Australia Agricultural Equipment Market

Australia Agricultural Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Tractors, Cultivating Machinery, Planting Machinery, Harvesting Machinery, Haying and Forage Machinery, Irrigation Machinery, Other Types), By Automation (Semi-automatic, Manual, Automatic), and Australia Agricultural Equipment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Agricultural Equipment Market Size Insights Forecasts to 2035

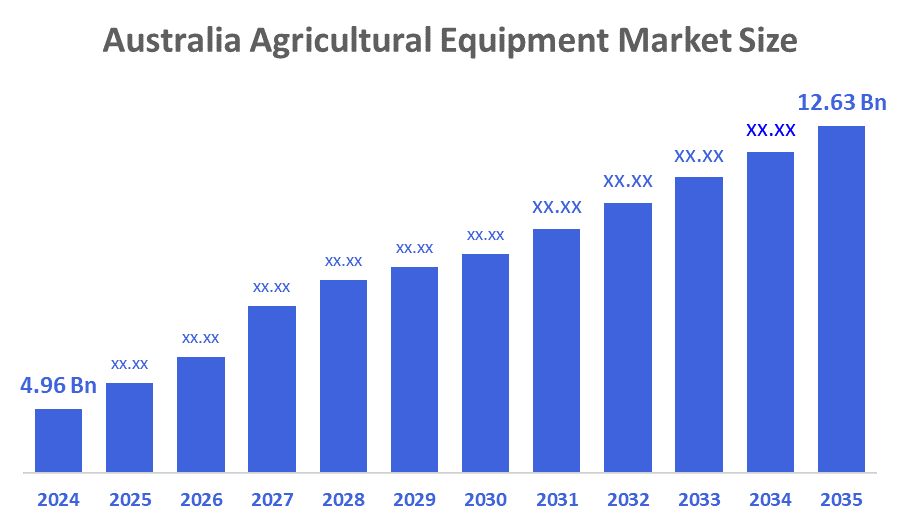

- The Australia Agricultural Equipment Market Size Was Estimated at USD 4.96 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.87% from 2025 to 2035

- The Australia Agricultural Equipment Market Size is Expected to Reach USD 12.63 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Agricultural Equipment Market Size is anticipated to Reach USD 12.63 Billion by 2035, Growing at a CAGR of 8.87% from 2025 to 2035. The agricultural equipment market in Australia is driven by the increased demand for food and fiber, large farming operations, uptake of technology and innovation such as precision agriculture and robotics, and government support for modernization and sustainability.

Market Overview

The agricultural equipment market represents the sector that produces, distributes, and sells machinery and tools for agricultural purposes. The equipment includes tools and machines for soil preparation, planting, irrigation, harvesting, and crop protection. The market facilitates the increased productivity, efficiency, and sustainability of agriculture through mechanization and new technologies. The increasing demand for food and fiber, the growth of big agriculture, and workers embracing precision agriculture, GPS-guided machines, and automation are some major ways the sector is growing. To support ag-tech and digital solutions to improve efficiency on farms, the Australian Government's On-Farm Connectivity Program provides rebates of up to AUD 30,000. The Australian Government is committed to supporting a transition to cleaner energy in agriculture. In line with this, sustainable agricultural practices are key to meeting Australia's target to reduce greenhouse gas emissions by 43% by 2030, as stated by the Australian Department of Agriculture, Fisheries and Forestry (DAFF). Accordingly, tractors powered by biofuels and other renewable energy sources will lower emissions and provide farmers with long-term savings. Autonomous tractors, robotics, low-emission machinery, and data-based farm management systems represent the future, addressing labor shortages and environmental challenges while enhancing productivity and sustainability in Australia's rapidly changing agriculture sector.

Report Coverage

This research report categorizes the market for the Australia agricultural equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia agricultural equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia agricultural equipment market.

Driving Factors

The agricultural equipment market in Australia is driven by increasing demand for food and fiber. This is underpinned by Australia’s export-oriented agriculture and expanding broadacre agriculture. Technological advances, including GPS-guided tractors and drones, offer opportunities for improving productivity and efficiency in resource use. The Australian government is offering financial support for the uptake of digital agriculture technologies through programs like the On-Farm Connectivity Program. Advances in automation and robotics are addressing rural labor shortages, and demand for lower emissions and fuel-efficient equipment is increasing sustainability. All of these reasons support the modernization of Australian agriculture, leading to improvements in the efficiency, profitability, and environmental performance of Australian farm systems to meet food production needs for tomorrow's market.

Restraining Factors

The agricultural equipment market in Australia is mostly constrained by high upfront costs, increasing fuel and maintenance costs, and climate variability, which leads to less agricultural equipment use. The availability of limited rural communications infrastructure and skilled labor challenges the uptake and effective use of advanced technologies. Furthermore, competitiveness and dependence on imports constrain profitability and market development for Australian manufacturers.

Market Segmentation

The Australia agricultural equipment market share is classified into equipment type and automation.

- The tractors segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia agricultural equipment market is segmented by equipment type into tractors, cultivating machinery, planting machinery, harvesting machinery, haying and forage machinery, irrigation machinery, and other types. Among these, the tractors segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Tractors are vital for multiple agricultural functions (e.g., tillage, planting, and hauling) on farms, making them an important piece of adaptable and widely used equipment across Australian farms. The increasing trend towards agricultural mechanization, the proliferation of larger farm-scale operations, and the emergence of innovative technologies, such as GPS-enabled and autonomous tractors, are also fueling the ignition of machinery demands.

- The semi-automatic segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia agricultural equipment market is segmented by automation into semi-automatic, manual, and automatic. Among these, the semi-automatic segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Semi-automatic equipment is appropriate for a variety of farms, ranging from medium-sized to large-scale enterprises, because it strikes a compromise between cost and efficiency. It offers the advantages of mechanization, such as lower labor costs and increased accuracy, without the high expense and intricate technical requirements of fully automated technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia agricultural equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Croplands Equipment

- Goldacres

- HARDI Australia

- Swarm Farm Robotics

- Loam Bio

- Rivulis Irrigation Australia

- Knight Farm Machinery

- McIntosh & Son Pty Ltd

- Hayco Australia

- Hustler Agricultural Equipment

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, an agricultural technology organization based in Australia named Loam Bio announced a seed treatment product, FurrowMate. The product was developed over four years with a stated investment of $3.5 million in research and advancement. FurrowMate aims to improve soil health and sustainability on farms.

- In August 2024, the global company Rivulis, a leader in micro-irrigation, launched Rivulis AI, a conversational AI bot. This advanced system is global in nature and not specific to Australia, but it provides farmers and irrigation professionals worldwide with expert, customized information to help increase crop yields, maximize water use, and enable sustainable practices.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia agricultural equipment market based on the below-mentioned segments:

Australia Agricultural Equipment Market, By Equipment Type

- Tractors

- Cultivating Machinery

- Planting Machinery

- Harvesting Machinery

- Haying and Forage Machinery

- Irrigation Machinery

- Other Types

Australia Agricultural Equipment Market, By Automation

- Semi-automatic

- Manual

- Automatic

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |