Australia Drone Market

Australia Drone Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fixed-wing, Multi-rotor, Single-rotor, and Hybrid), By End Use (Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, and Others), and Australia Drone Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Drone Market Insights Forecasts to 2035

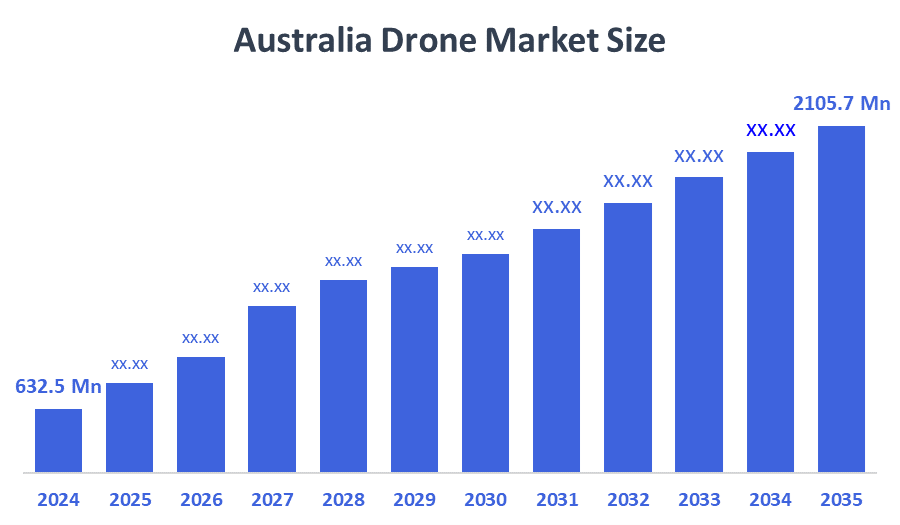

- The Australia Drone Market Size Was Estimated at USD 632.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.55% from 2025 to 2035

- The Australia Drone Market Size is Expected to Reach USD 2105.7 Million by 2035

According to a research report published by Decision Advisors & Consulting, the Australia drone market size is anticipated to reach USD 2105.7 million by 2035, growing at a CAGR of 11.55% from 2025 to 2035. The drone market in Australia is driven by autonomous technological developments, demand for drones in military and agriculture, government investments, BVLOS licenses, growing commercial uses, and efficiency advantages in the mining, logistics, surveying, and infrastructure sectors.

Market Overview

The Australia drone market is a collection of drones (UAVs), related technologies, services, and applications that are being used in Australia, and it includes military, commercial, industrial, and recreational uses, plus the mentioned sectors of defence, agriculture, mining, logistics, construction, surveillance, and infrastructure inspection. The primary factors that have contributed to this growth are the desire for greater efficiency in operations, decreased costs, and collecting accurate real-time data. Technology advancements related to augmented intelligence (AI), autonomous flight systems, sensor technology, and high levels of data analysis called precision flight offer greater capabilities to the drone industry.

The Australian government is involved very closely in the drone market and does so by undertaking defense as well as civil initiatives. An amount exceeding A$10 billion is earmarked for the acquisition of drone and counter-drone technologies, whereas the Emerging Aviation Technology Partnerships Program offers about A$32 million as grants. More money is being invested into BVLOS trials, homegrown manufacturing, counter-UAS development, and commercial innovation in drones for farming, logistics, and infrastructure sectors.

The precision in agriculture, inspecting infrastructure, and long-range logistics are the areas where the market has the greatest potential to grow. A few recent developments include the acquisition of drones for military purposes, approval of BVLOS trial tests, and the addition of investments in domestic drone production and testing facilities.

Report Coverage

This research report categorizes the market for the Australia drone market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia drone market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia drone market.

Driving Factors

The drone market in Australia is driven by the military's modernization, the growing use of drones in agriculture, mining, construction, and infrastructure inspection, and the need for less expensive aerial data. In addition to these factors, the government's encouraging policies, CASA's BVLOS approvals, and public funding for new aviation technologies all contribute to a faster acceptance of these technologies. The continuous innovation in AI, autonomous navigation, sensors, and data analytics is also a factor that makes the drone more efficient, reliable, and commercially viable in various sectors.

Restraining Factors

The drone market in Australia is mostly constrained by tough airspace regulations, high costs of complying with and getting certificates, worries about cybersecurity and privacy, lack of skilled workers, dependence on weather, and the difficulties of safely integrating drones with manned aircraft in controlled airspace.

Market Segmentation

The Australia drone market share is classified into product type and end use.

- The multi-rotor segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia drone market is segmented by product type into fixed-wing, multi-rotor, single-rotor, and hybrid. Among these, the multi-rotor segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their affordability, convenience of use, vertical takeoff and landing capability, and suitability for short-range missions are the main factors contributing to their dominance. Multi-rotor drones are utilized extensively in a variety of industries, including agricultural, mining, construction, media, surveillance, and infrastructure inspection. In these industries, precise data collection and hovering capabilities are essential for generating significant demand and income.

- The military and defense segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia drone market is segmented by end use into construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others. Among these, the military and defense segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. High government expenditures on border security, intelligence, surveillance, and defense modernization are the main causes of this supremacy. The segment's dominating market share is attributed to large-scale UAV acquisition, investments in autonomous and combat drones, and an increasing emphasis on sovereign manufacturing and counter-drone capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia drone market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DroneShield

- Aerosonde Ltd

- SYPAQ Systems

- AUAV

- Wildlife Drones

- Sentient Vision Systems

- Geodrones Australia

- Carbonix

- Sphere Drones

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Australia placed an order for six more Boeing MQ-28 Ghost Bat collaborative combat drones under an approximately $930 million deal, thus enlarging the domestic unmanned combat capabilities.

- In October 2025, DroneShield revealed an R&D counter-drone facility for A$13 million that will be located in Adelaide.

- In February 2025, Air Services Australia revealed the first group of UAV service providers that will be integrated with the new Flight Information Management System (FIMS) for drone traffic management.

- In August 2024, the Advanced Strategic Capabilities Accelerator (ASCA) puts in A$6.6 million towards the creation of Australian UAS prototypes that will be totally independent.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia drone market based on the below-mentioned segments:

Australia Drone Market, By Product Type

- Fixed-wing

- Multi-rotor

- Single-rotor

- Hybrid

Australia Drone Market, By End Use

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

FAQ’s

Q: What is the Australia drone market size?

A: Australia drone market size is expected to grow from USD 632.5 million in 2024 to USD 2105.7 million by 2035, growing at a CAGR of 11.55% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the military's modernization, the growing use of drones in agriculture, mining, construction, and infrastructure inspection, and the need for less expensive aerial data. In addition to these factors, the government's encouraging policies, CASA's BVLOS approvals, and public funding for new aviation technologies all contribute to a faster acceptance of these technologies. The continuous innovation in AI, autonomous navigation, sensors, and data analytics is also a factor that makes the drone more efficient, reliable, and commercially viable in various sectors.

Q: What factors restrain the Australia drone market?

A: Constraints include the tough airspace regulations, high costs of complying with and getting certificates, worries about cybersecurity and privacy, lack of skilled workers, dependence on weather, and the difficulties of safely integrating drones with manned aircraft in controlled airspace.

Q: How is the market segmented by product type?

A: The market is segmented into fixed-wing, multi-rotor, single-rotor, and hybrid.

Q: Who are the key players in the Australia drone market?

A: Key companies include DroneShield, Aerosonde Ltd, SYPAQ Systems, AUAV, Wildlife Drones, Sentient Vision Systems, Geodrones Australia, Carbonix, Sphere Drones, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 188 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |