Global Attention Deficit Hyperactivity Disorder Market

Global Attention Deficit Hyperactivity Disorder Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Stimulants, and Non-stimulants), By Demographics (Children, and Adults), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Attention Deficit Hyperactivity Disorder Market Size Insights Forecasts to 2035

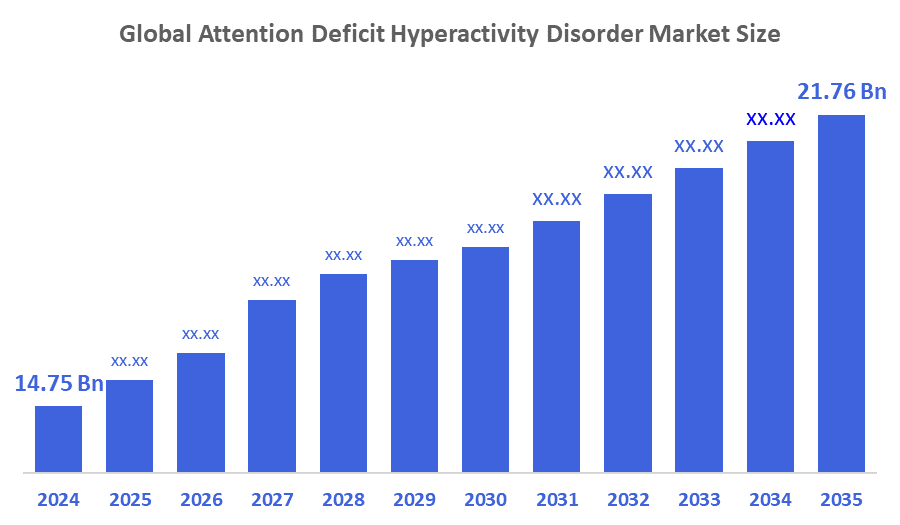

- The Global Attention Deficit Hyperactivity Disorder Market Size Was Estimated at USD 14.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.60% from 2025 to 2035

- The Worldwide Attention Deficit Hyperactivity Disorder Market Size is Expected to Reach USD 21.76 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Attention Deficit Hyperactivity Disorder Market Size was worth around USD 14.75 Billion in 2024 and is predicted to Grow to around USD 21.76 Billion by 2035 with a compound annual growth rate (CAGR) of 3.60% from 2025 to 2035. The increasing demand for attention deficit hyperactivity disorder (ADHD) medications, which is fueled by the growing incidence of ADHD worldwide, is responsible for the market's expansion. It is anticipated that as patients, medical experts, and other healthcare professionals become more aware of ADHD, the diagnosis and treatment of the disorder will increase, driving market expansion.

Market Overview

The worldwide marketplace devoted to the diagnosis, treatment, and management of ADHD using medications, behavioural therapies, and supportive care is referred to as the attention deficit hyperactivity disorder (ADHD) market. Children, adolescents, and adults can suffer from attention deficit hyperactivity disorder (ADHD), a neurological behavioural illness. It is caused by an imbalance of the chemical neurotransmitters dopamine and noradrenaline in the brain and is typified by problems with focus, hyperactivity, and impulsivity. Amphetamines and methylphenidate are two examples of psychostimulant first-line therapies for ADHD. A person must exhibit developmentally inappropriate symptoms of impulsivity, hyperactivity, and/or inattention in addition to functional difficulties in a variety of contexts to be diagnosed with ADHD. Clinical referrals are usually made primarily due to functional restrictions rather than newly emerging symptoms. Numerous variables, such as genetic mutations, prenatal exposure to alcohol or tobacco, low birth weight, and early childhood exposure to environmental pollutants, contribute to the growth in ADHD incidence. The likelihood of having ADHD might also be increased by a family history of the disorder and brain trauma.

In December 2025, NeuroSigma completed a $1 million investment into a high-volume manufacturing line for its second-generation Monarch eTNS device, designed to treat pediatric ADHD. The move strengthens its commercialisation pathway, with the first commercial units expected in March 2026.

In July 2023, ADHD Online raised $12 million in Series A funding to expand access to ADHD diagnosis and treatment through its telehealth platform. The round was led by Wakestream Ventures, with participation from Michigan Capital Network and Boomerang Ventures.

Report Coverage

This research report categorises the attention deficit hyperactivity disorder market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the attention deficit hyperactivity disorder market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the attention deficit hyperactivity disorder market.

Driving Factors

The worldwide ADHD market is growing swiftly because of increased prevalence fueled by enhanced diagnostic skills, greater awareness, efforts from healthcare professionals, and efforts for early detection, as well as improvements in standardised assessment tools, digital cognitive testing, and screening initiatives that facilitate prompt and precise diagnosis. Advancements in drug development, such as non-stimulant therapies, extended-release options, and newer psychostimulants with improved safety, are broadening treatment options and enhancing patient compliance. Additionally, an increasing emphasis on personalised medicine via genetic and neurobiological studies offers targeted treatments customised for patient subgroups, resulting in greater effectiveness and reduced side effects. Moreover, the growing acknowledgement of ADHD in adults, which has been historically underidentified, is creating new avenues with age-suitable treatments, enhanced by digital therapeutics such as mobile applications, cognitive training systems, and telepsychiatry that work alongside pharmacological and behavioural therapies for comprehensive, accessible management.

Restraining Factors

High treatment costs, a lack of awareness in developing nations, and worries about medication safety and abuse are some of the issues limiting the ADHD industry.

Market Segmentation

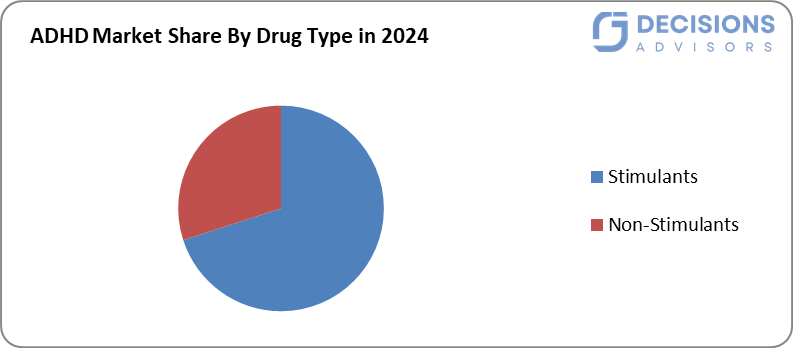

The attention deficit hyperactivity disorder market share is classified into drug type and demographics.

- The stimulants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the drug type, the attention deficit hyperactivity disorder market is segmented into stimulants, and non-stimulants. Among these, the stimulants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This high percentage can be influenced by the introduction of new goods, the rise in drug abuse, and the acceptance of extended drug versions as the most potent medications. They have the longest history of treating ADHD and the most studies demonstrating their effectiveness. The stimulant drug class includes several widely used drugs, such as Ritalin, Adderall, Dexedrine, and Focalin.

- The adult segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the demographics, the attention deficit hyperactivity disorder market is divided into children, and adults. Among these, the adult segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. For an adult to be diagnosed with ADHD, a comprehensive evaluation by a mental health professional is required. The adult will be asked about their attention span, hyperactivity, and impulsivity during this assessment. The World Health Organisation has created a self-screening test to determine whether an individual may have adult ADHD.

Regional Segment Analysis of the Attention Deficit Hyperactivity Disorder Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the attention deficit hyperactivity disorder market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the attention deficit hyperactivity disorder market over the predicted timeframe. The market for attention-deficit hyperactivity disorder (ADHD) is predicted to develop at the quickest rate in the Asia-Pacific region as a result of rising mental health awareness, educational changes, and healthcare spending. This growth is being driven by nations like South Korea, China, Japan, and India, which are expanding their mental health programs and improving access to pediatric care. Diagnosis and treatment rates are increasing due to government initiatives for early childhood intervention and rising demand for specialist mental health treatments. Japan is a major adopter of ADHD treatments and cognitive therapies due to its growing emphasis on neurodevelopmental diseases in younger and older populations.

In November 2025, Otsuka Pharmaceutical submitted a New Drug Application (NDA) to the U.S. FDA for Centanafadine, a novel ADHD treatment for children, adolescents, and adults. The filing, announced on November 25, 2025, is supported by pivotal Phase 3 trial data.

North America is expected to grow at a rapid CAGR in the attention deficit hyperactivity disorder market during the forecast period. North America dominates the global attention-deficit/hyperactivity disorder (ADHD) market due to its sophisticated healthcare infrastructure, high diagnosis rates, and significant expenditure in neurodevelopmental research. This is due to increased awareness, early diagnostic programs in schools, and widespread use of behavioural and pharmaceutical therapy; the United States has the biggest market share. Leading pharmaceutical corporations and large-scale research projects encourage ongoing innovation in drug formulations and digital therapy platforms. Treatment adoption rates have increased due to favourable insurance coverage for behavioural therapy and ADHD drugs, as well as robust support from mental health advocacy organisations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the attention deficit hyperactivity disorder market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aevi Genomic Medicine LLC

- Arbour Pharmaceuticals Inc.

- BioLite Inc.

- CoMentis

- Direct

- Janssen Pharmaceuticals

- Johnson & Johnson Ltd.

- Neos Therapeutics Inc.

- New River Pharmaceuticals

- Novartis

- Orient Pharma Co. Ltd.

- Otsuka Pharmaceuticals

- Pfizer

- Rhodes Pharmaceuticals L.P.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Neuraxpharm launched the “Refocus ADHD” campaign to coincide with ADHD Awareness Month and World Mental Health Day. The initiative aims to raise understanding, challenge stigma, and provide support for people living with ADHD worldwide.

- In September 2025, Cingulate Inc. entered into an exclusive manufacturing partnership with Bend Bio Sciences to support the future commercialisation of its next-generation ADHD treatment, CTx-1301. This agreement positions the company for commercial launch pending FDA approval.

- In May 2025, Busy Philipps partnered with Supernus Pharmaceuticals to launch the “Ms Represented” campaign, aimed at empowering women with ADHD by highlighting their often-overlooked symptoms and experiences. The initiative coincides with Mental Health Awareness Month and focuses on reducing stigma, improving diagnosis, and promoting treatment options like Qelbree.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors and Consulting has segmented the attention deficit hyperactivity disorder market based on the below-mentioned segments:

Global Attention Deficit Hyperactivity Disorder Market, By Drug Type

- Stimulants

- Non-stimulants

Global Attention Deficit Hyperactivity Disorder Market, By Demographics

- Children

- Adults

Global Attention Deficit Hyperactivity Disorder Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected size and growth rate of the global ADHD market?

The market was valued at USD 14.75 billion in 2024 and is expected to reach USD 21.76 billion by 2035, growing at a CAGR of 3.60% from 2025 to 2035.

- What are the main segments of the ADHD market by drug type?

The market divides into stimulants (e.g., Ritalin, Adderall, Dexedrine, Focalin) and non-stimulants. Stimulants held the largest share in 2024 and are projected to grow at a significant CAGR due to their proven efficacy, new formulations, and widespread use.

- How is the market segmented by demographics?

It splits into children and adults. The adult segment generated the highest revenue in 2024 and is anticipated to expand at a significant CAGR, driven by increased recognition and diagnosis in adults.

- Which region leads the ADHD market, and which is growing fastest?

Asia-Pacific is expected to hold the largest share over the forecast period, fueled by rising mental health awareness, government initiatives, and healthcare investments in countries like China, Japan, India, and South Korea. North America is projected to grow at the fastest CAGR, supported by advanced infrastructure, high diagnosis rates, and research in the U.S. and Canada.

- What are the primary drivers of the ADHD market growth?

Key factors include rising ADHD prevalence due to better diagnostics and awareness, advancements in treatments like extended-release stimulants and non-stimulants, personalised medicine, adult ADHD recognition, and digital therapeutics such as apps and telepsychiatry.

- What challenges or restraining factors affect the market?

High treatment costs, limited awareness in developing regions, and concerns over medication safety and abuse potential hinder growth.

- Who are the major companies in the ADHD market?

Key players include Aevi Genomic Medicine LLC, Arbour Pharmaceuticals Inc., Janssen Pharmaceuticals, Johnson & Johnson Ltd., Neos Therapeutics Inc., Novartis, Otsuka Pharmaceuticals, Pfizer, Purdue Pharma LP, and Rhodes Pharmaceuticals L.P., among others.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Drug Type

- Market Attractiveness Analysis By Demographics

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Medical experts, and other healthcare professionals become more aware of ADHD

- Restraints

- Worries about medication safety and abuse are some of the issues

- Opportunities

- Diagnostic skills, greater awareness, efforts from healthcare professionals

- Challenges

- High treatment costs, a lack of awareness in developing nations

- Global Attention Deficit Hyperactivity Disorder Market Analysis and Projection, By Drug Type

- Segment Overview

- Stimulants

- Non-stimulants

- Global Attention Deficit Hyperactivity Disorder Market Analysis and Projection, By Demographics

- Segment Overview

- Children

- Adults

- Global Attention Deficit Hyperactivity Disorder Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Attention Deficit Hyperactivity Disorder Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Attention Deficit Hyperactivity Disorder Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Aevi Genomic Medicine LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Arbour Pharmaceuticals Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BioLite Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- CoMentis

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Direct

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Janssen Pharmaceuticals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Johnson & Johnson Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Neos Therapeutics Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- New River Pharmaceuticals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Novartis

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Orient Pharma Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Otsuka Pharmaceuticals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Pfizer

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Rhodes Pharmaceuticals L.P.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Aevi Genomic Medicine LLC

List of Table

- Global Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Global Stimulants, Attention Deficit Hyperactivity Disorder Market, By Region, 2024-2035(USD Billion)

- Global Non-stimulants, Attention Deficit Hyperactivity Disorder Market, By Region, 2024-2035(USD Billion)

- Global Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Global Children, Attention Deficit Hyperactivity Disorder Market, By Region, 2024-2035(USD Billion)

- Global Adults, Attention Deficit Hyperactivity Disorder Market, By Region, 2024-2035(USD Billion)

- North America Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- North America Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- U.S. Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- U.S. Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Canada Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Canada Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Mexico Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Mexico Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Europe Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Europe Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Germany Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Germany Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- France Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- France Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- U.K. Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- U.K. Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Italy Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Italy Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Spain Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Spain Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Asia Pacific Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Asia Pacific Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Japan Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Japan Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- China Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- China Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- India Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- India Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- South America Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- South America Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- Brazil Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- Brazil Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- The Middle East and Africa Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- The Middle East and Africa Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- UAE Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- UAE Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

- South Africa Attention Deficit Hyperactivity Disorder Market, By Drug Type, 2024-2035(USD Billion)

- South Africa Attention Deficit Hyperactivity Disorder Market, By Demographics, 2024-2035(USD Billion)

List of Figures

- Global Attention Deficit Hyperactivity Disorder Market Segmentation

- Attention Deficit Hyperactivity Disorder Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Attention Deficit Hyperactivity Disorder Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Attention Deficit Hyperactivity Disorder Market

- Attention Deficit Hyperactivity Disorder Market Segmentation, By Drug Type

- Attention Deficit Hyperactivity Disorder Market For Stimulants, By Region, 2024-2035 ($ Billion)

- Attention Deficit Hyperactivity Disorder Market For Non-stimulants, By Region, 2024-2035 ($ Billion)

- Attention Deficit Hyperactivity Disorder Market Segmentation, By Demographics

- Attention Deficit Hyperactivity Disorder Market For Children, By Region, 2024-2035 ($ Billion)

- Attention Deficit Hyperactivity Disorder Market For Adults, By Region, 2024-2035 ($ Billion)

- Aevi Genomic Medicine LLC: Net Sales, 2024-2035 ($ Billion)

- Aevi Genomic Medicine LLC: Revenue Share, By Segment, 2024 (%)

- Aevi Genomic Medicine LLC: Revenue Share, By Region, 2024 (%)

- Arbour Pharmaceuticals Inc.: Net Sales, 2024-2035 ($ Billion)

- Arbour Pharmaceuticals Inc.: Revenue Share, By Segment, 2024 (%)

- Arbour Pharmaceuticals Inc.: Revenue Share, By Region, 2024 (%)

- BioLite Inc: Net Sales, 2024-2035 ($ Billion)

- BioLite Inc: Revenue Share, By Segment, 2024 (%)

- BioLite Inc: Revenue Share, By Region, 2024 (%)

- CoMentis: Net Sales, 2024-2035 ($ Billion)

- CoMentis: Revenue Share, By Segment, 2024 (%)

- CoMentis: Revenue Share, By Region, 2024 (%)

- Direct: Net Sales, 2024-2035 ($ Billion)

- Direct: Revenue Share, By Segment, 2024 (%)

- Direct: Revenue Share, By Region, 2024 (%)

- Janssen Pharmaceuticals: Net Sales, 2024-2035 ($ Billion)

- Janssen Pharmaceuticals: Revenue Share, By Segment, 2024 (%)

- Janssen Pharmaceuticals: Revenue Share, By Region, 2024 (%)

- Johnson & Johnson Ltd.: Net Sales, 2024-2035 ($ Billion)

- Johnson & Johnson Ltd.: Revenue Share, By Segment, 2024 (%)

- Johnson & Johnson Ltd.: Revenue Share, By Region, 2024 (%)

- Neos Therapeutics Inc.: Net Sales, 2024-2035 ($ Billion)

- Neos Therapeutics Inc.: Revenue Share, By Segment, 2024 (%)

- Neos Therapeutics Inc.: Revenue Share, By Region, 2024 (%)

- New River Pharmaceuticals.: Net Sales, 2024-2035 ($ Billion)

- New River Pharmaceuticals.: Revenue Share, By Segment, 2024 (%)

- New River Pharmaceuticals.: Revenue Share, By Region, 2024 (%)

- Novartis: Net Sales, 2024-2035 ($ Billion)

- Novartis: Revenue Share, By Segment, 2024 (%)

- Novartis: Revenue Share, By Region, 2024 (%)

- Orient Pharma Co. Ltd.: Net Sales, 2024-2035 ($ Billion)

- Orient Pharma Co. Ltd.: Revenue Share, By Segment, 2024 (%)

- Orient Pharma Co. Ltd.: Revenue Share, By Region, 2024 (%)

- Otsuka Pharmaceuticals: Net Sales, 2024-2035 ($ Billion)

- Otsuka Pharmaceuticals: Revenue Share, By Segment, 2024 (%)

- Otsuka Pharmaceuticals: Revenue Share, By Region, 2024 (%)

- Pfizer: Net Sales, 2024-2035 ($ Billion)

- Pfizer: Revenue Share, By Segment, 2024 (%)

- Pfizer: Revenue Share, By Region, 2024 (%)

- Rhodes Pharmaceuticals L.P.: Net Sales, 2024-2035 ($ Billion)

- Rhodes Pharmaceuticals L.P.: Revenue Share, By Segment, 2024 (%)

- Rhodes Pharmaceuticals L.P.: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 229 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |