Australia Clean Beauty Market

Australia Clean Beauty Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Skincare, Face care, Body care, Haircare, and Color cosmetics), By Distribution Channel (Hypermarkets and Supermarkets, Specialty Stores, Online, and Others), and Australia Clean Beauty Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Clean Beauty Market Insights Forecasts to 2035

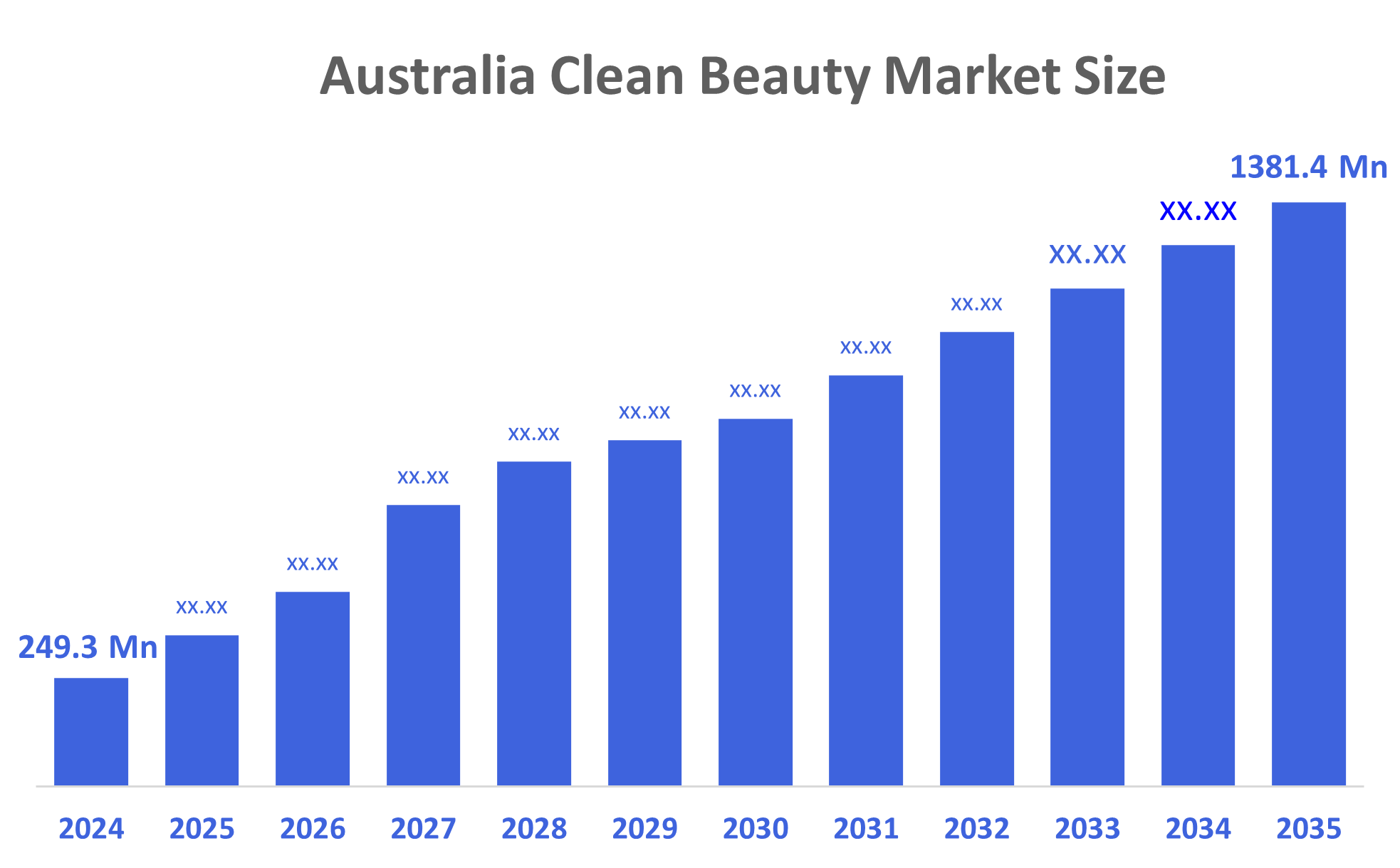

- The Australia Clean Beauty Market Size Was Estimated at USD 249.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16.84% from 2025 to 2035

- The Australia Clean Beauty Market Size is Expected to Reach USD 1381.4 Million by 2035

According to a research report published by Decisions Advisors, The Australia Clean Beauty Market Size is Anticipated to Reach USD 1381.4 Million by 2035, Growing at a CAGR of 16.84% from 2025 to 2035. The clean beauty market in Australia is driven by growing consumer awareness of safe, non-toxic skincare, growing demand for eco-friendly and sustainable formulations, and the powerful influence of digital platforms and social media.

Market Overview

The term clean beauty refers to products that have been developed without harmful/toxic components, and are dedicated to being transparent within their formulation with the end customer, as well as being responsibly produced from an environmental perspective. This includes skincare, hair care, make-up, and personal care products that are colour-safe and ethically sourced and made with natural materials in most cases. The growth of the Australian clean beauty market is due to more people looking for safe and non-toxic skin and body care items that do not contain any type of toxic or harmful ingredients or chemicals.

According to the Australian government, more than 80% of shoppers are influenced by their choice of environmentally-friendly products. This has been further encouraged by a national policy to promote more low-toxicity ingredients, recyclable packaging, and less chemical waste in products. The Australian Certified Organic (ACO) and COSMOS standards are two of the ways that these clean formulations are regulated. The Australian government's eco-labeling initiatives have also increased the demand for certified natural skincare across all large retail stores.

New technologies such as biodegradable packaging and digital skin analysis are helping to create greater interest in clean beauty products. There are opportunities for growth within the native botanical extract space and in refillable packaging. Some recent news includes local Australian brands winning clean beauty awards; additionally, retailers are expanding their 'eco-focused' product ranges in response to increasing interest from consumers.

Report Coverage

This research report categorizes the market for the Australia clean beauty market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia clean beauty market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia clean beauty market.

Driving Factors

The clean beauty market in Australia is driven by the consumers' growing awareness of the dangers of chemicals used in traditional skincare products and the decisive turn towards the application of non-toxic, safe formulations. The rising demand for products that are sustainable, cruelty-free, and eco-friendly is also one of the factors that hasten the adoption. The social media advocacy and the education of the influencers help to improve the consumer's knowledge of the ingredients and increase the transparency in the market. The government initiatives that provide standards for the procurement of raw materials ethically and for clearer labeling have the consumer trust as their main goal.

Restraining Factors

The clean beauty market in Australia is mostly constrained by the high costs and the lack of clear regulation regarding "clean" claims. Moreover, the disparity in the certification standards contributes to the market stagnation, too. The confusion among consumers, the difficulties in formulating the products, and the high prices of the natural ingredients are also factors that limit the market penetration and affordability of the products on a large scale.

Market Segmentation

The Australia clean beauty market share is classified into product type and distribution channel.

- The skincare segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia clean beauty market is segmented by product type into skincare, face care, body care, haircare, and color cosmetics. Among these, the skincare segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because Australian consumers are so concerned about ingredient safety, natural formulations, and skin health, it leads. Skincare is the biggest and fastest-growing sector due to rising consumer awareness of toxins, the need for mild and dermatologist-tested products, and widespread use of clean serums, moisturizers, and sunscreens.

- The online segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia clean beauty market is segmented by distribution channel into hypermarkets and supermarkets, specialty stores, online, and others. Among these, the online segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to consumers' growing reliance on e-commerce for ingredient transparency, feedback, and access to specialty clean beauty products, the online segment leads the Australian clean beauty market. Influencer marketing, digital platforms, and subscription models make online shopping more reliable, convenient, and in accordance with clean beauty's education-driven buying habits.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia clean beauty market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INIKA Organic

- Eye of Horus

- Botani

- Biologi

- Mukti Organics

- Grown Alchemist

- Kora Organics

- Imbibe

- Bodyblendz

- Edible Beauty Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Australian clean beauty brands were able to demonstrate innovation and sustainable practices at Cosmoprof India 2025 by having an Australian pavilion supported by Austrade, which was creating an international community presence in the global marketplace for their products.

- In October 2025, Retailers, including Sephora and Priceline, are expanding their beauty, wellness, and clean beauty product offerings by combining wellness master classes with curated products to create a new and exciting shopping experience for their customers.

- In August 2025, the opening of Adore Beauty’s first Queensland store at Westfield Carindale will continue to support the retail expansion of clean and ethical beauty products across Australia.

- In May 2025, the Naturally Good Expo highlighted Australian clean beauty companies’ commitment to sustainability and environmental stewardship through the use of recyclable and compostable packaging.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia clean beauty market based on the below-mentioned segments:

Australia Clean Beauty Market, By Product Type

- Skincare

- Face care

- Body care

- Haircare

- Color cosmetics

Australia Clean Beauty Market, By Distribution Channel

- Hypermarkets and Supermarkets

- Specialty Stores

- Online

- Others

FAQ’s

Q: What is the Australia clean beauty market size?

A: Australia clean beauty market size is expected to grow from USD 249.3 million in 2024 to USD 1381.4 million by 2035, growing at a CAGR of 16.84% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the consumers' growing awareness of the dangers of chemicals used in traditional skincare products and the decisive turn towards the application of non-toxic, safe formulations. The rising demand for products that are sustainable, cruelty-free, and eco-friendly is also one of the factors that hasten the adoption. The social media advocacy and the education of the influencers help to improve the consumer's knowledge of the ingredients and increase the transparency in the market.

Q: What factors restrain the Australia clean beauty market?

A: Constraints include the high costs and the lack of clear regulation regarding "clean" claims. Moreover, the disparity in the certification standards contributes to the market stagnation, too.

Q: How is the market segmented by product type?

A: The market is segmented into skincare, face care, body care, hair care, and color cosmetics.

Q: Who are the key players in the Australia clean beauty market?

A: Key companies include INIKA Organic, Eye of Horus, Botani, Biologi, Mukti Organics, Grown Alchemist, Kora Organics, Imbibe, Bodyblendz, Edible Beauty Australia, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |