Australia Agricultural Robot Market

Australia Agricultural Robot Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Unmanned Aerial Vehicles (UAVs)/Drones, Milking Robots, Automated Harvesting Systems, Driverless Tractors, and Others), By Application (Field Farming, Dairy Farm Management, Animal Management, Soil Management, Crop Management, and Others), and Australia Agricultural Robot Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Agricultural Robot Market Size Insights Forecasts to 2035

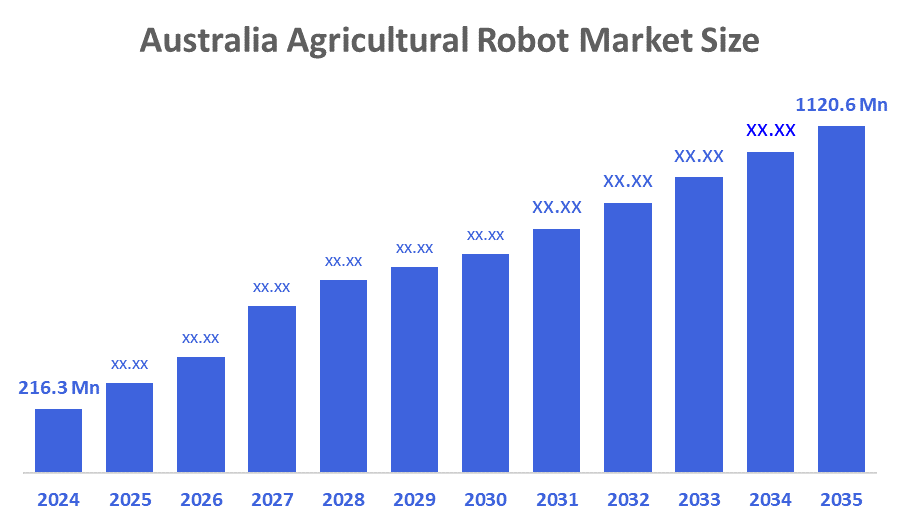

- The Australia Agricultural Robot Market Size Was Estimated at USD 216.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16.13% from 2025 to 2035

- The Australia Agricultural Robot Market Size is Expected to Reach USD 1120.6 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Agricultural Robot Market Size is anticipated to Reach USD 1120.6 Million by 2035, Growing at a CAGR of 16.13% from 2025 to 2035. The home decor market in Australia is driven by supportive government initiatives, labor shortages, sustainability needs, and rapid advances in AI, ML, and sensor technologies that boost automation efficiency.

Market Overview

An agricultural robot is an automated machine or system developed to be used for agricultural purposes to conduct tasks that typically require laborious manual work. Agricultural robots are a combination of different technologies, such as artificial intelligence (AI), sensors, cameras, GPS, and machine vision, that can operate autonomously, with precision, and with high efficiency in different agricultural scenarios, including outdoor plants, orchards, and greenhouses. The agricultural robot sector in Australia is experiencing strong growth as a result of the severe shortage of farm workers, a greater emphasis on sustainability, and robust federal and state government support through grants and technology initiatives.

The National Robotics Strategy, introduced by the Australian government in May 2024, is an extensive policy framework that anticipates robotics and automation technologies will increase productivity growth by 150 percent and contribute between USD 170 billion and USD 600 billion to Australia's GDP each year by 2030. The plan is underpinned by significant financial commitments, such as the USD 15 billion National Reconstruction Fund, which allocates USD 1 billion for advanced manufacturing and USD 1 billion for critical technologies, including robotics. Advancements in computing capabilities with artificial intelligence (AI), machine learning (ML), computer vision, and autonomous navigation technology are improving the accuracy of robots for tasks such as weeding, harvesting, spraying, and livestock monitoring. An opportunity exists for a robotics-as-a-service model, precision farming, and exporting Australian ag-robot technology.

Report Coverage

This research report categorizes the market for the Australia agricultural robot market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia agricultural robot market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia agricultural robot market.

Driving Factors

The agricultural robot market in Australia is driven by persistent labor shortages, rising production expenses, and the need for greater productivity on farms. Robots are utilized for monitoring crops, weeding, and spraying because of the increasing focus on precision and sustainable farming. Government backing through grants, connectivity programs, and innovation funding speeds up commercial implementation. Automation is a viable solution for both broadacre and horticultural farming systems due to the rapid improvements in AI, machine vision, sensors, and autonomous navigation.

Restraining Factors

The agricultural robot market in Australia is mostly constrained by high upfront costs, limited technical skills to operate robots among farmers, and challenges with servicing and parts constrain robotic adoption in Australia. Connectivity gaps in rural and remote areas and uncertainty around the return on investment also contribute to slow rates of adoption and widespread deployment across different types of farming systems.

Market Segmentation

The Australia agricultural robot market share is classified into product type and application.

- The unmanned aerial vehicles (UAVs)/drones segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia agricultural robot market is segmented by product type into unmanned aerial vehicles (UAVs)/drones, milking robots, automated harvesting systems, driverless tractors, and others. Among these, the unmanned aerial vehicles (UAVs)/drones segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their extensive use for crop monitoring, spraying, mapping, and farm data analytics provides farmers with quick, affordable, and scalable solutions, which is what propels this leadership. Drones are affordable for both small and large farms because they don't require the same initial investment as robots like driverless tractors or automated harvesters.

- The field farming segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia agricultural robot market is segmented by application into field farming, dairy farm management, animal management, soil management, crop management, and others. Among these, the field farming segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to Australia's heavy reliance on broadacre farming (wheat, barley, canola, cotton, and sugarcane), which necessitates automation for weeding, spraying, crop monitoring, and harvesting, this industry leads. Compared to dairy, cattle, or soil-specific applications, automation is more cost-effective due to the volume of operations, which accelerates adoption. Because of this, field farming still generates the most revenue and is predicted to continue growing rapidly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia agricultural robot market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SwarmFarm Robotics

- Stacked Farm

- FieldMicro

- AOS (Autonomous Off-road Systems)

- CSIRO AgTech Robotics

- TXA

- Ripe Robotics

- Wildlife Drones

- AQ1 Systems

- StevTech

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, CEFC (Clean Energy Finance Corporation) invested AUD 7 million in SwarmFarm for its low-emission farm bots, which aim to reduce herbicide use by as much as 95% and cut fuel-related emissions by 35%.

- In April 2025, some Australian farmers demonstrated the first-ever autofill system for robots, allowing them to autonomously dock, refill pesticide or fertiliser, and continue working completely independently.

- In December 2024, researchers from the University of Sydney enhanced the SwagBot, a robot cattle herder, with AI and sensors to assess pasture health better and autonomously move livestock to the best grazing areas.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Adivsors has segmented the Australia agricultural robot market based on the below-mentioned segments:

Australia Agricultural Robot Market, By Product Type

- Unmanned Aerial Vehicles (UAVs)/Drones

- Milking Robots

- Automated Harvesting Systems

- Driverless Tractors

- Others

Australia Agricultural Robot Market, By Application

- Field Farming

- Dairy Farm Management

- Animal Management

- Soil Management

- Crop Management

- Others

FAQ’s

Q: What is the Australia agricultural robot market size?

A: Australia agricultural robot market size is expected to grow from USD 216.3 million in 2024 to USD 1120.6 million by 2035, growing at a CAGR of 16.13% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by persistent labor shortages, rising production expenses, and the need for greater productivity on farms. Robots are utilized for monitoring crops, weeding, and spraying because of the increasing focus on precision and sustainable farming. Government backing through grants, connectivity programs, and innovation funding speeds up commercial implementation.

Q: What factors restrain the Australia agricultural robot market?

A: Constraints include the high upfront costs, limited technical skills to operate robots among farmers, and challenges with servicing and parts constrain robotic adoption in Australia. Connectivity gaps in rural and remote areas and uncertainty around the return on investment also contribute to slow rates of adoption and widespread deployment across different types of farming systems.

Q: How is the market segmented by product type?

A: The market is segmented into unmanned aerial vehicles (UAVs)/drones, milking robots, automated harvesting systems, driverless tractors, and others.

Q: Who are the key players in the Australia agricultural robot market?

A: Key companies include SwarmFarm Robotics, Stacked Farm, FieldMicro, AOS (Autonomous Off-road Systems), CSIRO AgTech Robotics, TXA, Ripe Robotics, Wildlife Drones, AQ1 Systems, and StevTech.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |