Australia Acoustic Camera Market

Australia Acoustic Camera Market Size, Share, and COVID-19 Impact Analysis, By Array Type (2D and 3D), By End User (Aerospace and Defense, Infrastructure, Energy and Power, Automotive, and Others), and Australia Acoustic Camera Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Acoustic Camera Market Insights Forecasts to 2035

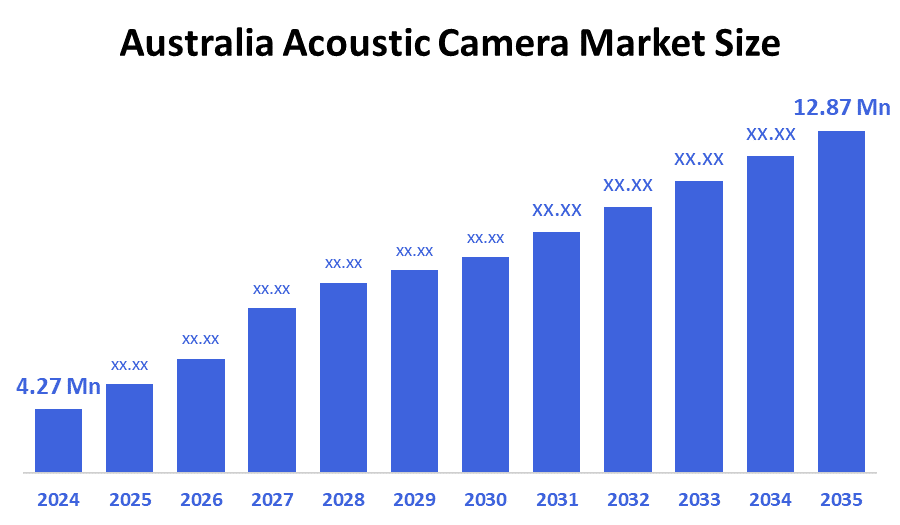

- The Australia Acoustic Camera Market Size Was Estimated at USD 4.74 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.51% from 2025 to 2035

- The Australia Acoustic Camera Market Size is Expected to Reach USD 12.87 Million by 2035

According to a research report published by decision advisor & Consulting, the Australia acoustic camera market size is anticipated to reach USD 12.87 million by 2035, growing at a CAGR of 9.51% from 2025 to 2035. The acoustic camera market in Australia is driven by strict noise regulations, renewable energy expansion, rising EV-related NVH testing, and AI-enabled acoustic analytics that enhance detection accuracy and efficiency.

Market Overview

The term "Acoustic Camera Market" refers to an industry primarily focused on the development, manufacturing, and application of acoustic cameras. Acoustic cameras utilize arrays of microphones combined with imaging technology to visualize, quantify, and locate the source of sound in real-time. The systems measure both the direction and the volume of noise to create sound maps. Acoustic cameras are an important source of noise measurement diagnostics for several industries, including automotive, aerospace, manufacturing, energy, and environmental. In Australia, the market for acoustic cameras is expanding mainly due to stricter enforcement of noise laws, especially in the transportation, urban, industrial, and construction sectors. The Australian Government is increasing its support for renewable energy projects (e.g., wind farms and battery energy storage), leading to a greater need for accurate monitoring of noise and compliance reports.

The rapid growth of renewable energy is supported by the pledges made by the federal government and state governments of 82% renewable energy by 2030 and net-zero emissions by 2050, through large policy frameworks such as the Future Made in Australia plan with AUD 22.7 billion of funding and the Capacity Investment Scheme. Product innovations such as AI-enhanced acoustic evaluation, lightweight portable 3D microphone arrays, and real-time sound mapping are driving market acceptance in predictive maintenance and simulation-led NVH testing of electric vehicles. Furthermore, opportunities are improving within the markets for smart city noise mapping, consultancy-style noise observation, and rental service models for large capital infrastructure projects.

Report Coverage

This research report categorizes the market for the Australia acoustic camera market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia acoustic camera market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia acoustic camera market.

Driving Factors

The acoustic camera market in Australia is driven by strict regulatory noise compliance enforcement across the industrial, construction, and transportation fields, which is requiring greater needs for accurate noise source incrementally and industry expansion of renewable energy initiatives, particularly from wind farms and battery storage installations which will require advanced acoustic monitoring for compliance, electric vehicle (EV) technology initiatives increasing NVH applications, and, the introduction of artificial intelligence enabled acoustic analytics used for predictive maintenance increasing operational efficiency. Growing smart city initiatives will also enhance the long-term application of acoustic imaging solutions.

Restraining Factors

The acoustic camera market in Australia is mostly constrained by high costs of equipment, the limited availability of operators that are qualified and/or skilled within cost-sensitive and cautious adoption industries, the lack of any national standardized guideline for noise compliance, and the continued preference towards traditional measurement as opposed to acoustics in certain sectors.

Market Segmentation

The Australia acoustic camera market share is classified into array type and end user.

- The 3D segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia acoustic camera market is segmented by array type into 2D and 3D. Among these, the 3D segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it provides greater spatial resolution, accurate sound source localization, enables EV NVH and industrial diagnostics, and satisfies more stringent compliance requirements across advanced applications, the 3D array segment dominates the Australian acoustic camera market.

- The automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia acoustic camera market is segmented by end user into aerospace and defense, infrastructure, energy and power, automotive, and others. Among these, the automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to strict NVH testing requirements, quick EV adoption, the need for accurate noise source localization, and significant R&D expenditure to produce quieter, high-performance vehicles, the automotive segment dominates the Australian acoustic camera market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia acoustic camera market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SoundCam Australia

- Air?Met Scientific Pty Ltd

- NVMS (Noise & Vibration Measurement Systems) Pty Ltd

- SAVTEK Pty Ltd

- Texcel Integrated Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, HW Technologies showcased further cutting-edge acoustic camera solutions at the "Acoustics 2025" conference in Perth (November 12-14, 2025).

- In November 2025, Australia's new legislation requires all new electric vehicles to be supplied with an Acoustic Vehicle Alerting System (AVAS) from November 1, 2025, increasing the significance of acoustic systems.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. decision advisor has segmented the Australia acoustic camera market based on the below-mentioned segments:

Australia Acoustic Camera Market, By Array Type

- 2D

- 3D

Australia Acoustic Camera Market, By End User

- Aerospace and Defense

- Infrastructure

- Energy and Power

- Automotive

- Others

FAQ’s

Q: What is the Australia acoustic camera market size?

A: Australia acoustic camera market size is expected to grow from USD 4.74 million in 2024 to USD 12.87 million by 2035, growing at a CAGR of 9,51% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by strict regulatory noise compliance enforcement across the industrial, construction, and transportation fields, which is requiring greater needs for accurate noise source incrementally and industry expansion of renewable energy initiatives, particularly from wind farms and battery storage installations which will require advanced acoustic monitoring for compliance, electric vehicle (EV) technology initiatives increasing NVH applications, and, the introduction of artificial intelligence enabled acoustic analytics used for predictive maintenance increasing operational efficiency.

Q: What factors restrain the Australia acoustic camera market?

A: Constraints include the high costs of equipment, the limited availability of operators that are qualified and/or skilled within cost-sensitive and cautious adoption industries, the lack of any national standardized guideline for noise compliance, and the continued preference towards traditional measurement as opposed to acoustics in certain sectors.

Q: How is the market segmented by array type?

A: The market is segmented into 2D and 3D.

Q: Who are the key players in the Australia acoustic camera market?

A: Key companies include SoundCam Australia, Air?Met Scientific Pty Ltd, NVMS (Noise & Vibration Measurement Systems) Pty Ltd, SAVTEK Pty Ltd., Texcel Integrated Pty Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 202 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |