Global Antibacterial Products Market

Global Antibacterial Products Market Size, Share, and COVID-19 Impact Analysis, By Product (Body Wash, Body Moisturizer, Hand Cream & Lotion, Hand Soaps, Hand Sanitizers, Facial Cleansers, Facial Mask), By Distribution Channel (Hypermarket & supermarket, Pharmacy & Drug stores, Specialty Store, Online, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Antibacterial Products Market Size Summary

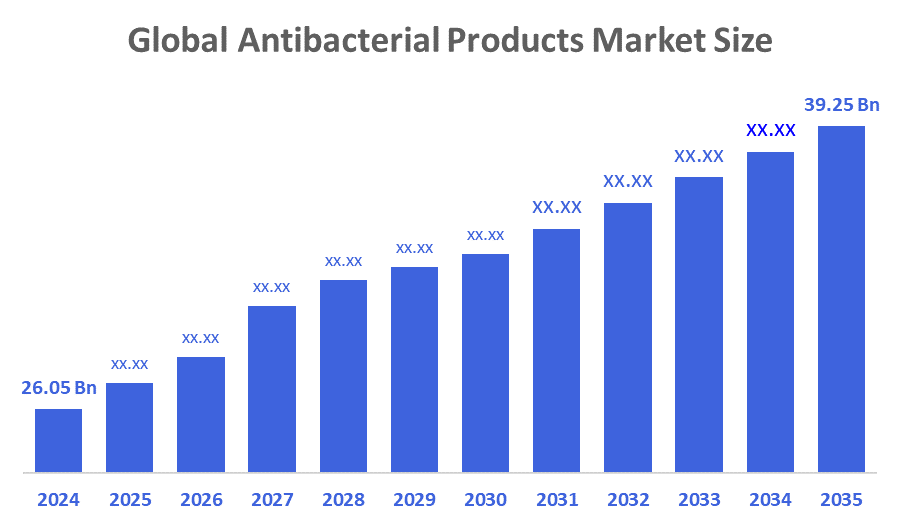

The Global Antibacterial Products Market Was Estimated at USD 26.05 Billion in 2024 and is Projected to Reach USD 39.25 Billion by 2035, Growing at a CAGR of 3.8% from 2025 to 2035. The global market for antibacterial products is expanding as a result of growing health consciousness, growing hygiene concerns, frequent infectious disease outbreaks, growing healthcare infrastructure, and increased demand for soaps, disinfectants, and sanitisers in homes, hospitals, and commercial settings.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific antibacterial products market held the largest revenue share of 45.4% and dominated the global market.

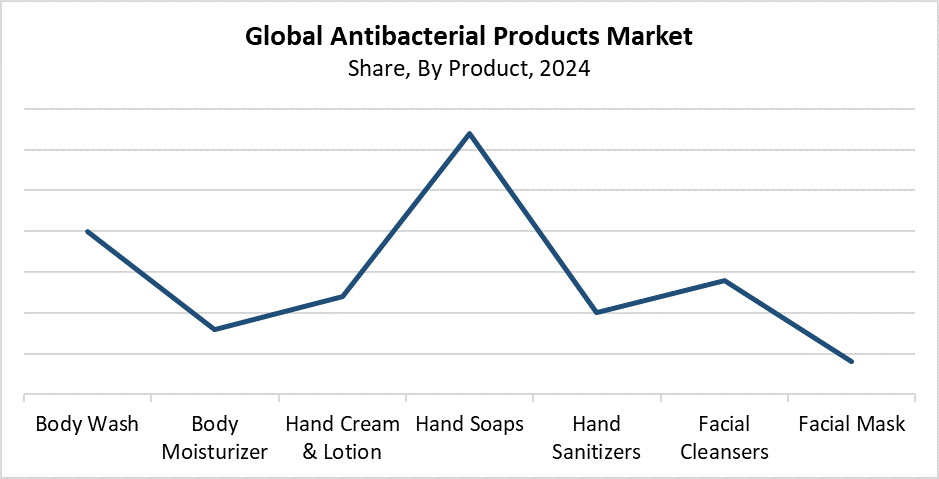

- In 2024, the hand soaps segment held the highest revenue share of 32.5% and dominated the global market by product.

- With the biggest revenue share in 2024, the hypermarkets and supermarkets segment led the worldwide antibacterial products market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 26.05 Billion

- 2035 Projected Market Size: USD 39.25 Billion

- CAGR (2025-2035): 3.8%

- Asia Pacific: Largest market in 2024

The market for antibacterial products contains various industrial and consumer goods which serve the purpose of eliminating germs or preventing their development. The items function in domestic settings as well as commercial establishments and medical facilities. The list of products includes antibacterial soaps, hand sanitisers, wipes, sprays, and surface disinfectants. The market has experienced substantial expansion because of rising infectious disease concerns and public health awareness, and increased demand for hygienic products since the COVID-19 pandemic began. People purchase antibacterial products at a higher rate because they want to keep their environment clean and their personal space free from germs. Healthcare facilities have started using these drugs at higher rates to stop hospital-acquired infections. This is because of rising hospital admissions and the growing elderly population.

Improvements in technology have been crucial in raising the effectiveness and practicality of antibacterial products. The market shows increasing interest toward three main innovations, which include long-lasting surface disinfectants, alcohol-free sanitisers, and environmentally friendly antibacterial compositions. The integration of nanotechnology with bio-based substances allows product performance and safety to achieve better results. The world governments support proper hygiene through their funding of infection control initiatives, their enforcement of stricter sanitation rules, and their public health awareness programs. The approval of new antibacterial agents and safety standards by regulatory bodies ensures product effectiveness. The market continues to expand internationally because public and private organisations work together to develop innovations.

Product Insights

The hand soaps segment held the largest revenue share of 32.5% in 2024 and led the antibacterial products market. Hand cleanliness knowledge among consumers shows itself as the primary reason for their leadership position because people see it as the main defence against infections and disease spread. The COVID-19 pandemic led to better handwashing practices. This created a lasting need for antibacterial hand soaps in residential areas, medical facilities, and business establishments. The market demand for antibacterial hand soaps with skin-friendly moisturising additives continues to rise, which drives manufacturers to produce new products for their expanding market segments. Their market domination is further supported by the products' extensive availability through pharmacies, supermarkets, and internet channels. Hand soaps maintain their position as the leading antibacterial market product because marketing campaigns, together with health authority endorsements, keep people washing their hands regularly.

The body wash segment of the antibacterial product market is expected to grow at the fastest CAGR. over the forecasted period. The market growth stems from increasing consumer interest in personal hygiene products, which combine cleaning functions with antibacterial protection. The requirement for multipurpose body washes keeps rising because urban and health-conscious people now understand better about skin care and body cleanliness. Manufacturers now create new skin formulas which contain natural antibacterial agents, moisturising elements, and skin-soothing substances to help people with sensitive skin. People prefer liquid soaps now because they find them easier to use than traditional bar soaps. The antibacterial body wash industry will experience rapid growth because of strong marketing efforts and consumer interest in wellness.

Distribution Channel Insights

The hypermarkets and supermarkets segment led the global antibacterial products market by generating the largest revenue share in 2024. These retail formats exist everywhere because they provide extensive product choices and simple shopping experiences to their customers. Customers choose to buy antibacterial items such as hand soaps, sanitisers, and sprays, and body washes from these stores because they can see product quality and compare brands, and benefit from in-store specials and bulk discounts. The distribution channel between supermarkets and hypermarkets proves successful for developed and developing countries because it delivers strong supply chains together with extensive product availability to customers. The antibacterial product market sustains its leading position through its extensive coverage of urban and suburban areas.

The online segment of the antibacterial products market is expected to grow at the fastest CAGR during the forecast period. The growth results from expanding internet access and smartphone adoption, as well as consumer demand for contactless shopping experiences. E-commerce platforms provide numerous antibacterial products at affordable prices with user feedback and home delivery services. This has made them more popular in urban and semi-urban areas. The growth of direct-to-consumer (D2C) brands, together with digital marketing approaches, has made online sales grow faster. The system uses subscription models and personalised recommendations to help keep customers coming back. The COVID-19 pandemic brought about increased digital adoption, which created lasting online shopping habits for hygiene and health products. The online segment will experience continuous strong growth throughout the entire global market.

Regional Insights

The Asia Pacific region leads the global antibacterial products market with the largest revenue share of 45.4% in 2024. The main factors driving this dominance include rising health and hygiene awareness, increasing population density, and frequent infectious disease outbreaks in China, India, and Southeast Asia. The market demand for antibacterial soaps, hand sanitisers, and disinfectants grows because urbanisation expands, disposable income increases, and healthcare and hygiene products become more accessible. The consumption of products has reached new heights because of government-led cleanliness initiatives such as India's Swachh Bharat Abhiyan. The market expansion occurs because major market players operate in an environment where e-commerce and retail infrastructure continue to develop. All of these elements work together to make Asia Pacific the world's top location for antibacterial products.

North America Antibacterial Products Market Trends

North America held a significant revenue share of the global antibacterial products market in 2024 because consumers understand hygiene and health needs while seeking effective infection prevention solutions. The region's healthcare system, together with regular product advancements from top manufacturers, has made antibacterial soaps and sanitisers, sprays, and wipes widely available to the public. The COVID-19 pandemic established permanent hygiene practices. This led to continuously increasing demand for hygiene products in homes, medical facilities, and business areas. The FDA, together with the CDC, have established strict regulations which maintain product quality standards that boost consumer trust in the products. North America leads global market trends and product innovation because consumers want antibacterial products that use natural ingredients and protect their skin.

Europe Antibacterial Products Market Trends

The European market for antibacterial products experiences significant growth because health concerns have grown, hygiene awareness among consumers has increased, and governments actively support safety and sanitation initiatives. The demand for antibacterial soaps, hand sanitisers, and surface disinfectants reaches its peak in Germany, France, and the UK for all home and business requirements. The increased product usage in this region results from its growing elderly population and frequent hospital visits, and healthcare facilities that focus on infection prevention. The market drives producers to develop new products because consumers now demand antibacterial items that protect both their skin and the environment. The European Union maintains high consumer confidence through its strict regulations about product safety and labelling requirements. The European market for antibacterial products continues to experience strong growth because retail and online distribution channels expand their reach.

Key Antibacterial Products Companies:

The following are the leading companies in the antibacterial products market. These companies collectively hold the largest market share and dictate industry trends.

- Reckitt Benckiser Group PLC

- Henkel AG & Co. KGaA

- Colgate-Palmolive Company

- GOJO Industries, Inc.

- Sebapharma

- The Himalaya Drug Company

- Johnson & Johnson Services, Inc.

- Unilever

- Bielenda

- Farouk Systems International

- Others

Recent Developments

- In November 2024, Proactiv, a brand owned by Taro Pharmaceuticals Inc., introduced a new range of products with formulas based on innovation that are optimised for skin that is prone to acne. The smoothing BHA cleanser, solution mini trial size packs, smooth and bright resurfacing mask, and blemish control body cream are among the recently released items under the Clear Skin Routine brand.

- In October 2024, the 11th season of the Banega Swasth India campaign was introduced by the Indian media outlet NDTV and the personal hygiene and cleaning products brand Dettol, which is owned by Reckitt Benckiser Group PLC. The campaign was started in 2014 to create a healthier society by influencing people's lives and changing their habits in order to promote a clean and healthy India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the antibacterial products market based on the below-mentioned segments:

Global Antibacterial Products Market, By Product

- Body Wash

- Body Moisturizer

- Hand Cream & Lotion

- Hand Soaps

- Hand Sanitizers

- Facial Cleansers

- Facial Mask

Global Antibacterial Products Market, By Distribution Channel

- Hypermarket & supermarket

- Pharmacy & Drug stores

- Specialty Store

- Online

- Others

Global Antibacterial Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 155 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |