Australia Antifungal Drugs Market

Australia Antifungal Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Azoles, Echinocandins, Polyenes, Allylamines, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), and Australia Antifungal Drugs Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Antifungal Drugs Market Insights Forecasts to 2035

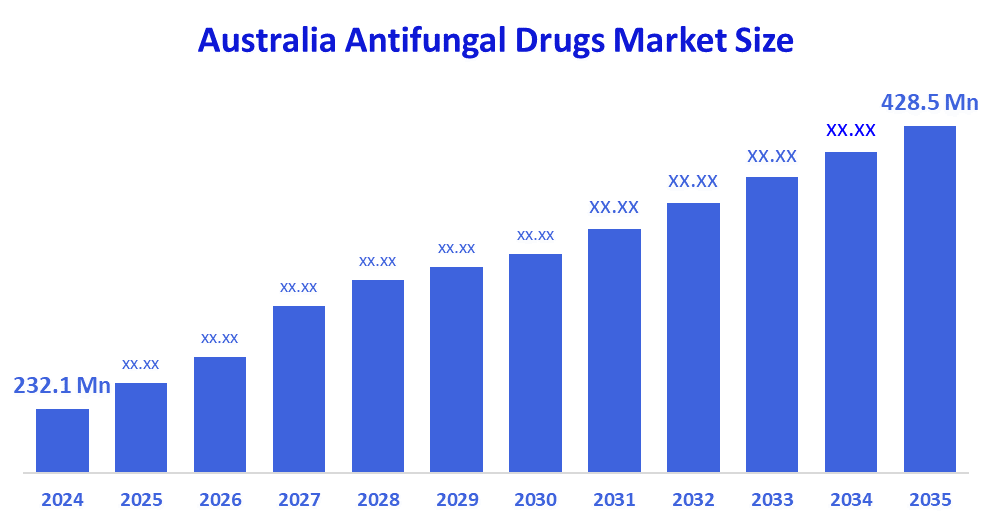

- The Australia Antifungal Drugs Market Size Was Estimated at USD 232.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.73% from 2025 to 2035

- The Australia Antifungal Drugs Market Size is Expected to Reach USD 428.5 Million by 2035

According To A Research Report Published By Decision Advisors, The Australia Antifungal Drugs Market Size Is Anticipated To Reach USD 428.5 Million By 2035, Growing At A CAGR Of 5.73% From 2025 To 2035. The antifungal drugs market in Australia is driven by growing immunocompromised populations, aging populations, improved diagnostic capabilities, and the ongoing introduction of cutting-edge antifungal therapies in hospital, clinic, and retail healthcare settings.

Market Overview

The Australia antifungal drugs market is made up of medicines that are used to either prevent or treat the infections caused by fungi in cases of the skin, nails, mucous membranes, and even in internal organs. The medications are administered in hospitals, clinics, and home care and are primarily used for the treatment of candidiasis, aspergillosis, dermatophytosis, and other infections, especially in cases of immunocompromised patients and elderly people.

The Pharmaceutical Benefits Scheme (PBS) is the means through which the Australian government backs the market for antifungal medications, limiting the expenses for patients to around A$31.60 per prescription and A$7.70 for concession holders. Furthermore, public healthcare allocations that surpass A$16 billion a year and designated grants for studies on antimicrobial resistance not only boost but also make it easier for the patients and the doctors to use the antifungal drugs over the entire territory of Australia.

Research and testing of antifungal drugs in Australia are making big strides. The Westmead Institute researchers identified a new antifungal lead compound (DT-23) that could make the treatment more effective and less resistant. Drug-resistant infections are being tested at Westmead Hospital using Fosmanogepix in clinical trials. Engineers at UNSW are making synthetic polymers that are capable of being used as alternative antifungal agents that would have wider activity and less toxicity. Among the options that the future holds are different drug classes, better resistance-targeting therapies, and improvements in diagnostics integration.

Report Coverage

This research report categorizes the market for the Australia antifungal drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia antifungal drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia antifungal drugs market.

Driving Factors

The antifungal drugs market in Australia is driven by the increasing incidence of fungal infections, especially among those who have low immunity, the elderly, and people with chronic diseases. Alongside, increased awareness of management of fungal diseases, development of new drug formulations, and better diagnostic facilities have paved the way for early identification and treatment. On the one hand, there are more admissions to the hospitals, more invasive procedures being performed, and government support for access to necessary drugs, which all contribute to the demand; on the other hand, continuous research and development of new antifungal therapies are the reasons for the growth in both hospital and retail settings.

Restraining Factors

The antifungal drugs market in Australia is mostly constrained by the high prices of the drugs, difficult regulatory approvals, lack of new formulations, increasing resistance to antifungal drugs, and adverse effects, which can limit the acceptance of the drugs and slow down the growth of the market.

Market Segmentation

The Australia Antifungal Drugs market share is classified into drug class and distribution channel.

- The azoles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia antifungal drugs market is segmented by drug class into azoles, echinocandins, polyenes, allylamines, and others. Among these, the azoles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because azoles, including fluconazole and itraconazole, are frequently used to treat a wide range of fungal infections, including opportunistic, superficial, and systemic infections. High utilization and revenue share are fueled by their oral availability, effectiveness, safety profile, and inclusion in mainstream treatment guidelines.

- The hospital pharmacies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia antifungal drugs market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and others. Among these, the hospital pharmacies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because hospitals serve as the main treatment facilities for severe and systemic fungal infections, guaranteeing a steady need for antifungal drugs. Compared to retail or other channels, hospital pharmacies have larger sales and market share because they give patients who need inpatient care, intravenous infusions, and specialty treatments immediate access.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia antifungal drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alphapharm Pty Ltd

- Sigma Healthcare Limited

- CSL Limited

- Mayne Pharma Group

- Starpharma Holdings

- Cipla Australia

- Arrotex Pharmaceuticals

- Advanz Pharma

- Herron Pharmaceuticals

- Ego Pharmaceuticals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April?2025, the Westmead Institute and Monash University research team announced a very potent antifungal lead compound, DT-23, which not only might open the door for new therapies but also lead to less resistance and toxicity.

- In February?2025, the Westmead Hospital gave the green light to the extraordinary clinical trials of the novel antifungal drug Fosmanogepix that aimed to win over drug-resistant invasive fungal infections.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia antifungal drugs market based on the below-mentioned segments:

Australia Antifungal Drugs Market, By Drug Class

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

Australia Antifungal Drugs Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

FAQ’s

Q: What is the Australia antifungal drugs market size?

A: Australia antifungal drugs market size is expected to grow from USD 232.1 million in 2024 to USD 428.5 million by 2035, growing at a CAGR of 5.73% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increasing incidence of fungal infections, especially among those who have low immunity, the elderly, and people with chronic diseases. Alongside, increased awareness of management of fungal diseases, development of new drug formulations, and better diagnostic facilities have paved the way for early identification and treatment.

Q: What factors restrain the Australia antifungal drugs market?

A: Constraints include the high prices of the drugs, difficult regulatory approvals, lack of new formulations, increasing resistance to antifungal drugs, and adverse effects, which can limit the acceptance of the drugs and slow down the growth of the market.

Q: How is the market segmented by drug class?

A: The market is segmented into azoles, echinocandins, polyenes, allylamines, and others.

Q: Who are the key players in the Australia antifungal drugs market?

A: Key companies include Alphapharm Pty Ltd, Sigma Healthcare Limited, CSL Limited, Mayne Pharma Group, Starpharma Holdings, Cipla Australia, Arrotex Pharmaceuticals, Advanz Pharma, Herron Pharmaceuticals, Ego Pharmaceuticals, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 207 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |