Australia Cyber Insurance Market

Australia Cyber Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Packaged, and Stand-alone), By End User (BFSI, Healthcare, IT and Telecom, Retail, and Others), and Australia Cyber Insurance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Cyber Insurance Market Insights Forecasts to 2035

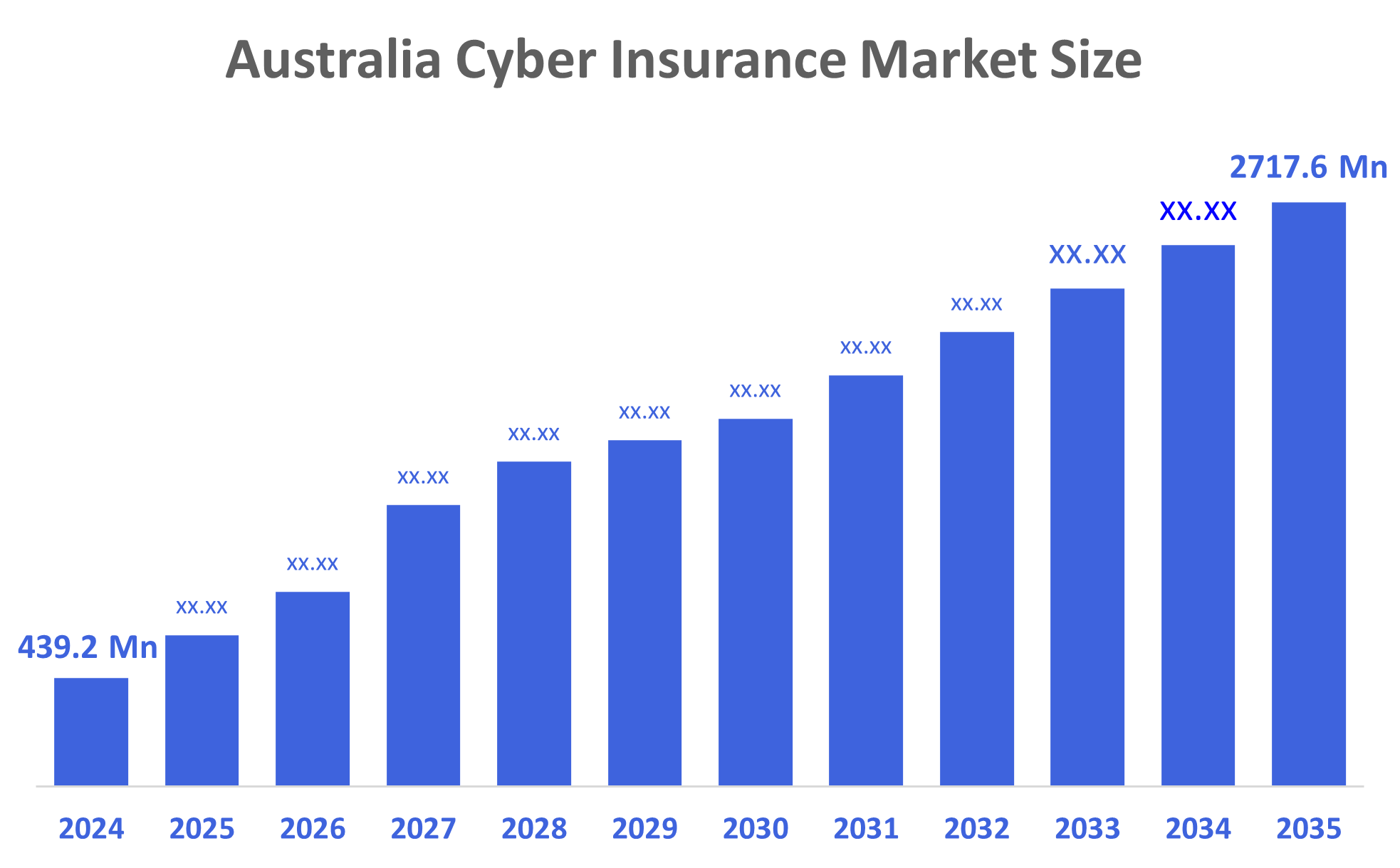

- The Australia Cyber Insurance Market Size Was Estimated at USD 439.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 18.02% from 2025 to 2035

- The Australia Cyber Insurance Market Size is Expected to Reach USD 2717.6 Million by 2035

According to a research report published by Decisions Advisors, The Australia Cyber Insurance Market Size is Anticipated to Reach USD 2717.6 Million by 2035, Growing at a CAGR of 18.02% from 2025 to 2035. The cyber insurance market in Australia is driven by rising cyber-attack frequency, expanding mobile and cloud-based business operations, regulatory compliance requirements, and insurer tech partnerships that offer real-time threat monitoring, incident response, and customized coverage for SMEs and enterprises.

Market Overview

The market for cyber insurance includes products and services that shield businesses and individuals from losses brought on by cyber events, including ransomware attacks, network outages, data breaches, and digital fraud. In an increasingly digital world, these insurance policies assist organizations in managing and transferring cyber risk by covering expenses for incident response, business interruption, legal obligations, data recovery, and cybersecurity services. The rapid growth of the Australian cyber insurance marketplace is being driven by the increasing number of data breaches, AI, and supply chain attacks that businesses are experiencing, which are leading to a greater demand for cyber insurance coverage for financial loss, business interruption, and liability. Underpinning this marketplace, the Australian government has taken steps through the 2023-2030 Australian Cyber Security Strategy to improve national cyber defences, strengthen incident reporting processes, and foster public/private collaboration in improving the resilience of businesses to cyber-attacks. To help protect businesses from cyber-attacks, the insurers are increasingly collaborating and forming partnerships with cybersecurity providers and cloud service providers in order to deliver a more integrated approach to cyber insurance by leveraging real-time threat detection, AI risk modelling, and dynamic underwriting. Consequently, insurers can offer cyber insurance policies that are scalable, tailored, and more affordable to small and medium enterprises (SMEs) and large corporations. Consequently, due to the increasing awareness of risk associated with cyber-attacks, regulatory support, and the speed of technological advancements, will enable the growth of Australia’s cyber insurance marketplace.

Report Coverage

This research report categorizes the market for the Australia cyber insurance market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia cyber insurance market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia cyber insurance market.

Driving Factors

The cyber insurance market in Australia is driven by the spate of cyber threats, particularly related to ransomware attacks, phishing scams, and unauthorised access to sensitive customer information. However, they are also being driven by increased regulation and requirements from the Federal Government around reporting incidents and penalties for failure to comply with those requirements. In addition, small to medium-sized enterprises (SMEs), in particular, have a major exposure to business interruptions and associated costs from data breaches that have become very common, and as a result, are increasingly seeking out cyber liability insurance. Additionally, cyber insurance partners are working both strategically with their clients to build capacity for better coverage and, as a result, are expanding underwriting capabilities so they can provide coverage to a wider range of organisations.

Restraining Factors

The cyber insurance market in Australia is mostly constrained by rising premiums, stricter underwriting for companies with inadequate security, a lack of historical loss data for precise pricing, uneven policy conditions, and a lack of knowledge among SMEs regarding the importance of cyber coverage.

Market Segmentation

The Australia cyber insurance market share is classified into insurance type and end user.

- The stand-alone segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia cyber insurance market is segmented by insurance type into packaged, and stand-alone. Among these, the stand-alone segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because it offers specialized incident response services that packaged plans usually don't, as well as dedicated, comprehensive coverage for cyber risks, including breaches, ransomware, and business disruption, the stand-alone cyber insurance segment dominates the Australian market.

- The BFSI segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia cyber insurance market is segmented by end user into BFSI, healthcare, it and telecom, retail, and others. Among these, the BFSI segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to high-value sensitive data, strict regulatory and compliance requirements, frequent targeted attacks, large budgets for risk transfer, and a strong preference for comprehensive, stand-alone policies with specialized incident-response and legal cover, the BFSI sector dominates Australia's cyber insurance market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia cyber insurance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aon Australia

- Allianz Australia

- Chubb Insurance Australia

- QBE Insurance Australia

- Berkshire Hathaway Specialty Insurance Australia

- Zurich Australia

- Hollard Insurance Australia

- CGU Insurance

- AXA Australia

- Allianz Global Corporate & Specialty (AGCS) Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, Google Cloud partnered with Beazley and Chubb on a risk protection program to expand into Australia. This will allow Google Cloud to provide customers with access to real-time cloud security data and related cloud security tools as part of its cyber insurance underwriting process. This was an important initiative to enable Australian Small and Medium Enterprises (SME) compliance with federal regulations as well as to support growth within the Australian cyber insurance market.

- In May 2025, COSBOA launched "Cyber Wardens" in conjunction with CyberCert as a means of creating Bronze Certification and Pre-Qualification for Cyber Insurance for Australian SME's (Small and Medium Enterprises) in the marketplace. This program improved access to affordable Cyber Insurance coverage, incentivized Cybersecurity Training, and increased the resilience of Australia's SME Sector.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia cyber insurance market based on the below-mentioned segments:

Australia Cyber Insurance Market, By Insurance Type

- Packaged

- Stand-alone

Australia Cyber Insurance Market, By End User

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |