Australia Beef Market

Australia Beef Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Loin, Chuck, Round, Brisket, Rib, and Others), By Cut Type (Ground Beef, Steaks, Roasts, Cubed, and Others), By Distribution Channel (Supermarket and Hypermarket, Retail Store, Wholesaler, E commerce, and Others), and Australia Beef Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Beef Market Insights Forecasts to 2035

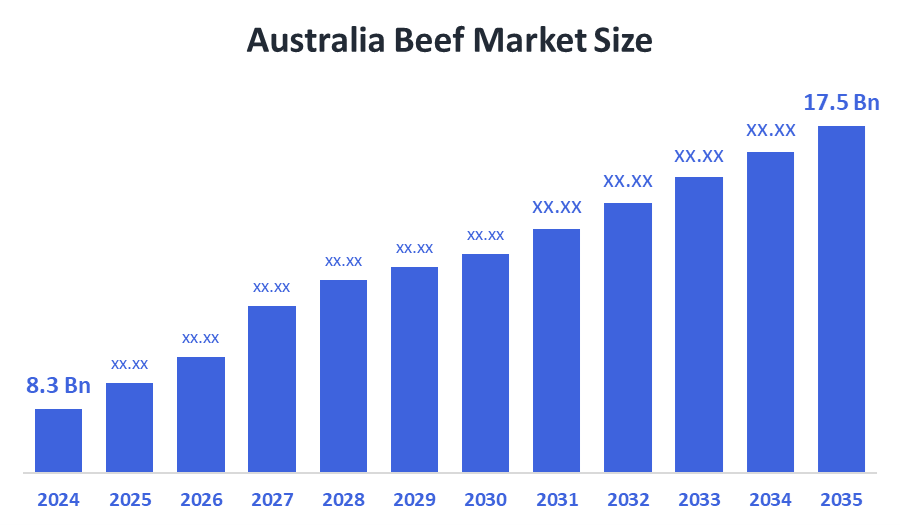

- The Australia Beef Market Size Was Estimated at USD 8.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.02% from 2025 to 2035

- The Australia Beef Market Size is Expected to Reach USD 17.5 Billion by 2035

According to a research report published by Spherical Insights & Consulting, the Australia beef market size is anticipated to reach USD 17.5 billion by 2035, growing at a CAGR of 7.02% from 2025 to 2035. The beef market in Australia is driven by the Higher demand for premium beef, at home and abroad. Australia is well admired for its premium beef products, especially Wagyu and grass-fed beef, which appeal to customers who place a premium on quality over quantity. Because of the value placed on Australian beef as a premium protein source in Asian countries, this represents the highest demand and the best export opportunity.

Market Overview

The beef market refers to the regional sector responsible for producing, processing, distributing, and consuming beef, which is the meat from cattle. The beef market covers all aspects of the supply chain: the farming of cattle, the slaughtering and processing of the meat, the packaging and distribution of meat products through wholesaler and retailer channels, and foodservice. Beef products could be classified to include fresh, frozen, processed, and value-added forms. The Australia beef market is an important segment of the country’s agricultural industries and is a major contributor to GDP and employment. According to the latest data from Meat & Livestock Australia (MLA), Australia produced 2.6 million tonnes of beef and veal in 2024. Government support through various programs, including sustainable livestock management, biosecurity, and facilities investment, also characterizes the industry. Productivity and quality are facilitated through advancements in technology, such as precision livestock farming, automated feeding systems, and genetic advancement. Future opportunities exist within premium and organic beef products, plant-based alternatives, digital traceability, and in expanding exports to other Asian markets based on protein demand.

Report Coverage

This research report categorizes the market for the Australia beef market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia beef market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia beef market.

Driving Factors

The beef market in Australia is driven by increasing domestic and international demand, driven by protein diets and rising populations in the Asia Pacific markets. Australia has shown strong export performance to Japan, the U.S., China, and Southeast Asia due to its brand emphasis on grass-fed and high-quality beef. Government initiatives contributing to competitiveness involve sustainable management of livestock, biosecurity, and export facilitation. Technological improvements are enhancing productivity and quality in livestock production with precision livestock farming, automated feeding, and genetic productivity. Additionally, consumers want premium, organic, and ethically produced beef alongside traceability and environmental products, which present opportunities for diversified and high-value segments.

Restraining Factors

The beef market in Australia is mostly constrained by impacts from extremes of climate, increasing costs of feed and labor, and uncertainties in the export market, often in conflict with trade barriers. Other issues are disease outbreaks and increasing competition from plant-based or lab-grown proteins, which also threaten supply and demand. Many companies cannot pass increasing costs onto consumers, while others feel the impact of market maturity and saturation on pricing flexibility, working against the goal of increasing volume and profitability in the industry.

Market Segmentation

The Australia beef market share is classified into product type, cut type, and distribution channel.

- The loin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia beef market is segmented by product type into loin, chuck, round, brisket, rib, and others. Among these, the loin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The loin segment is highly lucrative in the Australian beef market, given its high consumer demand, premium prices, and export prospects, generating the highest revenue share. The tenderness and versatility make it popular with consumers in both the domestic and export markets.

- The steaks segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia beef market is segmented by cut type into ground beef, steaks, roasts, cubed, and others. Among these, the steaks segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The steaks portion leads the Australian beef market because of robust domestic and international demand, premium price points, and a variety of cooking applications, making it the largest revenue-generating cut type.

- The supermarket and hypermarket segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia beef market is segmented by distribution channel into supermarket and hypermarket, retail store, wholesaler, e-commerce, and others. Among these, the supermarket and hypermarket segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The supermarket and hypermarket category continues to lead the beef category in Australia. It is the largest revenue-generating channel due to its broad range of goods and convenience, competitive pricing, and distribution.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia beef market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JBS Australia

- Teys Australia

- Thomas Foods International

- Mayura Station

- O’Connor Beef

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2025, Unveiled the new Teys Cattle Connect livestock platform at Clermont Beef Producers Information Day in Central Queensland, which aimed to simplify livestock management processes.

- In February 2025, Scott de Bruin, the Property Manager of Mayura Station, was the guest speaker at the workshop on Future Genetics in Adelaide, discussing the company's innovative methods of Wagyu beef production.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia beef market based on the below-mentioned segments:

Australia Beef Market, By Product Type

- Loin

- Chuck

- Round

- Brisket

- Rib

- Others

Australia Beef Market, By Cut Type

- Ground Beef

- Steaks

- Roasts

- Cubed

- Others

Australia Beef Market, By Distribution Channel

- Supermarket and Hypermarket

- Retail Store

- Wholesaler

- E-commerce

- Others

FAQ’s

Q: What is the Australia beef market size?

A: Australia beef market size is expected to grow from USD 8.3 billion in 2024 to USD 17.5 billion by 2035, growing at a CAGR of 7.02% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increasing domestic and international demand, driven by protein diets and rising populations in the Asia Pacific markets. Australia has shown strong export performance to Japan, the U.S., China, and Southeast Asia due to its brand emphasis on grass-fed and high-quality beef.

Q: What factors restrain the Australia beef market?

A: Constraints include impacts from extremes of climate, increasing costs of feed and labor, and uncertainties in the export market, often in conflict with trade barriers.

Q: How is the market segmented by product type?

A: The market is segmented into loin, chuck, round, brisket, rib, and others.

Q: Who are the key players in the Australia beef market?

A: Key companies include JBS Australia, Teys Australia, Thomas Foods International, Mayura Station, and O’Connor Beef.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |