Global AI Hardware Market

Global AI Hardware Market Size, Share, and COVID-19 Impact Analysis, By Hardware Component (Processors, Memory, Storage, Network, Specialized Embedded Hardware), By Application (Machine Learning/Deep Learning, Computer Vision, Natural Language Processing, Robotics, Generative AI), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

AI Hardware Market Size Summary

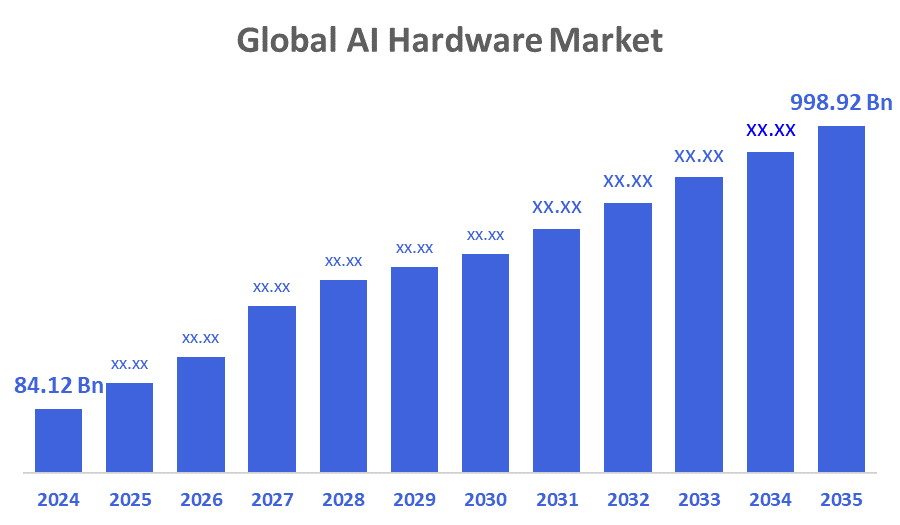

The Global AI Hardware Market Size Was Estimated at USD 84.12 Billion in 2024 and is Projected to Reach USD 998.92 Billion by 2035, Growing at a CAGR of 25.23% from 2025 to 2035. The market for AI hardware is expanding because of the growing need for processing power from sophisticated AI algorithms, the emergence of AI-driven applications in a variety of sectors, including healthcare and automotive, and the spread of Edge AI solutions for connectivity and real-time processing.

Key Regional and Segment-Wise Insights

- In 2024, the North American AI hardware market held the biggest revenue share, accounting for 31.7%.

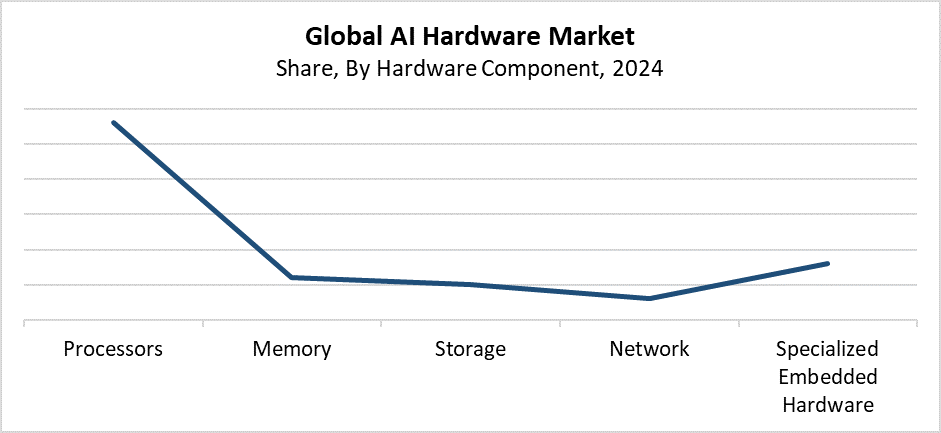

- In 2024, the processors segment had the highest revenue share and led the market by hardware component, accounting for 56.7%.

- In 2024, the machine learning/deep learning segment dominated the market by application, accounting for 41.4% revenue share.

Market Size & Forecast

- 2024 Market Size: USD 84.12 Billion

- 2035 Projected Market Size: USD 998.92 Billion

- CAGR (2025-2035): 25.23%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The AI Hardware Market consists of the physical computing infrastructure that specifically supports artificial intelligence operations such as data processing, machine learning, and deep learning. The components, including CPUs, GPUs, ASICs, FPGAs, and AI accelerators, power data centers, edge devices, autonomous cars, robotics, and smart devices. The industry experiences fast growth because AI continues to find increased adoption across healthcare, automotive, finance, manufacturing, and telecommunications sectors. The expansion of AI-powered applications such as computer vision and natural language processing, together with predictive analytics and high-performance computing needs and real-time data processing requirements, drives the increased demand for specialized AI hardware solutions.

Technology advances have a major impact on the AI hardware marketplace. The processing speed, along with energy efficiency and scalability of chip architectures, has seen improvements. Examples of these include the creation of AI-specific processors and neuromorphic computing. Businesses are spending a lot of money on specialized AI processors that are tailored for particular applications, such as edge AI and cloud computing. At the same time, government programs around the world like the European Union's Digital Strategy, China's AI development plan, and the United States' National AI Initiative are encouraging AI research, funding, and infrastructure development. These policies work to establish AI hardware as an essential part of future digital economies through innovation promotion alongside local semiconductor capability development and public-private partnership encouragement.

Hardware Component Insights

In 2024, the processors segment held the largest revenue share of 56.7% and led the AI hardware market. Processors control the majority of the AI hardware market revenue because these components execute AI algorithms and process complex computational tasks. High-performance processors, including GPUs (Graphics Processing Units), CPUs (Central Processing Units), and AI chips such as TPUs (Tensor Processing Units), serve as essential components for both training and inference operations in AI systems. Processor demand continues to rise because robotics and computer vision and natural language processing, and driverless cars require real-time data processing. The market leadership of this segment continues to grow because of continuous chip design improvements and its expanding use in edge devices, together with data centers.

The specialized embedded hardware segment of the AI hardware market is anticipated to experience significant growth throughout the forecast timeframe. The increase stems from the adoption of AI at edge locations, which require fast and energy-efficient computational solutions. The embedded AI hardware, such as Neural Processing Units (NPUs), along with AI accelerators and System-on-Chips (SoCs), finds widespread use in smart gadgets as well as industrial machinery, drones, autonomous vehicles, and Internet of Things systems. These elements allow for immediate decision-making without a cloud connection while enhancing responsiveness, privacy, and performance. Small application-specific embedded technology experiences growing demand because decentralized computing and intelligent edge applications create market shifts. The acceleration of adoption occurs across various industries due to advancements in power-efficient architectures and miniaturization techniques.

Application Insights

The machine learning and deep learning segment held the largest revenue share of 41.4% and led the AI hardware market in 2024. The rapid adoption of AI-based technology across various sectors, including manufacturing, healthcare, finance, and automotive, explains why this sector leads the market. The expanding requirement for high-performance computing platforms that operate complex algorithms with large datasets fueled this growth. The specialized hardware consists of GPUs and TPUs together with AI accelerators, which are needed for deep learning applications that process images and audio and enable natural language processing and autonomous systems. The segment's leading position in the AI hardware market was solidified by technological progress and expanding use cases, which led to substantial investments in component development and supporting infrastructure.

The generative AI segment is anticipated to grow at a significant CAGR throughout the forecasted period. The growing demand for advanced AI systems, which create textual, visual, and video content, drives this market expansion. The effectiveness of generative AI applications in processing complex computations depends on having powerful hardware platforms that include GPUs, TPUs, and AI-specific accelerators. General Artificial Intelligence applications receive quick adoption from marketing, healthcare, entertainment, and automotive industries because they deliver enhanced innovation capabilities, process automation, and user experience improvements. The rising demand for powerful AI hardware results from both AI algorithm advancements and edge computing development. The generative AI market segment will significantly influence the expanding AI hardware market throughout the forecast period.

Regional Insights

In 2024, the North American AI hardware market led globally with the largest revenue share of 31.7% worldwide. The existence of large technological businesses, robust R&D infrastructure, and substantial investments in AI development throughout the region are all factors contributing to this supremacy. With technological behemoths like NVIDIA, Intel, and AMD propelling developments in AI hardware, the United States has been at the forefront of AI innovation. The market has grown as a result of government programs and financing for AI research, as well as rising demand for AI-powered solutions in industries like healthcare, automotive, finance, and defense. Furthermore, North America's dominant position in the global AI hardware market has been strengthened by the early adoption of generative AI technology and cloud-based AI services.

Europe AI Hardware Market Trends

The European AI hardware market grows significantly because businesses across various sectors, such as manufacturing, healthcare, finance, and automotive, invest more in artificial intelligence. The United Kingdom, together with France and Germany, receives substantial government funding to advance AI research and innovation projects. The region's commitment to ethical AI development and GDPR-compliant data privacy has enabled the adoption of specialized hardware that supports safe and effective processing. Europe experiences growing market demand for edge AI devices together with high-performance computer infrastructure to back applications, including autonomous vehicles and predictive maintenance, and smart factories. The collaboration between government bodies and academic institutions with technology firms expands the European market and makes Europe a substantial contender in global AI hardware development.

Asia Pacific AI Hardware Market Trends

The Asia Pacific AI hardware market is anticipated to grow at the fastest CAGR during the forecast period because nations, including China, Japan, South Korea, and India, dedicate substantial resources to AI infrastructure development. The region witnesses rising demand for AI-based devices and data centers, and edge computing solutions, particularly within manufacturing, automotive and healthcare, and consumer electronics sectors. China leads the global market in AI hardware manufacturing through its established semiconductor industry. The growth of tech startups alongside smart city projects and smartphone adoption drives higher demand for sophisticated AI hardware, thus establishing the Asia Pacific as a crucial development center.

Key AI Hardware Companies:

The following are the leading companies in the AI hardware market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc. (AMD)

- Qualcomm Incorporated

- Intel Corporation

- Amazon.com, Inc.

- Cerebras Systems Inc.

- Microsoft

- NVIDIA Corporation

- Graphcore

- Apple Inc.

- Robert Bosch GmbH

- Others

Recent Developments

- In June 2025, NVIDIA Corporation and Hewlett Packard Enterprise, a U.S.-based information technology business, deepened their collaboration at HPE Discover in Las Vegas by introducing new turnkey AI platforms and modular AI infrastructure, such as HPE's AI-enabled RTX PRO Servers and the HPE Private Cloud AI platform. By offering full-stack AI factory solutions that integrate computing hardware, software, and services, the goal is to assist businesses in developing and scaling generative, agentic, and industrial AI applications.

- In September 2024, Intel Corporation improved enterprise AI speed and efficiency by introducing Xeon 6 CPUs with Gaudi 3 AI accelerators. These AI hardware solutions are designed to serve large-scale AI workloads and optimize the total cost of ownership.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the AI hardware market based on the below-mentioned segments:

Global AI Hardware Market, By Hardware Component

- Processors

- Memory

- Storage

- Network

- Specialized Embedded Hardware

Global AI Hardware Market, By Application

- Machine Learning/Deep Learning

- Computer Vision

- Natural Language Processing

- Robotics

- Generative AI

Global AI Hardware Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 148 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |