Australia Compression Therapy Market

Australia Compression Therapy Market Size, Share, and COVID-19 Impact Analysis, By Technology (Static Compression Therapy, and Dynamic Compression Therapy), By End Use (Hospitals, Specialty Clinics, Home Healthcare, Physician?s Office, Nursing Homes, and Others), and Australia Compression Therapy Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Compression Therapy Market Size Insights Forecasts to 2035

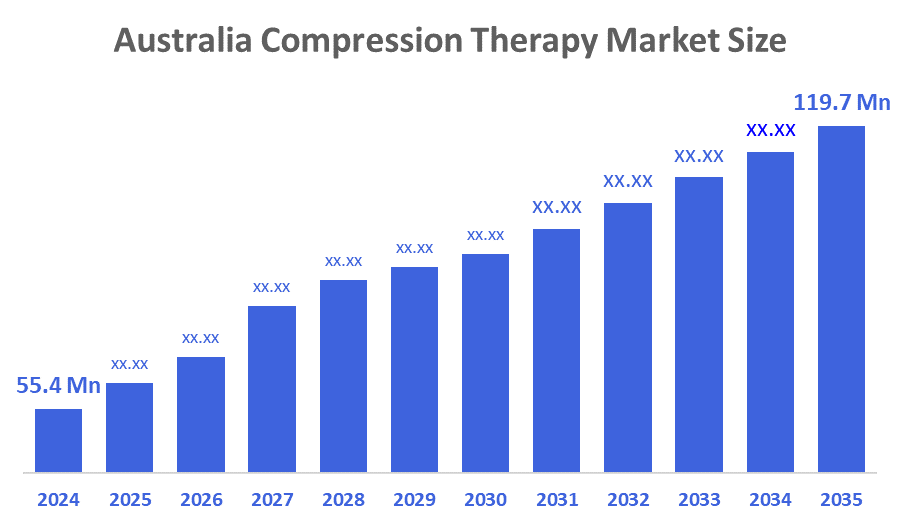

- The Australia Compression Therapy Market Size Was Estimated at USD 55.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.25% from 2025 to 2035

- The Australia Compression Therapy Market Size is Expected to Reach USD 119.7 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Compression Therapy Market Size is anticipated to Reach USD 119.7 Million by 2035, Growing at a CAGR of 7.25% from 2025 to 2035. The compression therapy market in Australia is driven by the increased incidence of lymphedema and venous illnesses, an aging population, an increase in diabetes cases, an increase in the need for post-surgical care, and a broader adoption of home-based and preventative healthcare solutions.

Market Overview

The compression therapy market in Australia includes medical items that use controlled pressure to promote blood circulation, reduce edema, and prevent venous diseases. In hospitals, clinics, and home care settings, these products, such as compression stockings, bandages, and pneumatic devices, are frequently utilized for sports injuries, lymphedema, varicose veins, deep vein thrombosis, chronic venous insufficiency, and post-surgical rehabilitation.

The Australian government subsidizes compression therapy products under the chronic disease management (CDM) plan, which enables patients who meet the criteria to get reimbursements for allied health services and assistive devices. Under the NDIS, the funding may be provided to people who have permanent disabilities for the purchase of compression garments and related equipment. Moreover, public hospital outpatient programs offered by state health systems to cover compression therapy for chronic venous and lymphatic conditions have made it cheaper for patients.

With the aid of wearable pneumatic devices and sensor-equipped clothing that continuously monitor pressure and circulation, Australian companies are progressing smart compression therapy and thus ensuring better results for venous and lymphatic disorders. Partnerships within the region combine the use of mobile applications and data analysis to ensure patient adherence. The future holds the promise of AI-dictated customization, telehealth incorporation, and an increase in home-use devices, all aimed at improving chronic care and rehabilitation.

Report Coverage

This research report categorizes the market for the Australia compression therapy market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia compression therapy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia compression therapy market.

Driving Factors

The compression therapy market in Australia is driven by the increased incidence of chronic venous disorders (CVD), lymphedema, and deep vein thrombosis (DVT) in Australia as a whole, as well as due to Australia’s aging population, who are at a greater risk for developing circulatory disorders. The increase in preventive health care awareness, the growing number of sports injuries, the introduction of technological advancements into compression garments, and the increasing use of compression garments during post-surgical rehabilitation will continue to drive this market growth in the years to come.

Restraining Factors

The compression therapy market in Australia is mostly constrained by the high cost of products, poor reimbursement policies, discomfort and non-adherence of the patient, lack of education in rural areas, the necessity of proper fitting, and clinical instruction for the efficient application of the therapy.

Market Segmentation

The Australia compression therapy market share is classified into technology and end use.

- The static compression therapy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia compression therapy market is segmented by technology into static compression therapy, and dynamic compression therapy. Among these, the static compression therapy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because most patients prefer static products over dynamic compression systems because they are easier to use, more reasonably priced, widely prescribed for lymphedema and chronic venous disorders, and easily accessible in clinics, hospitals, and retail settings.

- The hospitals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia compression therapy market is segmented by end use into hospitals, specialty clinics, home healthcare, physician’s office, nursing homes, and others. Among these, the hospitals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Patients with severe lymphedema, post-surgical rehabilitation demands, and persistent venous problems are primarily treated in hospitals. Compared to other end-use settings, they have higher uptake and revenue due to their huge patient numbers, access to qualified healthcare personnel, and integration of compression therapy into normal treatment regimens.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia compression therapy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OPC Health

- Lymphoedema Supply Company

- Western Medical

- Alpha Medical Solutions

- TSL Australia

- Second Skin Pty Ltd

- Solidea Australia / Rejuvenate Health Pty Ltd

- EzyAs (The Independence Shop)

- Biosx Compression

- 2XU Pty. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September?2024, Medi Australia increased its range of compression garments by introducing trendy colors and patterns for Mediven flat?knit stockings, thus giving better patient choice and comfort.

- In August?2023, Medi Australia introduced the revolutionary Duomed?soft 2easy two?piece compression stocking system, which considerably lessened the effort for the patient with mobility challenges to apply and take off the compression garment.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia compression therapy market based on the below-mentioned segments:

Australia Compression Therapy Market, By Technology

- Static Compression Therapy

- Dynamic Compression Therapy

Australia Compression Therapy Market, By End Use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Physician’s Office

- Nursing Homes

- Others

FAQ’s

Q: What is the Australia compression therapy market size?

A: Australia compression therapy market size is expected to grow from USD 55.4 million in 2024 to USD 119.7 million by 2035, growing at a CAGR of 7.25% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increased incidence of chronic venous disorders (CVD), lymphedema, and deep vein thrombosis (DVT) in Australia as a whole, as well as due to Australia’s aging population, who are at a greater risk for developing circulatory disorders.

Q: What factors restrain the Australia compression therapy market?

A: Constraints include the high cost of products, poor reimbursement policies, discomfort and non-adherence of the patient, and lack of education in rural areas.

Q: How is the market segmented by technology?

A: The market is segmented into static compression therapy, and dynamic compression therapy.

Q: Who are the key players in the Australia compression therapy market?

A: Key companies include OPC Health, Lymphoedema Supply Company, Western Medical, Alpha Medical Solutions, TSL Australia, Second Skin Pty Ltd, Solidea Australia / Rejuvenate Health Pty Ltd, EzyAs (The Independence Shop), Biosx Compression, 2XU Pty. Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 187 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |