Global Athlete?s Foot Market

Global Athletes Foot Market Size, Share, and COVID-19 Impact Analysis, By Treatment Type (Topical Antifungal Treatments, Oral Antifungal Medications, Combination Therapies, and Home Remedies), By Formulation (Cream, Gel, Spray, Powder, and Liquid), By Disease Type (Interdigital, Plantar, Vesicular, and Acute ulcerative), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Athlete’s Foot Market Size Insights Forecasts to 2035

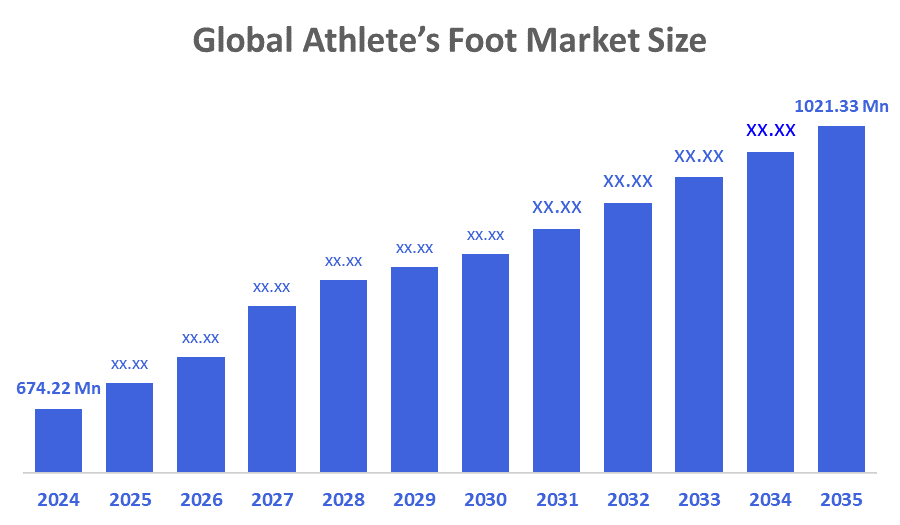

- The Global Athlete’s Foot Market Size Was Estimated at USD 674.22 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.85 % from 2025 to 2035

- The Worldwide Athlete’s Foot Market Size is Expected to Reach USD 1021.33 Million by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Athlete’s Foot Market Size Was Worth Around USD 674.22 Million In 2024 And Is Predicted To Grow To Around USD 1021.33 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 3.85 % From 2025 To 2035. Higher demand is also driven by better awareness and patient education about the condition and available treatments, supported through guidance from healthcare professionals and public health campaigns. New treatment options, including newer antifungal drugs and improved delivery methods, are enhancing outcomes and simplifying care, which supports continued market growth. Rising awareness of health and hygiene is increasing the demand for tinea pedis treatments, as consumers place a greater focus on personal care and foot health.

Market Overview

Athlete’s foot, also called tinea pedis, is a fungal infection of the skin on the feet and is most often seen between the toes. reported symptoms vary by individual and commonly include itching, burning, and stinging in the affected area. In some cases, the skin can become scaly, dry, and flaky; in more severe cases, blisters or ulcers may occur. The infection may also spread to other parts of the foot and to the toenails, which can become thick, brittle, and discoloured. In some cases, the condition may also lead to a foul odour or a rash on the foot. diagnosis typically includes a physical exam of the affected area, along with a review of the patient’s medical history and reported symptoms. In some cases, a skin culture is collected to confirm which fungus is causing the infection. This involves collecting a small sample from the affected skin and sending it to a lab for testing. Other diagnostic tests may also be used to support the diagnosis, including a skin scraping or an exam with a wood's lamp. The athletes' foot treatment market is changing in three ways. Customers are paying attention to their foot health, and they want to get rid of athlete's foot fast. They want to take care of athlete's foot before it gets worse. This is part of a trend where people want to be healthy and take care of themselves. Also, new technology is helping to make athletes' foot treatments work better. Ongoing research and development promise improved patient outcomes, making therapies more efficient and accessible.

Report Coverage

This research report categorises the athlete’s foot market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the athlete’s foot market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the athlete’s foot market.

Driving Factors

The athlete’s foot market is changing as more people pay attention to foot health and as fungal infections become more common. Consumers are more aware of the need for early treatment, and this has increased demand for antifungal products that deliver reliable results. The market offers several treatment formats, such as topical creams, sprays, and oral medicines, to meet different user needs and preferences. The rising demand for natural and organic remedies indicates a change in consumer behaviour, with more people choosing options they view as safer and better for the environment. The athlete's foot treatment market is expected to gain from new technology and improved product formulations. Advances in drug delivery methods and new active ingredients could improve treatment results and support better patient outcomes. The growth of e-commerce platforms is improving access to these products by letting consumers buy treatments online and receive them at home. Current market conditions point to continued growth, supported by steady consumer demand and ongoing dermatology research.

Restraining Factors

The rise of antifungal-resistant fungal strains is a major barrier to the growth of the global athlete's foot market. This resistance reduces the market's potential by affecting the effectiveness of established first-line treatments, like terbinafine and various azoles. As these standard treatments become less effective, the market sees more treatment failures and recurring chronic infections. Pharmaceutical companies must redirect significant financial resources from market expansion to high-risk research and development. This change raises the cost of introducing new drugs and delays the launch of profitable next-generation therapies.

Market Segmentation

The athlete’s foot market share is classified into treatment type, formulation and disease type.

- The topical antifungal treatments segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the treatment type, the athlete’s foot market is divided into topical antifungal treatments, oral antifungal medications, combination therapies, and home remedies. Among these, the topical antifungal treatments segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Topical antifungal treatments are the mainstay of the athlete's foot treatment market. They are known for their effectiveness and ease of use. These treatments act directly on the infection site, providing quick relief from symptoms and causing few side effects. This makes them a popular choice for consumers.

- The cream segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the formulation, the athlete’s foot market is segmented into cream, gel, spray, powder, and liquid. Among these, the cream segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Creams are the leading option in the Athlete's Foot Treatment Market. Their popularity comes from their effective formulation that allows for deep penetration into the affected areas. They often contain antifungal ingredients and are favoured by consumers for their effectiveness and ease of use.

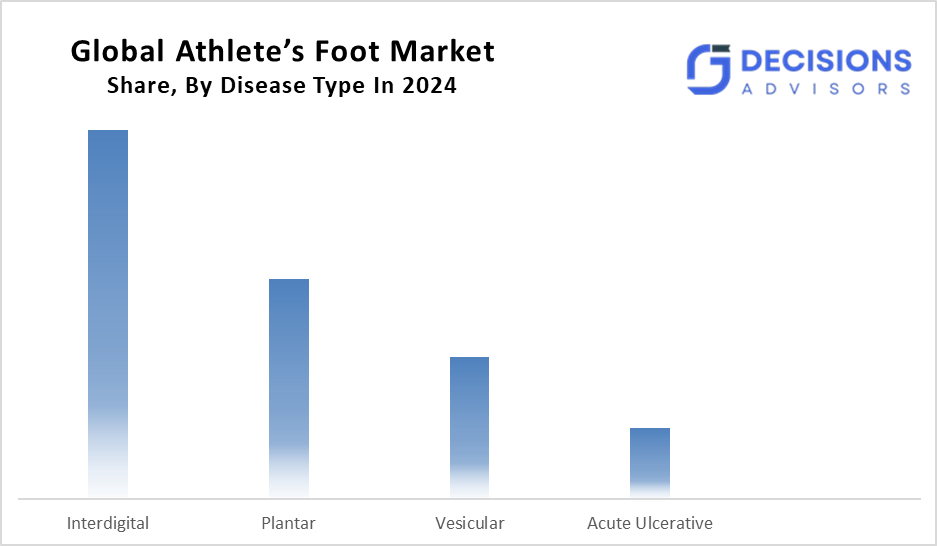

- The interdigital segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the disease type, the athlete’s foot market is divided into interdigital, plantar, vesicular, and acute ulcerative. Among these, the interdigital segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Interdigital tinea pedis involves the skin between the toes and commonly presents with itching and redness, with possible blistering or peeling. The condition occurs often, especially in athletes and in people who wear tight or poorly ventilated shoes, which increases the need for treatments that work. The risk of complications, including secondary bacterial infections and chronic infections, is increasing awareness and leading to earlier, more proactive treatment. This trend is contributing to higher demand for therapies used to treat interdigital tinea pedis.

Regional Segment Analysis of the Athlete’s Foot Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the athlete’s foot market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the athlete’s foot market over the predicted timeframe. The region is expected to hold a leading share over the forecast period due to the high rate of athlete’s foot, well-established health care facilities, and strong public awareness of the condition. In the Asia Pacific, the athlete’s foot treatment market is expected to grow, mainly due to a rising number of people with athlete’s foot, a large base of retail pharmacy stores, and ongoing improvements in health care infrastructure. The market in the Asia Pacific is expected to grow due to the region’s fast-expanding health care sector, wider access to medical facilities, and higher investment by major health care companies.

North America is expected to grow at a rapid CAGR in the athlete’s foot market during the forecast period. Tinea pedis is common in the region, mainly linked to lifestyle patterns such as frequent participation in sports and fitness activities. Heavy use of shared spaces such as gyms, locker rooms, and swimming pools raises the risk of athlete’s foot, which increases demand for treatments and contributes to regional market growth. North America has a strong base for pharmaceutical research and development, which supports ongoing work to improve antifungal treatments. This development supports a steady supply of updated treatment options for tinea pedis in the market. This supports continued growth in the region. The healthcare infrastructure in the U.S. is well developed, with wide hospital coverage and a large clinical workforce, but access and cost still vary by region and payer.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the athlete’s foot market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca PLC

- Bausch Health Companies Inc.

- Bayer AG

- Bristol-Myers Squibb Company

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Limited

- Johnson & Johnson

- Pfizer, Inc.

- Sanofi S.A.

- Sebela Pharmaceuticals Holdings Inc.

- Smith & Nephew plc

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Limited

- Viatris Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Propedix announced the launch of Dryello™, the first-ever dry stick antifungal treatment for athlete’s foot (tinea pedis). “Dryello’s unique formulation, delivery approach, and application offered an entirely new way to treat and prevent Athlete’s Foot — with a proprietary dry stick format that went on dry and stayed dry.”

- In September 2022, Dr Scholl’s launched its instant cool athlete’s foot solutions, introducing a refreshing take on antifungal care. Dr Scholl’s partnered with Rex Ryan, the former NFL head coach and current analyst, to promote its instant cool athlete’s foot treatment spray and wipes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the athlete’s foot market based on the below-mentioned segments:

Global Athlete’s Foot Market, By Treatment Type

- Topical Antifungal Treatments

- Oral Antifungal Medications

- Combination Therapies

- Home Remedies

Global Athlete’s Foot Market, By Formulation

- Cream

- Gel

- Spray

- Powder

- Liquid

Global Athlete’s Foot Market, By Disease Type

- Interdigital

- Plantar

- Vesicular

- Acute ulcerative

Global Athlete’s Foot Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected growth of the global athlete’s foot market from 2025 to 2035?

The market is expected to grow from USD 674.22 million in 2024 to USD 1021.33 million by 2035, at a CAGR of 3.85%, driven by rising awareness, hygiene focus, and new treatments.

- Which treatment type dominates the athlete’s foot market?

Topical antifungal treatments hold the largest share in 2024 and are projected to grow at a significant CAGR, due to their direct application, quick symptom relief, and minimal side effects.

- What formulation leads the market, and why?

Creams accounted for the largest share in 2024 and are expected to maintain strong growth, thanks to their deep penetration, effective antifungal ingredients, and user-friendly application.

- Which disease type generates the highest revenue?

The interdigital segment (affecting skin between toes) led revenue in 2024 and is set for significant CAGR growth, fueled by high prevalence in athletes and those wearing tight shoes, plus risks of complications.

- Which region holds the largest market share, and which is growing fastest?

Asia-Pacific is anticipated to hold the largest share due to high infection rates, robust healthcare infrastructure, and retail pharmacy networks; North America is expected to grow at the fastest CAGR, linked to sports culture and R&D advancements.

- What are the main drivers and challenges for market growth?

Drivers include heightened foot health awareness, e-commerce access, and innovative formulations; key restraints are antifungal-resistant strains, which reduce treatment efficacy and increase R&D costs for pharma companies.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |