Global Ashwagandha Supplements Market

Global Ashwagandha Supplements Market Size, Share, and COVID-19 Impact Analysis, By Form (Capsules, Tablets & Pills, Powder, Liquid, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Ashwagandha Supplements Market Summary

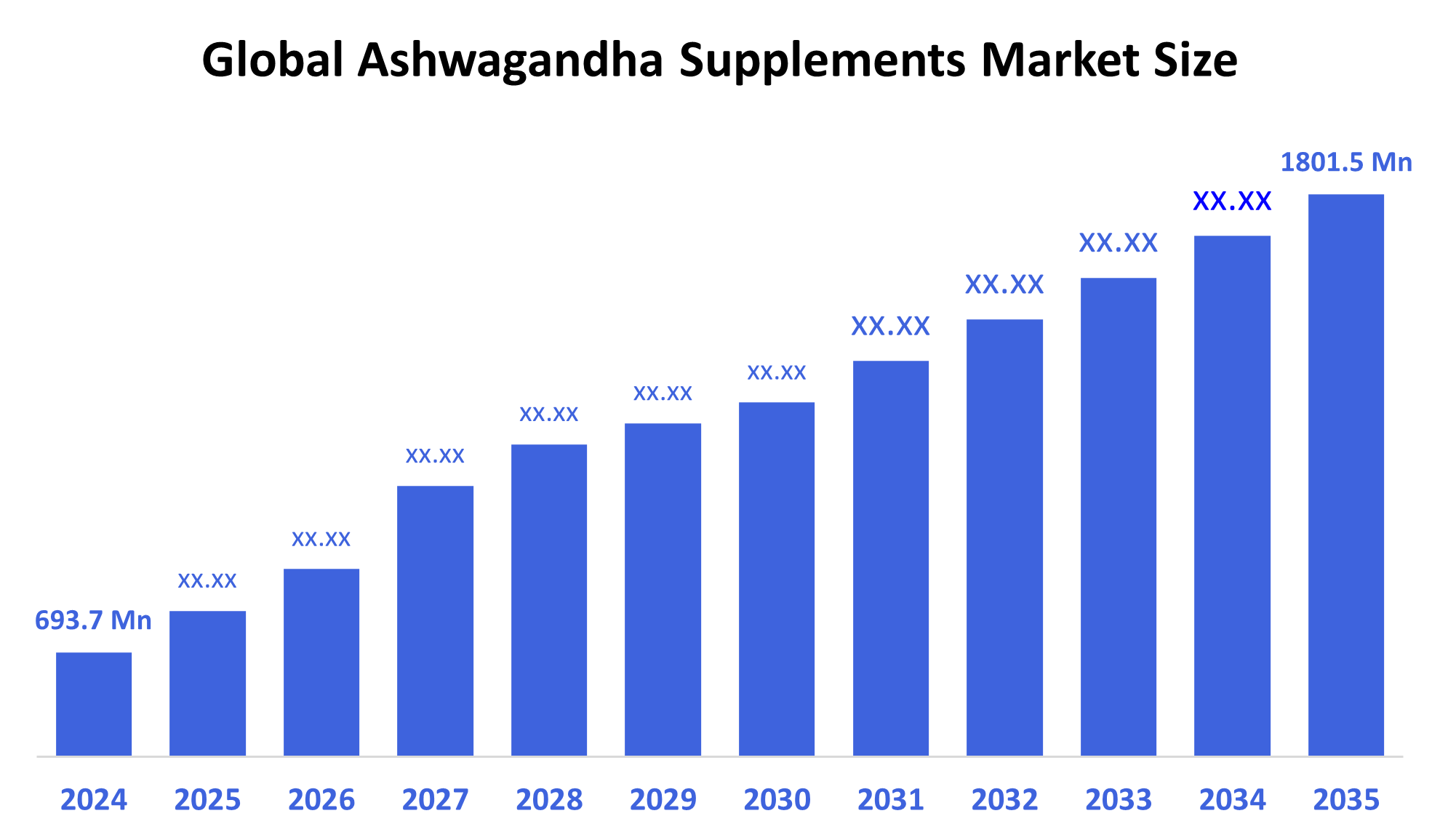

The Global Ashwagandha Supplements Market Size Was Estimated at USD 693.7 Million in 2024 and is Projected to Reach USD 1801.5 Million by 2035, Growing at a CAGR of 9.06% from 2025 to 2035. The market for ashwagandha supplements is booming as a result of growing wellness trends, growing consumer interest in natural and herbal medicines, growing knowledge of the supplement's health advantages, including increased immunity and stress relief, and growing availability through retail and online channels worldwide.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 21.5% and dominated the market globally.

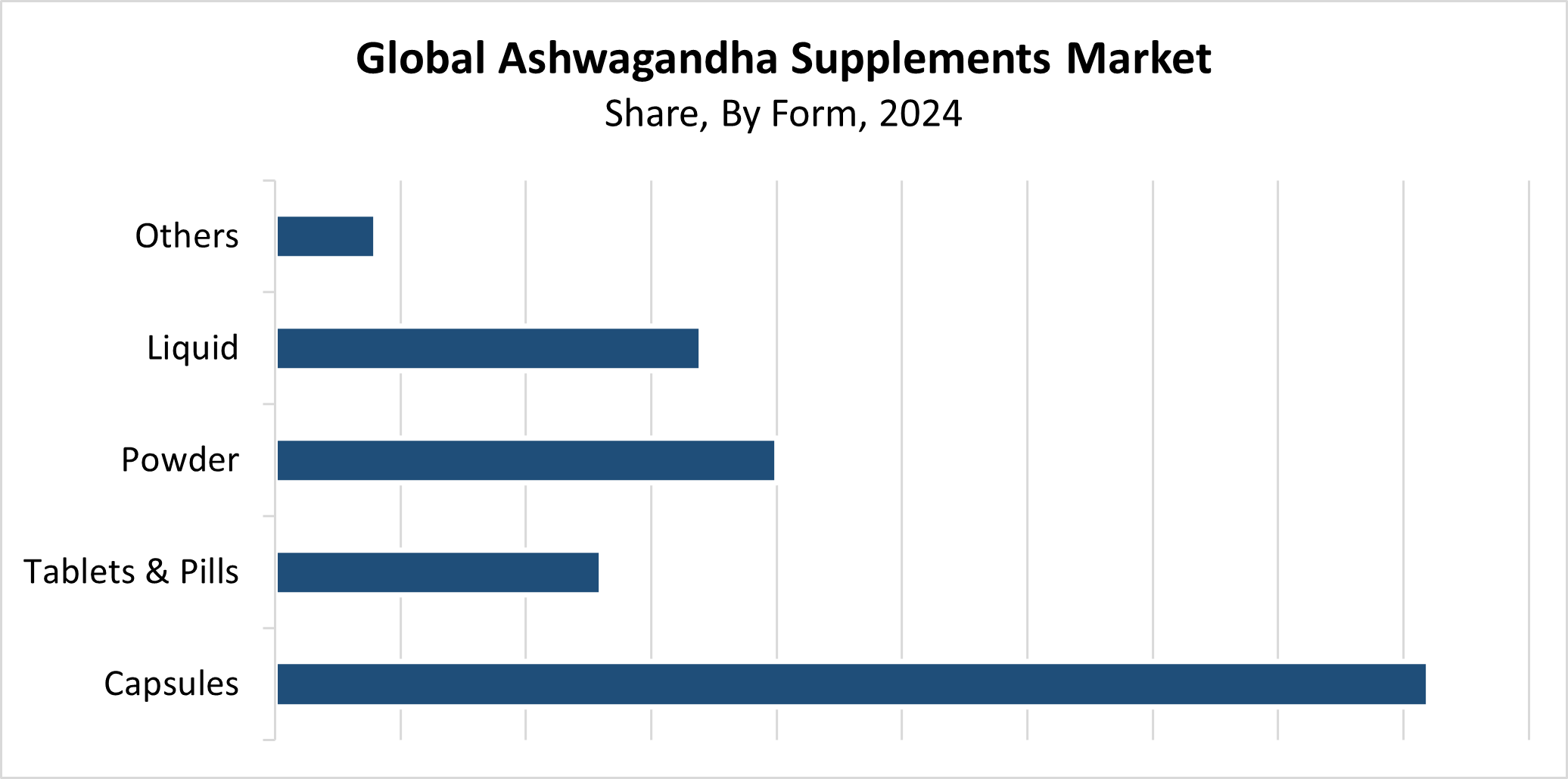

- In 2024, the capsules segment had the highest market share and led the market by form, accounting for 46.32%.

- In 2024, the retail pharmacy segment had the biggest market share and led the market by distribution channel, accounting for 45.63%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 693.7 Million

- 2035 Projected Market Size: USD 1801.5 Million

- CAGR (2025-2035): 9.06%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market for ashwagandha supplements consists of products derived from the Ashwagandha plant, which is an Ayurvedic herb known for its adaptogenic properties. The vitamins help users enhance their immune function while reducing stress and boosting energy levels, as well as supporting overall health. The industry experiences growth because customers increasingly choose natural and herbal healthcare products instead of synthetic medications. The market expands because of increasing lifestyle diseases, together with rising awareness about ashwagandha benefits and the expanding wellness industry. The worldwide customer demand for ashwagandha supplements increased because online retail and e-commerce platforms enable easier access to these products.

Technological breakthroughs have enhanced extraction and formulation methods, leading to higher efficacy and bioavailability of ashwagandha supplements. The market shows increasing interest in standardized extracts together with combination formulae, which include additional botanical substances. Herbal supplements, along with traditional medicine, experience market growth because government bodies in nations such as India actively promote them. Regulatory agencies establish quality and safety standards to uphold consumer confidence in the market. The market gains legitimacy through increased research spending and clinical studies, which validate Ashwagandha's benefits, thus driving its worldwide acceptance.

Form Insights

Why Did the Capsules Segment Dominate the Ashwagandha Supplement Market with a 46.32% Revenue Share in 2024?

The capsules segment dominated the ashwagandha supplement market with the largest revenue share of 46.32% in 2024. Customers choose capsules because they provide both simplicity and precise dosage, and convenience, which makes them ideal for daily supplement consumption. The product's appeal grows stronger when users can mix ashwagandha with different herbs through capsule packaging. Capsules demonstrate better product preservation qualities compared to both liquid and powder forms because they maintain their stability for extended periods. The requirement for easy-to-use supplement products emerges from people's hectic schedules, along with their rising health awareness. The segment's global market dominance results from the extensive distribution of ashwagandha capsules available in both physical stores and digital sales platforms.

The powder segment of the ashwagandha supplements market is expected to grow at a significant CAGR during the forecast period. The rising popularity of natural product alternatives among customers stands as the primary factor driving this market growth. Consumers can mix ashwagandha powder with their choice of beverages, including juices and smoothies, to match their personal taste and dosage needs. People who care about their health and want authentic herbal products usually choose powders because they represent a less processed and more natural form of the product. The increasing adoption of Ayurvedic and traditional wellness practices has led to rising sales of ashwagandha powder. The expansion of specialty health stores, together with internet retail platforms, makes products more accessible to consumers. The global market for ashwagandha supplements expands through packaging innovation and extended product shelf life.

Distribution Channel Insights

What Factors Enabled the Retail Pharmacy Segment to dominate the Ashwagandha Supplement Market with a 45.63% revenue share in 2024?

The retail pharmacy segment held the largest revenue share of 45.63% and led the ashwagandha supplement market in 2024. The supremacy of retail pharmacies stems from customers who trust them as reliable sources for health and wellness offerings. Retail pharmacies function as a preferred purchasing method because they deliver easy store access, expert pharmacist guidance, and authentic product guarantees. The broad network of retail pharmacies across urban and suburban areas makes it easy for customers to obtain Ashwagandha supplements. The sales volume through this channel increases because more people seek natural supplements while becoming more health-conscious. The market leader for this sector maintains its position through pharmacies that offer a broad selection of Ashwagandha products, including pills, powders, and capsules, to meet diverse customer needs.

The ashwagandha supplements market's online pharmacy segment is expected to grow at a significant CAGR through the forecast period. The fast expansion of this segment is driven by rising smartphone adoption and internet penetration, together with customer demand for convenient contactless purchasing. Online pharmacies serve busy health-oriented consumers by offering wide ashwagandha product selections at competitive prices with home delivery services. Online shoppers gain confidence from detailed product information and user reviews, and straightforward price comparison tools. The growing number of social media awareness campaigns and digital marketing efforts drives additional demand. The market for ashwagandha supplements experiences rapid growth through e-commerce because this distribution channel gains popularity worldwide, specifically among millennials and Gen Z consumers.

Regional Insights

The North American ashwagandha supplement industry dominated the global market in 2024 with the largest revenue share of 37.05%. The main reasons behind this dominance stem from high consumer awareness of natural products and herbal supplements, combined with rising holistic health interest and increasing stress-related health problems. The widespread acceptance of Ayurveda and adaptogenic herbs drives strong market demand for Ashwagandha-based products among millennials and wellness-focused buyers. The market growth receives additional support from recognized health supplement brands and advanced retail and e-commerce networks. The rising interest in clean-label and non-GMO products, along with fitness trends and mental health awareness, creates strong regional demand. North America maintains its market supremacy because natural supplement regulations alongside preventive healthcare trends support its growth.

Europe Ashwagandha Supplements Market Trends

The European market for ashwagandha supplements is expected to grow at a significant CAGR over the forecast period because of rising interest in plant-based supplements, together with increased knowledge about natural health alternatives. European consumers who are focused on holistic and preventive healthcare now use adaptogenic herbs such as ashwagandha to manage stress levels, anxiety, and fatigue. The rising popularity of herbal supplements receives additional support from customers who want clean-label and vegan products. The number of specialist health stores and online platforms, combined with favorable government policies for natural health product sales, is making these products more accessible to consumers. The ashwagandha supplement market in Europe shows promising growth because manufacturers increase their marketing efforts alongside educational programs.

Asia Pacific Ashwagandha Supplements Market Trends

During the forecast period, the Asia Pacific ashwagandha supplement market is expected to grow at the fastest CAGR. The fast expansion stems from the area's traditional medicine heritage, which recognizes ashwagandha as a vital adaptogen with wellness benefits. The shifting focus toward preventive wellness, along with rising disposable income and enhanced health awareness, drives the market growth for natural supplements. The increasing middle-class population, together with expanding urban areas, drives consumption growth across China, Japan, and India. Traditional medicine receives government support, which, combined with rising e-commerce adoption and better herbal supplement availability, propels market growth. The region's strong manufacturing sector enables large-scale production while also providing export opportunities.

Key Ashwagandha Supplements Companies:

The following are the leading companies in the ashwagandha supplements market. These companies collectively hold the largest market share and dictate industry trends.

- NOW Foods

- Gaia Herbs

- Himalaya Wellness Company

- Swanson

- Dabur

- KSM-66

- Nature's Bounty

- Solaray

- Nature Made

- Four Sigmatic

- Others

Recent Developments

- In June 2025, Natural Remedies unveiled Ashwa 30, a novel ashwagandha extract designed to promote endurance, increase energy, and alleviate stress. It has a novel ATP-active component that helps cells produce energy and is standardized to 15% withanolides.

- In May 2024, Herbochem introduced +91 ASHWAGANDHA components that can be used to make gummies, pills, capsules, or any other form that is preferred.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the ashwagandha supplements market based on the below-mentioned segments:

Global Ashwagandha Supplements Market, By Form

- Capsules

- Tablets & Pills

- Powder

- Liquid

- Others

Global Ashwagandha Supplements Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Global Ashwagandha Supplements Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |