Global Advanced IC Substrates Market

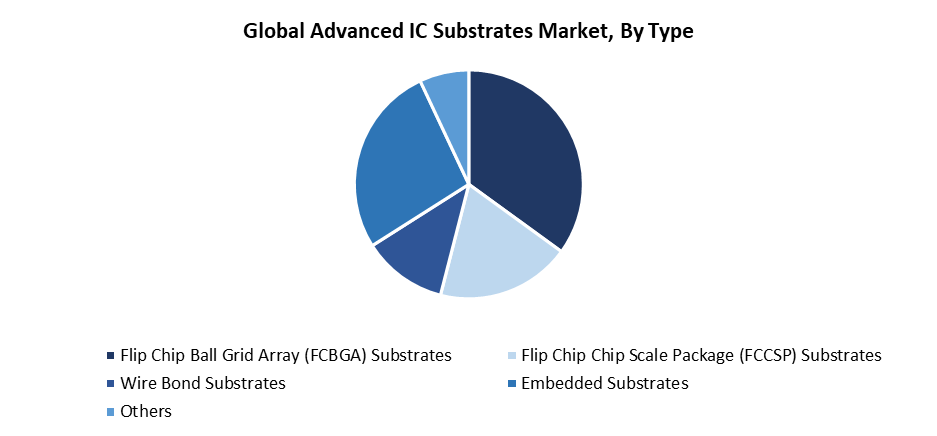

Global Advanced IC Substrates Market Size, Share, and COVID-19 Impact Analysis, By Type (Flip Chip Ball Grid Array (FCBGA) Substrates, Flip Chip Chip Scale Package (FCCSP) Substrates, Wire Bond Substrates, Embedded Substrates, Others), By Technology (High-Density Interconnect (HDI) Substrates, Build-Up Substrates, Coreless Substrates, Organic Substrates, Ceramic Substrates), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Advanced IC Substrates Market Summary

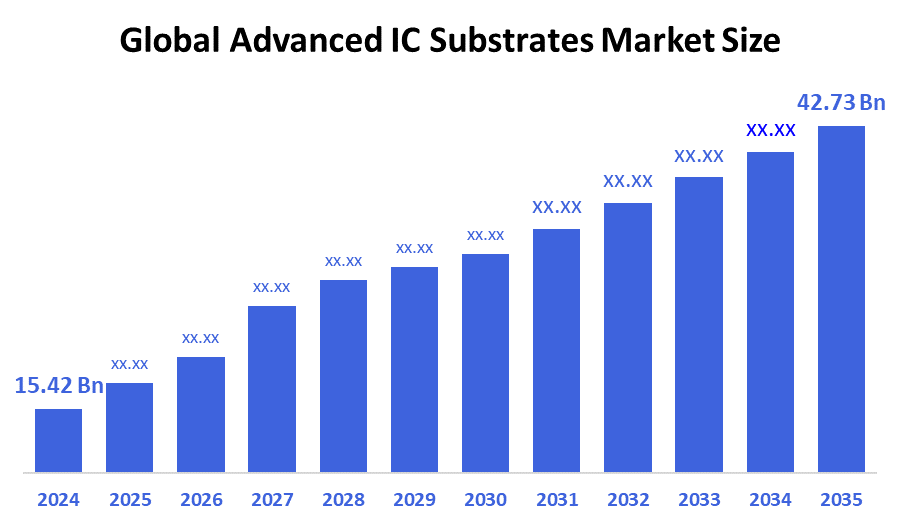

The Global Advanced IC Substrates Market Size Was Estimated at USD 15.42 Billion in 2024, and is Projected to Reach USD 42.73 Billion by 2035, Growing at a CAGR of 9.71% from 2025 to 2035. The market for advanced IC substrates is expanding quickly because of the growing need for small, high-performance electronics brought on by the spread of 5G, AI, IoT, and electric vehicles (EVs).

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 57.3% and dominated the market globally.

- In 2024, the Flip Chip Ball Grid Array (FCBGA) substrates segment had the highest market share by type, accounting for 35.2%.

- In 2024, the High-Density Interconnect (HDI) substrates segment had the biggest market share by technology.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 15.42 Billion

- 2035 Projected Market Size: USD 42.73 Billion

- CAGR (2025-2035): 9.71%

- Asia Pacific: Largest market in 2024

Advanced IC substrates serve as vital connectors for electronic devices through superior interconnect materials available in the advanced IC substrates market. The substrates serve as essential components in chip assembly by distributing power and managing heat, as well as allowing electrical signals to travel through them. Advanced packaging solutions drive fast market growth through the growing demand from AI, 5G, HPC, and automotive electronics. The market demands substrates with enhanced thermal management and improved line/space precision because chip designs now feature higher complexity alongside heterogeneous integration. Modern IC chip architectures using chiplet designs and multi-die packing practices have created growing market opportunities for sophisticated IC substrates.

The advanced IC substrate market dynamics shift rapidly as technology continues to develop. The industry develops new substrate technologies through glass-based substrates and build-up substrates, and substrate-like PCBs (SLPs) that enable smaller device sizes with enhanced signal quality and increased I/O density. Applications that require next-generation semiconductor technology need these improvements. Also, international governments support local substrate manufacturing and research and development through initiatives like the European Chips Joint Undertaking and the U.S. CHIPS Act, as well as substantial Asian investments. These initiatives work to boost domestic semiconductor networks and decrease supply chain reliance so they can speed up market growth.

Type Insights

The Flip Chip Ball Grid Array (FCBGA) substrates segment led the advanced IC substrates market with the largest revenue share of 35.2% in 2024. FCBGA substrates lead the market because their electrical performance and thermal management capabilities, along with high I/O density, make them essential for high-performance computing and data center applications as well as artificial intelligence systems. Advanced processors together with GPUs and networking devices achieve dependable connections and power delivery efficiency through the implementation of FCBGA technology. Advanced semiconductor designs find their ideal solution in this technology because it supports both large die sizes and multiple chip modules. The segment keeps its dominant market position due to leading semiconductor manufacturers who persist in using FCBGA substrates to meet their performance needs and electronic system miniaturization requirements.

The embedded substrates segment within the advanced IC substrates market is anticipated to grow at the fastest CAGR across the forecast period. The fast expansion occurs because modern electronic devices need smaller sizes and better performance in applications that include smartphones, wearables, automotive electronics, and IoT devices. Embedded substrates enable the integration of passive and active components, leading to smaller packages and enhanced signal quality and thermal management performance. These substrates perfectly fit modern chiplet designs as well as system-in-package (SiP) configurations because they enable both heterogeneous integration and high-density interconnect capabilities. The market for embedded substrate technology will experience explosive growth because sophisticated consumer and industrial products need increased functionality alongside reduced sizes.

Technology Insights

The High-Density Interconnect (HDI) substrates segment led the advanced IC substrates market during 2024. The supremacy of this segment comes mainly from the rising need for compact high-performance electronics, which serve the consumer electronics market as well as telecommunications and automotive industries. The capabilities of HDI substrates enable them to deliver smaller line spacing and higher wiring density, along with enhanced electrical properties, thus making them ideal for advanced packaging solutions that demand efficient space utilization and high-speed operation. The market experienced substantial expansion because these substrates are widely utilized in smartphones and tablets, along with high-speed computing devices. HDI substrates hold a critical role in supporting small semiconductor packages with high functionality and maintaining multi-layer interconnections as device complexity advances.

The coreless substrates segment of the advanced IC substrates market is anticipated to experience the fastest growth rate throughout the projected period. Demand for lightweight thin high-power semiconductor packages targeting wearables and mobile devices, along with high-end computing systems, drives this market expansion. Coreless substrates eliminate their traditional core layer to achieve better interconnect density while reducing signal paths, which both enhance electrical performance and provide design freedom alongside reduced warpage. The characteristics of coreless substrates make them perfect for applications that need both very thin profiles and quick signal transmission. Market analysts predict that coreless substrate technology will gain widespread adoption because device manufacturers will maintain their drive for improved performance and smaller form factors, leading to rapid market expansion.

Regional Insights

The North American market for advanced IC substrates maintained a substantial portion of worldwide revenue during 2024. The substantial group of leading semiconductor corporations, together with advanced research capabilities and increasing 5G, AI, and high-performance computing needs, drives the region's market growth. Modern packaging solutions, including flip chip and integrated substrate technologies, are gaining traction because they meet the performance and miniaturization standards set by future electronic systems. The Science Act and the U.S. CHIPS program act as government support to enhance funding for advanced substrate development while encouraging domestic semiconductor manufacturing. The various elements combine to establish North America as the leading force in the worldwide advanced IC substrate market.

Europe Advanced IC Substrates Market Trends

Europe held a significant revenue share of the advanced IC substrates market because of its strong industrial foundation, which supports industries that need dependable high-performance semiconductor elements like automotive electronics, aerospace, and industrial automation. The region's dedication to achieving technical independence and reducing foreign semiconductor supply chain dependence has led to increased investments in state-of-the-art packaging and substrate technologies. The EU Chips Act, together with other initiatives, has enabled substantial funding to establish local semiconductor manufacturing facilities and develop next-generation IC substrates through research and development programs. European research institutes together with universities and industrial partners have established collaborative partnerships that advance embedded substrate solutions and high-density interconnects, thus strengthening Europe's position in the worldwide market.

Asia Pacific Advanced IC Substrates Market Trends

The Asia Pacific advanced IC substrates market led globally with the largest revenue share of 57.3% in 2024. The region's leading semiconductor manufacturing ecosystem, together with Taiwan, South Korea, China, and Japan, fuels this market leadership. Leading foundries together with substrate suppliers and packaging firms from these countries devote substantial resources to developing flip chip and embedded and high-density interconnect (HDI) substrates. The region's expanding consumer electronics market, together with 5G infrastructure development and automotive electronics growth, and AI applications, creates robust demand for high-performance IC substrates. The global market leadership of Asia Pacific in advanced IC substrates receives additional support through progressive government policies and increased domestic research and development expenses.

Key Advanced IC Substrates Companies:

The following are the leading companies in the advanced IC substrates market. These companies collectively hold the largest market share and dictate industry trends.

- ASE TECHNOLOGY HOLDING

- SAMSUNG ELECTRO-MECHANICS

- KYOCERA Corporation

- Fujitsu

- IBIDEN

- LG Innotek

- KINSUS INTERCONNECT TECHNOLOGY CORP

- NAN YA PLASTICS CORPORATION

- AT&S Austria Technologie & Systemtechnik Aktiengesellschaft

- Unimicron

- Others

Recent Developments

- In March 2025, the International Finance Corporation (IFC), a World Bank Group organization, granted AT&S a USD 250 million sustainability-linked loan to help build its state-of-the-art IC substrate plant in Kulim, Malaysia. As a result of the loan, AT&S will have reduced its yearly greenhouse gas emissions by 31% by fiscal year 2028 as compared to its baseline in 2022. By increasing AMD's data-center CPU production, this funding will increase Southeast Asia's capacity to manufacture substrates.

- In February 2025, in Penang, Malaysia, ASE Group opened its fifth chip packaging and testing plant. The area of this new factory was increased to 3.4 million square feet. It strengthened ASE's worldwide ability to support GenAI, EV, and autonomous driving chip packaging by introducing AIoT-driven automation for yield optimization and environmental sensing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the advanced IC substrates market based on the below-mentioned segments:

Global Advanced IC Substrates Market, By Type

- Flip Chip Ball Grid Array (FCBGA) Substrates

- Flip Chip Chip Scale Package (FCCSP) Substrates

- Wire Bond Substrates

- Embedded Substrates

- Others

Global Advanced IC Substrates Market, By Technology

- High-Density Interconnect (HDI) Substrates

- Build-Up Substrates

- Coreless Substrates

- Organic Substrates

- Ceramic Substrates

Global Advanced IC Substrates Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |