Global AI in Medical Coding Market

Global AI in Medical Coding Market Size, Share, and COVID-19 Impact Analysis, By Mode (Outsourced, In-house), By Application (Automated Coding, Fraud and Error Detection, Data Analysis, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

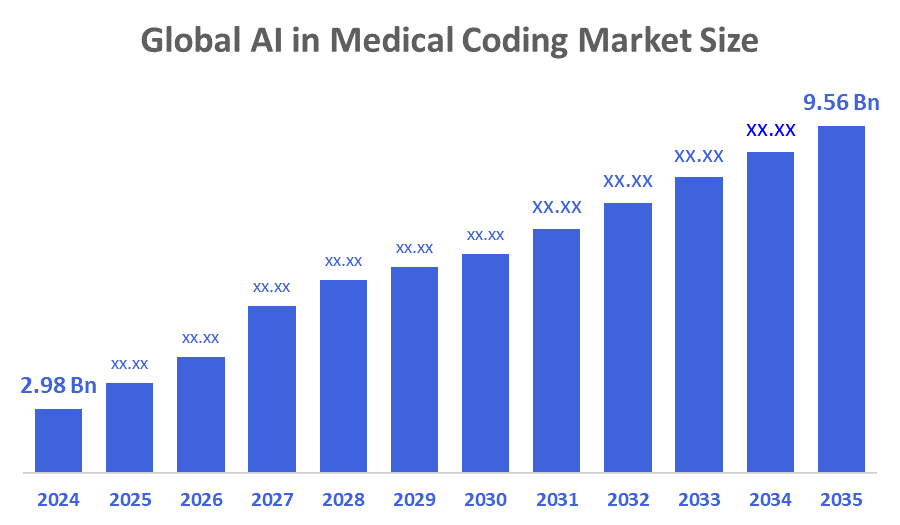

Global AI in Medical Coding Market Size Insights Forecasts to 2035

- The Global AI in Medical Coding Market Size Was Estimated at USD 2.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.18% from 2025 to 2035

- The Worldwide AI in Medical Coding Market Size is Expected to Reach USD 9.56 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global AI in Medical Coding Market Size was worth around USD 2.98 Billion in 2024 and is predicted to Grow to around USD 9.56 Billion by 2035 with a compound annual growth rate (CAGR) of 13.18% from 2025 to 2035. The market is expanding due to the increased focus on medical coding accuracy, the lack of qualified medical coders, and the rapidly growing amount of coding data. Additionally, by streamlining workflow and lowering the need for repeat imaging, AI can help reduce costs. The AI medical imaging industry has seen a rise in partnerships and investment due to the potential for better patient outcomes and operational efficiency, which is promoting worldwide market expansion.

Market Overview

AI in medical coding refers to the use of artificial intelligence, primarily machine learning and natural language processing (NLP), to automatically or semi-automatically assign standardised medical codes to diagnoses, procedures, and clinical documentation. It improves speed, accuracy, compliance, and billing efficiency compared to traditional manual coding. Automating medical coding processes through the application and advancement of artificial intelligence has made it easier for healthcare providers to assign standardised service codes to medical records for submission to insurance carriers since the codes are used for billing, maintaining records and compiling statistics on healthcare. An artificial intelligence system to review clinical documentation, identify the required information for each clinical document, and assign the appropriate diagnostic code, procedure code and/or service code for the given episode of care. The increase in precision, error reduction and coding efficiencies will benefit the healthcare industry. This means ai assisted coding will continue to be used by healthcare facilities to automate and improve the revenue cycle management process, as well as billing. The utilisation of electronic health records by healthcare providers will continue to grow along with the demand for healthcare services, and the AI market is forecasted to continue expanding, therefore benefiting healthcare providers and insurers as well as patients.

KODE Health raised $27 million in Series B funding to expand its AI-enhanced medical coding platform, addressing staffing shortages and inefficiencies that contribute to 15–30% of U.S. healthcare administrative costs. The round was led by Noro?Moseley Partners with participation from Mercury, FCA Venture Partners, Epsilon Innovation Fund, and 111 West Capital.

Report Coverage

This research report categorises the AI in medical coding market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the AI in medical coding market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the AI in medical coding market.

Driving Factors

The increasing demand for accuracy is one of the main reasons the healthcare sector, specifically medical coding, is integrating AI technology. A wide array of tools, such as automated machine learning, natural language processing (NLP), and robotic process automation (RPA), are reshaping the whole process of medical coding by eliminating errors and increasing the level of accuracy. Working with unstructured text data is an area where NLP algorithms stand out, which boosts the market growth. Moreover, the use of NLP enables these documents to be comprehended, and relevant data can be retrieved. Subsequently, once the system has this data, it can automatically generate medical codes, which in turn will greatly expedite the entire coding process. Using multiple AI-enabled tools contributes to improving the accuracy of the medical coding process, and at the same time, these technologies are pretty much responsible for the significant progress being made in this market expansion.

Clinion launched a revolutionary AI-powered medical coding solution specifically designed for clinical trials, aiming to automate and streamline the traditionally slow, error-prone, and costly process of medical coding. The platform leverages advanced machine learning and natural language processing to deliver faster, more accurate coding, helping trial teams accelerate timelines and improve data quality.

Restraining Factors

The market could be restrained by the laws surrounding healthcare, which are complex and evolving rapidly, requiring continuous adaptation of AI systems in order to remain compliant with these laws. Many healthcare organisations wishing to implement AI technology for use in medical billing face an enormous challenge in balancing the need to comply with the law while also protecting patient information from being hacked.

Market Segmentation

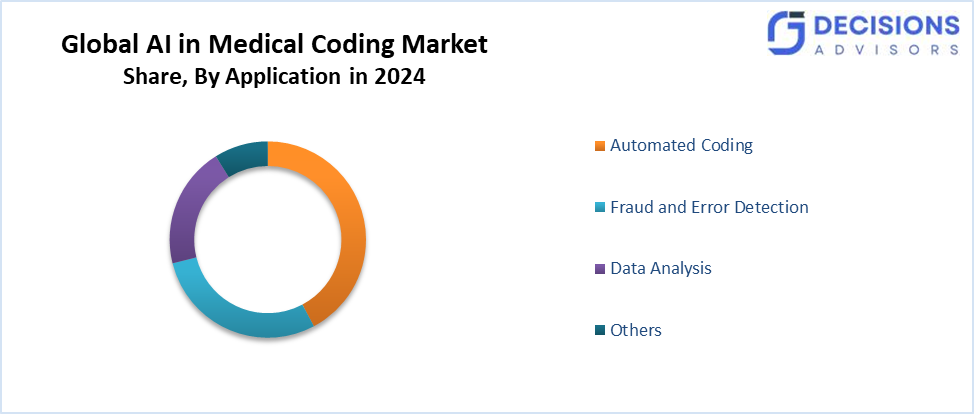

The AI in medical coding market share is classified into mode, and application.

- The outsourced segment dominated in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the mode, the AI in medical coding market is segmented into outsourced, in-house. Among these, the outsourced segment dominated in 2024 and is projected to grow at a substantial CAGR during the forecast period. Healthcare providers can profit from AI-driven coding without having to make the initial financial commitment by outsourcing medical coding services to specialist vendors. It offers affordable alternatives, particularly for smaller medical facilities. In addition to relieving internal workers of coding responsibilities, outsourced coding services may quickly integrate AI technology, guaranteeing code correctness, scalability, and compliance.

- The automated coding segment accounted for the highest revenue share in 2024 and is anticipated to grow at a remarkable CAGR over the forecast period.

Based on the application, the AI in medical coding market is differentiated into automated coding, fraud and error detection, data analysis, and others. Among these, the automated coding segment accounted for the highest revenue share in 2024 and is anticipated to grow at a remarkable CAGR over the forecast period. Compared to manual coding, automated coding drastically cuts down on the time needed to code medical records. For healthcare providers handling massive amounts of patient data, this effectiveness is essential. These systems guarantee great accuracy by following coding rules consistently, which adds to their growing market demand.

Regional Segment Analysis of the AI in Medical Coding Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the AI in medical coding market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the AI in medical coding market over the predicted timeframe. The rapid Economic Development that has occurred within the Asia-Pacific Region (which includes both China & India) has led to an increase in Healthcare Spending Levels and a growing demand for Advanced Technology such as Artificial Intelligence (AI) in Medical Coding. The Asia-Pacific region also has a significant proportion of the World's population, coupled with a high incidence of numerous types of diseases, the need for effective Healthcare Services is growing significantly. In order to stimulate the advancement and use of AI Technology in the Healthcare Industry of China, the Chinese Government recently created the National AI Industry Investment Fund with an initial investment of ¥60 billion. In addition, the Chinese Government has also created policies through their Healthy China 2030 Initiative.

The Japan National Database registers over 1.7 billion Healthcare Insurance Claims each year. The Growth of Electronic Medical Records and the focus on streamlining healthcare operations in Japan will drive the market in Japan.

North America is expected to grow at a rapid CAGR in the AI in medical coding market during the forecast period. With significant research and development investments in the healthcare and AI sectors, North America continues to spur innovation and improve various medical applications of AI technology, such as in medical coding. Many capital sources are available within the region to support the growth of startups and tech firms, resulting in increased AI startup activity regarding medical coding solutions. North America has established collaborative efforts among healthcare organisations, technology firms and AI startups to develop these solutions.

Centres for Medicare and Medicaid Services has developed a standardised coding system to establish a common language across all states for the processing of claims nationwide. In addition, U.S. insurance companies have to process more than 5 Billion Claims over the course of each year in order to reimburse their members for medical expenses. The rapid growth of electronic health record usage (EHR) within the healthcare field has also contributed to the need for medical coding. The largest suppliers of EHRs in Canada are Meditech and Epic Systems Corporation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the AI in medical coding market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AGS Health

- Aidéo Technologies

- aiHealth

- Arintra

- Buddi AI

- Clinion

- CodaMetrix

- Corti HQ

- Datavant

- Diagnoss

- Fathom, Inc.

- MediCodio

- Nuance Communications, Inc.

- Semantic Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Netsmart launched AlphaCoding, an AI-powered medical coding tool with an embedded assistant called “Benny.” The solution is designed to improve accuracy, efficiency, and compliance in clinical coding by delivering near real-time, evidence-based recommendations guided by CMS standards.

- In October 2025, Med First, a primary and urgent care provider network in North and South Carolina, reported a 6% revenue uplift after adopting Arintra’s AI-powered autonomous medical coding solution in 2025. This financial boost is enabling the group to nearly double its clinic footprint, expanding access to care for more than 220,000 patients annually.

- In August 2025, Infinx announced a strategic investment in Maverick AI to integrate real-time autonomous medical coding into its revenue cycle management (RCM) platform. The partnership combines Infinx’s deep RCM expertise with Maverick’s generative AI agents to improve coding accuracy, compliance, and reimbursement speed.

- In April 2025, the Cleveland Clinic and AKASA announced a strategic collaboration in April 2025 to deploy generative AI tools across the health system’s U.S. locations, aimed at improving efficiency and accuracy in medical coding and documentation during the mid-revenue cycle. Early results show significant gains in coding accuracy and documentation quality, with plans to expand into clinical documentation integrity (CDI).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the AI in the medical coding market based on the below-mentioned segments:

Global AI in Medical Coding Market, By Mode

- Outsourced

- In-house

Global AI in Medical Coding Market, By Application

- Automated Coding

- Fraud and Error Detection

- Data Analysis

- Others

Global AI in Medical Coding Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size and projected growth?

The market was valued at USD 2.98 billion in 2024 and is expected to reach USD 9.56 billion by 2035, growing at a CAGR of 13.18% from 2025 to 2035.

- What are the main market segments by mode?

The market is segmented into outsourced (dominant in 2024 and projected to grow substantially) and in-house.

- What are the key applications of AI in medical coding?

Applications include automated coding (the highest revenue share in 2024), fraud and error detection, data analysis, and others.

- Which region holds the largest market share?

Asia-Pacific is anticipated to hold the largest share, driven by rapid economic development, rising healthcare spending, and government initiatives like China's National AI Industry Investment Fund.

- Which region is expected to grow the fastest?

North America is projected to grow at the fastest CAGR, fueled by R&D investments, EHR adoption, and collaborations in the U.S. and Canada.

- What are the primary growth drivers?

Key drivers include demand for coding accuracy, shortages of qualified coders, growing coding data volumes, and AI tools like NLP and machine learning that reduce errors and streamline workflows.

- Who are some key players in the market?

Major companies include AGS Health, CodaMetrix, Clinion, Nuance Communications, MediCodio, and others like KODE Health, which recently raised $27 million for its platform.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 267 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |