Australia Advanced Glass Market

Australia Advanced Glass Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Coated Glass, Laminated Glass, Toughened Glass, Ceramic Glass, and Others), By End User (Building and Construction, Aerospace and Defense, Automotive, Electronics, Sports and Leisure, Optical, and Others), and Australia Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Advanced Glass Market Size Insights Forecasts to 2035

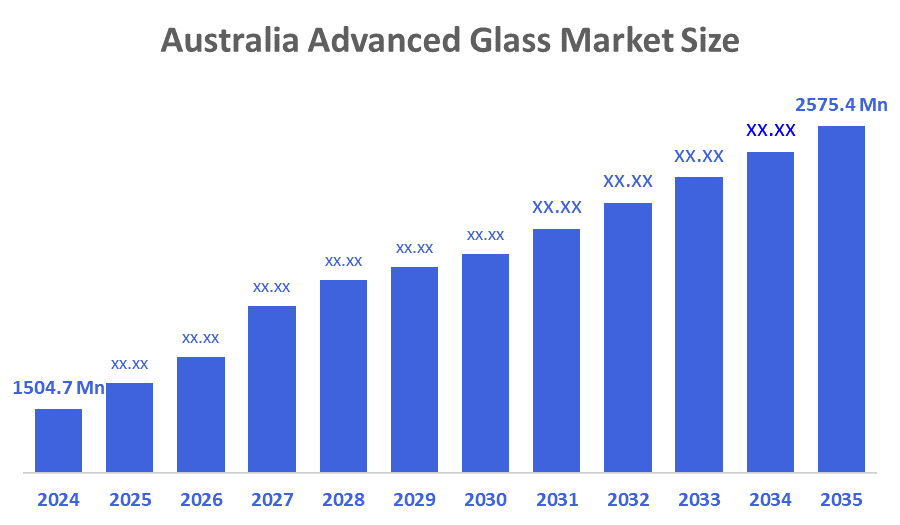

- The Australia Advanced Glass Market Size Was Estimated at USD 1504.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.01% from 2025 to 2035

- The Australia Advanced Glass Market Size is Expected to Reach USD 2575.4 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Advanced Glass Market Size is Anticipated to Reach USD 2575.4 Million by 2035, Growing at a CAGR of 5.01% from 2025 to 2035. The advanced glass market in Australia is driven by technological innovation, sustainable construction demand, and renewable energy expansion, alongside rising adoption of smart glass for improved energy efficiency, durability, and building performance.

Market Overview

Advanced glass is designed to be more efficient, functional, and durable than traditional glass, utilizing specialized properties like strength, energy efficiency, and heat resistance. Advanced glass products include smart glass, laminated glass, and toughened glass, with applications across multiple industries, such as construction, automotive, and electronics. The advanced glass market in Australia is experiencing growth as the rise of energy-efficient buildings, smart buildings, and the ability to integrate renewable energy sources into buildings continues to increase. Building codes and regulations, like the National Construction Code (NCC) and NABERS, are moving builders to high-performance glass solutions to help reduce carbon emissions. Furthermore, advancements in technology low-E coatings, electrochromic glass, and solar-integrated glass, are providing builders with enhanced versatility and ease of adoption.

For instance, in July 2025, ClearVue launched a $20 million ARC Research Hub project in collaboration with RMIT University and other partners to advance solar glass technology for next-generation smart greenhouses. Opportunities for advanced glass exist in the green building space, the use of building-integrated photovoltaics, and smart city projects. Recent advancements for advanced glass include ClearVue’s advancement in its solar glass system and increasing investment in smart glass applications for commercial and residential construction, supporting a positive long-term outlook for the advanced glass market in Australia.

Report Coverage

This research report categorizes the market for the Australia advanced glass market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia advanced glass market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia advanced glass market.

Driving Factors

The advanced glass market in Australia is driven by an increase in energy-efficient buildings, more strict construction regulations under the National Construction Code, and greater adoption of smart glass in commercial and residential structures. The expansion of renewable energy projects is encouraging the use of solar-integrated glass and high-performance glass, and the rapid advancement of technology of low-E coatings, electrochromic glazing, and multifunctional architectural glass only further fuels adoption. Urbanization and smart city development initiatives are also strengthening the market, in addition to government policies focused on sustainability and development across multiple sectors.

Restraining Factors

The advanced glass market in Australia is mostly constrained by high production costs, limited local manufacturing capability, and reliance on imported specialty materials limit Australia's advanced glass market. Adoption rates are also slowed by high installation costs, technical complexity, and limited knowledge of the benefits of long-term energy efficiency for small builders and consumers.

Market Segmentation

The Australia advanced glass market share is classified into product type and end user.

- The coated glass segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia advanced glass market is segmented by product type into coated glass, laminated glass, toughened glass, ceramic glass, and others. Among these, the coated glass segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to Australia's warm temperature and the National Construction Code's (NCC) stringent energy efficiency regulations, coated glass, especially low-E and solar control versions, has the highest demand.

- The building and construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia advanced glass market is segmented by end user into building and construction, aerospace and defense, automotive, electronics, sports and leisure, optical, and others. Among these, the building and construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because advanced glass, including low-E, laminated, and toughened glass, is frequently utilized in residential, commercial, and industrial buildings to satisfy stringent energy efficiency standards under the National Construction Code (NCC), this sector dominates.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia advanced glass market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- G. James Glass & Aluminium

- Glassworks Australia

- Australian Glass Group

- Switchglass

- K&K Glass

- Intelli Glass

- Vacuum Insulated Glass Australia (VIGA)

- BlackWidow Australia

- Interglaze

- Oceania Glass

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, ClearVue drew attention to its Gen-3 Solar Vision Glass product, which generates 66% more energy per square metre and is easier to manufacture.

- In October 2025, GlassKote FGI is investing over AUD 1.2 billion to construct two new low-iron float glass plants, one in Queensland, Australia, that will develop a near-zero carbon footprint and is scheduled to start production in early 2026.

- In July 2025, Glassworks Australia will be receiving a fully automated insulating glass line and glass sorting system to automate and improve its capacity.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia advanced glass market based on the below-mentioned segments:

Australia Advanced Glass Market, By Product Type

- Coated Glass

- Laminated Glass

- Toughened Glass

- Ceramic Glass

- Others

Australia Advanced Glass Market, By End User

- Building and Construction

- Aerospace and Defense

- Automotive

- Electronics

- Sports and Leisure

- Optical

- Others

FAQ’s

Q: What is the Australia advanced glass market size?

A: Australia advanced glass market size is expected to grow from USD 1504.7 million in 2024 to USD 2575.4 million by 2035, growing at a CAGR of 5.01% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by an increase in energy-efficient buildings, more strict construction regulations under the National Construction Code, and greater adoption of smart glass in commercial and residential structures. The expansion of renewable energy projects is encouraging the use of solar-integrated glass and high-performance glass, and the rapid advancement of technology of low-E coatings, electrochromic glazing, and multifunctional architectural glass only further fuels adoption.

Q: What factors restrain the Australia advanced glass market?

A: Constraints include the high production costs, limited local manufacturing capability, and reliance on imported specialty materials limit Australia's advanced glass market.

Q: How is the market segmented by product type?

A: The market is segmented into coated glass, laminated glass, toughened glass, ceramic glass, and others.

Q: Who are the key players in the Australia advanced glass market?

A: Key companies include G. James Glass & Aluminium, Glassworks Australia, Australian Glass Group, Switchglass, K&K Glass, Intelli Glass, Vacuum Insulated Glass Australia (VIGA), BlackWidow Australia, Interglaze, and Oceania Glass.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |