Global Acute Myeloid Leukaemia (AML) Market

Global Acute Myeloid Leukemia (AML) Market Size, Share, and COVID-19 Impact Analysis, By Disease (Myeloblastic Leukemia, Myelomonocytic Leukemia, Promyelocytic Leukemia, Monocytic Leukemia, and Other Leukemia Types), By Treatment (Chemotherapy, Targeted Therapy, Immunotherapy, and Other Treatment Types), By Route of Administration (Oral, and Parenteral), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Acute Myeloid Leukaemia (AML) Market Size Insights Forecasts to 2035

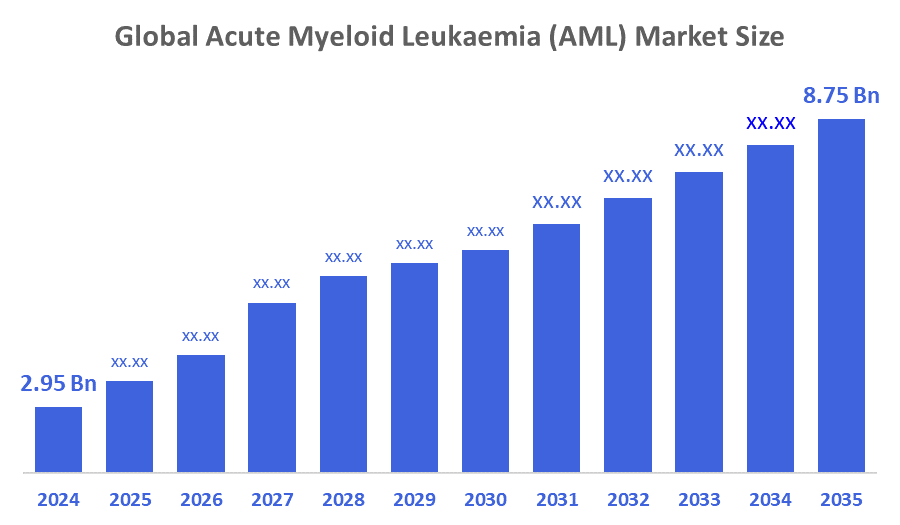

- The Global Acute Myeloid Leukemia (AML) Market Size Was Estimated at USD 2.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.39% from 2025 to 2035

- The Worldwide Acute Myeloid Leukemia (AML) Market Size is Expected to Reach USD 8.75 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Acute Myeloid Leukaemia (AML) Market Size was worth around USD 2.95 Billion in 2024 and is predicted to Grow to around USD 8.75 Billion by 2035 with a compound annual growth rate (CAGR) of 10.39% from 2025 to 2035. High market growth is largely associated with the following factors, such as the advancement in research and technology, as well as the increased number of government initiatives and policies leading to early diagnosis, together with the implementation of screening programs. Moreover, the increasing prevalence of acute myeloid leukaemia (AML) is a substantial factor that is propelling the market to grow.

Market Overview

The global sector dedicated to the development, marketing, and distribution of therapies, tests, and supportive care options for AML patients is known as the acute myeloid leukaemia (AML) market. Acute Myeloid Leukaemia (AML) is a blood and bone marrow cancer. It is among the cancers that are caused due to the increased division of immature myeloid cells. Myeloid cells are cells that, when fully developed, become red blood cells, white blood cells, or platelets. In the case of AML, proliferation of these immature cells occurs in the bone marrow, leading to a shortage of normal blood cells.

The disease affects mainly the bone marrow and white blood cells (WBCs). Some of its symptoms include discolouration of the skin, shortness of breath, tiredness, high body temperature, weight loss, bleeding from the gums, and nosebleeds. Thus, these drugs are mostly accompanied by stem cell transplants, which are done to increase the effectiveness of the drugs, alleviate the side effects and strengthen the body's immune system.

A $13 million grant was awarded to the University of Virginia (UVA) research team to lead a national, multi-institutional study aimed at developing new therapies for Acute Myeloid Leukaemia (AML), the deadliest form of leukaemia.

CHARM Therapeutics secured $80 million in an oversubscribed Series B round to advance its AI-designed menin inhibitor into clinical development for Acute Myeloid Leukaemia (AML), with trials expected to begin in early 2026.

AvenCell Therapeutics raised $112 million in Series B financing to accelerate clinical development of its universal, switchable CAR-T cell therapy platform, with a strong focus on Acute Myeloid Leukaemia (AML).

Report Coverage

This research report categorises the acute myeloid leukemia (AML) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the acute myeloid leukemia (AML) market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the acute myeloid leukemia (AML) market.

Driving Factors

Surging government initiatives and policies have been instrumental in the growth of the acute myeloid leukaemia market. Besides that, increased government funding for medical research, including that for acute myeloid leukaemia, is one of the major factors leading to the advancement of the molecular basis of AML, which in turn supports the development of novel drugs and treatment modalities. The plan involves medical facilities, equipment, and the training of healthcare professionals. Globally, the growing incidence of leukaemia is a major contributor to the expanding market. In addition, the increasing elderly population, which is at a higher risk of such diseases, is likewise contributing to the market growth. Acute myeloid leukaemia (AML) is largely a result of genetic mutations in the body that affect the production of blood cells. Along with this, the use of combination and targeted therapies has become more popular, and there is more awareness about the different options for cancer treatment, which are also helping the market to grow.

In 2023, the National Cancer Institute (NCI) granted Ohio State University and New York University a total of USD 43.3 million to develop precision oncology strategies for AML treatment by identifying genetic variants and other genomic factors.

Restraining Factors

The high cost of treatment for AML, which is largely due to expensive targeted therapies, chemotherapy, and supportive care, places substantial financial burdens on both patients and healthcare systems. Limited insurance coverage and the challenges of reimbursement make the situation worse in terms of affordability, particularly in developing regions. These obstacles prevent access to innovative therapies, thus increasing healthcare inequities and limiting the total market growth.

Market Segmentation

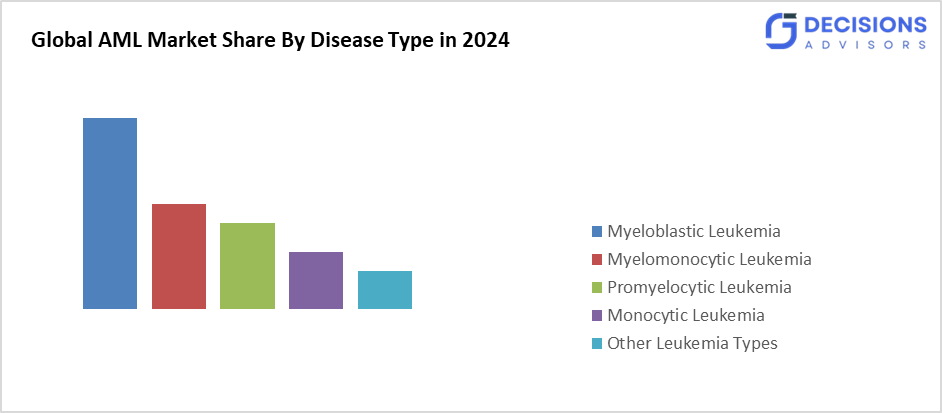

The acute myeloid leukaemia (AML) market share is classified into disease, treatment, and route of administration.

- The myeloblastic leukaemia segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the disease, the acute myeloid leukaemia (AML) market is differentiated into myeloblastic leukaemia, myelomonocytic leukaemia, promyelocytic leukaemia, monocytic leukaemia, and other leukaemia type. Among these, the myeloblastic leukaemia segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The myeloblastic leukaemia is a blood malignancy characterised by an exponential growth of immature myeloid cells in the bone marrow. As a result, they build up in the bone marrow and obstruct the development of healthy blood cells. Symptoms of myeloblastic leukaemia include weakness, exhaustion, easy bleeding or bruising, and heightened vulnerability to infections.

- The chemotherapy segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the treatment, the acute myeloid leukaemia (AML) market is segmented into chemotherapy, targeted therapy, immunotherapy, and other treatment type. Among these, the chemotherapy segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The chemotherapy section includes a variety of drugs that are given orally, intravenously, and subcutaneously, such as anthracyclines, cytarabine, and hypomethylating medications. Moreover, to induce remission and extend survival in individuals with AML, chemotherapy entails the injection of cytotoxic medicines to destroy rapidly dividing cancer cells.

- The parenteral segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the route of administration, the acute myeloid leukaemia (AML) market is classified into oral and parenteral. Among these, the parenteral segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Patients can self-administer drugs at home or in outpatient settings with the use of oral chemotherapeutic agents, targeted therapies, and maintenance medications. This strategy lessens the strain on healthcare infrastructure and resources related to hospital-based therapies while improving patient autonomy and quality of life.

Regional Segment Analysis of the Acute Myeloid Leukaemia (AML) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the acute myeloid leukemia (AML) market over the predicted timeframe.

Asia Pacific is projected to hold the largest share of the acute myeloid leukemia (AML) market over the predicted timeframe. The region exhibits different trends in the treatment of AML, which are largely influenced by economic factors, the regulatory environment, and cultural aspects. Regulators in the Asia Pacific region are also making efforts to simplify the approval processes for new drugs in order to shorten the time from the lab to the clinic.

For instance, in China and Japan, the need for novel therapies is rising as a result of a higher number of AML cases and better healthcare infrastructure. For example, Nippon Shinyaku introduced Vyxeos Combination for IV injection in Japan in May 2024 after receiving marketing permission from the Ministry of Health, Labour, and Welfare for the treatment of high-risk AML.

North America is expected to grow at a rapid CAGR in the acute myeloid leukemia (AML) market during the forecast period. This can be attributed to a number of factors including high healthcare spending, an excellent research infrastructure, and the provision of reimbursement policies that are very favourable to patients. Every year, around 11,400 people in the United States lose their lives to AML, which makes it imperative to come up with new therapies. Consequently, there has been a rise in the regulatory level approval of novel therapeutics used in the treatment of AML. As an example, in July 2023, the FDA gave the green light for the use of quizartinib (Vanflyta) together with chemotherapy as the primary treatment for AML patients carrying a specific genetic mutation called FLT3.

The FDA recently approved ziftomenib (Komzifti, Kura Oncology) as a new targeted therapy for relapsed or refractory Acute Myeloid Leukaemia (AML) with NPM1 mutations, marking a major advance in precision oncology for this aggressive blood cancer.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the acute myeloid leukemia (AML) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- Agilent Technologies, Inc.

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Illumina, Inc.

- Merck KGAA

- Myriad Genetics, Inc.

- QIAGEN

- Quest Diagnostics Incorporated.

- Siemens Healthcare GmbH

- Thermo Fisher Scientific, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Flashpoint Therapeutics published new preclinical data showing its structural nanomedicine platform delivers superior anti-leukaemia efficacy, selectively targeting AML cells with improved safety. a promising novel strategy for AML that may change the therapeutic landscape by fusing enhanced safety with tailored efficacy.

- In October 2025, the FDA approved Syndax’s Revuforj (revumenib), a menin inhibitor, for adult and pediatric patients (≥1 year) with relapsed or refractory Acute Myeloid Leukaemia (AML) harbouring an NPM1 mutation. This marks the first and only FDA-approved therapy for this patient population, significantly expanding treatment options.

- In March 2025, Pacylex Pharmaceuticals announced that the first Acute Myeloid Leukaemia (AML) patient had been dosed with zelenirstat in a new Phase 1/2 clinical trial, marking a major milestone for this first-in-class therapy. Pacylex possesses 27 more powerful NTMs that could be used as payloads in antibody drug conjugates (ADCs) to treat solid tumour malignancies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the acute myeloid leukemia (AML) market based on the below-mentioned segments:

Global Acute Myeloid Leukaemia (AML) Market, By Disease

- Myeloblastic Leukaemia

- Myelomonocytic Leukaemia

- Promyelocytic Leukaemia

- Monocytic Leukemia

- Other Leukaemia Type

Global Acute Myeloid Leukaemia (AML) Market, By Treatment

- Chemotherapy

- Targeted Therapy

- Immunotherapy

- Other Treatment Type

Global Acute Myeloid Leukaemia (AML) Market, By Route of Administration

- Oral

- Parenteral

Global Acute Myeloid Leukaemia (AML) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected size of the global AML market by 2035?

The market is expected to grow from USD 2.95 billion in 2024 to USD 8.75 billion by 2035.

- What is the CAGR for the AML market from 2025 to 2035?

The compound annual growth rate (CAGR) is 10.39% during the forecast period.

- Which region is expected to hold the largest market share?

Asia Pacific is anticipated to hold the largest share over the forecast period.

- What is the leading treatment segment in the AML market?

Chemotherapy accounted for the highest revenue in 2024 and is expected to grow significantly.

- Which disease subtype dominates the AML market?

Myeloblastic leukaemia held the largest share in 2024 and is projected to grow at a significant CAGR.

- What is the most common route of administration for AML treatments?

The parenteral route accounted for the highest revenue in 2024 and is expected to continue leading.

- What are the main drivers of AML market growth?

Key factors include government initiatives, rising AML prevalence, ageing population, and advances in targeted therapies.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Disease

- Market Attractiveness Analysis By Treatment

- Market Attractiveness Analysis By Route of Administration

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- The use of combination and targeted therapies

- Restraints

- High cost of treatment for AML

- Opportunities

- Advancement in research and technology, as well as the increased number of government initiatives

- Challenges

- Limited insurance coverage and the challenges of reimbursement

- Global Acute Myeloid Leukaemia (AML) Market Analysis and Projection, By Disease

- Segment Overview

- Myeloblastic Leukaemia

- Myelomonocytic Leukaemia

- Promyelocytic Leukaemia

- Monocytic Leukaemia

- Other Leukaemia Types

- Global Acute Myeloid Leukaemia (AML) Market Analysis and Projection, By Treatment

- Segment Overview

- Chemotherapy

- Targeted Therapy

- Immunotherapy

- Other Treatment Types

- Global Acute Myeloid Leukaemia (AML) Market Analysis and Projection, By Route of Administration

- Segment Overview

- Oral

- Parenteral

- Global Acute Myeloid Leukaemia (AML) Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Acute Myeloid Leukaemia (AML) Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Acute Myeloid Leukaemia (AML) Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Abbott

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Agilent Technologies, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BIOMÉRIEUX

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bio-Rad Laboratories, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- DiaSorin S.p.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- F. Hoffmann-La Roche Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Hologic, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Illumina, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Merck KGAA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Myriad Genetics, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- QIAGEN

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Quest Diagnostics Incorporated.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Siemens Healthcare GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Thermo Fisher Scientific, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Abbott

List of Table

- Global Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Global Myeloblastic Leukemia, Acute Myeloid Leukemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Myelomonocytic Leukemia, Acute Myeloid Leukemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Promyelocytic Leukemia, Acute Myeloid Leukemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Monocytic Leukemia, Acute Myeloid Leukemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Other Leukemia Types, Acute Myeloid Leukemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Global Chemotherapy, Acute Myeloid Leukaemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Targeted Therapy, Acute Myeloid Leukaemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Immunotherapy, Acute Myeloid Leukaemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Other Treatment Types, Acute Myeloid Leukaemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Global Oral, Acute Myeloid Leukaemia (AML) Market, By Region, 2024-2035(USD Billion)

- Global Parenteral, Acute Myeloid Leukaemia (AML) Market, By Region, 2024-2035(USD Billion)

- North America Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- North America Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- North America Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- U.S. Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- U.S. Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- U.S. Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Canada Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Canada Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Canada Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Mexico Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Mexico Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Mexico Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Europe Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Europe Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Europe Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Germany Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Germany Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Germany Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- France Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- France Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- France Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- U.K. Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- U.K. Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- U.K. Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Italy Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Italy Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Italy Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Spain Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Spain Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Spain Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Asia Pacific Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Asia Pacific Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Asia Pacific Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Japan Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Japan Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Japan Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- China Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- China Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- China Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- India Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- India Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- India Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- South America Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- South America Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- South America Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- Brazil Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- Brazil Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- Brazil Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- The Middle East and Africa Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- The Middle East and Africa Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- The Middle East and Africa Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- UAE Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- UAE Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- UAE Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

- South Africa Acute Myeloid Leukaemia (AML) Market, By Disease, 2024-2035(USD Billion)

- South Africa Acute Myeloid Leukaemia (AML) Market, By Treatment, 2024-2035(USD Billion)

- South Africa Acute Myeloid Leukaemia (AML) Market, By Route of Administration, 2024-2035(USD Billion)

List of Figures

- Global Acute Myeloid Leukaemia (AML) Market Segmentation

- Acute Myeloid Leukaemia (AML) Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Acute Myeloid Leukaemia (AML) Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Acute Myeloid Leukaemia (AML) Market

- Acute Myeloid Leukaemia (AML) Market Segmentation, By Disease

- Acute Myeloid Leukaemia (AML) Market For Myeloblastic Leukaemia, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market For Myelomonocytic Leukaemia, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market For Promyelocytic Leukaemia, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market For Monocytic Leukaemia, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market For Other Leukaemia Types, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market Segmentation, By Treatment

- Acute Myeloid Leukaemia (AML) Market For Chemotherapy, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market For Targeted Therapy, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market For Immunotherapy, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market For Other Treatment Types, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market Segmentation, By Route of Administration

- Acute Myeloid Leukaemia (AML) Market For Oral, By Region, 2024-2035 ($ Billion)

- Acute Myeloid Leukaemia (AML) Market For Parenteral, By Region, 2024-2035 ($ Billion)

- Abbott: Net Sales, 2024-2035 ($ Billion)

- Abbott: Revenue Share, By Segment, 2024 (%)

- Abbott: Revenue Share, By Region, 2024 (%)

- Agilent Technologies, Inc.: Net Sales, 2024-2035 ($ Billion)

- Agilent Technologies, Inc.: Revenue Share, By Segment, 2024 (%)

- Agilent Technologies, Inc.: Revenue Share, By Region, 2024 (%)

- BIOMÉRIEUX: Net Sales, 2024-2035 ($ Billion)

- BIOMÉRIEUX: Revenue Share, By Segment, 2024 (%)

- BIOMÉRIEUX: Revenue Share, By Region, 2024 (%)

- Bio-Rad Laboratories, Inc.: Net Sales, 2024-2035 ($ Billion)

- Bio-Rad Laboratories, Inc.: Revenue Share, By Segment, 2024 (%)

- Bio-Rad Laboratories, Inc.: Revenue Share, By Region, 2024 (%)

- DiaSorin S.p.A.: Net Sales, 2024-2035 ($ Billion)

- DiaSorin S.p.A.: Revenue Share, By Segment, 2024 (%)

- DiaSorin S.p.A.: Revenue Share, By Region, 2024 (%)

- F. Hoffmann-La Roche Ltd.: Net Sales, 2024-2035 ($ Billion)

- F. Hoffmann-La Roche Ltd.: Revenue Share, By Segment, 2024 (%)

- F. Hoffmann-La Roche Ltd.: Revenue Share, By Region, 2024 (%)

- Hologic, Inc.: Net Sales, 2024-2035 ($ Billion)

- Hologic, Inc.: Revenue Share, By Segment, 2024 (%)

- Hologic, Inc.: Revenue Share, By Region, 2024 (%)

- Illumina, Inc.: Net Sales, 2024-2035 ($ Billion)

- Illumina, Inc.: Revenue Share, By Segment, 2024 (%)

- Illumina, Inc.: Revenue Share, By Region, 2024 (%)

- Merck KGAA.: Net Sales, 2024-2035 ($ Billion)

- Merck KGAA.: Revenue Share, By Segment, 2024 (%)

- Merck KGAA.: Revenue Share, By Region, 2024 (%)

- Myriad Genetics, Inc.: Net Sales, 2024-2035 ($ Billion)

- Myriad Genetics, Inc.: Revenue Share, By Segment, 2024 (%)

- Myriad Genetics, Inc.: Revenue Share, By Region, 2024 (%)

- QIAGEN: Net Sales, 2024-2035 ($ Billion)

- QIAGEN: Revenue Share, By Segment, 2024 (%)

- QIAGEN: Revenue Share, By Region, 2024 (%)

- Quest Diagnostics Incorporated.: Net Sales, 2024-2035 ($ Billion)

- Quest Diagnostics Incorporated.: Revenue Share, By Segment, 2024 (%)

- Quest Diagnostics Incorporated.: Revenue Share, By Region, 2024 (%)

- Siemens Healthcare GmbH: Net Sales, 2024-2035 ($ Billion)

- Siemens Healthcare GmbH: Revenue Share, By Segment, 2024 (%)

- Siemens Healthcare GmbH: Revenue Share, By Region, 2024 (%)

- Thermo Fisher Scientific, Inc.: Net Sales, 2024-2035 ($ Billion)

- Thermo Fisher Scientific, Inc.: Revenue Share, By Segment, 2024 (%)

- Thermo Fisher Scientific, Inc.: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 253 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |