Australia Active Dosimeter Market

Australia Active Dosimeter Market Size, Share, and COVID-19 Impact Analysis, By Application (Medical, Industrial, Military and Homeland Security, Power and Energy, and Others), By End Use (Personal Monitoring, Environmental Monitoring, and Area Monitoring), and Australia Active Dosimeter Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Active Dosimeter Market Insights Forecasts to 2035

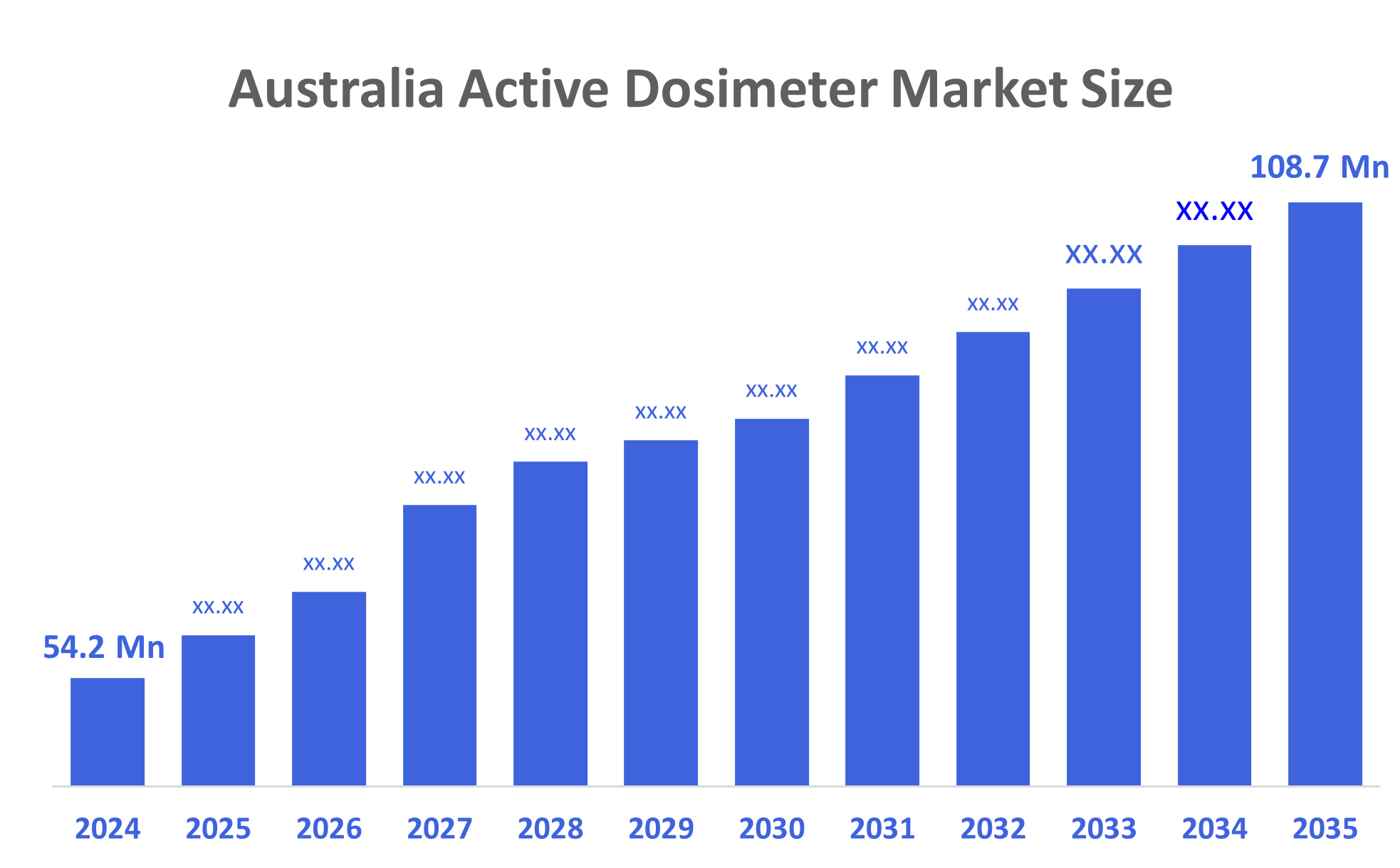

- The Australia Active Dosimeter Market Size Was Estimated at USD 54.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.53% from 2025 to 2035

- The Australia Active Dosimeter Market Size is Expected to Reach USD 108.7 Million by 2035

According to a research report published by Decisions Advisors, The Australia Active Dosimeter Market Size is Anticipated to Reach USD 108.7 Million by 2035, Growing at a CAGR of 6.53% from 2025 to 2035. The active dosimeter market in Australia is driven by government investments in advanced radiotherapy and dosimetry infrastructure, stricter radiation safety regulations, growth in nuclear medicine, radiopharmaceutical production, and emphasis on occupational health in radiation-exposed industries.

Market Overview

The active dosimeter market refers to the industry that develops and sells devices that monitor and measure the exposure of individuals to ionizing radiation in real time. Active dosimeters have the advantage of providing immediate feedback, alerts, and digital readouts so that corrective actions can be taken immediately to reduce radiation exposure. Rapid growth in the Australia active dosimeter market can be attributed to increased use of real-time radiation monitors across industries, which enables companies to ensure safe working environments and comply with regulatory requirements. Major factors driving this market include government-sponsored investment into building radiotherapy facilities, stringent occupational health and safety regulations, and an increase in the application of nuclear medicine and industrial uses of radiation. Several initiatives by the government, including regulatory frameworks created by ARPANSA at both the National and State levels, are supporting the adoption of active dosimeters and providing companies with structures to comply with these new regulations.

For instance, Australian hospitals conducting radiotherapy or nuclear medicine procedures must monitor staff exposure, where devices capable of measuring up to 20?mSv per year help ensure compliance with safety limits.” Recent advancements in technology include automated dose tracking features and the ability to integrate active dosimeters via the Cloud, which offers users the ability to receive real-time alerts in the event of a radiation exposure. The opportunity for enhanced safety and improved data-driven management of employee radiation exposure exists within the healthcare, mining, and industrial sectors.

Report Coverage

This research report categorizes the market for the Australia active dosimeter market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia active dosimeter market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia active dosimeter market.

Driving Factors

The active dosimeter market in Australia is driven by increased awareness about the dangers of working with radiation and more stringent regulatory controls enforced by ARPANSA and state governments. Furthermore, the continued growth of the healthcare, radiotherapy, nuclear medicine, mining, and industrial sectors is also contributing to demand for active dosimetry. Technological developments have enabled sellers’ ability to provide devices that provide instantaneous monitoring conditions, cloud-based data management tools, and automated alerts for safety compliance. Furthermore, Federal Government investment into Radiotherapy Facilities and increased emphasis upon Radiation Safety Programs is increasing the number of opportunities for manufacturers and service providers within the Australia active dosimeter market.

Restraining Factors

The active dosimeter market in Australia is mostly constrained by high costs of devices, limited understanding of active dosimetry equipment by many Small and Medium Enterprises (SMEs), and the technical expertise required to operate advanced dosimetry systems. The complex regulatory compliance requirements and slow adoption of active dosimetry devices by specific Industry types are two additional factors contributing to the slow growth within this industry.

Market Segmentation

The Australia active dosimeter market share is classified into application and end use.

- The medical segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia active dosimeter market is segmented by application into medical, industrial, military and homeland security, power and energy, and others. Among these, the medical segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market for active dosimeters in Australia is dominated by the medical sector because radiation, diagnostic imaging, and nuclear medicine treatments are widely used. Strong demand in this market is driven by hospitals' and healthcare facilities' need for ongoing, real-time radiation exposure monitoring to guarantee patient and staff safety, adhere to ARPANSA rules, and reduce occupational hazards.

- The personal monitoring segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia active dosimeter market is segmented by end use into personal monitoring, environmental monitoring, and area monitoring. Among these, the personal monitoring segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Australian active dosimeter market is dominated by the personal monitoring sector since it is crucial for real-time tracking of individual radiation exposure. The highest revenue share is generated by the use of personal dosimeters by healthcare workers, industrial workers, and employees in nuclear and research institutions to ensure safety, adhere to rules, and avoid overexposure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia active dosimeter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM Nuclear Technologies

- SIStec Australia

- Landauer Australasia

- Nu Scientific

- Nuclear Australia

- GMS Australia Pty Ltd

- SGS Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, ARPANSA launched a new online radiation monitoring program to provide up-to-date public information on radon, gamma, air, water, and soil & radionuclides as part of ARPANSA's Environmental Radiation Monitoring and Assessment Program to enhance the general knowledge of radiation safety & exposure among Australian industry professionals and the general public.

- In August 2025, the New South Wales Environment Protection Authority (NSW EPA) issued a new law entitled "Protection from Harmful Radiation Regulation 2025," which enhances employer obligations for radiation monitoring in workplaces and creates new obligations around personal monitoring devices as well as maintaining records on monitoring devices; these changes also increase the need for government approved personal and/or active dosimeters.

- In April 2025, the Australian Radiation Protection and Nuclear Safety Agency (ARPANSA) released an updated version of the Radiation Protection Series S-3, which establishes more stringent requirements related to ensuring accurate calibration and manufacturing standards for all dosimeters that are manufactured and offered to consumers through dosimetry service providers to promote assurance of the quality of personal and area monitoring devices.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia active dosimeter market based on the below-mentioned segments:

Australia Active Dosimeter Market, By Application

- Medical

- Industrial

- Military and Homeland Security

- Power and Energy

- Others

Australia Active Dosimeter Market, By End Use

- Personal Monitoring

- Environmental Monitoring

- Area Monitoring

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |