Australia Castor Oil Market

Australia Castor Oil Market Size, Share, and COVID-19 Impact Analysis, By Type (Cold Pressed Castor Oil, Hydrogenated Castor Oil, Jamaican Black Castor Oil, Dehydrated Castor Oil, and Others), By End Use (Pharmaceuticals, Lubricants, Paints, Soaps, and Others), and Australia Castor Oil Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Castor Oil Market Insights Forecasts to 2035

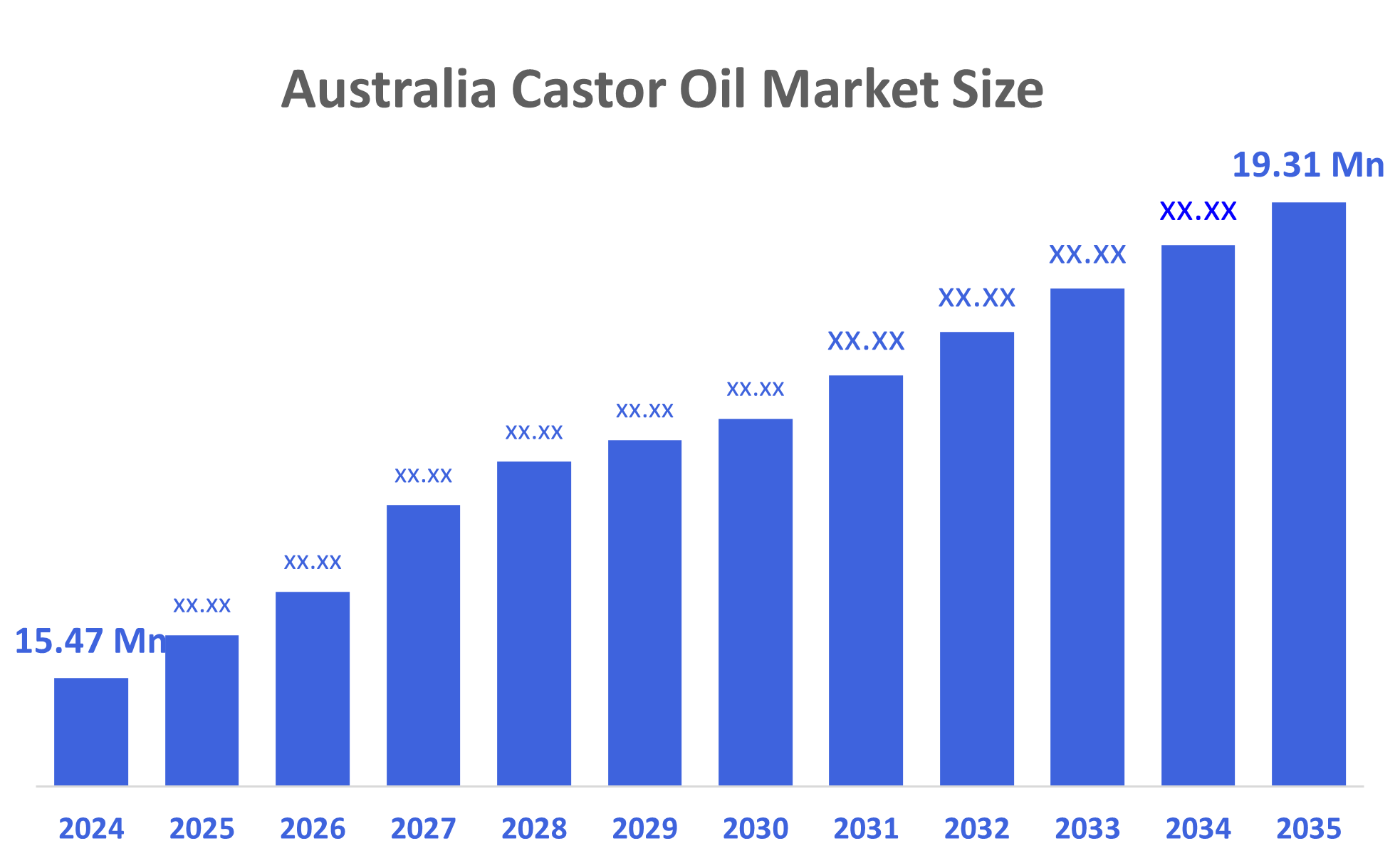

- The Australia Castor Oil Market Size Was Estimated at USD 15.47 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.04% from 2025 to 2035

- The Australia Castor Oil Market Size is Expected to Reach USD 19.31 Million by 2035

According to Research Report published by Decisions Advisors, The Australia Castor Oil Market Size is Anticipated to Reach USD 19.31 Million by 2035, Growing at a CAGR of 2.04% from 2025 to 2035. The castor oil market in Australia is driven by increasing use of bio-based and sustainable industrial products as well as the growing demand for natural and organic ingredients in pharmaceutical and personal care applications. Additionally, the market share of castor oil in Australia is growing due to the expansion of retail and e-commerce establishments.

Market Overview

The castor oil industry refers to the economic activities related to the production, refinement, distribution, and consumption of castor oil derived from castor beans (Ricinus communis), a vegetable oil used in industrial and therapeutic applications. The oil is utilized in numerous applications (such as lubricants, coatings, cosmetics, bio-based polymers, medicines, and personal care) and is well-known for having a high content of ricinoleic acid. The castor oil market in Australia is growing, fueled by increasing demand for bio-based chemicals, lubricants, cosmetics, and pharmaceutical components. The significant ricinoleic acid content in castor oil renders it essential for specialized applications that require sustainable and high-performance ingredients. Government programs that promote biofuels, renewable energy, and local processing of added-value products indirectly boost investment in non-food oilseed crops and specialty oil refining. Advancements in extraction and derivative production technologies, like hydrogenated castor oil and esters, are creating higher-value prospects. Although castor is not widely cultivated commercially in Australia, there are possibilities for import substitution, growth in cosmetic production, and specialized industrial applications. Recent sustainability initiatives and feedstock experiments suggest an increasing interest in establishing local production and processing capacities.

Report Coverage

This research report categorizes the market for the Australia castor oil market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia castor oil market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia castor oil market.

Driving Factors

The castor oil market in Australia is driven by the increased demand for bio-based chemicals, with castor oil having better functionality for lubricants, cosmetics, and pharmaceutical ingredients. Committing to sustainability and circular economy practices also supports the domestication of specialty oils while shifting reliance on imported oils. Further, technology developments in improved refining and production of derivatives support higher valued uses, while the growth within personal care and industrial manufacturing sectors strengthens market adoption.

Restraining Factors

The castor oil market in Australia is mostly constrained by more domestic farming of castor oil, which affects domestic reliance on imports and may make domestic sourcing, production, or processing more costly than major producers. Other barriers to commercializing castor oil include agronomic factors, toxicity levels with castor seeds, the potential for regulatory limitations, and limited processing facilities for creating refinements at a small scale.

Market Segmentation

The Australia castor oil market share is classified into type and end use.

- The hydrogenated castor oil segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia castor oil market is segmented by type into cold pressed castor oil, hydrogenated castor oil, jamaican black castor oil, dehydrated castor oil, and others. Among these, the hydrogenated castor oil segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its increasing demand in high-performance industrial applications such as lubricants, coatings, adhesives, plastics, cosmetics, and pharmaceuticals is the primary cause of this. Hydrogenated castor oil is a favored option for producing specialist goods because of its exceptional stability, wax-like qualities, and chemical resistance.

- The pharmaceuticals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia castor oil market is segmented by end use into pharmaceuticals, lubricants, paints, soaps, and others. Among these, the pharmaceuticals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment's dominant market position is supported by the growing demand for natural and plant-based pharmaceutical ingredients, Australia's robust healthcare industry, and growing regulatory attention to safe excipients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia castor oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Castor Oil Company Pty Ltd

- Australian Wholesale Oils (NSW)

- Range Products Pty Ltd (WA)

- Natural Ingredients Australia

- Corechem Pty Ltd

- CCC Ingredients

- Greenleaf Oil Australia

- MPL Products

- Encon Pty Ltd

- Active Global Exports Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia castor oil market based on the below-mentioned segments:

Australia Castor Oil Market, By Type

- Cold Pressed Castor Oil

- Hydrogenated Castor Oil

- Jamaican Black Castor Oil

- Dehydrated Castor Oil

- Others

Australia Castor Oil Market, By End Use

- Pharmaceuticals

- Lubricants

- Paints

- Soaps

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |