Global Anti-fog Additives Market

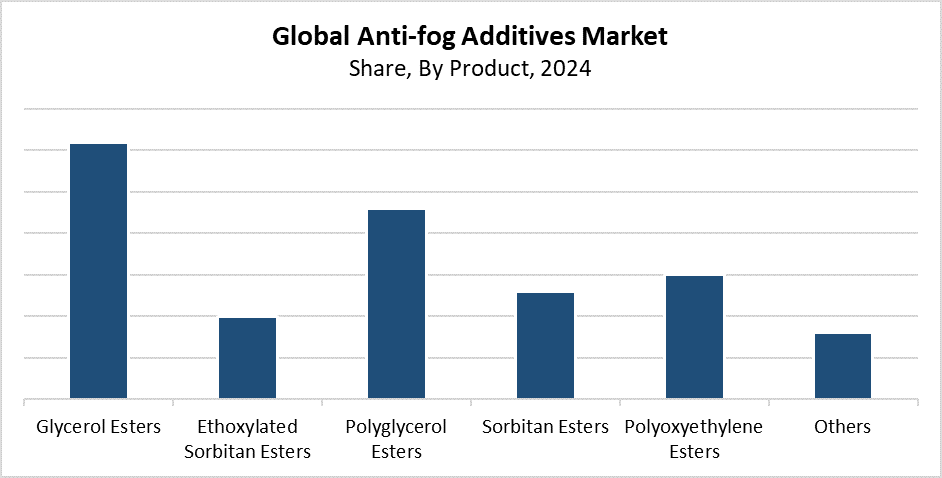

Global Anti-fog Additives Market Size, Share, and COVID-19 Impact Analysis, By Product (Glycerol Esters, Ethoxylated Sorbitan Esters, Polyglycerol Esters, Sorbitan Esters, Polyoxyethylene Esters, Others), By Application (Agricultural films, Food packaging films, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Anti-fog Additives Market Summary

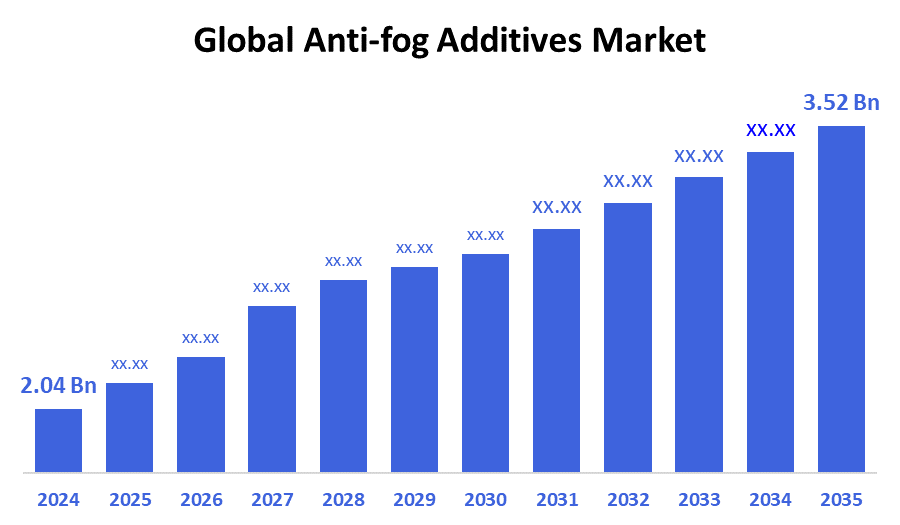

The Global Anti-Fog Additives Market Size Was Estimated at USD 2.04 Billion in 2024 and is Projected to Reach USD 3.52 Billion by 2035, Growing at a CAGR of 5.08% from 2025 to 2035. The market for anti-fog additives is expanding as a result of factors such as improved consumer safety, growing need for clear visibility in packaging, greater use in the food and automotive industries, improvements in additive formulas, and expanding adoption in electronic device and healthcare applications.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 36.72% and dominated the market globally.

- In 2024, the glycerol esters segment had the highest market share and led the market by product, accounting for 31.47%.

- In 2024, the food packaging films segment had the biggest market share and led the market by application, accounting for 65.21%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.04 billion

- 2035 Projected Market Size: USD 3.52 billion

- CAGR (2025-2035): 5.08%

- Asia Pacific: Largest market in 2024

The anti-fog additives market employs specialty chemical compounds to prevent condensation-induced fog production on surfaces and packaging materials. The additives improve both transparency levels and visibility, which proves essential for applications in electronics and food packaging as well as automotive and healthcare sectors. The food industry's growing requirement for hygienic transparent packaging drives the market because it needs to keep products visible without moisture buildup. Market growth is driven by factors that include shelf life extension, consumer safety, and packaging convenience. The healthcare industry's expansion, together with rising automobile manufacturing and medical equipment requirements for fog-free devices and protective clothing, drives the demand for anti-fog additives.

Modern anti-fog additive formulas deliver improved performance together with extended effects while demonstrating compatibility with multiple substrate types, including plastics and glass. Water-based, environmentally friendly additives that meet specific criteria serve as examples of technological progress. The advancement of non-toxic biodegradable anti-fog solutions receives support from government programs, which promote sustainable packaging alongside plastic waste reduction initiatives. Market growth remains steady because North American and European regulatory frameworks focus on environmental protection and food safety standards, which drive market acceptance.

Product Insights

The glycerol esters segment led the anti-fog additives market, accounting for the largest revenue share of 31.47% in 2024. The dominant market position of glycerol esters stems from their excellent anti-fog properties, together with their safe nature and biodegradable composition, which makes them suitable for maintaining clear visibility in food packaging. Their widespread application occurs because they maintain compatibility with various polymer substrates, including polyethylene and polypropylene. The non-toxic nature of glycerol esters, together with their environmentally friendly characteristics, makes them the first choice for packaging applications that require sustainable solutions. The segment's growth continues to expand because of formulation technology advancements that boost additive performance and durability, thereby reinforcing glycerol esters as the leading anti-fog additive in industry standards.

The polyglycerol esters segment will experience substantial growth during the forecast period. The rising demand for environmentally friendly anti-fog solutions spanning various industries, including food packaging, healthcare, and automotive, drives this market growth. Polyglycerol esters deliver superior anti-fog performance together with excellent polymer film compatibility and enhanced stability when compared to standard additives. Their biodegradable nature and non-toxic composition make them highly suitable for both regulatory requirements and the rising worldwide sustainability focus. The combination of improved production methods and reduced costs has made polyglycerol esters more appealing to manufacturers who want packaging solutions that combine transparency with security and environmental friendliness.

Application Insights

The food packaging films segment dominated the anti-fog additives market, accounting for the largest revenue share of 65.21% in 2024. The requirement to maintain product visibility together with freshness and sanitation in packaged foods, including fruits, vegetables, meats, and ready-to-eat meals, drives this strong market attitude. Anti-fog additives prevent the formation of condensed moisture on packing material surfaces, which enables clear visibility and enhances consumer attractiveness. The increasing consumer preference for convenience foods and extended product shelf durations supports the usage of these compounds. The worldwide dominance of this market segment continues to grow because producers utilize advanced anti-fog products due to food safety regulations and the rising demand for sustainable packaging materials.

During the projection period, the agricultural films segment will experience a substantial CAGR. The rising use of greenhouse films, which require anti-fog characteristics to maintain light transmission and prevent water droplet accumulation on interior surfaces, represents the main driving force behind this growth. The accumulation of fog on agricultural films leads to decreased sunlight transmission, which produces negative effects on both plant development and harvest yield. The application of anti-fog chemicals on films enhances their transparency, which enables better photosynthetic activity and creates optimal growing conditions for crops. The worldwide attention toward year-round farming and protected agriculture methods, and food security, drives up the requirement for innovative agricultural films. The market expansion for this segment happens because governmental support combines with technological progress and modern farming methods.

Regional Insights

The Asia Pacific anti-fog additives market dominated worldwide with the largest revenue share of 36.72% during 2024. The leading market position of this region stems from its fast-expanding food packaging sector and agricultural and automotive sectors, which specifically thrive in China, India, and Japan. The growing need for packaged foods, together with consumer product visibility and hygiene awareness, drives the use of anti-fog chemicals. The market expansion receives substantial support from government initiatives that promote advanced agricultural methods, together with the widespread adoption of modern greenhouse films in agriculture. The Asia Pacific market leadership for anti-fog additives stems from the large industrial base and growing investments in innovative packaging, along with supportive government regulations in the region.

North America Anti-fog Additives Market Trends

The North American market for anti-fog additives is growing significantly because food packaging, along with the automotive and healthcare industries, requires these products. Modern consumers prefer packaging solutions that combine clear visibility with tamper-evident features and appealing design for fresh fruit and dairy products and prepared foods. The region promotes producers to adopt high-performance anti-fog chemicals through its strict food safety standards and its emphasis on clear packaging solutions. Anti-fog products in the automobile sector increase driver safety by enhancing window and mirror visibility. Medical equipment, along with healthcare staff, requires protective gear that must remain fog-free during use. The market experiences growth because environmental restrictions promote sustainable, non-toxic additives, and technological advancements exist together with large market players.

Europe Anti-fog Additives Market Trends

The European market for anti-fog additives experiences substantial growth because of rising demand for sustainable packaging solutions across the food and agricultural, and medical industries. The use of eco-friendly anti-fog chemicals receives support from strict food safety and environmental protection standards, which also focus on minimizing packaging waste. The food packaging sector stands as a vital application area because consumers require clean, transparent packaging for both fresh and processed products. New greenhouse farming methods require anti-fog agricultural films to meet the increasing demand for light transmission and crop productivity enhancement. Europe presents a mature market for anti-fog additives because of its technological development alongside strong environmental rules and increasing public interest in sustainability.

Key Anti-fog Additives Market Companies:

The following are the leading companies in the anti-fog additives market.. These companies collectively hold the largest market share and dictate industry trends.

- Clariant AG

- Ampacet Corporation

- Addcomp Holland

- AkzoNobel N.V.

- Lifeline Technologies

- Palsgaard

- Croda International PLC

- Evonik Industries

- Polyvel Inc.

- Schulman, Inc.

- Sabo S.p.A

- DuPont

- PolyOne Corporation

- Fine Organics

- Others

Recent Developments

- In September 2025, Palsgaard showcased sustainable solutions for the packaging and plastics industries at K 2025 with its food-grade, plant-based polymer additives. Their Einar series provided safe, effective substitutes for traditional additives derived from fossil fuels. These substitutes were created from vegetable oils such as certified palm oil, rapeseed, and sunflower oil.

- In December 2024, Emirates Biotech, a joint venture between Global Biopolymers Industries of Hong Kong and SS Royal Kit Emirates Investment of the United Arab Emirates, announced intentions to build the largest polylactic acid (PLA) production facility in the world in the KEZAD free zone of Abu Dhabi.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the anti-fog additives market based on the below-mentioned segments:

Global Anti-fog Additives Market, By Product

- Glycerol Esters

- Ethoxylated Sorbitan Esters

- Polyglycerol Esters

- Sorbitan Esters

- Polyoxyethylene Esters

- Others

Global Anti-fog Additives Market, By Application

- Agricultural films

- Food packaging films

- Others

Global Anti-fog Additives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |