Global Age-Related Macular Degeneration Market

Global Age-Related Macular Degeneration Market Size, Share, and COVID-19 Impact Analysis, By Product (Eylea, Lucentis, Beovu, Vabysmo, Syfovre, Avastin, and Others), By Disease Type (Wet AMD, and Dry AMD), By Age Group (50-64 years, 65-74 years, and 75 and above), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Age-Related Macular Degeneration Market Size Insights Forecasts to 2035

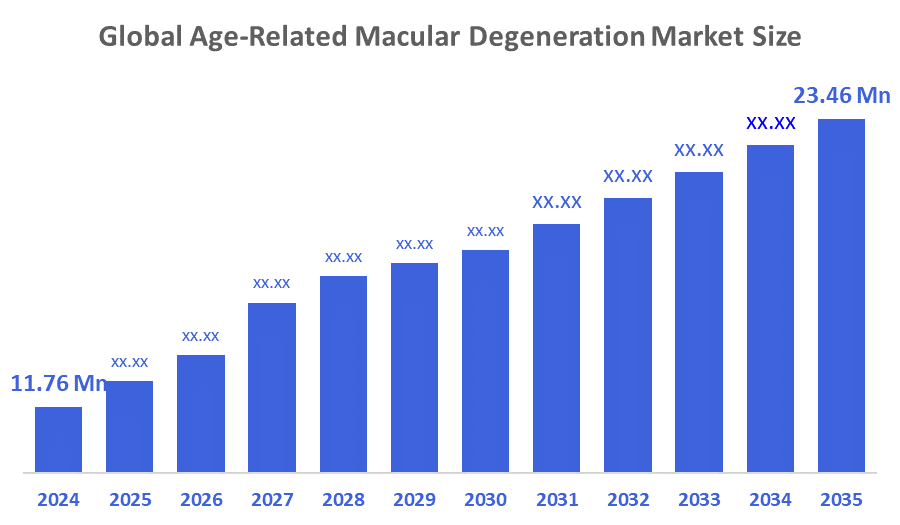

- The Global Age-Related Macular Degeneration Market Size Was Estimated at USD 11.76 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.48 % from 2025 to 2035

- The Worldwide Age-Related Macular Degeneration Market Size is Expected to Reach USD 23.46 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Age-Related Macular Degeneration Market Size was worth around USD 11.76 Million in 2024 and is predicted to Grow to around USD 23.46 Million by 2035 with a compound annual growth rate (CAGR) of 6.48 % from 2025 to 2035. The AMD market includes medicines used to treat AMD, a degenerative condition that causes central vision loss by damaging the macula, the centre of the retina. The launch of new products, a solid product pipeline, and an increase in AMD prevalence are expected to be important market drivers. Advanced medication discovery, expanded healthcare infrastructure, and strong regional government backing are driving expansion.

Market Overview

The development, commercialisation, and distribution of therapies, diagnostics, and supportive technologies targeted at preventing, slowing, or treating age-related macular degeneration (AMD), a progressive retinal disease that damages the macula and results in central vision loss, is commonly referred to as the global market for AMD. The macula, the inner portion of the retina that provides clear, central vision, is specifically damaged by the condition. Dry and moist are the two primary forms of this illness. Wet AMD can produce abrupt and severe central vision impairment, while dry AMD grows slowly and may cause mild to moderate vision loss. Individuals with the illness may have trouble reading, fuzzy or distorted central vision, black or empty patches in the middle of the visual field, trouble identifying faces, etc. A study of the patient's medical history, an ocular examination, and any underlying symptoms are usually necessary to make the diagnosis.

age-related macular degeneration (AMD), the primary cause of vision loss in older individuals, affects over 196 million people worldwide. Dry AMD is significantly more common than wet AMD, and this number includes both early-stage and late-stage cases.

In September 2025, with $100 million in Series A funding, Ollin Biosciences emerged from stealth to develop vision therapeutics and position itself for competitiveness in AMD treatments. These expenditures show how dry AMD pipelines are gaining traction in the midst of clinical developments.

In July 2025, the Retinal Disease Foundation Australia awarded more than $1 million to eight research initiatives, including gene treatments for associated retinal disorders and the prediction of AMD progression.

Report Coverage

This research report categorises the age-related macular degeneration market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the age-related macular degeneration market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the age-related macular degeneration market.

Driving Factors

The market for age-related macular degeneration (AMD) is experiencing significant growth, primarily due to the increasing global elderly population, which raises the incidence of vision impairment. Also, increasing occurrences associated with risk factors such as smoking, obesity, hypertension, and genetic vulnerabilities need treatment. Besides, progress in anti-VEGF therapies, gene therapies, and long-lasting drug delivery systems like Eylea and new biologics improves effectiveness and patient compliance. Moreover, advancements in retinal imaging, telehealth, and customised medicine utilising biomarkers facilitate quicker diagnosis and individualised treatments, driving market growth. Additionally, government programs, heightened R&D funding, and the advancement of clinical trials for innovative treatments such as stem cell implants and laser photocoagulation also drive the industry revenue.

In March 2025, Character Biosciences secured $93 million in a Series B investment to proceed with clinical studies for its precision medicine candidates, CTX203 and CTX114, for dry age-related macular degeneration (AMD). Based on an observational study of more than 6,500 AMD patients, the financing, spearheaded by aMoon and Luma Group with cooperation from Bausch + Lomb, promotes patient data-driven medicines that target disease subtypes.

Restraining Factors

The market for treatments for age-related macular degeneration (AMD) is constrained by some factors, such as high treatment costs, a lack of therapeutic options for dry AMD, difficulties with patient compliance brought on by frequent intravitreal injections, and regulatory obstacles that impede the adoption of new treatments.

Market Segmentation

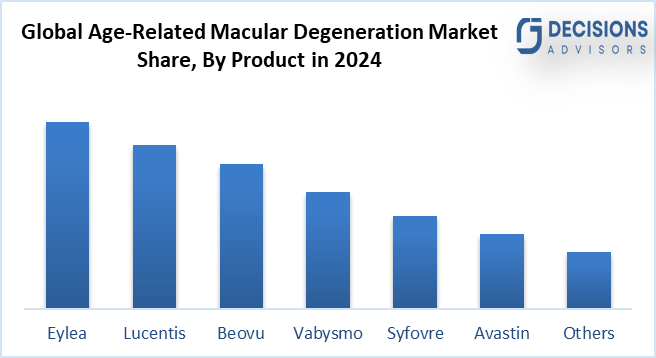

The age-related macular degeneration market share is classified into product, disease type and age group.

- The Eylea segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the age-related macular degeneration market is divided into Eylea, Lucentis, Beovu, Vabysmo, Syfovre, Avastin, and others. Among these, the Eylea segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The demand for Eylea grew as wet AMD became more as compared to earlier anti-VEGF treatments. Eylea takes fewer injections and offers long-lasting management of neovascular (wet) AMD. This is because of its shown effectiveness, longer dose intervals, and high physician acceptance, and it has garnered prolonged and continuing use, reflecting more annual prescriptions than earlier treatments with better patient results.

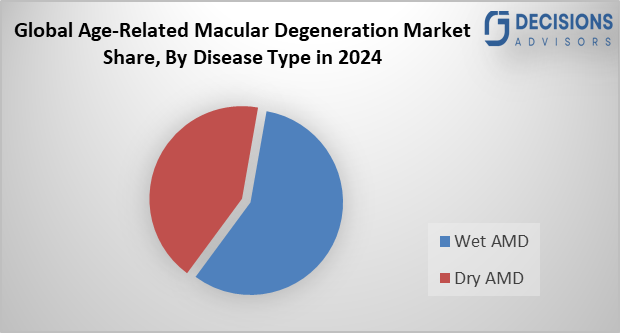

- The wet AMD dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the disease type, the age-related macular degeneration market is differentiated into wet AMD, and dry AMD. Among these, the wet AMD dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. Improved diagnosis and medication therapy for this illness, as well as an expanding patient pool, are the key factors driving this segment's rise. The market for treatments for age-related macular degeneration has also expanded due to the ageing population and significant advancements in the AMD treatment system.

- The 65–74 segment accounted for the highest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the age group, the age-related macular degeneration market is segmented into 50–64 years, 65–74 years, and 75 and above. Among these, the 65–74 segment accounted for the highest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. According to the National Eye Institute and CDC state that the prevalence of AMD rises dramatically after 65. The 65–74 age group is more likely to use services like online educational content, home delivery of AREDS2 supplements, and eye injection reminders, all of which boost the segment's revenue.

Regional Segment Analysis of the Age-Related Macular Degeneration Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the age-related macular degeneration market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the age-related macular degeneration market over the predicted timeframe. The rapid developments in the healthcare industry in nations like China, Japan, India, and a few others are the primary drivers of this region's growth. The market for age-related macular degeneration treatments has also grown as a result of the public and commercial sectors' increasing interest in research and development pertaining to the disease's treatment. Additionally, the market for treatments for Age-Related Macular Degeneration has grown due to the presence of regional players in the eye drug industry, such as Tarsier Pharma, Astellas Pharma, Chugai, and a few others.

In October 2025, 4D Molecular Therapeutics (4DMT) announced a major $420 million deal with Otsuka Pharmaceutical, aimed at advancing its retinal gene therapy programs into Phase 3 clinical development. "With 4DMT continuing to lead phase 3 clinical trial and manufacturing activities globally, as well as pre-commercial and commercial activities outside the APAC region, this partnership is a key pillar of our global strategy," Kirn praised.

North America is expected to grow at a rapid CAGR in the age-related macular degeneration market during the forecast period. The growing technology advancements in the healthcare sector are the primary driver of this region's expansion. Additionally, the growing prevalence of age-related macular degeneration (AMD) disorders in nations like the United States and Canada has raised the need for AMD treatment, propelling market expansion. The market for treatments for age-related macular degeneration (AMD) has also expanded as a result of the introduction of new government programs for the development of therapeutic approaches for AMD illnesses.

In September 2025, Sanofi’s investigational gene therapy SAR402663 received FDA Fast Track designation in the United States for the treatment of neovascular (wet) age-related macular degeneration (AMD). This recognition highlights its potential to reduce treatment burden by offering a one-time intravitreal therapy.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the age-related macular degeneration market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen

- Apellis Pharmaceuticals

- Bayer

- Biocon Biologics

- Celltrion

- F. Hoffmann-La Roche

- Formycon

- Novartis

- Pfizer

- Regeneron Pharmaceuticals

- Sandoz Group

- STADA Arzneimittel

- Xbrane Biopharma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Regenerative Patch Technologies (RPT) began its Phase IIb clinical trial for an allogeneic bioengineered retinal pigment epithelial (RPE) cell implant, treating the first two patients with advanced dry age-related macular degeneration (AMD). This marks a significant step toward confirming safety, efficacy, and durability signals observed in earlier trials.

- In August 2025, Annexon’s drug candidate Vonaprument (ANX007) was selected by the European Medicines Agency (EMA). Moreover, to participate in its new Product Development Coordinator (PDC) pilot program, underscoring its potential as a breakthrough therapy for dry age-related macular degeneration (AMD) with geographic atrophy (GA).

- In June 2025, Scotland officially approved bevacizumab gamma (Lytenava) for the treatment of wet age-related macular degeneration (AMD), making it the first licensed ophthalmic formulation of bevacizumab available in the UK. It strengthens patient access while reshaping the competitive dynamics of the anti-VEGF market in the UK.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the age-related macular degeneration market based on the below-mentioned segments:

Global Age-Related Macular Degeneration Market, By Product

- Eylea

- Lucentis

- Beovu

- Vabysmo

- Syfovre

- Avastin

- Others

Global Age-Related Macular Degeneration Market, By Disease Type

- Wet AMD

- Dry AMD

Global Age-Related Macular Degeneration Market, By Age Group

- 50–64 years

- 65–74 years

- 75 and above

Global Age-Related Macular Degeneration Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

Q1. What is age-related macular degeneration (AMD)?

AMD is a progressive retinal disease that damages the macula, the central part of the retina responsible for sharp, central vision. It leads to central vision loss, affecting activities such as reading, driving, and recognising faces.

Q2. What are the main types of AMD?

AMD is broadly classified into two types: Wet (neovascular) AMD, less common but more severe and fast?progressing, caused by abnormal blood vessel growth under the retina.

Dry (non-neovascular) AMD – more common, progresses slowly due to gradual thinning of the macula and accumulation of drusen.

Q3. How large is the global AMD market?

The global age-related macular degeneration market was valued at approximately USD 11.76 million in 2024 and is projected to reach about USD 23.46 million by 2035.

Q4. What is the forecast period and CAGR for the AMD market?

The forecast period is 2025–2035, during which the market is expected to grow at a CAGR of around 6.48%.

Q5. Which products are covered in this AMD market study?

The report covers key therapies and brands, including Eylea, Lucentis, Beovu, Vabysmo, Syfovre, Avastin, and other emerging or off-label treatments.

Q6. Which product segment currently holds the largest market share?

Eylea accounted for the largest market share in 2024 and is expected to grow at a significant CAGR, driven by strong physician preference, longer dosing intervals, and robust real-world efficacy in wet AMD.

Q7. Which disease type dominates the AMD market?

Although dry AMD is more prevalent epidemiologically, the wet AMD segment dominated the market in 2024 in revenue terms, due to higher treatment intensity, greater biologic usage, and strong adoption of anti-VEGF therapies.

Q8. Which age group represents the greatest demand for AMD treatments?

Patients aged 65–74 years accounted for the highest market share in 2024 and are anticipated to grow at a significant CAGR, reflecting the sharp rise in AMD prevalence after age 65.

Q10. Which region is expected to hold the largest market share?

Asia-Pacific is anticipated to hold the largest share over the forecast period, supported by rapid healthcare expansion, rising patient volumes, and active local and multinational ophthalmology players.

Q11. Which region is expected to exhibit the fastest growth?

North America is expected to grow at the fastest CAGR, driven by high disease awareness, advanced diagnostic infrastructure, strong reimbursement in key markets, and rapid uptake of novel therapies, including gene and cell-based treatments.

Q12. Who are the major players in the global AMD market?

Key companies profiled include Amgen, Apellis Pharmaceuticals, Bayer, Biocon Biologics, Biogen, Celltrion, F. Hoffmann-La Roche, Formycon, Novartis, Pfizer, Regeneron Pharmaceuticals, Sandoz Group, STADA Arzneimittel, Xbrane Biopharma, and other regional and emerging biotech firms

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product

- Market Attractiveness Analysis By Disease Type

- Market Attractiveness Analysis By Age Group

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Advanced medication discovery, expanded healthcare infrastructure, and strong regional government backing

- Restraints

- High treatment costs, a lack of therapeutic options for AMD, and difficulties with patients

- Opportunities

- The launch of new products, a robust environment, and an increase in AMD prevalence

- Challenges

- Compliance brought on by frequent intravitreal injections and regulatory obstacles

- Global Age-Related Macular Degeneration Market Analysis and Projection, By Product

- Segment Overview

- Eylea

- Lucentis

- Beovu

- Vabysmo

- Syfovre

- Avastin

- Others

- Global Age-Related Macular Degeneration Market Analysis and Projection, By Disease Type

- Segment Overview

- Wet AMD

- Dry AMD

- Global Age-Related Macular Degeneration Market Analysis and Projection, By Age Group

- Segment Overview

- 50–64 years

- 65–74 years

- 75 and above

- Global Age-Related Macular Degeneration Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Age-Related Macular Degeneration Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Age-Related Macular Degeneration Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Amgen

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Apellis Pharmaceuticals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bayer

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Biocon Biologics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Celltrion

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- F. Hoffmann-La Roche

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Formycon

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Novartis

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Pfizer

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Regeneron Pharmaceuticals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sandoz Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- STADA Arzneimittel

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Xbrane Biopharma

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Amgen

List of Table

- Global Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Global Eylea, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Lucentis, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Beovu, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Vabysmo, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Syfovre, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Avastin, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Others, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Global Wet AMD, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Dry AMD, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Global 50–64 years, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global 65–74 years, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- Global 75 and above, Age-Related Macular Degeneration Market, By Region, 2024-2035(USD Billion)

- North America Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- North America Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- North America Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- U.S. Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- U.S. Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- U.S. Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Canada Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Canada Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Canada Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Mexico Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Mexico Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Mexico Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Europe Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Europe Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Europe Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Germany Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Germany Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Germany Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- France Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- France Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- France Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- U.K. Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- U.K. Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- U.K. Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Italy Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Italy Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Italy Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Spain Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Spain Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Spain Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Asia Pacific Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Asia Pacific Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Asia Pacific Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Japan Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Japan Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Japan Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- China Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- China Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- China Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- India Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- India Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- India Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- South America Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- South America Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- South America Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- Brazil Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- Brazil Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- Brazil Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- The Middle East and Africa Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- The Middle East and Africa Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- The Middle East and Africa Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- UAE Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- UAE Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- UAE Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

- South Africa Age-Related Macular Degeneration Market, By Product, 2024-2035(USD Billion)

- South Africa Age-Related Macular Degeneration Market, By Disease Type, 2024-2035(USD Billion)

- South Africa Age-Related Macular Degeneration Market, By Age Group, 2024-2035(USD Billion)

List of Figures

- Global Age-Related Macular Degeneration Market Segmentation

- Age-Related Macular Degeneration Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Age-Related Macular Degeneration Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Age-Related Macular Degeneration Market

- Age-Related Macular Degeneration Market Segmentation, By Product

- Age-Related Macular Degeneration Market For Eylea, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For Lucentis, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For Beovu, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For Vabysmo, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For Syfovre, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For Avastin, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For Others, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market Segmentation, By Disease Type

- Age-Related Macular Degeneration Market For Wet AMD, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For Dry AMD, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market Segmentation, By Age Group

- Age-Related Macular Degeneration Market For 50–64 years, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For 65–74 years, By Region, 2024-2035 ($ Billion)

- Age-Related Macular Degeneration Market For 75 and above, By Region, 2024-2035 ($ Billion)

- Amgen: Net Sales, 2024-2035 ($ Billion)

- Amgen: Revenue Share, By Segment, 2024 (%)

- Amgen: Revenue Share, By Region, 2024 (%)

- Apellis Pharmaceuticals: Net Sales, 2024-2035 ($ Billion)

- Apellis Pharmaceuticals: Revenue Share, By Segment, 2024 (%)

- Apellis Pharmaceuticals: Revenue Share, By Region, 2024 (%)

- Bayer: Net Sales, 2024-2035 ($ Billion)

- Bayer: Revenue Share, By Segment, 2024 (%)

- Bayer: Revenue Share, By Region, 2024 (%)

- Biocon Biologics: Net Sales, 2024-2035 ($ Billion)

- Biocon Biologics: Revenue Share, By Segment, 2024 (%)

- Biocon Biologics: Revenue Share, By Region, 2024 (%)

- Celltrion: Net Sales, 2024-2035 ($ Billion)

- Celltrion: Revenue Share, By Segment, 2024 (%)

- Celltrion: Revenue Share, By Region, 2024 (%)

- F. Hoffmann-La Roche: Net Sales, 2024-2035 ($ Billion)

- F. Hoffmann-La Roche: Revenue Share, By Segment, 2024 (%)

- F. Hoffmann-La Roche: Revenue Share, By Region, 2024 (%)

- Formycon: Net Sales, 2024-2035 ($ Billion)

- Formycon: Revenue Share, By Segment, 2024 (%)

- Formycon: Revenue Share, By Region, 2024 (%)

- Novartis: Net Sales, 2024-2035 ($ Billion)

- Novartis: Revenue Share, By Segment, 2024 (%)

- Novartis: Revenue Share, By Region, 2024 (%)

- Pfizer: Net Sales, 2024-2035 ($ Billion)

- Pfizer: Revenue Share, By Segment, 2024 (%)

- Pfizer: Revenue Share, By Region, 2024 (%)

- Regeneron Pharmaceuticals: Net Sales, 2024-2035 ($ Billion)

- Regeneron Pharmaceuticals: Revenue Share, By Segment, 2024 (%)

- Regeneron Pharmaceuticals: Revenue Share, By Region, 2024 (%)

- Sandoz Group: Net Sales, 2024-2035 ($ Billion)

- Sandoz Group: Revenue Share, By Segment, 2024 (%)

- Sandoz Group: Revenue Share, By Region, 2024 (%)

- STADA Arzneimittel: Net Sales, 2024-2035 ($ Billion)

- STADA Arzneimittel: Revenue Share, By Segment, 2024 (%)

- STADA Arzneimittel: Revenue Share, By Region, 2024 (%)

- Xbrane Biopharma: Net Sales, 2024-2035 ($ Billion)

- Xbrane Biopharma: Revenue Share, By Segment, 2024 (%)

- Xbrane Biopharma: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 278 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |