Australia Egg Powder Market

Australia Egg Powder Market Size, Share, and COVID-19 Impact Analysis, By Type (Whole Egg Powder, Yolk Egg Powder, White Egg Powder, and Others), By End User (Bakery, Sauces, Dressings, and Mixes, and Others), and Australia Egg Powder Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Egg Powder Market Insights Forecasts to 2035

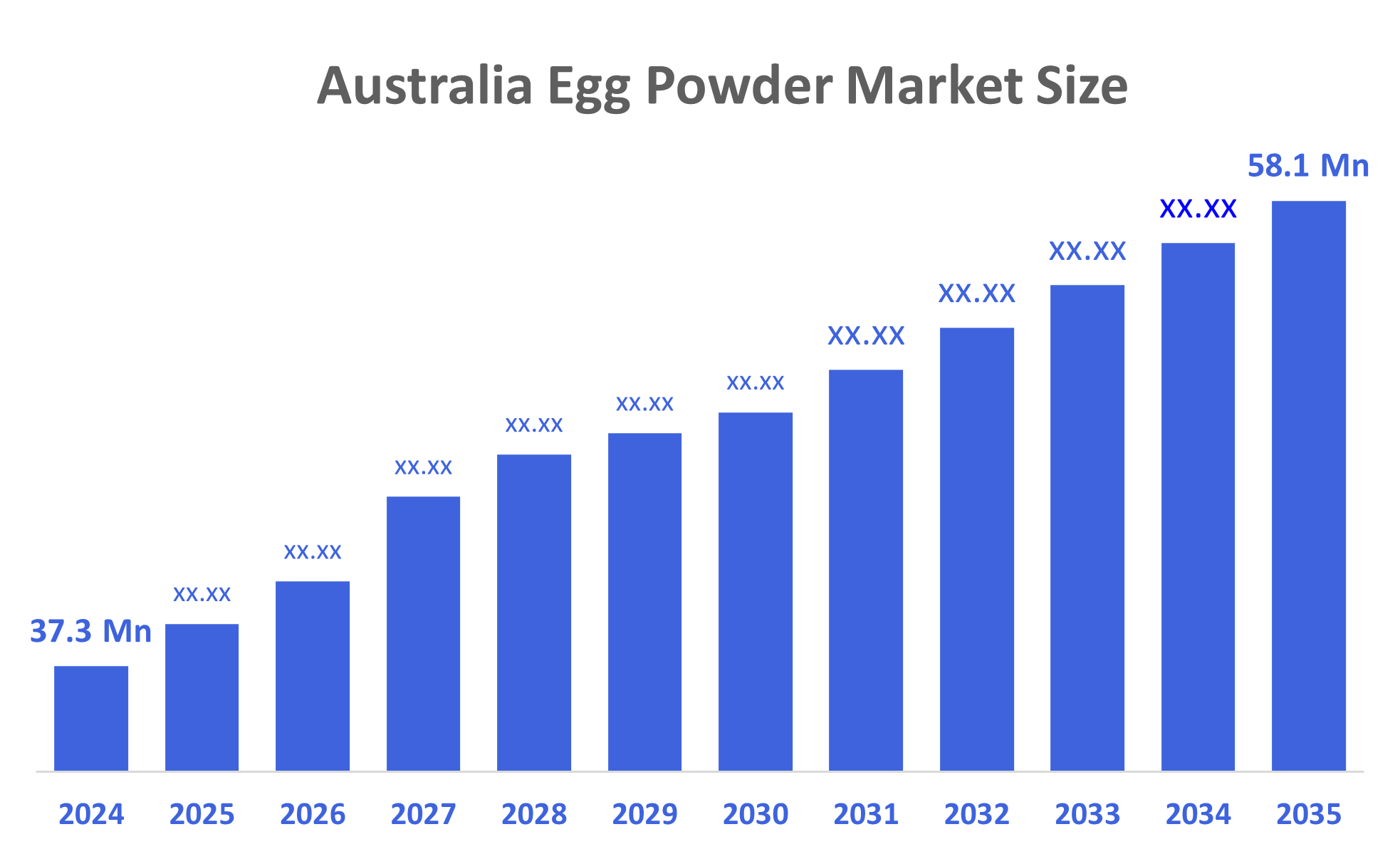

- The Australia Egg Powder Market Size Was Estimated at USD 37.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.11% from 2025 to 2035

- The Australia Egg Powder Market Size is Expected to Reach USD 58.1 Million by 2035

According to a research report published by Decision Advisors, The Australia Egg Powder Market Size is Anticipated to Reach USD 58.1 Million by 2035, Growing at a CAGR of 4.11% from 2025 to 2035. The egg powder market in Australia is driven by increased demand from the baking and food processing industries, as well as rising health and fitness awareness, which is boosting the demand for protein supplements. In addition, the market share of egg powder in Australia is being driven by the rise in the consumption of convenience foods due to hectic lives.

Market Overview

The egg powder market refers to the market for egg products, which includes the manufacturing, processing, distribution, and consumption of dehydrated egg powder products such as whole egg powder, egg yolk, and egg white powder. Egg powder is made by spray drying liquid eggs to remove moisture, making them easier to store and transport. The Australian egg powder market provides constituents to bakery, food service, and industrial users with long-term shelf-stocked, protein-based egg ingredients, further gaining relevance due to volatility in the supply of fresh eggs. Growth in the segment is driven by food manufacturers, bakery and export markets, and efficiency benefits over fresh eggs. Biosecurity measures and industry levies from the government aided in maintaining supply and funding R&D and emergency funding. Advancements in the technologies of spray-drying, formulation, and nutritional application based on egg provide a better functional performance and support a product development pipeline for fortified and convenience foods. There are opportunities in value-added egg ingredients, being able to procure for institutional use, and building upon export growth, though recent outbreaks of avian influenza have impacted supply and highlighted the need for resilience across the supply chain.

Report Coverage

This research report categorizes the market for the Australia egg powder market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia egg powder market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia egg powder market.

Driving Factors

The egg powder market in Australia is driven by robust demand from food manufacturers and bakers for ready-to-use, shelf-stable, and high-protein ingredients. Egg powders provide the benefits of storage duration, ease of transport, and lower risk of contamination than fresh eggs, and therefore lend themselves to industrial use and export. Continued consumer interest in ready-to-eat and fortified foods promotes novel market developments. In addition, Australia’s existing focus on biosecurity and production efficiency provides assurance in reliability and potential for broader uptake in domestic and export markets.

Restraining Factors

The egg powder market in Australia is mostly constrained by fluctuating raw egg prices, high processing and energy costs, and lower consumer awareness than fresh egg products. The biosecurity risks from outbreaks of avian influenza threaten supply chains and affect overall market stability and export prospects.

Market Segmentation

The Australia egg powder market share is classified into type and end user.

- The whole egg powder segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia egg powder market is segmented by type into whole egg powder, yolk egg powder, white egg powder, and others. Among these, the whole egg powder segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that whole egg powder has a wide range of applications in the bakery, confectionery, ready-to-eat, and foodservice sectors. It can replace fresh eggs while guaranteeing a longer shelf life, lower storage costs, and improvements in food safety.

- The bakery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia egg powder market is segmented by end user into bakery, sauces, dressings, and mixes, and others. Among these, the bakery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This market growth due to it offers aeration, structure, binding, and increased shelf stability, egg powder is an essential component of baked goods such as cakes, pastries, biscuits, and muffins. Major demand in this category is driven by Australia's robust commercial baking sector, growing consumption of packaged and ready-to-eat baked goods, and the preference for hygienic and convenient handling over shell eggs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia egg powder market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Egg Domain

- NFTC (New Farm Trading Co.)

- Frutex Australia

- Pure Product Australia

- Pace Farm

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2024, the Department of Agriculture, Fisheries, and Forestry updated its heat-treatment import conditions for egg whites, egg yolk, and egg powder, improving regulatory clarity for the processed-egg-product industry in Australia.

- In June 2024, Emergency biosecurity measures were implemented after a new outbreak of highly pathogenic avian influenza occurred at a commercial egg farm in Hawkesbury, New South Wales; concerns were raised around the continuity of supply of processed-egg-products.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia egg powder market based on the below-mentioned segments:

Australia Egg Powder Market, By Type

- Whole Egg Powder

- Yolk Egg Powder

- White Egg Powder

- Others

Australia Egg Powder Market, By End User

- Bakery

- Sauces, Dressings, and Mixes

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 194 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |