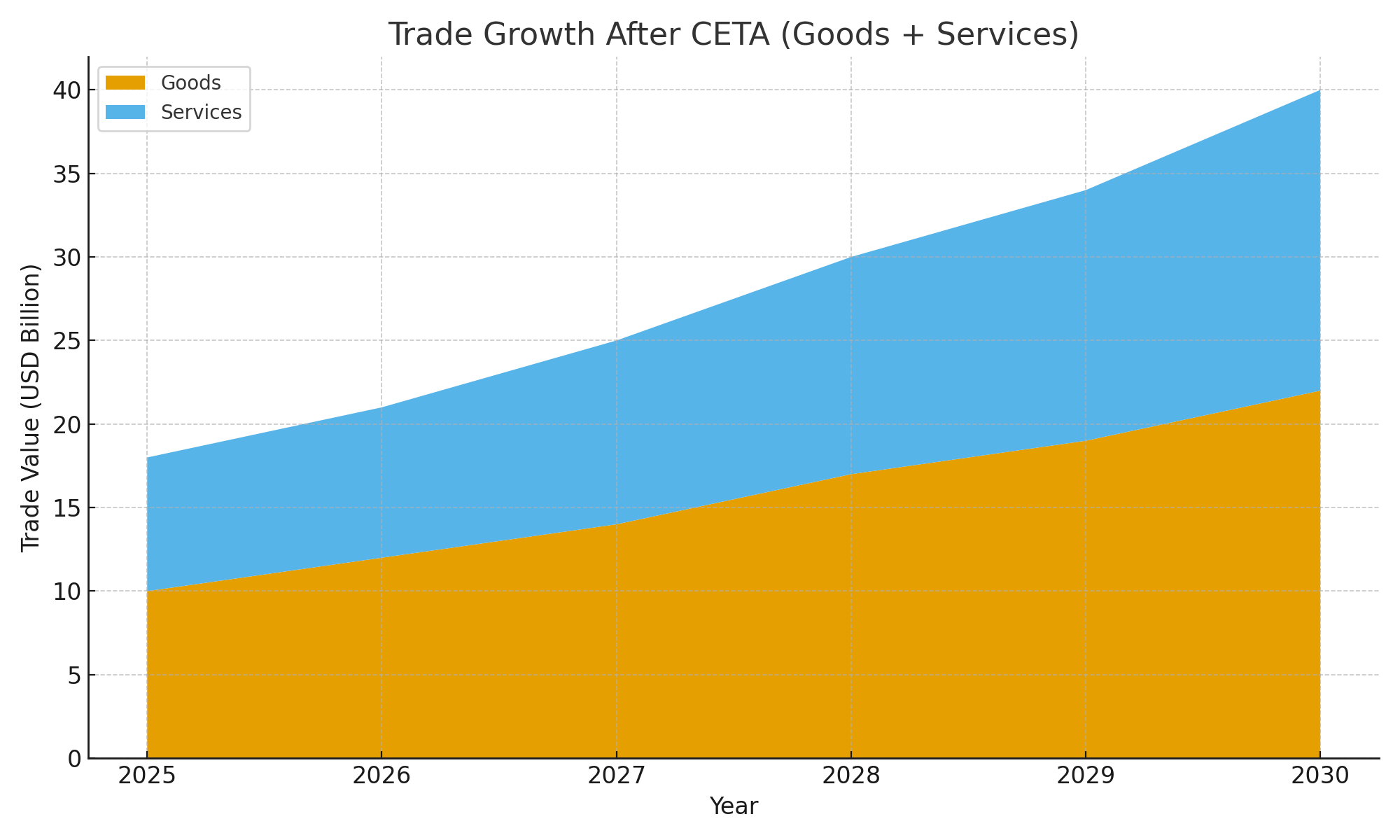

The agreement is expected to dramatically enhance bilateral trade, improve market access, increase investment flows, and strengthen sectoral cooperation. With bilateral trade valued at around USA 22.23 Billion prior to the agreement, both nations aim to expand this to over USA 120 Billion by 2030.

This blog presents a detailed analysis of the agreement, its provisions, its sector-wise impact, opportunities, challenges, and strategic implications. It is specially designed for corporate clients, exporters, investors, and policymakers.

Key Provision of CETA1. Tariff Reduction & Market Access

- The UK will eliminate duties on nearly all tariff lines over a 7-year period, covering almost all Indian exports by value.

- India will eliminate or reduce tariffs for mostUK exports over a 10-year transition.

- Major Indian export sectors textiles, apparel, gems and jewellery, pharmaceuticals, marine products, leather goods, footwear, engineering goods, and chemicals stand to gain significantly due to improved market access.

- Tariff reductions for UK goods include automobiles, electric and hybrid vehicles (under quota), spirits such as whisky and gin, and high-value manufactured goods.

2. Services Liberalisation & Mobility of Professionals

- Liberalisation across more than 100 subsectors in IT, legal services, finance, education, engineering, and professional services.

- Relaxed mobility and visa policies will allow Indian professionals engineers, chefs, educators, wellness experts, and service specialists to operate more competitively in the UK.

- Social security contribution exemptions for temporary Indian workers in the UK enhance cost competitiveness for exporters of services.

3. Modernised Trade Facilitation & Digital Trade

- Simplified customs processes, digital documentation, single-window clearance, faster release of consignments, and streamlined valuation/origin rulings.

- Digital trade provisions include legal recognition of e-signatures and e-contracts, cross-border data flow permissions, and protection for algorithms and digital IP.

- Enhanced collaboration in AI, cybersecurity, digital identity, fintech, and e-governance.

4. Intellectual Property, Government Procurement & Safeguards

- Strengthened IPR protections for patents, trademarks, and GIs supporting Indian handicrafts, textiles, food products, and specialty goods.

- Access for Indian firms to UK public-procurement contracts in goods, services, and construction.

- Safeguard mechanisms allow both countries to impose anti-dumping or countervailing duties in case of unfair trade practices

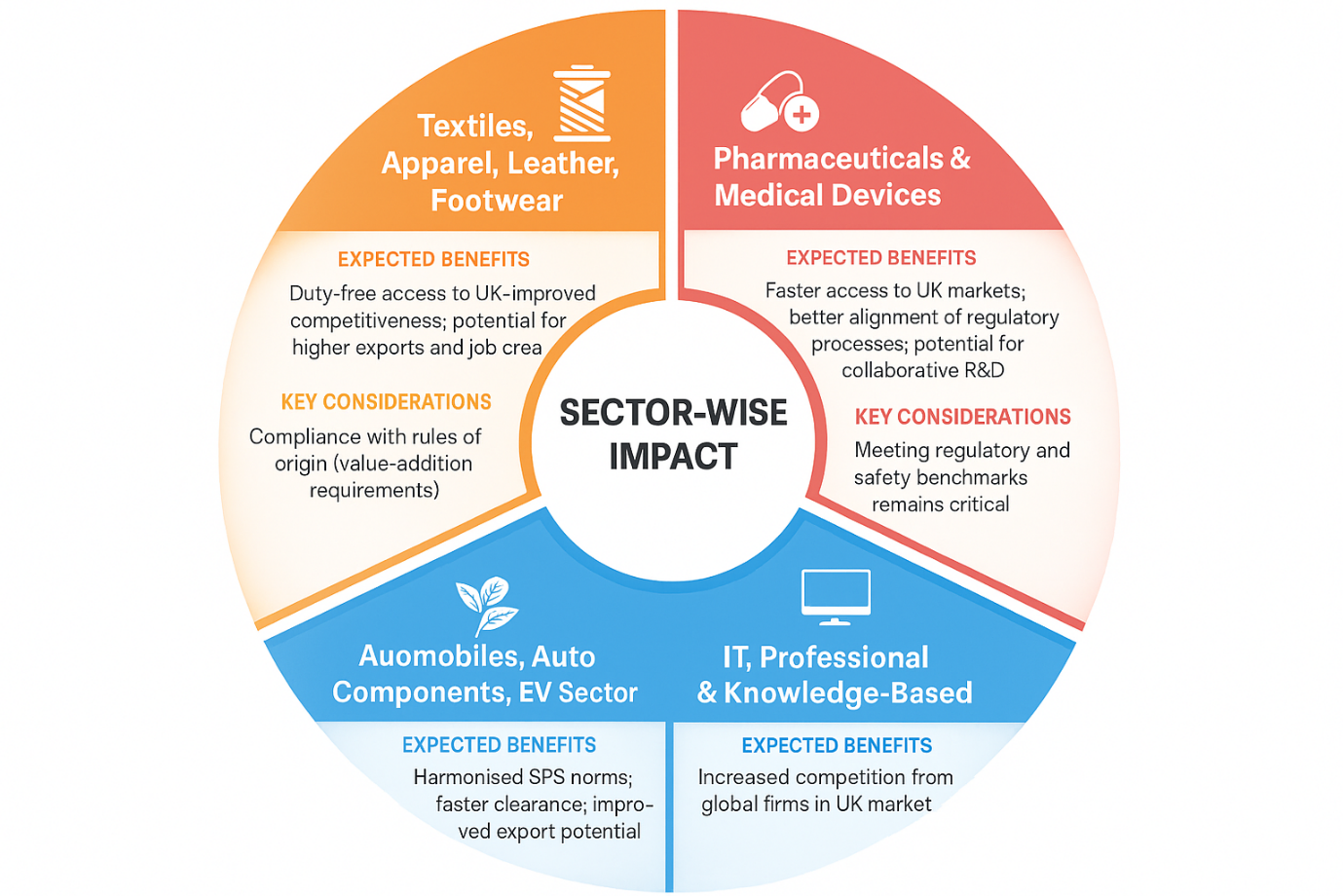

Sector-Wise Impact Assessment

|

Sector |

Expected Benefits |

Key Considerations |

|

Textiles, Apparel, Leather, Footwear |

Duty-free access to UK; improved competitiveness; potential for higher exports and job creation. |

Compliance with rules of origin (value-addition requirements). |

|

Gems & Jewellery, Handicrafts |

Tariff elimination boosts export competitiveness; scope for doubling export volume. |

Need strict adherence to labelling, authenticity and quality standards. |

|

Pharmaceuticals & Medical Devices |

Faster access to UK markets; better alignment of regulatory processes; potential for collaborative R&D. |

Meeting regulatory and safety benchmarks remains critical. |

|

Automobiles, Auto Components, EV Sector |

Export growth potential for Indian components; opportunities for EV technology transfer. |

Competition from imported UK vehicles in premium segment. |

|

Agriculture & Processed Foods |

Harmonised SPS norms; faster clearance; improved export potential for rice, fruits, vegetables, and seafood. |

High compliance and certification costs for exporters. |

|

IT, Professional & Knowledge-Based Services |

Easier market entry; simplified mobility; enhanced opportunities in consulting, IT, finance, education. |

Increased competition from global firms in UK market. |

|

MSMEs, Artisans & Startups |

Access to global value chains; better branding through IPR and GI recognition. |

Need substantial support for documentation, quality, and export processes. |

Macroeconomic & Strategic Implications

1. Employment Generation & MSME Empowerment

Duty-free access for labour-intensive sectors like textiles, leather, footwear, handicrafts, and jewellery is expected to generate significant employment. MSMEs and artisan clusters may experience accelerated growth due to improved access to UK markets.

2. Enhancing Export Competitiveness

With almost all Indian goods gaining tariff-free entry into the UK, Indian products become more price-competitive, potentially elevating India’s position as a global manufacturing and export hub.

3. Boost to Investments and Technology Transfer

Reduced trade barriers, improved services access, and strong IPR protections can attract substantial UK investments in Indian manufacturing, EV technologies, clean energy, pharmaceuticals, and engineering sectors.

4. Strengthening Strategic Partnership

Beyond economic cooperation, the agreement deepens strategic ties in areas such as clean energy, digital governance, life sciences, and technological innovation.

5. Positive Impact on GDP & Foreign Exchange

A projected increase in bilateral trade to over US$ 120 billion can contribute significantly to India’s economic growth, foreign exchange earnings, and long-term developmental objectives.

Challenges and Risks

Despite its strong potential, CETA brings several challenges:

1. Compliance with Rules of Origin

Exporters must meet regional value-content requirements to qualify for tariff benefits. Firms relying on imported components may require supply-chain restructuring.

2. Quality and Capacity Limitations for MSMEs

Small businesses may struggle with global standards, certification costs, and documentation burdens, limiting their ability to fully benefit.

3. Competitive Pressure on Domestic Industries

Lowered barriers for UK imports—especially high-end consumer goods and automobiles—may create competitive challenges for Indian manufacturers.

4. Non-Tariff Barriers

Even with tariff reductions, meeting SPS standards, technical regulations, packaging norms, and certification processes remains costly and complex.

5. Environmental & Carbon Compliance Risks

Future carbon-border mechanisms and environmental standards could affect exports of carbon-intensive goods like steel, cement, and aluminium.

What CETA Means for Indian Businesses — A Client-Centric View

Manufacturers & Exporters

- Assess supply chains for eligibility under rules of origin.

- Strengthen quality, packaging, and certification compliance.

- Explore high-growth sectors like apparel, leather, pharma, and engineering.

Service Providers

- Capitalise on easier mobility and expanded UK market access.

- Develop partnerships and UK presence for consulting, IT, finance, and education services.

Agri-Food Exporters

- Align with SPS norms; invest in cold-chain, testing, and certification.

- Focus on high-demand products like basmati rice, fruits, vegetables, and processed foods.

Investors

- Evaluate emerging opportunities in pharmaceuticals, EVs, clean energy, food processing, and digital services.

- Consider joint ventures or technology-transfer partnerships.

MSMEs & Artisan Clusters

- Leverage GI protections, branding, and e-commerce platforms.

- Form export consortiums to reduce per-unit compliance costs.

Conclusion

The India–UK Comprehensive Economic and Trade Agreement is a transformative framework that reshapes bilateral economic relations and positions both nations for robust long-term growth. While the agreement offers significant opportunities across goods, services, investments, and digital trade, the ultimate benefits will depend on how effectively Indian businesses align with global standards and prepare for compliance.

For exporters, manufacturers, service providers, investors, and policymakers, this agreement opens unprecedented opportunities but also demands strategic planning, operational readiness, and investment in quality and compliance. Businesses that act early and adapt quickly are likely to benefit the most from this historic partnership.