Australia Crop Protection Chemicals Market

Australia Crop Protection Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Herbicides, Fungicides, Insecticides, and Others), By Application (Foliar Spray, Seed Treatment, Soil Treatment, and Others), and Australia Crop Protection Chemicals Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Crop Protection Chemicals Market Size Insights Forecasts to 2035

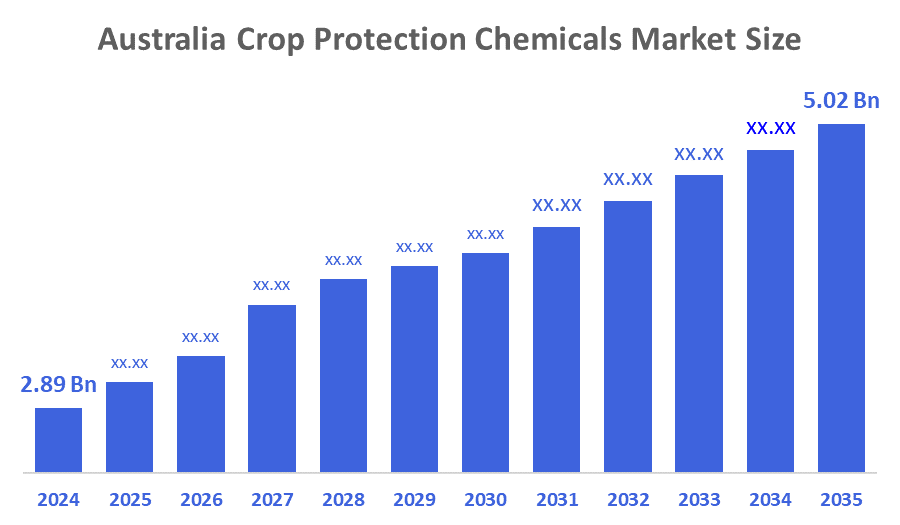

- The Australia Crop Protection Chemicals Market Size Was Estimated at USD 2.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.15% from 2025 to 2035

- The Australia Crop Protection Chemicals Market Size is Expected to Reach USD 5.02 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Crop Protection Chemicals Market Size is anticipated to Reach USD 5.02 Billion by 2035, Growing at a CAGR of 5.15% from 2025 to 2035. The home decor market in Australia is driven by the increasing need for novel agrochemical products, horticulture production, and sustainable agriculture. The industry's hopeful outlook and expanding proportion in various agricultural areas are being bolstered by ideal weather conditions, advantageous regulatory regulations, and desires for higher crop yields.

Market Overview

The market for crop protection chemicals develops and supplies chemicals targeted at the protection of crops against pests, diseases, weeds, and every potential biotic and abiotic danger. These products include herbicides, insecticides, fungicides, and other products that protect crops with benefits, as protection can help maintain crop health, forecast quality yield, and lessen losses. The agrochemical industry within Australia is significant, as crop protection is crucial for grain and horticulture growing operations, as it is used to protect high-value exportable crops from resistant weeds, pests, and diseases. Government support services include the newly appointed inspector-general is spearheading an improvement of the agricultural and veterinary chemicals regulatory process by the APVMA, funding is being allocated to reduce barriers of access to safer agricultural and veterinary chemicals, and renewed emphasis on digital agricultural tools. The market is also increasingly adopting and integrating technology, including but not limited to drone spraying, AI-based monitoring of conditions and spraying, and new generation formulations to improve chemical efficiency and sustainability. Investors/interested parties will capitalise on opportunities in biopesticides, resistance management solutions, smart farming services and consulting, and rapid methods to evaluate agronomic efficacy and safety of chemicals.

Report Coverage

This research report categorizes the market for the Australia crop protection chemicals market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia crop protection chemicals market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia crop protection chemicals market.

Driving Factors

The crop protection chemicals market in Australia is driven by high demand for crop protection in the grain and horticulture sectors, which represent high-value exports. There is increasing resistance to weeds and pests, particularly in broadacre farming, resulting in the need for new modes of action for herbicides and integrated pest-management strategies. There is an increasing adoption of precision agriculture tools, especially drone spraying and digital data and monitoring tools, which will improve chemical efficiency and the use of new formulations of products. Demand for higher-performing, safer products is also encouraged by compliance with the strictest of residue and maximum residue limits (MRLs) for export markets. Additionally, climate variability and increased pest pressure create additional demand for new sources of crop protection inputs.

Restraining Factors

The crop protection chemicals market in Australia is mostly constrained by the high regulatory controls and lengthy approval timelines, and before full approval, manufacturers must absorb the costs associated with APVMA compliance. Increasingly, environmental and health directives are imposing restrictions or phase-outs of specific chemical actives, which reduce the availability of products to farmers. Additionally, there are limitations on the effectiveness of modes of action for weeds and pests due to the development of resistance, and there are higher costs of treatments associated with resistance.

Market Segmentation

The Australia crop protection chemicals market share is classified into product type and application.

- The herbicides segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia crop protection chemicals market is segmented by product type into herbicides, fungicides, insecticides, and others. Among these, the herbicides segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Strong demand for herbicides is driven by high weed pressure in Australia's broadacre crops, such as wheat, barley, and canola; growing resistance increases the need for sophisticated formulations, further solidifying herbicides' market dominance.

- The foliar spray segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia crop protection chemicals market is segmented by application into foliar spray, seed treatment, soil treatment, and others. Among these, the foliar spray segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its extensive usage in broadacre farming, which offers quick and efficient defense against pests, weeds, and diseases directly on crop foliage, is the main reason for its domination.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia crop protection chemicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nufarm Limited

- Accensi

- 4Farmers

- Crop Smart

- Australis Crop Protection

- Sumitomo Chemical Australia

- Syngenta Australia

- Bayer CropScience Australia

- BASF Australia

- Corteva Agriscience Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, the Australian Pesticides and Veterinary Medicines Authority (APVMA) announced its intention to suspend certain dimethoate-based pesticides for berries, effective August 2025, for safety concerns.

- In July 2025, CropLife Australia issued revised "Resistance Management Strategies" for insecticides, fungicides, and herbicides, which are meant to assist Australian agriculture in the fight against resistance to chemicals.

- In April 2024, the Australian government announced it would seek changes at the APVMA to improve decision-making capability, after an examination of regulatory culture and performance.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia crop protection chemicals market based on the below-mentioned segments:

Australia Crop Protection Chemicals Market, By Product Type

- Herbicides

- Fungicides

- Insecticides

- Others

Australia Crop Protection Chemicals Market, By Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 149 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |