Australia Animation Market

Australia Animation Market Size, Share, and COVID-19 Impact Analysis, By Animation Type (2D Animation, 3D Animation, Motion Graphics, Visual Effects (VFX), and Others), By Application (Entertainment & Media, Gaming Industry, Advertising & Marketing, Architecture & Real Estate, Education & E-Learning and Others), and Australia Animation Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Animation Market Size Insights Forecasts to 2035

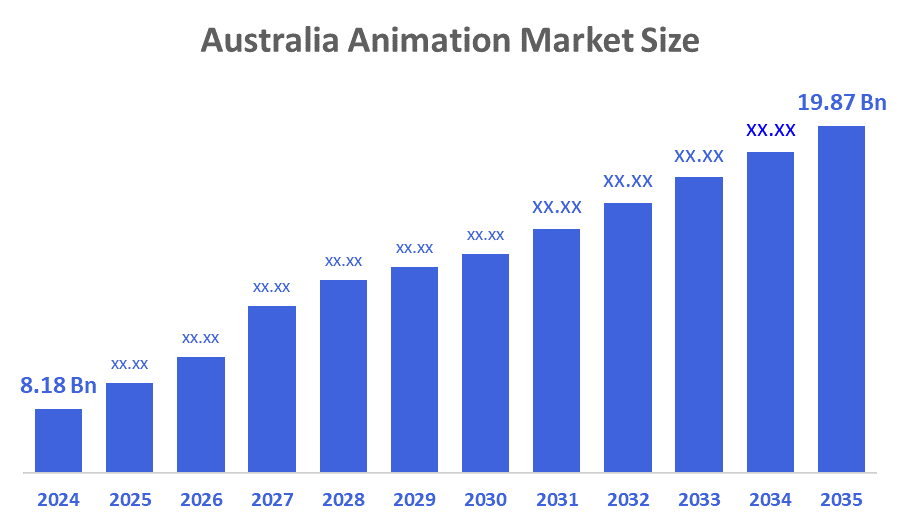

- The Australia Animation Market Size Was Estimated at USD 8.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.4% from 2025 to 2035

- The Australia Animation Market Size is Expected to Reach USD 19.87 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Animation Market Size is anticipated to Reach USD 19.87 Billion by 2035, Growing at a CAGR of 8.4% from 2025 to 2035. The animation market in Australia is driven by rising digital content consumption, expanding streaming platforms, government production incentives, growing demand for VFX in films and gaming, and increasing adoption of animation in advertising and education.

Market Overview

The animation market is defined as the field of producing, creating, and distributing animated content in forms such as traditional hand-drawn, computer-generated, 2D, and 3D animation, stop-motion, and motion graphics. Animation is widely used in film, television, advertising, gaming, virtual reality, education, and digital media. The Australian animation industry is growing steadily. The increase in digital content consumption for audiences, boomed demand for VFX in film, TV, gaming, and advertising, and the sheer number of operating streaming services commissioning locally produced animated content has increased market growth. The various government incentives of a 30% Post, Digital and Visual Effects (PDV) Offset, Producer Offset, Location Offset, and state-based rebates all significantly increase the international competitiveness of Australian studio activity, in addition to Screen Australia providing assistance with development and production funding. Continued technological improvements in areas such as real-time engines, AI-assisted animation, cloud rendering, and virtual production have also assisted in efficiency and improved costs. New opportunities exist in catering content for children's audience, educational animation, immersive media, and co-production opportunities with international partners. Announcements of a more buoyant funding environment with increased funding rounds and incentives being made available to support the animation and VFX ecosystem in Australia are positive.

Report Coverage

This research report categorizes the market for the Australia animation market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia animation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia home animation market.

Driving Factors

The animation market in Australia is driven by increasing demand for high-quality digital content across streaming platforms, video gaming, advertising, and education. Government production incentives, notably the 30% PDV Offset and states with additional rebates for domestic and international animation and VFX productions, continue to be very strong factors for the market's growth and development. Investments in technology for animation, such as real-time engines, AI-assisted workflows, cloud rendering, and virtual production, are expected to increase the speed and quality of production, while the increased investment in children's programming, immersive media, and co-productions will enhance growth potential and cement Australia's competitive positioning globally.

Restraining Factors

The animation market in Australia is mostly constrained by rising production costs, talent shortages, increased competition from more affordable markets, unpredictable fluctuations in content investment, and reliance on the government for production incentives. Moreover, the limited scale of existing studios and the unpredictable nature and inclusion of potential projects create commissioning cycles that complicate sustainable long-term development timelines.

Market Segmentation

The Australia animation market share is classified into animation type and application.

- The 3D animation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia animation market is segmented by animation type into 2D animation, 3D animation, motion graphics, visual effects (VFX), and others. Among these, the 3D animation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its widespread use in high-demand industries like movies, streaming content, gaming, advertising, and education, the 3D animation segment dominates the Australian animation market. Australian studios possess strong technical expertise in 3D production, which is bolstered by cutting-edge software, real-time engines, virtual production, and motion-capture technologies.

- The entertainment & media segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia animation market is segmented by application into entertainment & media, gaming industry, advertising & marketing, architecture & real estate, education & e-learning, and others. Among these, the entertainment & media segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that animation plays a major role in movies, TV series, streaming services, and digital video content, all of which are rapidly expanding in Australia. High demand is being driven by the rising commissioning of animated series, VFX-heavy productions, and children's programming by major broadcasters and OTT platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia animation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Animal Logic

- Rising Sun Pictures (RSP)

- Glitch Productions

- Flying Bark Productions

- Plastic Wax Studios

- Act3animation

- SLR Productions

- Alt.VFX

- Viskatoons

- Kojo Studios

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In June 2025, Australia attends the Annecy International Animation Film Market (Mifa) as a national delegation, representing local animation talent and tax incentives.

- In April 2025, W?t? FX extends its Australian base in Melbourne, potentially creating 80 jobs with support from the Victorian Government.

- In October 2024, an announcement is made in Melbourne of a VFX, animation & games tertiary provider, GameChanger Academy, supported by CG Spectrum, VicScreen, and an AUD 3.6 million contribution from the Victorian Government.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia animation market based on the below-mentioned segments:

Australia Animation Market, By Animation Type

- 2D Animation

- 3D Animation

- Motion Graphics

- Visual Effects (VFX)

- Others

Australia Animation Market, By Application

- Entertainment & Media

- Gaming Industry

- Advertising & Marketing

- Architecture & Real Estate

- Education & E-Learning

- Others

FAQ’s

Q: What is the Australia animation market size?

A: Australia animation market size is expected to grow from USD 8.18 billion in 2024 to USD 19.87 billion by 2035, growing at a CAGR of 8.4% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increasing demand for high-quality digital content across streaming platforms, video gaming, advertising, and education. Government production incentives, notably the 30% PDV Offset and states with additional rebates for domestic and international animation and VFX productions, continue to be very strong factors for the market's growth and development.

Q: What factors restrain the Australia animation market?

A: Constraints include rising production costs, talent shortages, increased competition from more affordable markets, unpredictable fluctuations in content investment, and reliance on the government for production incentives.

Q: How is the market segmented by animation type?

A: The market is segmented into 2D animation, 3D animation, motion graphics, visual effects (VFX), and others.

Q: Who are the key players in the Australia animation market?

A: Key companies include Animal Logic, Rising Sun Pictures (RSP), Glitch Productions, Flying Bark Productions, Plastic Wax Studios, Act3animation, SLR Productions, Alt.VFX, Viskatoons, and Kojo Studios.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 185 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |