Global AR Golfers Market

Global AR Golfers Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Device Type (Wearable Devices (Smart Glasses, Headsets), Mobile Devices (Smartphones, Tablets), and Stationary AR Simulators), By End User (Professional Golfers, Amateur Golfers, Golf Clubs & Training Academies, Entertainment Centers, and Recreational Users), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

AR Golfers Market Summary, Size & Emerging Trends

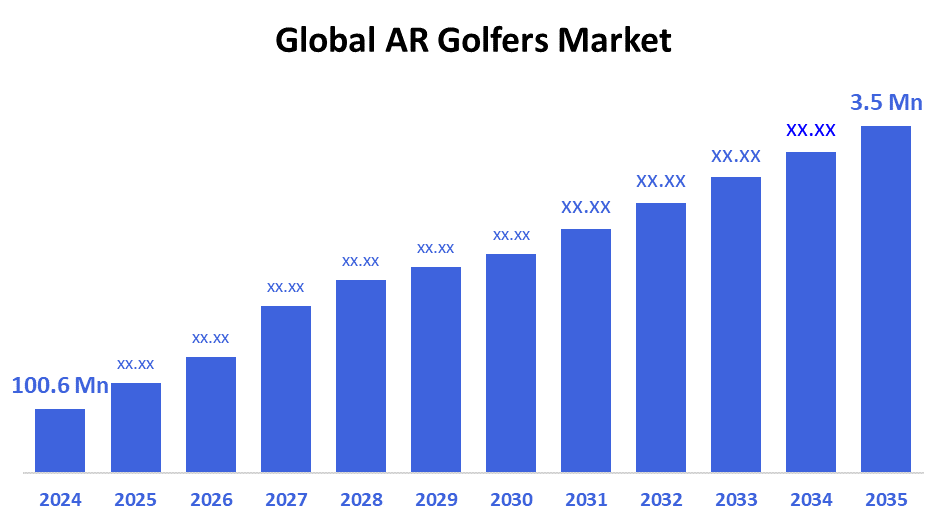

According to Decision Advisor, The Global AR Golfers Market Size is expected to grow from USD 100.6 Million in 2024 to USD 626.9 Million by 2035, at a CAGR of 18.1% during the forecast period 2025-2035. Growth is fueled by the increasing adoption of augmented reality (AR) in sports training, rising interest in golf among younger demographics, and the surge in immersive entertainment technologies. AR applications enhance swing analysis, virtual course navigation, and interactive learning, transforming how golf is played, practiced, and enjoyed.

Key Market Insights

- North America is expected to dominate the AR golfers market in 2024.

- Among device types, wearable devices (especially smart glasses) accounted for the largest market share.

- Golf clubs & training academies represent the fastest-growing end-user segment due to demand for advanced training aids.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 100.6 Million

- 2035 Projected Market Size: USD 626.9 Million

- CAGR (2025-2035): 18.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

AR Golfers Market

The AR golfers market is an emerging sector focused on enhancing golf training, gameplay, and fan engagement through augmented reality technology. It leverages AR to project digital overlays onto real-world environments, enabling immersive swing tracking, real-time feedback, and virtual course simulations. This technology is gaining adoption across professional training programs, entertainment centers, and consumer golf apps. As sports tech continues to evolve, the integration of AR is helping golfers of all levels improve performance, analyze metrics, and enjoy interactive experiences. Rising interest in tech-driven sports and increasing availability of AR-compatible devices are fueling adoption globally.

AR Golfers Market Trends

- Increasing demand for immersive sports training solutions.

- Rise of wearable AR technology tailored for athletes.

- Growing partnerships between sports tech firms and golf academies.

- Expansion of AR-based mobile golf gaming and simulations.

AR Golfers Market Dynamics

Driving Factors: Rising adoption of immersive sports training and smart devices

The market is primarily driven by the growing interest in advanced training tools among golfers and institutions. AR enhances real-time feedback, helps analyze swing mechanics, and creates engaging practice environments. Wearable and mobile AR devices allow users to access professional-level analytics on the go. Golf clubs and training centers increasingly invest in AR to attract younger players and improve coaching efficiency. The growing consumer preference for tech-enabled fitness and recreation is further supporting growth.

Restrain Factors: High cost and limited consumer awareness

Adoption is limited by the high cost of AR hardware such as smart glasses and simulators. Many golf enthusiasts remain unaware of available AR applications or lack access to compatible devices. Concerns over battery life, device comfort, and software integration challenges also hinder widespread usage. Additionally, traditionalists in the sport may resist adopting high-tech enhancements, especially in amateur or grassroots settings.

Opportunity: Integration with AI, 5G, and mobile platforms

The market has vast potential as AR is increasingly combined with AI for intelligent feedback, and 5G enables faster data processing in real-time scenarios. Mobile apps that gamify training or offer virtual coaching open up accessibility to amateur and recreational users. Expansion into developing countries where mobile penetration is high but access to golf courses is limited also presents untapped market potential.

Challenges: Technical limitations and content availability

Challenges include the need for better hardware durability in outdoor settings, limited AR golf-specific content, and a fragmented device ecosystem. Developing standard AR platforms that are compatible across devices and regions is key. Furthermore, privacy concerns regarding performance data and location tracking could impede broader adoption in some user segments.

Global AR Golfers Market Ecosystem Analysis

The AR golfers market ecosystem includes device manufacturers, AR software developers, sports training institutions, and entertainment venues. Device providers (e.g., smart glasses, AR headsets) partner with software firms to develop tailored golf applications. Training academies and golf clubs are key adopters, integrating AR into coaching programs. Entertainment centers and tech-savvy golf venues use AR to enhance visitor engagement. The market is further supported by cloud and 5G infrastructure providers enabling low-latency, real-time AR experiences.

Global AR Golfers Market, By Device Type

The wearable devices segment accounted for the largest revenue share of approximately 48% in the global AR golfers market during the forecast period. This dominance is driven by the increasing adoption of smart glasses and headsets that provide hands-free, real-time AR overlays for golf training. These devices allow professional golfers and coaches to access swing analysis, ball trajectory, and virtual course layouts without interrupting gameplay. Their integration into high-end golf clubs and training academies has made them the preferred choice for elite-level performance enhancement and immersive learning environments.

The mobile devices segment held a significant share of around 35% in the AR golfers market. With widespread smartphone and tablet usage, this segment continues to grow rapidly, especially among amateur and recreational golfers. AR-enabled mobile apps provide interactive tutorials, shot tracking, and virtual simulations that enhance practice sessions without requiring expensive hardware. The affordability, accessibility, and convenience of mobile-based AR solutions make them an attractive entry point for new users, particularly in regions with high smartphone penetration.

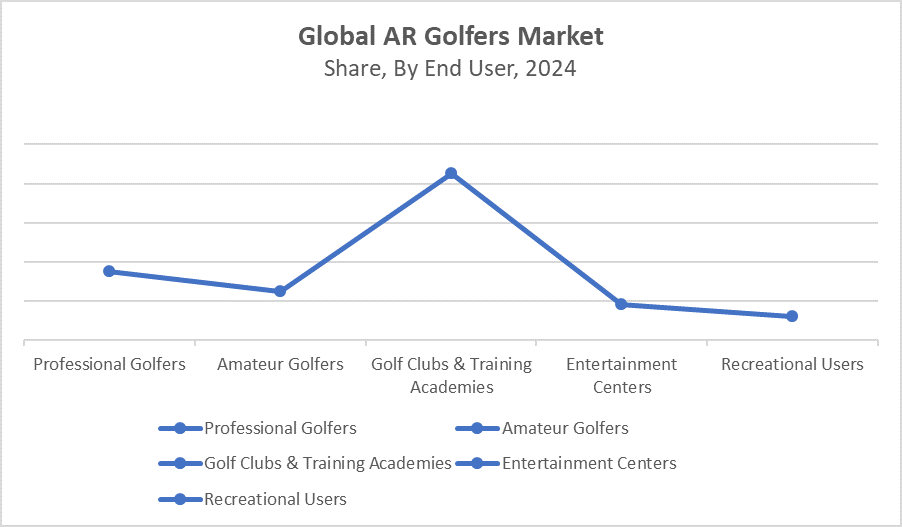

Global AR Golfers Market, By End User

The golf clubs & training academies segment accounted for the largest revenue share of approximately 42% in the global AR golfers market during the forecast period. This dominance stems from the increasing demand for cutting-edge training technologies that can offer a competitive edge. AR systems are widely adopted in clubs to provide immersive swing analysis, real-time feedback, and interactive course simulations. These solutions enhance the coaching experience, attract a younger and tech-oriented clientele, and help clubs differentiate themselves in a competitive market.

The professional golfers segment captured a notable market share of about 28%. AR technology is increasingly integrated into professional training programs to analyze biomechanics, optimize swing mechanics, and simulate real-world course conditions. Professional players use AR as part of their performance improvement strategies, often combining it with data analytics and AI-driven insights. The segment’s growth is also fueled by endorsement from top athletes and partnerships with sports tech companies focusing on elite-level enhancement.

North America accounted for the largest revenue share of approximately 40% in the global AR golfers market in 2024.

The region’s dominance is attributed to its mature golf culture, high concentration of premium golf clubs, and robust sports tech ecosystem. The United States leads with early adoption of AR technologies by golf training academies and entertainment venues like Topgolf. High disposable income and a strong base of recreational and professional golfers further support market penetration. Strategic partnerships between tech companies and sports institutions also play a key role in driving innovation and commercial adoption across the region.

Asia Pacific is the fastest-growing region, projected to grow at a CAGR of over 17.5% during the forecast period.

The market is driven by a rising interest in golf among younger populations and the surge in smartphone usage, enabling mobile AR applications. Countries like Japan, South Korea, and China are leading innovation through investments in smart sports facilities and tech-integrated golf training programs. The region also benefits from growing urbanisation and rising disposable incomes, particularly among tech-savvy millennials seeking immersive recreational experiences.

Europe holds a significant market share of around 22% in the AR golfers market.

The region’s strong golfing heritage, especially in countries like the UK, Germany, and Sweden, supports consistent adoption of advanced training technologies. European golf clubs and academies are increasingly implementing AR for swing analysis and virtual simulations to enhance coaching efficiency. The push toward digitization in sports training and growing interest in fitness tech among younger demographics also contribute to the region’s steady growth trajectory.

WORLDWIDE TOP KEY PLAYERS IN THE AR GOLFERS MARKET INCLUDE

- PuttView

- Golfzon

- ViewAR

- Microsoft (HoloLens)

- Apple (Vision Pro)

- Vuzix

- TrackMan

- Full Swing

- SkyTrak

- Magic Leap

- Others

Product Launches in AR Golfers Market

- In March 2024, PuttView launched its next-generation AR-based putting training system in March 2024, aimed at both professional and amateur golfers. The system uses smart glasses to project real-time visual guides directly onto the green, helping users visualize the ideal putting line, speed, and break. This innovation enhances putting accuracy, improves learning retention, and provides immediate visual feedback without distracting from natural movement. The product has seen rapid adoption in elite training centers and is gaining popularity in golf academies worldwide for its immersive coaching capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the AR golfers market based on the below-mentioned segments:

Global AR Golfers Market, By Device Type

- Wearable Devices (Smart Glasses, Headsets)

- Mobile Devices (Smartphones, Tablets)

- Stationary AR Simulators

Global AR Golfers Market, By End User

- Professional Golfers

- Amateur Golfers

- Golf Clubs & Training Academies

- Entertainment Centers

- Recreational Users

Global AR Golfers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the projected growth of the Global AR Golfers Market from 2024 to 2035?

A. The market is expected to grow from USD 100.6 million in 2024 to USD 626.9 million by 2035, at a CAGR of 18.1% during the forecast period 2025-2035.

Q. Which region is expected to dominate the AR golfers market in 2024?

A. North America is expected to dominate the AR golfers market in 2024, accounting for approximately 40% of the global revenue.

Q. What are the main device types in the AR golfers market?

A. The key device types include wearable devices (smart glasses and headsets), mobile devices (smartphones and tablets), and stationary AR simulators.

Q. Which device type holds the largest market share?

A. Wearable devices, particularly smart glasses, hold the largest market share with approximately 48% of the revenue during the forecast period.

Q. Who are the primary end users in the AR golfers market?

A. The primary end users include professional golfers, amateur golfers, golf clubs & training academies, entertainment centers, and recreational users.

Q. Which end-user segment is growing the fastest?

A. Golf clubs and training academies represent the fastest-growing end-user segment due to their demand for advanced training aids.

Q. What are the key factors driving market growth?

A. Growth is fueled by rising adoption of immersive sports training solutions, increasing interest in golf among younger demographics, and the surge in wearable AR technology.

Q. What are the main challenges restraining market growth?

A. High costs of AR hardware, limited consumer awareness, concerns over battery life, comfort, software integration, and resistance from traditional golf players are key challenges.

Q. How is technology like AI and 5G expected to impact the market?

A. Integration with AI and 5G enables intelligent feedback, real-time data processing, and improved mobile platform experiences, opening new avenues for growth and accessibility.

Q. Which region is expected to witness the fastest growth?

A. The Asia Pacific region is the fastest-growing market, with a CAGR of over 17.5%, driven by rising interest in golf and increasing smartphone usage.

Q. Who are the key players in the global AR golfers market?

A. Leading companies include PuttView, Golfzon, ViewAR, Microsoft (HoloLens), Apple (Vision Pro), Vuzix, TrackMan, Full Swing, SkyTrak, and Magic Leap.

Q. Are there any recent notable product launches in this market?

A. Yes, in March 2024, PuttView launched its next-generation AR-based putting training system using smart glasses to enhance putting accuracy and provide real-time visual guides.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |