Australia Car Rental Market

Australia Car Rental Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Luxury, Executive, Economy, SUVs, and Others), By Booking Type (Offline Booking, and Online Booking), and Australia Car Rental Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Car Rental Market Size Insights Forecasts to 2035

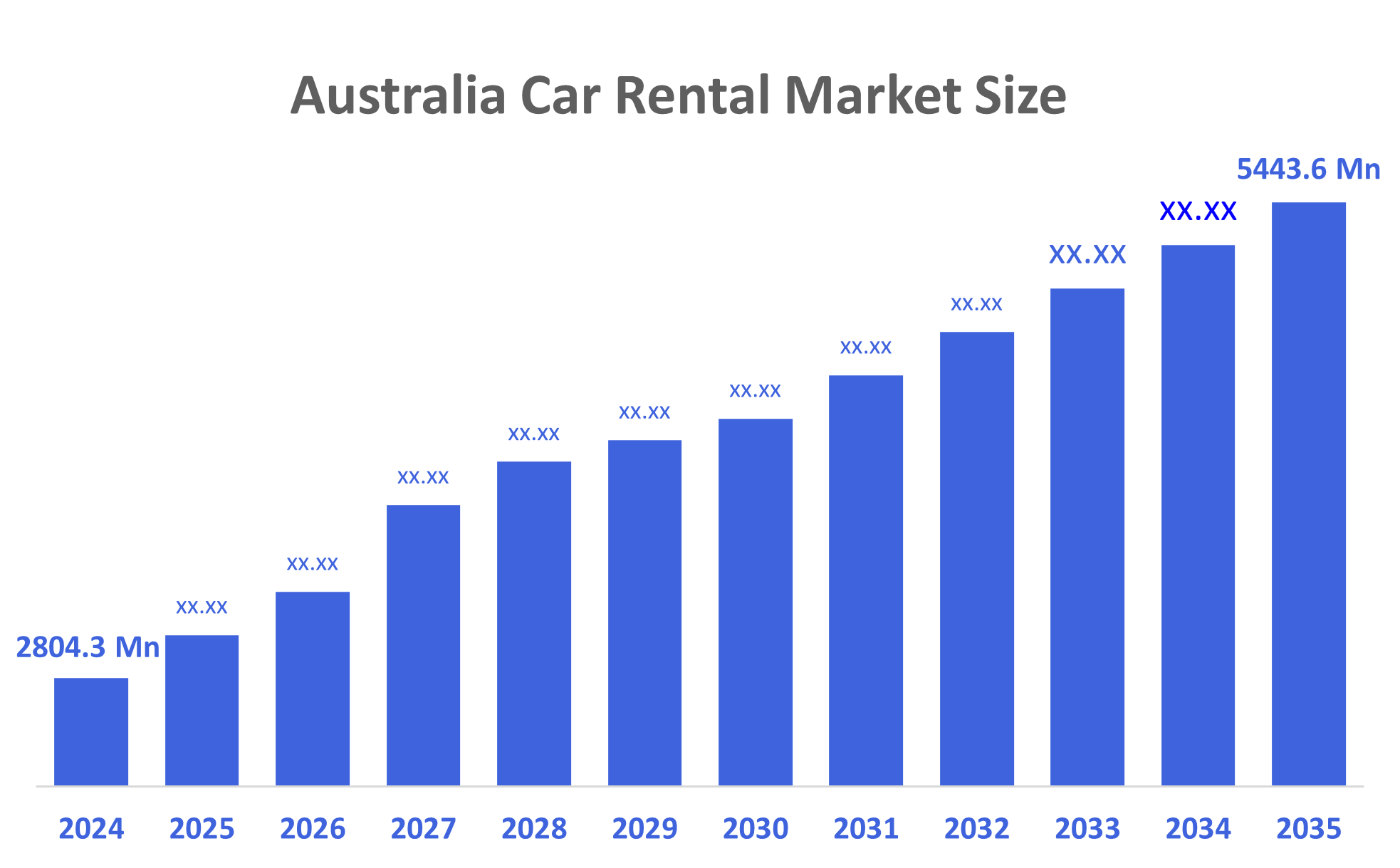

- The Australia Car Rental Market Size Was Estimated at USD 2804.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.22% from 2025 to 2035

- The Australia Car Rental Market Size is Expected to Reach USD 5443.6 Million by 2035

According to a research report published by Decisions Advisors, The Australia Car Rental Market Size is Anticipated to Reach USD 5443.6 Million by 2035, Growing at a CAGR of 6.22% from 2025 to 2035. The home decor market in Australia is driven by tourism recovery, rising business travel, increasing digital booking adoption, demand for sustainable vehicles, flexible mobility preferences, urbanization, and the growing popularity of short-term and on-demand transportation services.

Market Overview

The car rental sector entails the industry sector that supplies automobiles to both persons and enterprises for a fee, whether temporarily or for a longer period, thus presenting flexible transportation options by means of online and offline booking channels for travel, business, and personal movement requirements. The Australian car rental market is a very important component of the transport and tourism ecosystem of the country, as it caters to different users, such as leisure, business, and corporate. The Australian government provides indirect support for the car rental industry through tourism promotion funding of approximately AUD 200 million per year, as well as by providing incentives for electric vehicles through the application of FBT exemptions and offering state rebates on EV purchases up to AUD 7,000. Additionally, more than AUD 500 million has been invested in EV charging infrastructure and transport development in Australia. The market is growing due to the fact that countries are becoming more tourist-friendly, and people are traveling more for business, and also, an increasing number of people prefer flexible mobility solutions over owning a car. The introduction of mobile booking apps, contactless rentals, telematics, and AI-based fleet management, among others, are some of the technological advancements that have improved the efficiency and customer experience in the market. The areas of electric vehicle rentals, subscription models, and regional market expansion are some of the opportunities that exist.

Report Coverage

This research report categorizes the market for the Australia car rental market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia car rental market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia car rental market.

Driving Factor

The car rental market in Australia is driven by the remarkable revival of both the domestic and international tourism markets, the rise of business and corporate travel, and the increasing consumer choice of flexible mobility instead of car ownership. Furthermore, urbanization in cities, expansion of airports, and better transport infrastructure developments have also added to the demand. The digital transformation in the form of online booking platforms, mobile applications, and contactless services has been a great contributor to the demand by making the process more convenient and accessible. Moreover, the increased uptake of electric and hybrid vehicles due to government subsidies and the general public's awareness of sustainability is a factor that supports the growth of the market in both leisure and commercial segments.

Restraining Factors

The car rental market in Australia is mostly constrained by high costs for the acquisition of vehicles and maintenance, limitations on fleet supply, increased insurance and fuel expenditure, shortage of skilled labor, compliance with regulatory requirements, and price sensitivity of consumers during times of economic uncertainty.

Market Segmentation

The Australia car rental market share is classified into vehicle type and booking type.

- The economy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia car rental market is segmented by vehicle type into luxury, executive, economy, SUVs, and others. Among these, the economy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it is reasonably priced, very fuel-efficient, and appropriate for both leisure and business passengers. Higher rental volumes than in other vehicle categories are driven by strong demand from tourists, urban users, and cost-conscious consumers.

- The online booking segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia car rental market is segmented by booking type into offline booking, and online booking. Among these, the online booking segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is fueled by the ubiquitous use of smartphones and the internet, the simplicity with which prices can be compared, the availability of vehicles in real time, contactless reservations, and consumers' increasing inclination for app-based and digital travel services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia car rental market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Redspot Car Rentals

- Alpha Car Hire

- East Coast Car Rentals

- Apex Car Rentals Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, the car rental company Sixt increased its operations in Australia through a franchising partnership with NRMA, thus taking the total number of branches to around 160 and the number of vehicles to 16,000, among which are also electric cars meant to back the company's sustainability targets.

- In November 2025, the already existing car share service in Chippendale, which is also known as Chippendale Carshare, has not only expanded its fleet but also its service area in Sydney, providing users with the option of renting and sharing cars at low rates and through a seamless online process in major urban areas.

- In April 2025, the Revised Car Rental Code of Practice was launched to enhance the aspects of transparency, pricing clarity, and consumer protection among rental providers; this is going to be in effect from April 2025.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia car rental market based on the below-mentioned segments:

Australia Car Rental Market, By Vehicle Type

- Luxury

- Executive

- Economy

- SUVs

- Others

Australia Car Rental Market, By Booking Type

- Offline Booking

- Online Booking

FAQ’s

Q: What is the Australia car rental market size?

A: Australia car rental market size is expected to grow from USD 2804.3 million in 2024 to USD 5443.6 million by 2035, growing at a CAGR of 6.22% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the remarkable revival of both the domestic and international tourism markets, the rise of business and corporate travel, and the increasing consumer choice of flexible mobility instead of car ownership. Furthermore, urbanization in cities, expansion of airports, and better transport infrastructure developments have also added to the demand. The digital transformation in the form of online booking platforms, mobile applications, and contactless services has been a great contributor to the demand by making the process more convenient and accessible.

Q: What factors restrain the Australia car rental market?

A: Constraints include the high costs for the acquisition of vehicles and maintenance, limitations on fleet supply, increased insurance and fuel expenditure, shortage of skilled labor, compliance with regulatory requirements, and price sensitivity of consumers during times of economic uncertainty.

Q: How is the market segmented by vehicle type?

A: The market is segmented into luxury, executive, economy, SUVs, and others.

Q: Who are the key players in the Australia car rental market?

A: Key companies include Redspot Car Rentals, Alpha Car Hire, East Coast Car Rentals, Apex Car Rentals Australia, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |