Australia Dietary Supplements Market

Australia Dietary Supplements Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Vitamin and Mineral Dietary Supplements, Herbal Dietary Supplements, Protein Dietary Supplements, and Others), By Application (Additional Supplements, Medicinal Supplement, and Sports Nutrition), and Australia Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Dietary Supplements Market Insights Forecasts to 2035

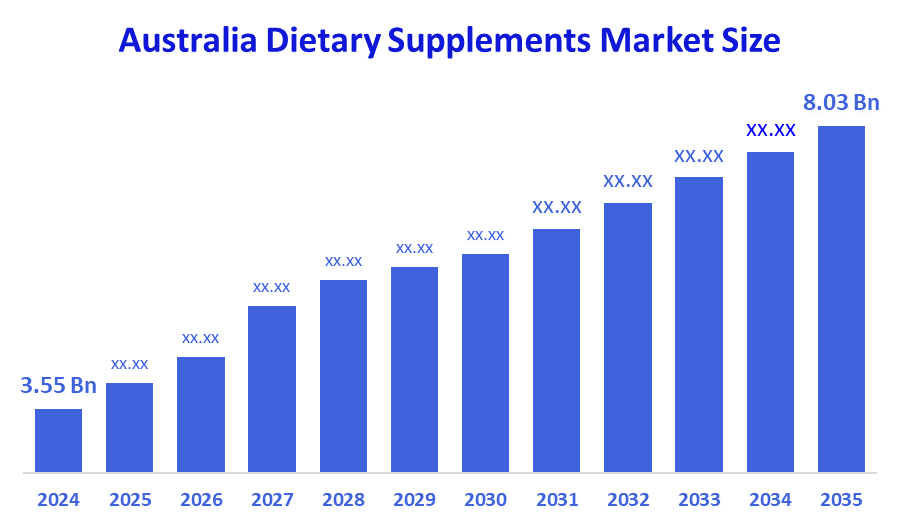

- The Australia Dietary Supplements Market Size Was Estimated at USD 3.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.7% from 2025 to 2035

- The Australia Dietary Supplements Market Size is Expected to Reach USD 8.03 Billion by 2035

According To A Research Report Published By Decision Advisors, The Australia Dietary Supplements Market Size Is Anticipated To Reach USD 8.03 Billion By 2035, Growing At A CAGR Of 7.7% From 2025 To 2035. Growing Consumer Preferences For Preventative Nutrition, Expanding E-Commerce Channels, Creative Product Formulations, And Increased Demand For Natural And Plant-Based Supplements Are Some Of The Factors Driving Growth In The Australian Dietary Supplements Market.

Market Overview

The manufacturing, distribution, and consumption of non-pharmaceutical items meant to augment the diet with vitamins, minerals, herbs, amino acids, and other nutrients to promote health and wellness are all included in the Australian dietary supplements market. These items are designed to improve physical performance, prevent nutritional deficiencies, promote general health, and address particular health issues.

The government plays a crucial role in regulating the dietary supplements market in Australia alongside public health measures. Supplements are utilized by nearly one-third (33.6%) of the population, and at the same time, factors such as AUD 1.5 billion in preventive health spending, TGA regulation, labeling reforms, and nutrition awareness campaigns like Eat for Health are ensuring safe and sustainable consumption which consequently increases demand in the market.

For instance, in January 2024, Australian company PhytoLove introduced Ahiflower, a completely new plant-derived omega supplement from flax oil, which has omega-3 and omega-6 acids in it, and has been made for the purpose of assisting heart health and, at the same time, possibly engaging in the prevention of Alzheimer's disease. The market is driven by increased health consciousness, the elderly population, and increasing disposable incomes.

Report Coverage

This research report categorizes the market for the Australia dietary supplements market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia dietary supplements market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia dietary supplements market.

Driving Factors

The demand for nutritional supplements has increased due to consumer awareness of health, wellness, and preventative healthcare, which is one of the reasons propelling the Australian dietary supplements market. The demand for dietary supplements has increased due to the rising prevalence of chronic and lifestyle-related diseases like diabetes, obesity, and cardiovascular ailments. Product appeal has also increased due to the use of natural and plant-based goods, as well as advancements in formulation, delivery systems, and fortification. Additionally, bolstering consumer confidence and promoting regular supplement intake, supporting government legislation, health campaigns, and professional endorsements all contribute to market expansion.

Restraining Factors

The Australian market for dietary supplements is restricted by a number of factors, such as strict regulations, expensive products, low consumer awareness of benefits that have been scientifically proven, possible adverse effects, and competition from natural diets and alternative wellness products.

Market Segmentation

The Australia dietary supplements market share is classified into product type and application.

- The vitamin and mineral dietary supplements segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia dietary supplements market is segmented by product type into vitamin and mineral dietary supplements, herbal dietary supplements, protein dietary supplements, and others. Among these, the vitamin and mineral dietary supplements segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growing consumer awareness of nutritional inadequacies and preventative healthcare is driving the market for vitamin and mineral dietary supplements. Growth is also supported by the growing demand for fortified foods, immunity-boosting products, and customized nutrition.

- The additional supplements segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia dietary supplements market is segmented by application into additional supplements, medicinal supplement, and sports nutrition. Among these, the additional supplements segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The increasing focus on preventative healthcare and everyday nutritional intake among consumers is driving the additional supplements market. The popularity of vitamins, minerals, and herbal supplements has increased due to growing adoption across a range of age groups and growing knowledge of their benefits for general wellness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia dietary supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Nutrition

- Amway Corp.

- Bayer AG

- BioGaia Australia

- Blackmores Group

- Bulk Nutrients

- Lipa Pharmaceuticals

- Nature's Sunshine Products of Australia Pty Ltd

- NOW Health Group, Inc.

- Nu Skin Pacific

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2024, Nutritional Growth Solutions (NGS) announced an exclusive partnership with The Healthy Chef® to produce and distribute 28 wellness products in the U.S. and Canada, targeting women’s health and generating over USD 1.5 million in revenue.

- In March 2024, Nature's Way launched zero-sugar gummy vitamin supplements made with plant-based sweeteners, including monk fruit and stevia, containing Vitamins C, D3, and zinc for enhanced wellness.

- In January 2024, Abbott launched PROTALITY™, a high-protein nutrition shake providing 30g protein, 25 vitamins and minerals, low sugar, designed to support weight loss and maintain muscle mass in adults.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia dietary supplements market based on the below-mentioned segments:

Australia Dietary Supplements Market, By Product Type

- Vitamin and Mineral Dietary Supplements

- Herbal Dietary Supplements

- Protein Dietary Supplements

- Others

Australia Dietary Supplements Market, By Application

- Additional Supplements

- Medicinal Supplement

- Sports Nutrition

FAQ’s

Q: What is the Australia dietary supplements market size?

A: Australia dietary supplements market size is expected to grow from USD 3.55 billion in 2024 to USD 8.03 billion by 2035, growing at a CAGR of 7.7% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Rising health consciousness, increasing preventive healthcare adoption, growing demand for natural and plant-based supplements, innovations in formulations, and expanding e-commerce and retail channels drive the Australian dietary supplements market.

Q: What factors restrain the Australia dietary supplements market?

A: Stringent regulations, high product costs, limited awareness of scientifically proven benefits, potential side effects, and competition from natural diets and alternative wellness products restrain market growth in Australia.

Q: How is the market segmented by product type?

A: The market is segmented into vitamin and mineral dietary supplements, herbal dietary supplements, protein dietary supplements, and others.

Q: Who are the key players in the Australia dietary supplements market?

A: Key companies include Abbott Nutrition, Amway Corp., Bayer AG, BioGaia Australia, Blackmores Group, Bulk Nutrients, Lipa Pharmaceuticals, Nature's Sunshine Products of Australia Pty Ltd, NOW Health Group, Inc., Nu Skin Pacific, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |