Australia Adipic Acid Market

Australia Adipic Acid Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Nylon 66 Fibers, Nylon 66 Engineering Resins, Polyurethanes, Adipate Esters, and Others), By End User (Automotive, Electrical and Electronics, Textiles, Food and Beverage, Personal Care, Pharmaceuticals, and Others), and Australia Adipic Acid Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Adipic Acid Market Size Insights Forecasts to 2035

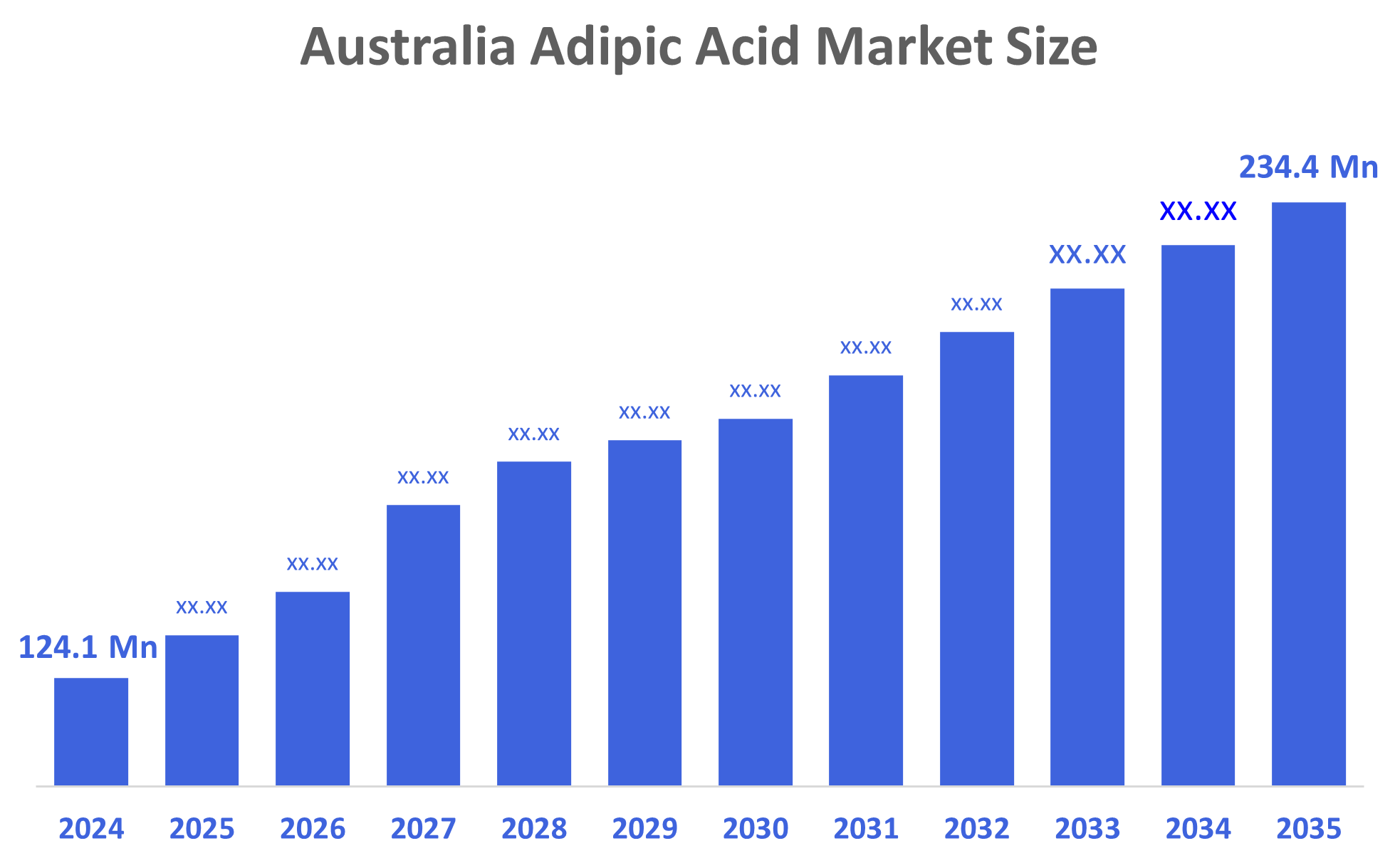

- The Australia Adipic Acid Market Size Was Estimated at USD 124.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.95% from 2025 to 2035

- The Australia Adipic Acid Market Size is Expected to Reach USD 234.4 Million by 2035

According to a research report published by Decisions Advisors, The Australia Adipic Acid Market Size is Anticipated to Reach USD 234.4 Million by 2035, Growing at a CAGR of 5.95% from 2025 to 2035. The adipic acid market in Australia is driven by greater automotive light weighting and EV adoption, increased demand for high-performance nylon, the growth of technical textiles, and greater attention to sustainable, bio-based, and circular chemical production processes.

Market Overview

Adipic acid market in Australia means the whole process of adipic acid, which consists of producing, distributing, and consuming it in the country, where it is mainly used as a major raw material for the production of nylon 6,6, polyurethanes, plasticizers, coatings, and even industrial chemicals in the automotive, textile, electrical, and construction sectors. The growth of the adipic acid market in Australia is supported by the continued need for automotive lightweighting, the increasing use of electric vehicles, and demand for high-performance nylon in the automotive, electrical/electronic, and textile industries.

The market for adipic acid in Australia is positively affected by government backing through support initiatives such as the Future Made in Australia Package (AUD 22.7?billion), R&D Tax Incentive (AUD 14.4?billion in 2024–25), and the Modern Manufacturing Initiative (co-funding AUD 1–20?million). By means of these programs, the chemical industry is encouraged to adopt environmentally friendly production practices, be up to date with state-of-the-art manufacturing techniques, and engage in research and development, and hence gain an edge in the market, which in turn, indirectly, benefits the adipic acid makers and associated industries. The scientific community is concentrating its research efforts on low-emission and bio-based adipic acid production technologies. The areas of focus for the companies are sustainable polymers, recycled materials, and EV component manufacturing.

Report Coverage

This research report categorizes the market for the Australia adipic acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia adipic acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia adipic acid market.

Driving Factors

The adipic acid market in Australia is driven by the increasing demand for lightweight and high-performance materials in the automotive industry, which is mainly caused by the adoption of electric vehicles and the implementation of fuel-efficiency programs. Moreover, the growth of technical textiles and the rising usage of nylon 6,6 in electronic, construction, and industrial applications are other factors supporting the market growth. This trend of using sustainable and bio-based chemicals, along with government incentives for green manufacturing and circular economy initiatives, is leading to the adoption of eco-friendly adipic acid production processes across industries at a faster pace.

Restraining Factors

The adipic acid market in Australia is mostly constrained by the high production costs, dependence on petroleum-based feedstocks, and the nitrous oxide emissions that cause environmental concerns. The stringent regulations and limited domestic manufacturing capacity can also thwart large-scale adoption and slow down the growth of the market.

Market Segmentation

The Australia adipic acid market share is classified into product type and end user.

- The nylon 66 fibers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia adipic acid market is segmented by product type into nylon 66 fibers, nylon 66 engineering resins, polyurethanes, adipate esters, and others. Among these, the nylon 66 fibers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it is widely used in high-performance industrial applications, technical textiles, and automotive lightweighting, where strength, durability, and heat resistance are essential. Strong revenue creation for this area is driven by the growing demand for nylon-based textiles and components in the automotive, electronics, and textile industries.

- The automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia adipic acid market is segmented by end user into automotive, electrical and electronics, textiles, food and beverage, personal care, pharmaceuticals, and others. Among these, the automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is caused by the growing use of lightweight materials, high-performance nylon components, and electric automobiles, which call for nylon 66 and polyurethanes made from adipic acid for improved performance, durability, and fuel efficiency in automotive parts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia adipic acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allnex Australia Pty Ltd

- Brenntag Australia Pty Ltd

- Orica Limited

- Chemiplas Pty Ltd

- Australian Chemical Reagents

- Troy Chemical Pty Ltd

- Sigma-Aldrich (Merck) Australia

- Coogee Chemicals Pty Ltd

- Australian Vinyls Corporation

- PQ Corporation Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, the chemical inventory lists of Australia were revised, and this impacted industrial chemicals, including disposables like polymers related to adipic acid, thus making it easier for the companies to comply with the regulations.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia adipic acid market based on the below-mentioned segments:

Australia Adipic Acid Market, By Product Type

- Nylon 66 Fibers

- Nylon 66 Engineering Resins

- Polyurethanes

- Adipate Esters

- Others

Australia Adipic Acid Market, By End User

- Automotive

- Electrical and Electronics

- Textiles

- Food and Beverage

- Personal Care

- Pharmaceuticals

- Others

FAQ’s

Q: What is the Australia adipic acid market size?

A: Australia adipic acid market size is expected to grow from USD 124.1 million in 2024 to USD 234.4 million by 2035, growing at a CAGR of 5.95% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increasing demand for lightweight and high-performance materials in the automotive industry, which is mainly caused by the adoption of electric vehicles and the implementation of fuel-efficiency programs. Moreover, the growth of technical textiles and the rising usage of nylon 6,6 in electronic, construction, and industrial applications are other factors supporting the market growth. This trend of using sustainable and bio-based chemicals, along with government incentives for green manufacturing and circular economy initiatives, is leading to the adoption of eco-friendly adipic acid production processes across industries at a faster pace.

Q: What factors restrain the Australia adipic acid market?

A: Constraints include the high production costs, dependence on petroleum-based feedstocks, and the nitrous oxide emissions that cause environmental concerns. The stringent regulations and limited domestic manufacturing capacity can also thwart large-scale adoption and slow down the growth of the market.

Q: How is the market segmented by product type?

A: The market is segmented into nylon 66 fibers, nylon 66 engineering resins, polyurethanes, adipate esters, and others.

Q: Who are the key players in the Australia adipic acid market?

A: Key companies include Allnex Australia Pty Ltd, Brenntag Australia Pty Ltd, Orica Limited, Chemiplas Pty Ltd, Australian Chemical Reagents, Troy Chemical Pty Ltd, Sigma-Aldrich (Merck) Australia, Coogee Chemicals Pty Ltd, Australian Vinyls Corporation, PQ Corporation Australia, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |