Australia Accounts Receivable Automation Market

Australia Accounts Receivable Automation Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Solution, and Services), By Vertical Type (Consumer Goods and Retail, BFSI, Manufacturing, IT and Telecom, Healthcare, Energy and Utilities, and Others), and Australia Accounts Receivable Automation Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Accounts Receivable Automation Market Insights Forecasts to 2035

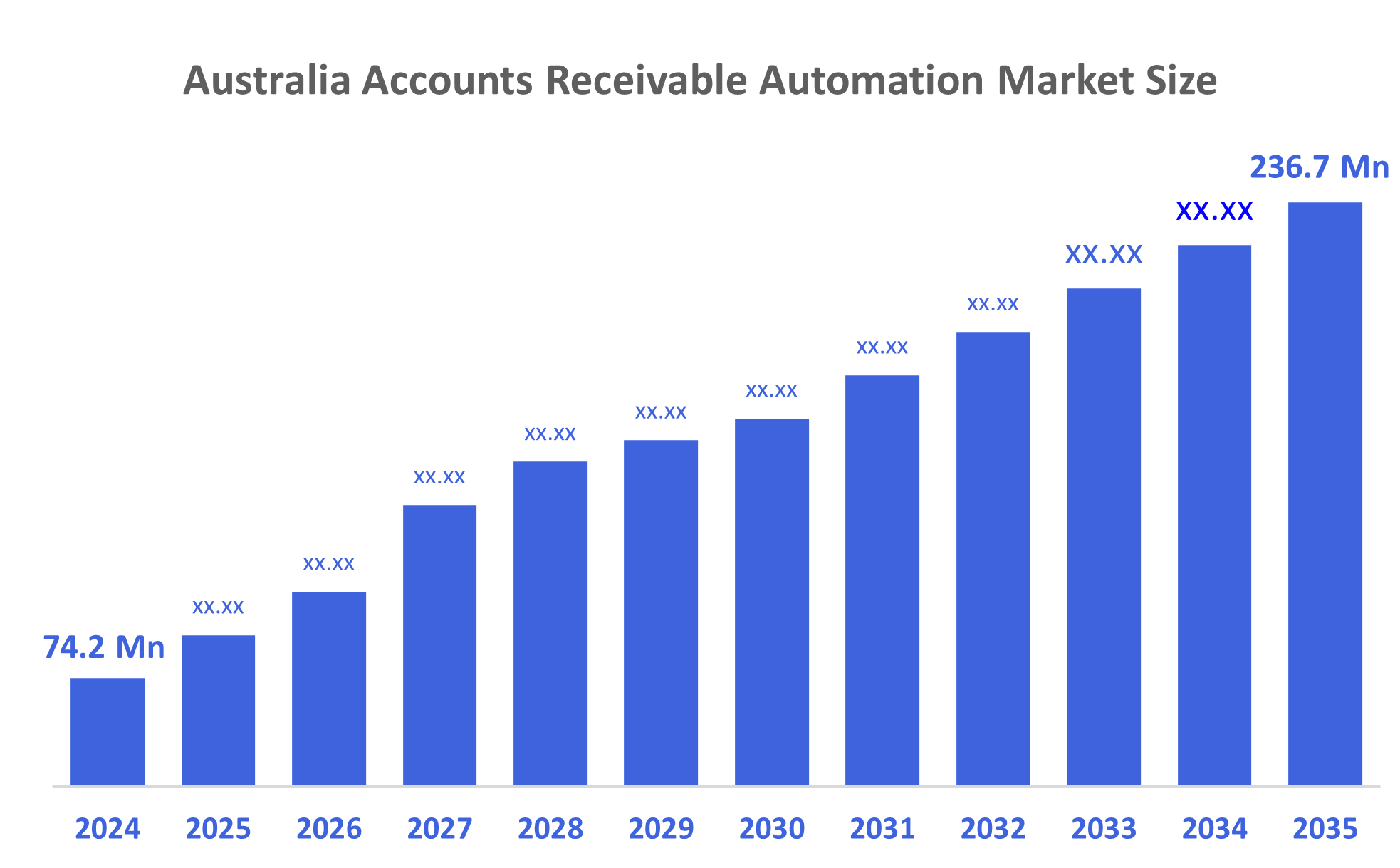

- The Australia Accounts Receivable Automation Market Size Was Estimated at USD 74.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.12% from 2025 to 2035

- The Australia Accounts Receivable Automation Market Size is Expected to Reach USD 236.7 Million by 2035

According to a research report published by Decisions Advisors, The Australia Accounts Receivable Automation Market Size is Anticipated to Reach USD 236.7 Million by 2035, Growing at a CAGR of 11.12% from 2025 to 2035. The accounts receivable automation market in Australia is driven by rising cloud adoption among SMEs, increasing use of AI-powered analytics, growing focus on operational efficiency, faster cash flow management, and strategic partnerships and acquisitions that strengthen market presence.

Market Overview

The accounts receivable automation industry provides businesses with technology and services that enable the automation and management of all aspects of their accounts receivable process. The market in Australia for accounts receivable automation is growing at a rapid pace due to companies transitioning away from using manual processes for invoicing and accounts receivable collections towards utilizing cloud-based platforms that leverage Artificial Intelligence technology to provide better visibility into cash flow and ultimately reduce DSO. The primary driving forces behind this rapid growth are increased digital adoption for small and medium enterprises (SMEs), the growing need for predictive analytics, and increased pressure on companies to operate more efficiently. In addition, government programs that provide digital transformation grants, small business technology incentives, and R&D funding will continue to encourage and enable further adoption of Accounts Receivable Automation solutions.

Government programs such as the ASBAS Digital Solutions fund (AUD 25.136 million) and past incentives like the 20% Technology Investment Boost help SMEs lower the cost of adopting digital tools. For example, a small business investing AUD 10,000 in AR automation software could previously claim an extra AUD 2,000 deduction, making automation more affordable and accelerating adoption. Potential growth opportunities for accounts receivable automation solutions include SME oriented solutions, industry-specific accounts receivable tools, and partnerships between FinTechs and Accounting providers.

Report Coverage

This research report categorizes the market for the Australia accounts receivable automation market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia accounts receivable automation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia accounts receivable automation market.

Driving Factors

The accounts receivable automation market in Australia is driven by rapid digital transformation across SMEs, rising adoption of cloud-based finance tools, and growing reliance on AI and machine learning for predictive collections and cash-flow analytics. Government statutes and legislation, such as digital capability grants and tax credits for investments in technology, along with research and development (R&D) grants, support the development of these accounts receivable automation systems and assist in their introduction into the marketplace and their acceptance by SME (small to medium enterprises).

Restraining Factors

The accounts receivable automation market in Australia is mostly constrained by high initial implementation costs, resistance to change by SMEs, insufficient digital skill sets, along fears regarding data security, which are all typical reasons that prevent SMEs from implementing automation technology within their business.

Market Segmentation

The Australia accounts receivable automation market share is classified into component and vertical types.

- The solution segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia accounts receivable automation market is segmented by component type into solution and services. Among these, the solution segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because businesses are increasingly using cloud-based invoicing, payment processing, and AI-driven analytics to reduce manual workload, lower errors, and accelerate cash flow cycles, the solution segment dominates the Australian accounts receivable automation market. As a result, software solutions generate more revenue than service-based offerings.

- The BFSI segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia accounts receivable automation market is segmented by vertical type into consumer goods and retail, BFSI, manufacturing, it and telecom, healthcare, energy and utilities, and others. Among these, the BFSI segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to high transaction volumes, stringent regulatory compliance, and the requirement for effective cash flow management, the BFSI (Banking, Financial Services, and Insurance) segment dominates the Australian accounts receivable automation market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia accounts receivable automation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reckon Limited

- MYOB

- Technology One

- Pronto Software

- simPRO Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, Xero announced new features, including an AI-powered financial “superagent” called JAX, which can auto-reconcile bank transactions and provide real?time cashflow, P&L, and balance?sheet insights.

- In July 2025, Zip Co integrated with Xero (via Stripe) in Australia, allowing small businesses to add flexible payment?plan options to invoices, while still receiving full payment upfront. This helps tackle late payments and strengthen cash flow management.

- In June 2025, Xero agreed to acquire US-based bill?pay platform Melio in a US$2.5 billion deal, signaling a move to integrate AR/AP, invoicing, and payments within one platform.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia accounts receivable automation market based on the below-mentioned segments:

Australia Accounts Receivable Automation Market, By Component Type

- Solution

- Services

Australia Accounts Receivable Automation Market, By Vertical Type

- Consumer Goods and Retail

- BFSI

- Manufacturing

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |