Australia Activated Carbon Fiber Market

Australia Activated Carbon Fiber Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Synthetic and Natural), By Application (Water Treatment, Food and Beverage Processing, Pharmaceutical and Medical, Automotive, Air Purification, and Others), and Australia Activated Carbon Fiber Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Activated Carbon Fiber Market Size Insights Forecasts to 2035

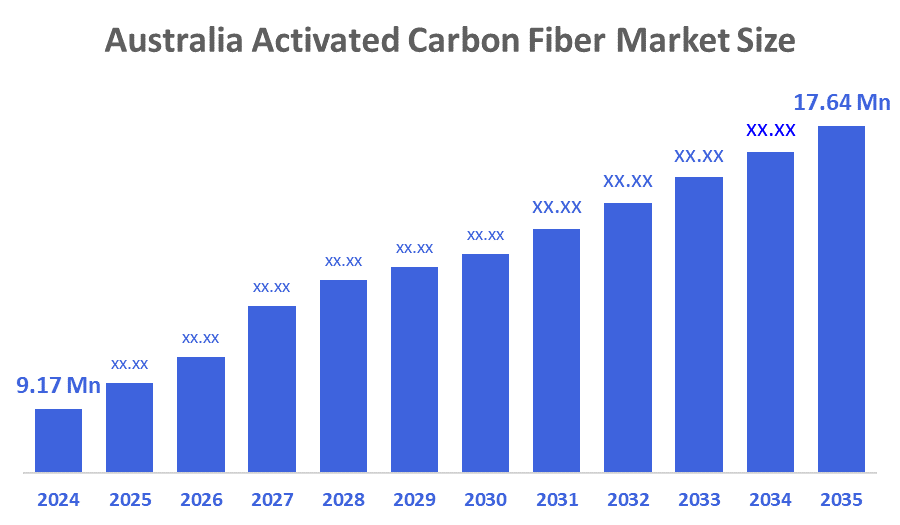

- The Australia Activated Carbon Fiber Market Size Was Estimated at USD 9.17 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.13% from 2025 to 2035

- The Australia Activated Carbon Fiber Market Size is Expected to Reach USD 17.64 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Activated Carbon Fiber Market Size is anticipated to Reach USD 17.64 Million by 2035, Growing at a CAGR of 6.13% from 2025 to 2035. The activated carbon fiber market in Australia is driven by stricter water and air quality regulations, rising PFAS concerns, expanding pharmaceutical production, and technological advancements in high-performance filtration and membrane materials.

Market Overview

The activated carbon fiber (ACF) market consists of the enterprises that manufacture and market fibrous activated carbon products with extremely high surface area, fast adsorption rate, and exceptional purification. Activated carbon fibers are used for water and air filtration, industrial gas purification, chemical processing, protective equipment, and pharmaceutical manufacturing applications. The market for activated carbon fiber (ACF) in Australia is growing, mainly due to stricter water quality regulations, heightened concerns regarding PFAS contamination, and an increased focus on advanced air and industrial filtration technologies. Government support that includes funding for research and development, tightening regulations, as well as investment in water-treatment infrastructure, is increasing the acceptance of a wide range of high-performance adsorbent media. Advancements in technology, such as sustainable production of ACF, the use of magnetic ion-exchange sorbents, and next-generation filtration technologies, are enhancing domestic innovation. Opportunities for adsorption technology are surfacing in municipal water treatment, pharmaceuticals, energy storage, and emission control. Recent developments include new technologies for PFAS removal, federal funding of advanced sorbent R&D, and upgrades for wastewater treatment facilities across Australia.

Report Coverage

This research report categorizes the market for the Australia activated carbon fiber market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia activated carbon fiber market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Australia activated carbon fiber market.

Driving Factors

The activated carbon fiber market in Australia is driven by increased water quality regulation and heightened awareness of the population of PFAS contaminant issues, leading both municipal/public utilities and industries to seek high-efficiency filtration alternatives. In addition to pollution control from industrial emissions, and continued growth in pharmaceutical and chemical production creating the need for ACF technologies supporting elevated production efficiencies, advancing improvements in sustainable ACF manufacturing costs, the development of compact magnetic ion-exchange sorbents, and the next generation of membrane systems that increase performance capabilities further advance the sustainable use of ACFs in water treatment.

Restraining Factors

The activated carbon fiber market in Australia is mostly constrained by the high cost of production, limited capacity for producing at a domestic level, and reliance on international supply chains for raw materials. The more methodical adoption cycle by smaller utilities, along with concern over the technical aspects of regeneration and competition with trade-offs associated with alternative activated carbon systems acting as safer, cheaper substitutes, contributes to current limitations around industry and operational use.

Market Segmentation

The Australia activated carbon fiber market share is classified into raw material and application.

- The synthetic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia activated carbon fiber market is segmented by raw material into synthetic and natural. Among these, the synthetic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Compared to natural alternatives, synthetic precursors yield activated carbon fibers with higher purity, larger surface area, more uniform pore structure, and better adsorption performance, most notably polyacrylonitrile (PAN) and pitch. That is primarily why they are the dominant staple in this area.

- The water treatment segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia activated carbon fiber market is segmented by application into water treatment, food and beverage processing, pharmaceutical and medical, automotive, air purification, and others. Among these, the water treatment segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Australia's growing concerns about drinking water quality, PFAS and industrial wastewater loading, and evolving drinking water standards requiring high levels of adsorption solids, this category is leading.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia activated carbon fiber market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bygen

- Activated Carbon Technologies (ACT)

- James Cumming & Sons

- Western Carbon & Chemicals

- Carbon Activated Australia

- Filchem Australia

- Hydroflux Industrial

- Character Products

- Haycarb Holdings Australia Pty Ltd

- Carbonxt Group Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, the same research team from Adelaide, New South Wales, publishes their PFAS degrading technique using photocatalytic powder.

- In June 2025, Bygen raised A$3.5 million to continue to develop its coal-free activated carbon technology for water purification.

- In December 2024, A new mobile PFAS treatment system (utilizing GAC + ion-exchange resin) is installed at the Cascade Water Filtration Plant in New South Wales.

- In April 2024, Bygen raised A$2.6 million in a Series A to scale its sustainable activated carbon production.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia activated carbon fiber market based on the below-mentioned segments:

Australia Activated Carbon Fiber Market, By Raw Material

- Synthetic

- Natural

Australia Activated Carbon Fiber Market, By Application

- Water Treatment

- Food and Beverage Processing

- Pharmaceutical and Medical

- Automotive

- Air Purification

- Others

FAQ’s

Q: What is the Australia activated carbon fiber market size?

A: Australia activated carbon fiber market size is expected to grow from USD 9.17 million in 2024 to USD 17.64 million by 2035, growing at a CAGR of 6.13% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increased water quality regulation and heightened awareness of the population of PFAS contaminant issues, leading both municipal/public utilities and industries to seek high-efficiency filtration alternatives.

Q: What factors restrain the Australia activated carbon fiber market?

A: Constraints include the high cost of production, limited capacity for producing at a domestic level, and reliance on international supply chains for raw materials.

Q: How is the market segmented by application?

A: The market is segmented into water treatment, food and beverage processing, pharmaceutical and medical, automotive, air purification, and others.

Q: Who are the key players in the Australia activated carbon fiber market?

A: Key companies include Bygen, Activated Carbon Technologies (ACT), James Cumming & Sons, Western Carbon & Chemicals, Carbon Activated Australia, Filchem Australia, Hydroflux Industrial, Character Products, Haycarb Holdings Australia Pty Ltd, and Carbonxt Group Limited.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 174 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |