Global 3D Dental Scanners Market

Global 3D Dental Scanners Market Size, Share, and COVID-19 Impact Analysis, By Product (Intraoral Scanners (IOS), Desktop / Laboratory Scanners, Cone Beam Computed Tomography (CBCT Scanners)), By Technology (Structured Light Scanners, Laser Scanners, Photogrammetry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

3D Dental Scanners Market Summary

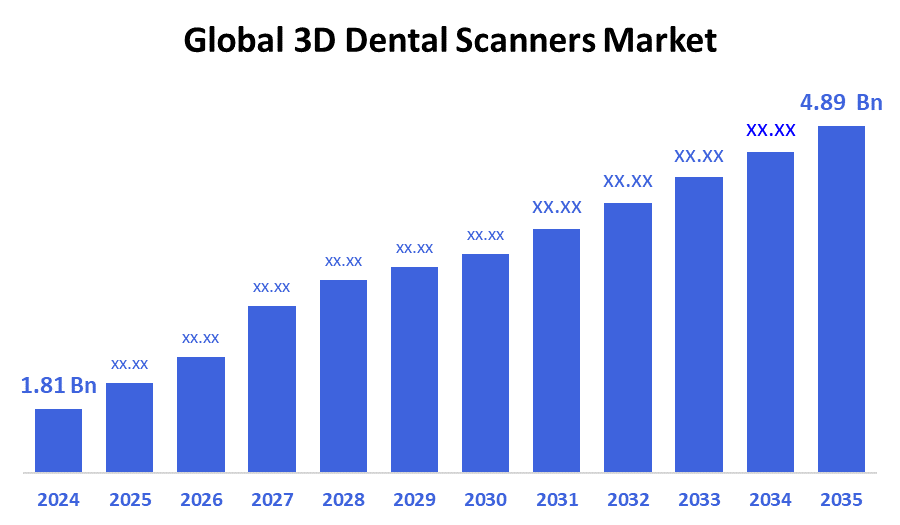

The Global 3D Dental Scanners Market Size Was Estimated at USD 1.81 Billion in 2024 and is Projected to Reach USD 4.89 Billion by 2035, Growing at a CAGR of 9.46% from 2025 to 2035. The market for 3D dental scanners is growing as a result of a number of factors, including the rise in dental problems, the need for digital dentistry, the development of CAD/CAM technology, patients' desire for non-invasive procedures, and the expansion of dental healthcare infrastructure globally.

Key Regional and Segment-Wise Insights

- In 2024, North America held the greatest revenue share of 37.4% in the market for 3D dental scanners.

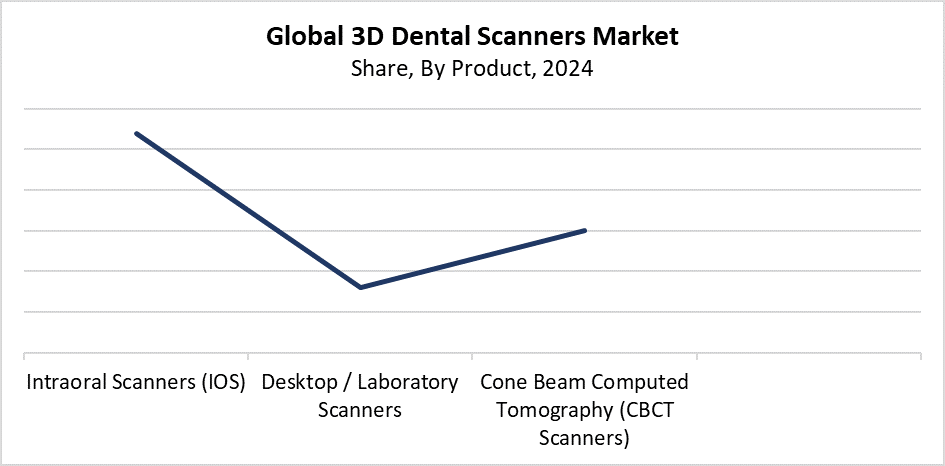

- In 2024, the intraoral scanners (IOS) segment had the highest revenue share of 54.32% and led the market by product.

- In 2024, the structured light scanners segment had the highest revenue share of 45.73% and led the market by technology.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.81 Billion

- 2035 Projected Market Size: USD 4.89 Billion

- CAGR (2025-2035): 9.46%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The 3D dental scanner market functions as a specialized industry that designs and sells advanced scanning instruments that generate highly accurate three-dimensional dental anatomy images. Modern dental practice depends on these scanners to deliver precise diagnoses while creating treatment plans and manufacturing dental prosthetics such as implants, along with crowns and bridges. Rising dental issues alongside growing digital dentistry adoption and expanding CAD/CAM technology implementation serve as primary factors that drive this market. The market grows substantially because dental facilities require faster, more exact and patient-friendly dental impressions, and because dental care infrastructure expands around the world.

The dental scanner market continues to evolve rapidly because of intraoral scanners, which deliver enhanced accuracy together with user-friendly features and improved patient comfort. The integration between CAD/CAM systems and scanning operations creates an efficient workflow that starts from digital scanning and leads directly to production. Wireless and portable scanners have expanded accessibility within dental offices because of their recent market introduction. Government initiatives promoting digital healthcare, along with product safety and quality regulations, have become key drivers for market expansion. Multiple factors unite to push forward continuous innovation while expanding worldwide adoption of 3D dental scanners.

Product Insights

What Factors Enabled the Intraoral Scanners (IOS) Segment to Lead the 3D Dental Scanners Market with a 54.32% Revenue Share in 2024?

In 2024, the intraoral scanners (IOS) segment led the 3D dental scanners market with the largest revenue share of 54.32%. The leading position of IOS stems from its ability to generate high-precision digital dental impressions through quick and comfortable procedures performed inside patients' mouths. Dental practitioners value these devices because they offer easy operation and improved patient comfort, and they integrate smoothly with CAD/CAM systems to produce precise dental restoration results. The rising acceptance of IOS systems receives additional momentum from technological upgrades, which focus on better wireless functionality and enhanced imaging quality. The intraoral scanners segment maintains its leading market position in 3D dental scanners due to rising patient preference for minimally invasive dental care and the adoption of digital clinical workflows.

The cone beam computed tomography (CBCT) scanner segment of the 3D dental scanners market is anticipated to experience substantial growth during the forecast period. The expansion of CBCT scanners stems from their ability to generate high-resolution three-dimensional images of soft oral tissues alongside bones and anatomical structures. Precise diagnosis and intricate treatment planning depend heavily on this imaging technique, especially within orthodontics and implantology practices. The expanding use of CBCT scanners results from surgeons needing precise imaging solutions that enhance their procedures while decreasing patient recovery times. Modern technology has lowered patient exposure to radiation while boosting image quality, thus making CBCT scanners both safer and more widely available. The segment's rapid growth emerges from increased funding for modern dental technology alongside dental experts' rising understanding of 3D imaging benefits.

Technology Insights

How Did the Structured Light Scanners Segment Achieve the Largest Revenue Share in the 3D Dental Scanners Market in 2024?

The structured light scanners segment led the 3D dental scanners market with the largest revenue share of 45.73% in 2024. This particular technology stands out because of its remarkable precision, together with rapid scan times and its ability to generate exact 3D images without causing patient discomfort. The digital dental surface receives light patterns from structured light scanners before the system tracks pattern deformation for model accuracy. These scanners deliver outstanding performance in dental procedures through their precise work and efficient operations, which make them suitable for implantology and orthodontics, and prosthodontics. The market leadership of this segment strengthens because of continuous developments in structured light technology that enhance both resolution and portability, which dental clinics actively adopt.

During the upcoming forecast period laser scanners segment within the 3D dental scanners market is anticipated to experience the fastest growth rate. Laser scanner technology experiences rapid expansion because it delivers precise measurements along with detailed dental anatomical data essential for advanced dental procedures. The dental industry embraces laser scanners more frequently because this technology provides non-invasive scanning, together with fast data acquisition and compatibility with digital workflows. The adoption of laser scanning technology continues to expand because manufacturers have enhanced its speed and precision and simplified its operation. Laser scanner market growth will accelerate because dental professionals seek improved, precise imaging systems for their practices.

Regional Insights

North America held the largest revenue share of 37.4% in 2024 and dominated the 3D dental scanner market. The established dental care infrastructure and major market participant base, and advanced digital technology adoption in this region establish its market leadership position. The market experiences growth because of the high number of dental procedures combined with growing awareness about oral health and the rising popularity of cosmetic dentistry. The region maintains its market leadership because clinics and hospitals invest heavily in dental technology and benefit from favorable reimbursement programs. Digital dentistry finds its innovation hub in North America, where the United States stands at the forefront because it introduced CAD/CAM systems and 3D imaging technologies first.

Europe 3D Dental Scanners Market Trends

The European 3D dental scanners market continues to grow because of rising needs for accurate non-invasive diagnostic tools and digital dentistry implementation. The market growth stems from technological advancements in CAD/CAM systems, increasing cosmetic and restorative dental procedures, and better awareness about oral care. European countries dedicate resources to upgrading dental labs and clinics, which drives the adoption of 3D scanning technology. The rise in adoption occurs because health authorities give regulatory backing, and patient outcome improvement stands as the primary focus. The existence of established dental equipment manufacturers together with professional dental teams enables both market accessibility and innovative developments. Europe stands as a key expanding market for 3D dental scanners throughout the worldwide industry.

Asia Pacific 3D Dental Scanners Market Trends

The Asia Pacific 3D dental scanners market is anticipated to grow at the fastest CAGR throughout the forecast period because of expanding healthcare facilities, combined with rising dental knowledge and digital technology adoption in dentistry. The expanding middle-income bracket, together with rising consumer spending, along with rising dental, cosmetic, and restorative procedures, fuels the expanding need for advanced dental imaging solutions across China, India, and Japan. The market expansion results from governmental initiatives that focus on digital health development, together with better oral healthcare services. Product availability improves because of low-cost manufacturing centers alongside growing foreign firm investments. The combination of these market drivers positions Asia Pacific as the leading region for 3D dental scanner market growth.

Key 3D Dental Scanners Companies:

The following are the leading companies in the 3D dental scanners market. These companies collectively hold the largest market share and dictate industry trends.

- Midmark Corporation

- Institut Straumann AG

- KaVo Dental

- 3Shape A/S

- MEDIT Corp.

- Amann Girrbach AG

- Condor Technologies NV

- Planmeca

- SHINING 3D

- Dentsply Sirona

- densys Ltd

- VATECH Networks

- Others

Recent Developments

- In June 2025, EinScan Rigil, a Tri-Mode 3D scanner with integrated computer, wireless capability, and hybrid light technology, was introduced by SHINING 3D. This gadget offers three work modes and an integrated wireless workflow.

- In October 2024, Align Technology unveiled the new features of its iTero Intraoral Scanner. In general dentistry clinics, this solution enhances digital dentistry workflows and incorporates restorative, oral health, and orthopaedic treatment alternatives.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. decision Advisors has segmented the 3D dental scanners market based on the below-mentioned segments:

Global 3D Dental Scanners Market, By Product

- Intraoral Scanners (IOS)

- Desktop / Laboratory Scanners

- Cone Beam Computed Tomography (CBCT Scanners)

Global 3D Dental Scanners Market, By Technology

- Structured Light Scanners

- Laser Scanners

- Photogrammetry

Global 3D Dental Scanners Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 245 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |