Global Agricultural Food Loss Reduction Solutions Market

Global Agricultural Food Loss Reduction Solutions Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Crop Type (Fruits & Vegetables, Cereals & Grains, and Oilseeds & Pulses), By Technology (Cold Chain Logistics, Precision Agriculture, Sensor-Based Monitoring, Modified Atmosphere Packaging, and Blockchain Traceability), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Agricultural Food Loss Reduction Solutions Market Summary, Size & Emerging Trends

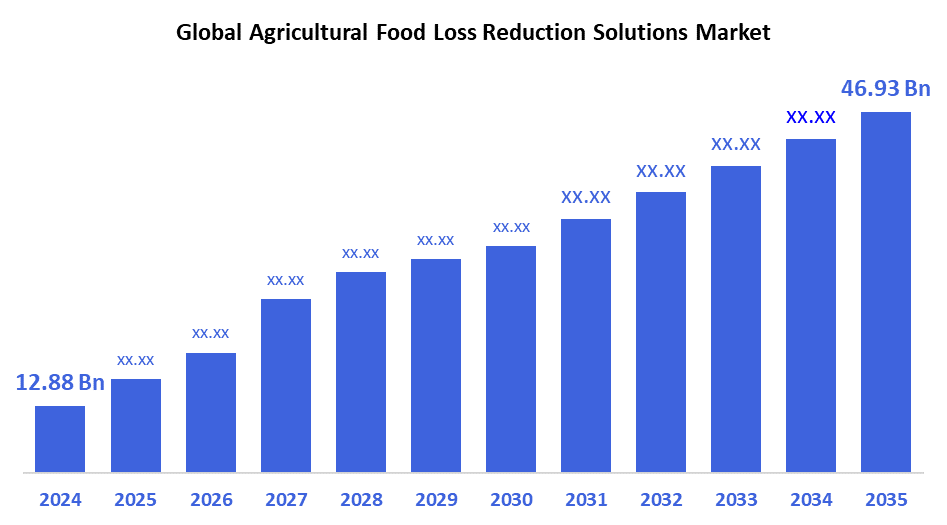

According to Decision Advisor, The Global Agricultural Food Loss Reduction Solutions Market Size is expected to grow from USD 12.88 Billion in 2024 to USD 46.93 Billion by 2035, at a CAGR of 12.47% during the forecast period 2025-2035. Growing global focus on food security, sustainability, and supply chain efficiency is driving the adoption of advanced technologies to reduce food loss from farm to market.

Key Market Insights

- Asia Pacific held the largest market share in 2024 due to large-scale crop production and government initiatives to reduce post-harvest loss.

- The fruits & vegetables segment led by crop type due to their highly perishable nature.

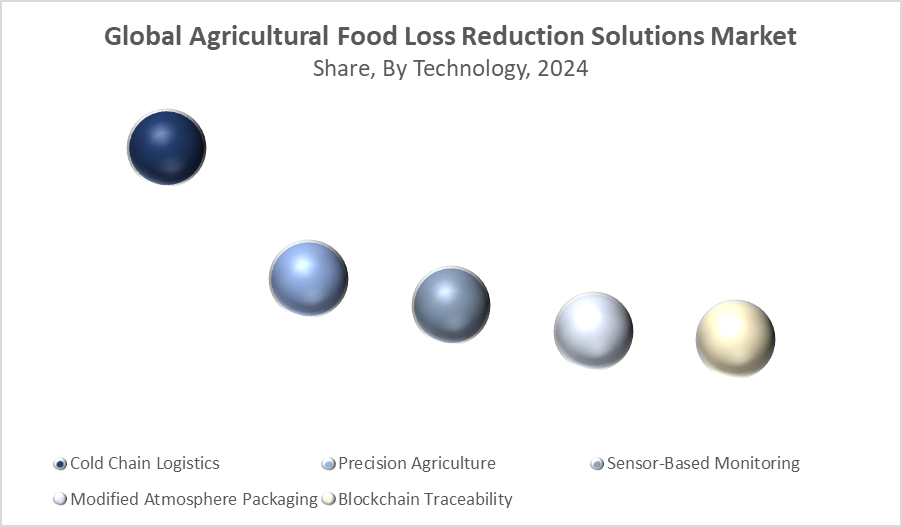

- Among technologies, cold chain logistics dominated in revenue due to increasing demand for refrigerated transport and storage.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 12.88 Billion

- 2035 Projected Market Size: USD 46.93 Billion

- CAGR (2025-2035): 12.47%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Agricultural Food Loss Reduction Solutions Market

The agricultural food loss reduction solutions market focuses on technologies and practices that minimise post-harvest losses across the value chain from production and storage to distribution and retail. Food loss is a critical global issue, particularly in developing nations where infrastructure limitations, poor storage, and inefficient logistics contribute to massive waste. Emerging technologies like sensor-based monitoring, modified atmosphere packaging, and blockchain traceability are being adopted alongside cold chain systems and precision agriculture tools to mitigate losses. These solutions support both economic development and sustainability by enhancing food availability and reducing environmental impact.

Agricultural Food Loss Reduction Solutions Market Trends

- Increased government funding for smart agriculture and cold chain infrastructure in developing countries.

- Rising integration of IoT and AI in sensor-based crop monitoring and logistics optimization.

- Growing interest in blockchain traceability to enhance transparency and reduce fraud in agri-supply chains.

- Development of eco-friendly packaging and sustainable storage solutions to reduce spoilage.

Agricultural Food Loss Reduction Solutions Market Dynamics

Driving Factors: Global food security concerns and economic loss due to spoilage

A major driver for the agricultural food loss reduction solutions market is the urgent need to address global food security. According to the FAO, nearly one-third of all food produced globally is lost or wasted, causing significant economic, social, and environmental impacts. This loss occurs predominantly during post-harvest stages, particularly in developing countries, where poor handling, storage, and transportation infrastructure are prevalent. As a result, governments and international organizations are increasingly investing in technologies that can reduce waste across the agricultural value chain. Tools like cold chain logistics, sensor-based monitoring, and precision agriculture are being deployed to maintain product quality, extend shelf life, and enhance supply chain efficiency. These efforts are also aligned with broader sustainability goals, such as reducing carbon emissions and improving resource efficiency in the food system.

Restrain Factors: High implementation costs and infrastructure limitations

Despite the strong need and growing interest, the market faces key restraints, particularly related to high initial investment costs. Technologies such as refrigerated storage, sensor networks, and automated tracking systems require significant capital outlays, which can be a barrier, especially for smallholder farmers and agribusinesses in low-income regions. Furthermore, many rural and developing areas lack the basic infrastructure needed to support these solutions, including reliable electricity, cold storage facilities, internet connectivity, and logistics networks. Without these foundational systems, even the most advanced technologies cannot be effectively deployed or maintained.

Opportunity: Public-private partnerships and digital transformation in agriculture

Despite the challenges, there are significant opportunities for growth, especially through public-private partnerships (PPPs) and the ongoing digital transformation of agriculture. Governments, NGOs, and international bodies are increasingly collaborating with agri-tech startups, logistics companies, and technology providers to develop and scale food loss reduction solutions. These partnerships help lower the cost barrier and extend solutions into underserved rural markets. At the same time, the expansion of digital agriculture platforms, including mobile-based advisory tools, cloud analytics, and remote sensing technologies, is enabling real-time decision-making, predictive maintenance, and early spoilage detection. Innovative approaches like mobile cold storage units, solar-powered refrigeration, and AI-driven logistics optimisation are also making food preservation more affordable and accessible.

Challenges: Technical complexity and lack of awareness

One of the core challenges in this market is the lack of awareness and technical knowledge among end users, particularly small and medium-scale farmers. Many are unfamiliar with the benefits of food loss reduction technologies or lack the training to use them effectively. This knowledge gap limits adoption, even when solutions are available or subsidised. Additionally, technical complexity in integrating multiple systems, such as linking blockchain traceability with cold chain logistics, poses challenges for many organisations, especially in regions with limited IT infrastructure or technical personnel.

Global Agricultural Food Loss Reduction Solutions Market Ecosystem Analysis

The ecosystem comprises technology providers (e.g., cold chain, IoT, blockchain), agriculture solution integrators, logistics firms, and government agencies. Key players such as Carrier Transicold, Emerson Electric, IBM, Bühler Group, and Trimble play crucial roles. Collaborations with NGOs and agri-tech startups are rising, especially in emerging markets, to deliver localized and cost-effective solutions. Policy support and infrastructure development are vital to ecosystem expansion.

Global Agricultural Food Loss Reduction Solutions Market, By Crop Type

What factors enabled the fruits & vegetables segment to dominate the agricultural food loss reduction solutions market in 2024?

The fruits & vegetables segment dominated the agricultural food loss reduction solutions market in 2024 due to the highly perishable nature of these products and their significant contribution to global food waste. Post-harvest losses in fruits and vegetables are typically higher than in other crop categories, making them a key priority for intervention. Increased investment in cold chain logistics, packaging innovations, and real-time monitoring technologies targeted specifically at preserving freshness helped drive growth in this segment. Additionally, growing consumer and regulatory pressure to minimize waste and ensure food security further accelerated the adoption of loss reduction solutions in the fruits & vegetables segment, establishing it as the market leader.

Why is the cereals & grains segment experiencing increased adoption of food loss reduction solutions in 2024?

The cereals & grains segment gained momentum in the agricultural food loss reduction solutions market in 2024 due to increasing awareness of post-harvest losses caused by poor storage, pests, and inefficient handling practices. As staple foods with high global consumption, even small improvements in reducing waste in this segment can have a significant impact on food security and economic returns. Advances in silo technology, controlled-atmosphere storage, and digital monitoring systems contributed to better preservation and reduced spoilage. Moreover, government initiatives and supply chain modernization efforts in developing countries further accelerated the adoption of food loss reduction solutions for cereals and grains, driving notable growth in this segment.

Global Agricultural Food Loss Reduction Solutions Market, By Technology

How did cold chain logistics gain a competitive edge in the food loss reduction solutions market in 2024?

Cold chain logistics held the largest market share in the agricultural food loss reduction solutions market in 2024 due to its critical role in preserving perishable goods such as fruits, vegetables, dairy, and meat throughout the supply chain. By maintaining optimal temperature conditions from farm to consumer, cold chain systems significantly reduced spoilage, extended shelf life, and improved food safety. The rising demand for fresh produce, globalization of food trade, and growing investments in refrigerated storage and transportation infrastructure contributed to the dominance of cold chain logistics. Additionally, technological advancements in temperature monitoring, real-time tracking, and energy-efficient systems enhanced operational reliability, making cold chain logistics the most effective and widely adopted solution in the market.

What made precision agriculture an emerging solution in the agricultural food loss reduction market in 2024?

Precision agriculture experienced rapid growth in the agricultural food loss reduction solutions market in 2024 due to its ability to optimize resource use, improve crop monitoring, and minimize losses from field to harvest. Technologies such as GPS-guided equipment, drones, IoT sensors, and data analytics allowed farmers to make informed decisions about planting, irrigation, and harvesting, leading to better yield quality and reduced waste. As food systems faced pressure to become more efficient and sustainable, precision agriculture emerged as a powerful tool to reduce variability, detect early signs of crop stress or disease, and ensure timely interventions. Government support, falling costs of agri-tech tools, and the growing focus on sustainable farming further accelerated its adoption across small and large farms alike.

Asia Pacific emerged as the leading region in the global agricultural food loss reduction solutions market.

This dominance is largely due to the region’s massive agricultural output, especially in countries like India, China, and Indonesia, which are among the world’s top producers of fruits, vegetables, grains, and pulses. The region also has a large population dependent on agriculture for livelihood, making food loss a major economic and social issue. Recognizing this, several governments across Asia Pacific have introduced programs and policies to enhance post-harvest infrastructure, including cold storage, transportation, and supply chain digitization.

India is a key growth market

driven by high post-harvest losses in perishables and government programs like PM Kisan Sampada Yojana aimed at cold chain development. Agri-tech startups are deploying mobile cold storage and AI-based tools to support smallholder farmers and reduce food waste. The country is investing heavily in supply chain modernization and smart agriculture.

North America is also a significant player in the market

ranking just behind Asia Pacific. The region benefits from a well-developed agricultural infrastructure and high technological maturity, particularly in the U.S. and Canada. These countries have been early adopters of precision agriculture, using satellite imagery, IoT sensors, and data analytics to reduce on-field waste and optimise harvest processes. In addition, there is growing implementation of blockchain traceability systems to track food through the supply chain, ensuring transparency and reducing losses due to inefficiencies or fraud.

The U.S. leads in adopting advanced solutions like blockchain traceability, AI-powered logistics, and sensor-integrated silos. The food industry's shift toward sustainability, combined with strict regulations on food safety, supports ongoing investment. Public-private collaborations further promote innovation in minimising food loss across farming and distribution stages.

WORLDWIDE TOP KEY PLAYERS IN THE AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET INCLUDE

- Deere & Company

- DJI

- AGCO

- CNH Industrial

- Bühler Group

- Lineage Logistics

- Carrier Transicold

- BASF SE

- Corteva Agriscience

- Hexagon AB

- Others

Product Launches in Agricultural Food Loss Reduction Solutions Market

- In April 2024, Carrier Transicold introduced a solar-powered cold storage container, specifically designed for rural and off-grid regions. This innovation addresses one of the biggest challenges in agricultural supply chains lack of reliable electricity, by enabling sustainable, temperature-controlled storage for perishable crops like fruits, vegetables, and dairy. The solution is expected to significantly reduce post-harvest losses in energy-constrained areas, especially in developing countries, by extending shelf life and maintaining product quality during transport and storage.

- In October 2023, IBM expanded its blockchain-based food traceability platform to support the tracking of grains and pulses across North America and Africa. This platform allows stakeholders to monitor product movement in real time, ensuring transparency, reducing fraud, and enabling quick identification of spoilage points within the supply chain. By improving visibility and accountability, IBM’s solution helps minimize losses and supports safer, more efficient agricultural trade and logistics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the agricultural food loss reduction solutions market based on the below-mentioned segments:

Global Agricultural Food Loss Reduction Solutions Market, By Crop Type

- Fruits & Vegetables

- Cereals & Grains

- Oilseeds & Pulses

Global Agricultural Food Loss Reduction Solutions Market, By Technology

- Cold Chain Logistics

- Precision Agriculture

- Sensor-Based Monitoring

- Modified Atmosphere Packaging

- Blockchain Traceability

Global Agricultural Food Loss Reduction Solutions Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Agricultural Food Loss Reduction Solutions Market in 2024?

A: The Global Agricultural Food Loss Reduction Solutions Market size was estimated at USD 12.88 billion in 2024.

Q: What is the forecasted CAGR of the Global Agricultural Food Loss Reduction Solutions Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of approximately 12.47% during the period 2025–2035.

Q: What is the projected market size of the Agricultural Food Loss Reduction Solutions Market by 2035?

A: The market is projected to reach USD 46.93 billion by 2035.

Q: Which crop type segment led the Agricultural Food Loss Reduction Solutions Market in 2024?

A: The fruits & vegetables segment led the market in 2024 due to the highly perishable nature of these crops.

Q: Which technology dominated the Agricultural Food Loss Reduction Solutions Market in 2024?

A: Cold chain logistics dominated in revenue due to rising demand for refrigerated transport and storage solutions.

Q: Which region held the largest market share in the Agricultural Food Loss Reduction Solutions Market in 2024?

A: Asia Pacific held the largest market share in 2024, driven by large-scale crop production and government initiatives to reduce post-harvest losses.

Q: Which region is expected to be the fastest-growing market for Agricultural Food Loss Reduction Solutions?

A: North America is expected to be the fastest-growing market due to technological maturity and adoption of advanced solutions.

Q: Who are the key players in the Global Agricultural Food Loss Reduction Solutions Market?

A: Major players include Deere & Company, DJI, AGCO, CNH Industrial, Bühler Group, Lineage Logistics, Carrier Transicold, BASF SE, Corteva Agriscience, and Hexagon AB.

Q: What are the main drivers of growth in the Agricultural Food Loss Reduction Solutions Market?

A: Key drivers include global food security concerns, economic loss from spoilage, and growing adoption of advanced technologies such as cold chain logistics, precision agriculture, and blockchain traceability.

Q: What are the key challenges limiting the adoption of food loss reduction solutions?

A: High implementation costs, infrastructure limitations, technical complexity, and lack of awareness among small and medium-scale farmers remain significant restraints.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |