Australia Electric Scooters Market

Australia Electric Scooters Market Size, Share, and COVID-19 Impact Analysis, By Drive Type (Belt Drive, Chain Drive, and Hub Motors), By Battery Type (Lead Acid, Lithium Ion, and Others), By End Use (Personal, and Commercial), and Australia Electric Scooters Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Electric Scooters Market Insights Forecasts to 2035

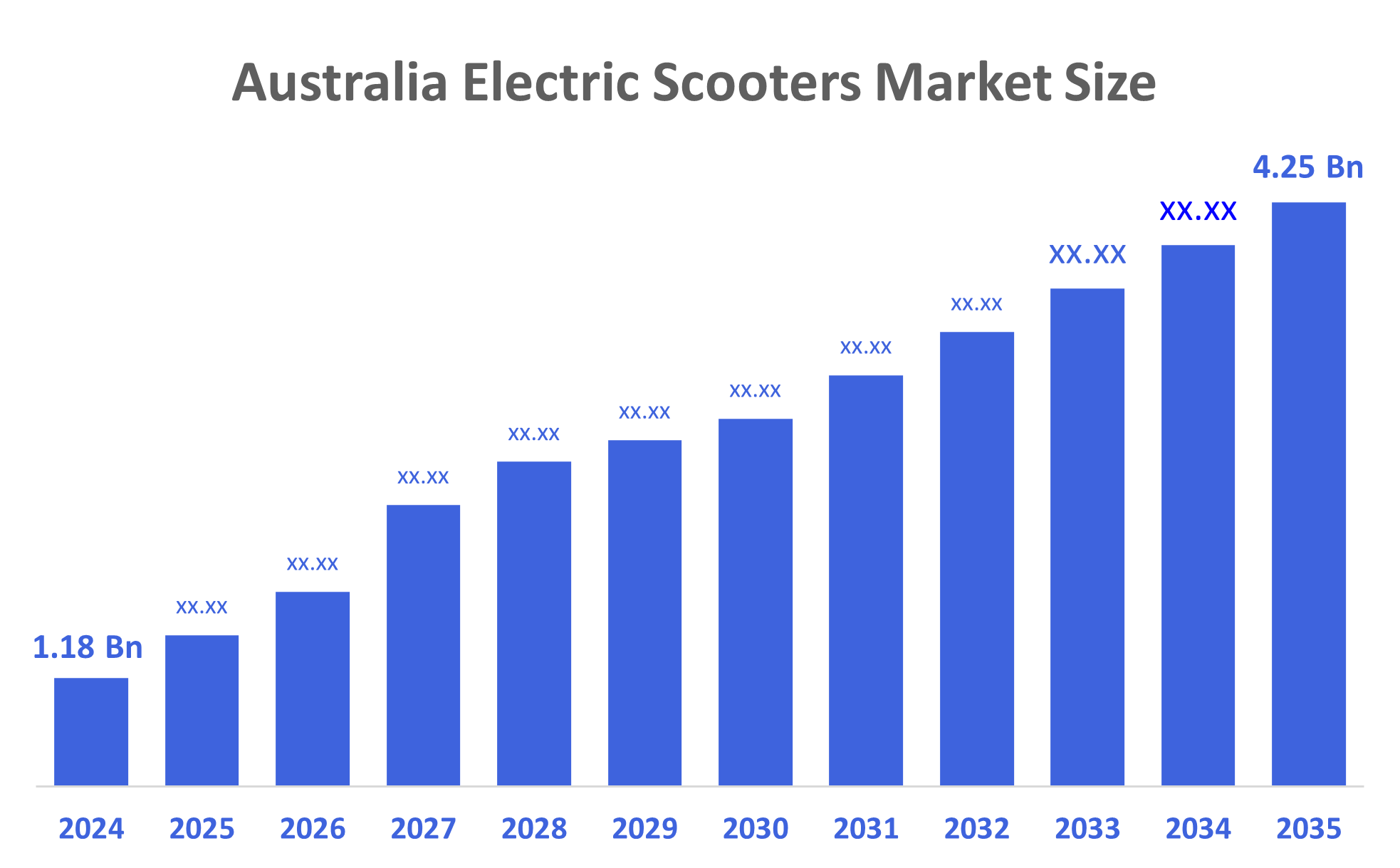

- The Australia Electric Scooters Market Size Was Estimated at USD 1.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.35% from 2025 to 2035

- The Australia Electric Scooters Market Size is Expected to Reach USD 4.25 Billion by 2035

According to a research report published by Decisions Advisors, The Australia Electric Scooters Market Size is Anticipated to Reach USD 4.25 Billion by 2035, Growing at a CAGR of 12.35% from 2025 to 2035. The electric scooters market in Australia is driven by customers' move toward more economical and effective urban mobility options due to factors like fast urbanization, rising gasoline prices, favorable government incentives, and rising demand for practical short-distance commuting options.

Market Overview

An electric scooter is a two-wheeled vehicle that runs on electricity, allowing for personal travel with a rechargeable electric motor, which offers many benefits, including low cost, ease of use, and low environmental impact from the reduced amount of emissions produced when in operation. Electric scooters are available in several types of folding, shared, and performance scooters. Individuals and businesses alike can use electric scooters, as there are several companies that have fleets operating in cities. The electric scooter market in Australia is rapidly expanding, with the rise of urbanization, rising fuel prices, and the need for more accessible, low-emission transportation options for first/last-mile commuting, driving this growth. To support this transition, many States in Australia have developed policies and incentives. The Queensland government introduced the "E-Mobility Rebate Scheme" (2024), which provides rebates up to AU$200 for electric scooters, as an example of this. In South Australia, a similar law allows individuals to use privately owned electric scooters on roads starting in July 2025. Prospects include growing fleets of shared scooters, combining e-scooters with public transportation, and taking advantage of cost-conscious, environmentally conscientious urban travelers. Recent legislative developments in South Australia provide evidence of this increasing regulatory momentum related to electric scooters.

Report Coverage

This research report categorizes the market for the Australia electric scooters market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia electric scooters market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia electric scooters market.

Driving Factors

The electric scooters market in Australia is driven by urbanization, increasing traffic congestion, and rising fuel prices. The increased awareness of the environment and the need for cleaner forms of transportation in cities mean that e-scooters are becoming a popular alternative to traditional scooters and bicycles since they produce no tailpipe emissions. Previous technological advances have increased the viability of e-scooter technology by making batteries and motors more efficient and increasing confidence in the practical use of the scooters by users. Furthermore, the continued growth of shared scooter programs and the growing level of support from private and public entities for creating infrastructure that supports this form of transportation is allowing e-scooters to become more widely adopted by people living in cities and suburban areas.

Restraining Factors

The electric scooters market in Australia is mostly constrained by a lack of infrastructure, such as designated scooter lanes, scooter parking zones, and charging stations. Additionally, the fact that many people have safety concerns about e-scooters, such as the danger posed by people riding without helmets, as well as the possibility of fire from lithium-ion batteries that do not meet safety standards, inhibits many people from adopting the technology.

Market Segmentation

The Australia electric scooters market share is classified into drive type, battery type, and end use.

- The hub motors segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia electric scooters market is segmented by drive type into belt drive, chain drive, and hub motors. Among these, the hub motors segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because the hub-motor category incorporates the motor directly into the wheel, it has a simpler, quieter, low-maintenance design, efficient power supply, and superior appropriateness for flat urban travel. As a result, it dominates the electric scooter industry.

- The lithium ion segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia electric scooters market is segmented by battery type into lead acid, lithium ion, and others. Among these, the lithium ion segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Scooters can travel farther between charges because of lithium ion batteries' significantly higher energy density, which also keeps them lightweight and manageable. Additionally, they have a longer lifespan, require less maintenance, and recharge more quickly, all of which make them perfect for frequent urban use.

- The personal segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia electric scooters market is segmented by end use into personal, and commercial. Among these, the personal segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that personal e-scooters provide inexpensive, low-maintenance, environmentally friendly transportation for short journeys in crowded cities, errands, and commuting.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia electric scooters market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Neuron Mobility

- Vmoto

- Electric Kicks

- iScoot Australia Specialist

- Ride Electric

- Zoomo

- Ensun

- Scooter Hut

- Bolzzen

- ESA (Electric Scooter Australia)

- PedL

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2025, the WA Road Safety Commission proposed minimum safety standards for rental e-scooters in WA following many deaths, as well as increasing worries about user safety and battery fire safety

- In May 2025, the NSW government released an Action Plan allowing e-scooters for people aged 16+ on shared paths and bike lanes with speed limits between 10 and 20 km/h and revised safety and usage regulations

- In October 2024, Victoria implemented a new statewide permanent rule framework for renting e-scooters, including increased fines for offences such as not wearing helmets, riding on footways, transporting passengers, and operating while intoxicated/drugged to promote safety.

- In October 2024, the E-micromobility action plan released by the NSW government will create a pathway to legalise e-scooters for all types of use and establish a framework to establish legal framework for e-scooters.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia electric scooters market based on the below-mentioned segments:

Australia Electric Scooters Market, By Drive Type

- Belt Drive

- Chain Drive

- Hub Motors

Australia Electric Scooters Market, By Battery Type

- Lead Acid

- Lithium Ion

- Others

Australia Electric Scooters Market, By End Use

- Personal

- Commercial

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |