Australia Automotive Steering System Market

Australia Automotive Steering System Market Size, Share, and COVID-19 Impact Analysis, By Steering Type (Electric Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-Hydraulic Power Steering (EHPS), and Manual Steering), By Component Type (Steering Column, Steering Wheel Speed Sensors, Electric Motors, Hydraulic Pumps, and Others), and Australia Automotive Steering System Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

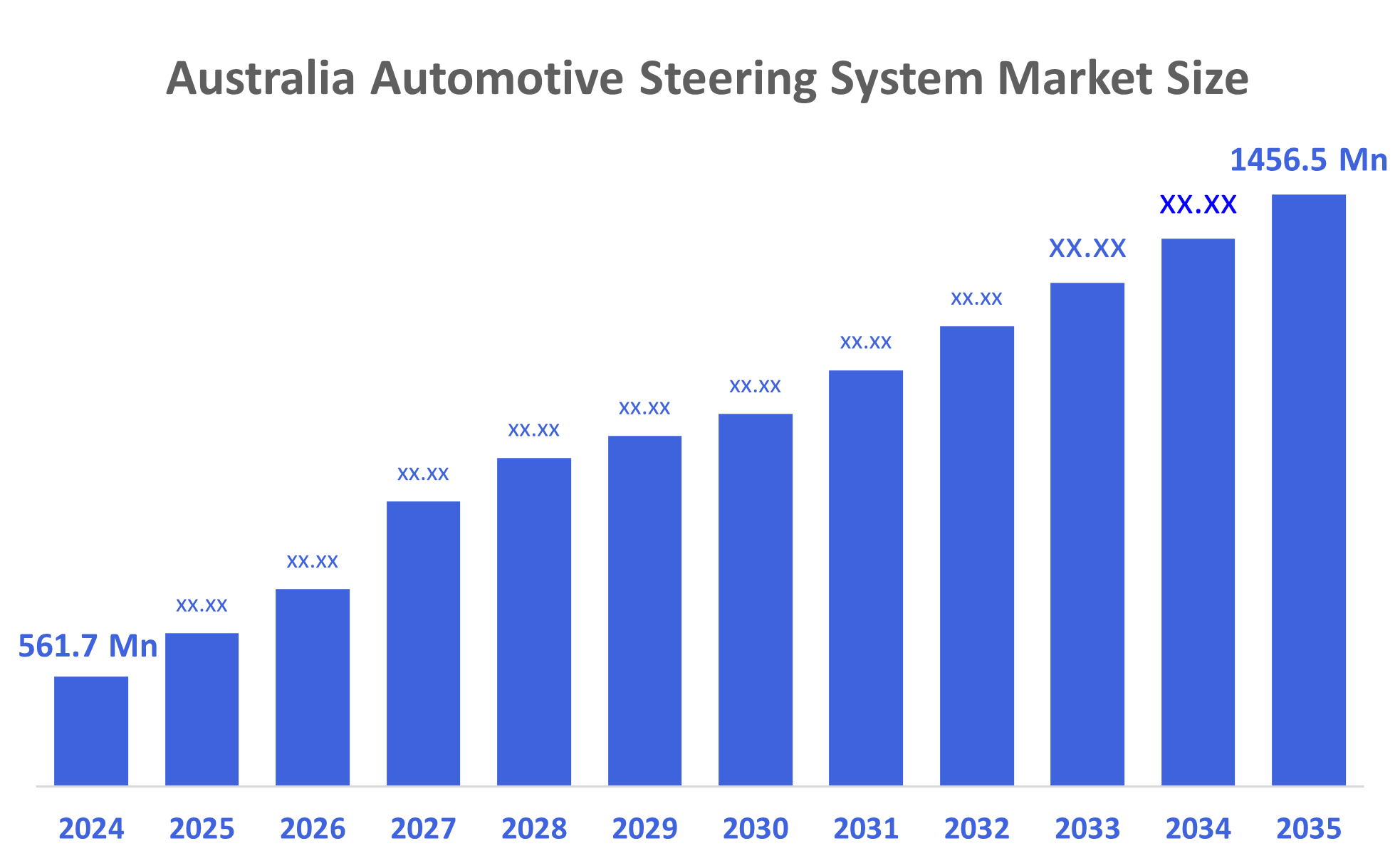

Australia Automotive Steering System Market Insights Forecasts to 2035

- The Australia Automotive Steering System Market Size Was Estimated at USD 561.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.05% from 2025 to 2035

- The Australia Automotive Steering System Market Size is Expected to Reach USD 1456.5 Million by 2035

According to a research report published by Decisions Advisors, The Australia Automotive Steering System Market Size is Anticipated to Reach USD 1456.5 Million by 2035, Growing at a CAGR of 9.05% from 2025 to 2035. The automotive steering system market in Australia is driven by increased vehicle production, strict safety and emission regulations, growing demand for fuel-efficient vehicles, and technological advancements like electric power steering, AI-integrated systems, and E-HPS in commercial vehicles.

Market Overview

An automotive steering system is a market consisting of creating, producing, and providing mechanisms that enable vehicle operators to determine where a vehicle goes and improve riding safety. Australia's automotive steering systems market continues to expand. This is because of growing automotive assembly and manufacturing, strict government requirements for vehicle emissions trapping, and the increasing consumer demand for fuel-efficient and maximally comfortable passenger cars. Some of the biggest drivers of this rapid textile advancement include increased use of electric power steering (EPS), the introduction of electrically assisted hydraulic power steering (E-HPS), integration with Advanced Driver Assistance Systems (ADAS), and combining with Artificial Intelligence (AI) based systems. Government initiatives aimed at improving fuel efficiency and increasing the use of EVs will encourage the continued development of new and innovative electric steering systems. The potential for growth in Australia’s automotive steering systems market exists in the rapid development and commercialization of electric vehicles (EVs), hybrid cars, commercial vehicles, and aftermarket maintenance services for electronic steering systems. Although not much specific information about the market exists today, the trend toward EPS in both passenger and commercial vehicles clearly demonstrates the ongoing technological development of the automotive market within Australia.

Report Coverage

This research report categorizes the market for the Australia automotive steering system market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia automotive steering system market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia automotive steering system market.

Driving Factors

The automotive steering system market in Australia is driven by increased vehicle production, rising consumer demand for both safe and fuel-efficient cars, and evolving governmental regulations concerning vehicle safety and emissions. Since technology evolves daily with the introduction of new products that incorporate electric power steering (EPS), electrically-assist hydraulic power steering (E-HPS), and artificial intelligence systems that provide driver assistance, consumers are presented with more options for comfort, handling, and economy. In addition, the increased use of hybrid and electric vehicles is driving greater use of electronically controlled steering systems. As commercial fleet operations grow and modernization programs occur within fleets, there is also a rise in demand for these advanced steering solutions.

Restraining Factors

The automotive steering system market in Australia is mostly constrained by the high cost of these systems, which can prevent adoption by consumers who do not have access to financial assistance to purchase them. A second challenge is the lack of trained technicians available to service these systems. Lastly, many Australian consumers are interested in using EPS and E-HPS technology, but due to the complexities involved in installing them on existing platforms, adoption may be delayed among these consumers.

Market Segmentation

The Australia automotive steering system market share is classified into steering type and component type.

- The electric power steering (EPS) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia automotive steering system market is segmented by steering type into electric power steering (EPS), hydraulic power steering (HPS), electro-hydraulic power steering (EHPS), and manual steering. Among these, the electric power steering (EPS) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Compared to hydraulic or manual steering, EPS offers better fuel efficiency, less maintenance, and integration with cutting-edge driver assist systems. Because of its lightweight design, which lowers engine load, enhances vehicle handling, and fits with the increasing demand for hybrid and electric vehicles, it is the favored option for contemporary passenger and commercial vehicles, earning the highest revenue share.

- The electric motors segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia automotive steering system market is segmented by component type into steering column, steering wheel speed sensors, electric motors, hydraulic pumps, and others. Among these, the electric motors segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Electro-hydraulic power steering (E-HPS) and electric power steering (EPS) systems rely on electric motors to provide accurate, energy-efficient steering assistance. Compared to other parts like steering columns, hydraulic pumps, or sensors, their extensive use in passenger cars, SUVs, and commercial vehicles, along with the increasing popularity of fuel-efficient and electric vehicles, drives higher demand and revenue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia automotive steering system market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hydrosteer Pty Ltd

- Complete Steering Australia

- Hardy Spicer

- Flexible Drive Pty Ltd

- Steering & Suspension Warehouse

- Statewide Bearings

- Gerrard Hydraulics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, Tesla launched Full Self-Driving (Supervised) across Australia, but states follow different rules on driver supervision and system use, creating confusion for motorists as autonomous vehicle regulations remain inconsistent nationwide.

- In December?2024, Australian regulatory compliance drives manufacturers to standardize EPS and E-HPS in new vehicles to meet safety and emission targets.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia automotive steering system market based on the below-mentioned segments:

Australia Automotive Steering System Market, By Steering Type

- Electric Power Steering (EPS)

- Hydraulic Power Steering (HPS)

- Electro-Hydraulic Power Steering (EHPS)

- Manual Steering

Australia Automotive Steering System Market, By Component Type

- Steering Column

- Steering Wheel Speed Sensors

- Electric Motors

- Hydraulic Pumps

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |