Australia Car Care Products Market

Australia Car Care Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Car Cleaning Products, Car Polish, Car Wax, Wheel and Tire Care Products, Glass Cleaners, and Others), By Distribution Channel (DIY/Retail Stores, and DIFM/Service Centers), and Australia Car Care Products Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Car Care Products Market Insights Forecasts to 2035

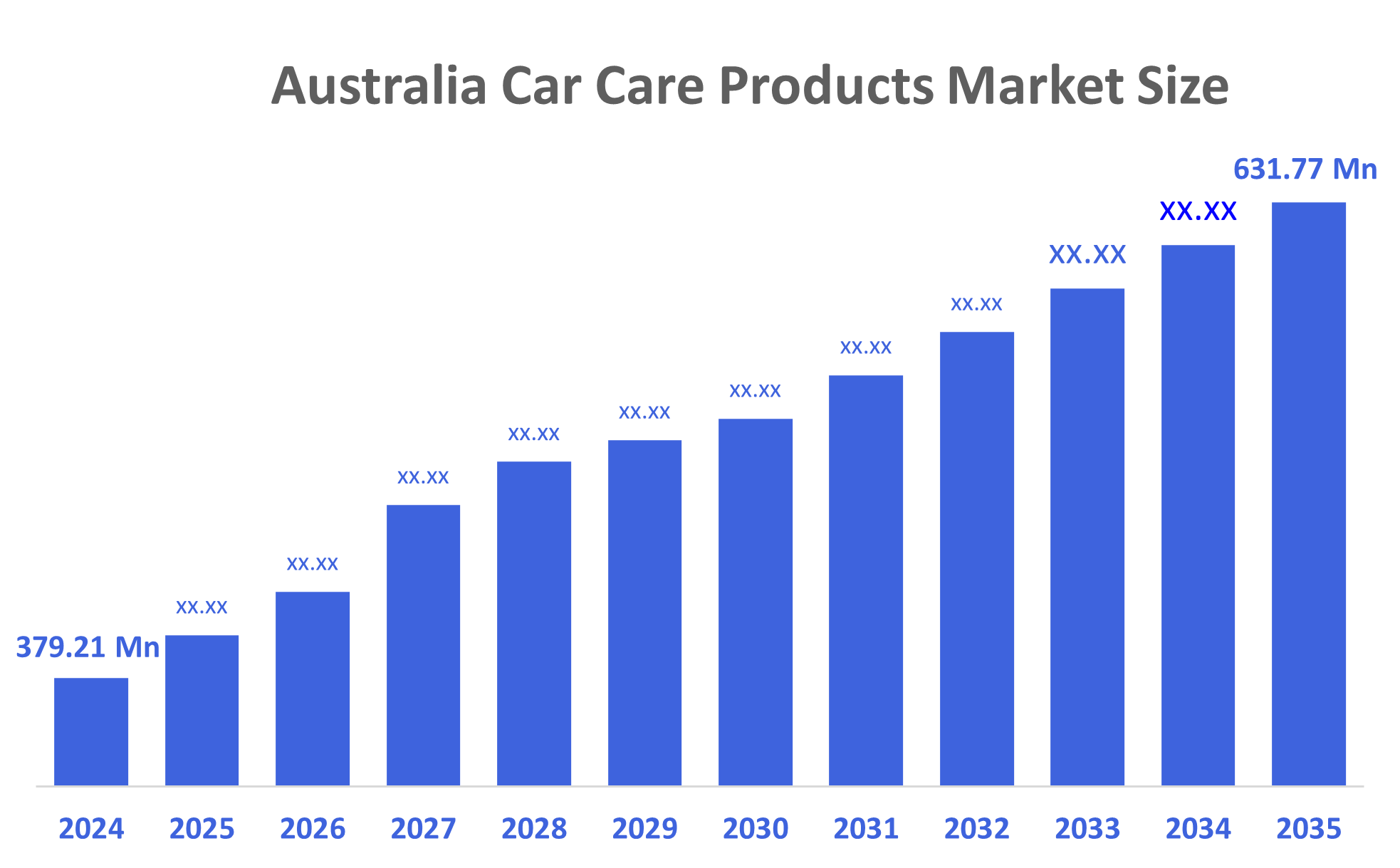

- The Australia Car Care Products Market Size Was Estimated at USD 379.21 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.75% from 2025 to 2035

- The Australia Car Care Products Market Size is Expected to Reach USD 631.77 Million by 2035

According to a research report published by Decisions Advisors, The Australia Car Care Products Market Size is Anticipated to Reach USD 631.77 Million by 2035, Growing at a CAGR of 4.75% from 2025 to 2035. The car care products market in Australia is driven by growing DIY vehicle maintenance trends, strong retail and online product availability, growing desire for eco-friendly solutions, and cutting-edge technologies such as nanotechnology coatings that offer improved durability.

Market Overview

The car care products market is an incorporated manufacturing and supply industry that manufactures products for the purpose of cleaning, maintaining, protecting, and enhancing the look, feel, and performance of vehicles. This market is designed to serve do-it-yourself consumers, as well as professional car detailing businesses, in all aspects of the automotive maintenance and aftermarket sectors. The automotive cleaning supplies market of Australia is growing due to the increasing DIY culture in Australia and the availability of many different automotive cleaning supplies via both retail and E-Commerce channels. As of January 31, 2023, there were around 21.2 million registered motor cars on Australian roads, up 2.3% over the previous year, according to a government-linked figure from Australia that contributes to the need for car maintenance goods. The need for routine cleaning, maintenance, and cosmetic upkeep naturally increases with such a big and growing fleet of vehicles, driving up demand for car care products. The increased knowledge and desire to be environmentally conscious are fuelling the demand for eco-friendly, low-water-use, and safer products, supported by national regulatory requirements, such as the Australian Inventory of Chemical Substances (AICIS). Improvements in product performance and consumer interest have also been driven by advancements in technology, such as nano coatings and long-lasting protective coatings. Emerging opportunities exist within premium quality detailing products, sustainable product lines, and e-commerce growth.

Report Coverage

This research report categorizes the market for the Australia car care products market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia car care products market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia car care products market.

Driving Factors

The car care products market in Australia is driven by an increase in DIY vehicle maintenance. Consumers want convenience and savings, which will continue to spur demand for eco-friendly, low water-use, and biodegradable automotive cleaning products. The availability of products through retail and expanding e-commerce will also help continue to drive the growth of the Australian car care products market. Advances in technology, including improved performance and durability with the use of new types of coatings and premium coatings, are resulting in more consumers using automotive care and maintenance products and spending increased amounts of money on products to maintain and enhance their vehicles' appearance and performance.

Restraining Factors

The car care products market in Australia is mostly constrained by the high cost of premium coatings, increasing requirements for compliance with stringent chemical regulations, and increasing amounts of environmental restrictions on the use of traditional cleaning products. Additionally, a lack of awareness about advanced products in more rural areas can hamper market penetration and limit growth potential.

Market Segmentation

The Australia car care products market share is classified into product type and distribution channel.

- The car cleaning products segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia car care products market is segmented by product type into car cleaning products, car polish, car wax, wheel and tire care products, glass cleaners, and others. Among these, the car cleaning products segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Higher volume demand is driven by these products' widespread availability through retail and online channels, regular use for normal washing and maintenance, and lower cost compared to high-end polishes or coatings.

- The DIY/retail stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia car care products market is segmented by distribution channel into DIY/retail stores, and DIFM/service centers. Among these, the DIY/retail stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because cleaning and detailing solutions are convenient, affordable, and widely available in supermarkets, auto shops, and e-commerce platforms, the majority of consumers prefer to buy them for personal use, making it the greatest revenue-generating channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia car care products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Autobarn

- Supercheap Auto

- Bunnings Warehouse

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In October 2025, GWM unveiled an ambitious growth strategy for Australia at its 2025 Tech Day, announcing two new plug-in hybrid models, the launch of its premium WEY brand, and plans to expand its dealer network to 125 outlets nationwide.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia car care products market based on the below-mentioned segments:

Australia Car Care Products Market, By Product Type

- Car Cleaning Products

- Car Polish

- Car Wax

- Wheel and Tire Care Products

- Glass Cleaners

- Others

Australia Car Care Products Market, By Distribution Channel

- DIY/Retail Stores

- DIFM/Service Centers

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |