Australia Bicycle Market

Australia Bicycle Market Size, Share, and COVID-19 Impact Analysis, By Product (Mountain, Hybrid, Road, Cargo), By Technology (Electric, Conventional), By Distribution Channel (Online, Offline), By End User (Men, Women, Kids), and Australia Bicycle Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Bicycle Market Size Insights Forecasts to 2035

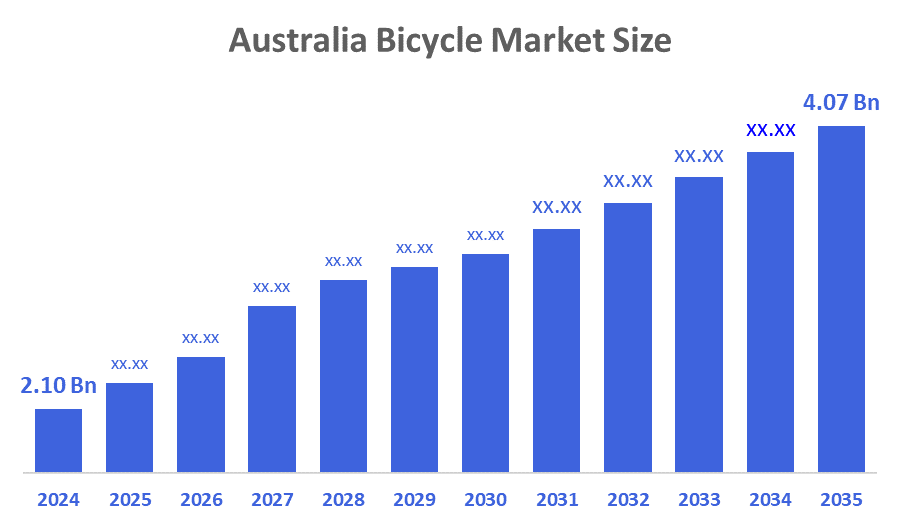

- The Australia Bicycle Market Size Was Estimated at USD 2.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.2% from 2025 to 2035

- The Australia Bicycle Market Size is Expected to Reach USD 4.07 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Bicycle Market Size is anticipated to Reach USD 4.07 Billion by 2035, Growing at a CAGR of 6.2% from 2025 to 2035. The bicycle market in Australia is driven by growing health consciousness, environmental concerns, and the demand for sustainable mobility. The expanding consumer base and shifting market dynamics are also fueled by advancements in bicycle technology and increased government initiatives to promote cycling.

Market Overview

Bicycles are a type of vehicle used for both individual and professional transportation of persons and goods. They are employed for recreational pursuits, including travel and physical activity. Bicycles vary in shape and features depending on the rider and the intended use. They can be powered basically by human strength or, in addition, by an electric engine. Electrical bicycles, in contrast to electrically propelled scooters and mopeds, are always equipped with pedals, which enable human power to propel them forward. For instance, AusCycling, Australia’s peak cycling organization, has teamed up with Amy’s Foundation in a new three-year initiative to help reduce cyclist deaths and serious injuries across the country, in conjunction with advocacy, education, and research initiatives, to facilitate safer roads for cyclists. Cycling safety continues to be a significant issue in Australia, where last year was the highest total number of road fatalities since 2010, with 41 cyclists killed and more than 8700 hospitalized from a road crash. The market has benefited from the Australian government's investments in bike infrastructure, including bike-sharing schemes and designated bike lanes. Additionally, more individuals are choosing bicycles due to growing awareness of climate change and the health advantages of riding one. The market is also being boosted by the rise of electric bicycles, which give people looking for a more convenient method to ride their bikes and those with longer commutes an alternative.

Report Coverage

This research report categorizes the market for the Australia bicycle market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia bicycle market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia bicycle market.

Driving Factors

The bicycle market in Australia is driven by rising health and fitness awareness, growing environmental concerns, government investments in cycling infrastructure, and increasing fuel costs. Urban mobility trends, e-bike adoption, and recreational cycling popularity also boost demand, while safety initiatives and sustainability goals further encourage cycling participation. For instance, the Australian government has committed USD 2.94 billion over 6 years since 1 Jan 2021 for the Road Safety Program, which includes cycleway improvements, shoulder widening, intersection upgrades, etc.

Restraining Factors

The bicycle market in Australia is mostly constrained by limited dedicated cycling infrastructure, rising accident rates, and safety concerns among riders. High upfront costs of premium and electric bicycles, adverse weather conditions, and competition from motor vehicles also hinder market growth and reduce regular commuter adoption across urban areas.

Market Segmentation

The Australia bicycle market share is classified into product, technology, distribution channel, and end user.

- The road segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia bicycle market is segmented by product into mountain, hybrid, road, and cargo. Among these, the road segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The country's robust culture surrounding recreational and competitive road cycling and high levels of cyclist participation in organized cycling activities, such as the Tour Down Under and community rides, also positions road cycling as gaining momentum.

- The conventional segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia bicycle market is segmented by technology into electric and conventional. Among these, the conventional segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because bicycles are comparatively cheaper, simpler, and readily available than electric bikes. Because traditional bikes do not require batteries or charging infrastructure, they are financially cost-effective and low-maintenance for everyday commuting and leisure activities.

- The offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia bicycle market is segmented by distribution channel into online and offline. Among these, the offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Primarily, consumers tend to opt for in-store shopping with higher price point items, such as bicycles, where fit, comfort, and testing performance are vital to the experience. In addition, customers will be able to receive individualized support to educate and determine which bicycle is the best fit for them, while also providing test rides, maintenance, and after-sales service as necessary, which enhances customer trust and loyalty.

- The men segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia bicycle market is segmented by end user into men, women, and kids. Among these, the men segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Men exhibit higher participation rates across both commuting and recreational cycling. Additionally, men consistently engage in road racing, mountain biking, and endurance events, which leads them to seek out higher-performance and higher-cost bicycles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia bicycle market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bastion Cycles

- Bossi Bicycles

- Curve Cycling

- Down Under Cycles

- EARTH Electric Bikes

- GPI Apollo

- Reid Cycles

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2025, South Australia allocated USD 2 million via the State Bicycle Fund to 18 local infrastructure projects, including new bike lanes and crossings.

- In June 2024, the Queensland Government announced a USD 315 million investment over 4 years for cycling and walking infrastructure projects.

- In January 2024, Australian e-bike manufacturer TAV signed a memorandum of understanding worth USD 10 million to expand its manufacturing capacity in Tamil Nadu. This arrangement aims to increase production capacity from 25,000 to 100,000 within three years. TAV plans to produce its first mid-drive electric bike in India, called the Family e-bike.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia bicycle market based on the below-mentioned segments:

Australia Bicycle Market, By Product

- Mountain

- Hybrid

- Road

- Cargo

Australia Bicycle Market, By Technology

- Electric

- Conventional

Australia Bicycle Market, By Distribution Channel

- Online

- Offline

Australia Bicycle Market, By End User

- Men

- Women

- Kids

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |