Australia Enterprise Resource Planning Market

Australia Enterprise Resource Planning Market Size, Share, and COVID-19 Impact Analysis, By Deployment Type (SaaS and Cloud, and On-Premise), By Application (BFSI, Manufacturing, Healthcare, Government and Utilities, Retail and Distribution, Aerospace & Defence, Construction, IT and Telecom, and Others), and Australia Enterprise Resource Planning Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Enterprise Resource Planning Market Insights Forecasts to 2035

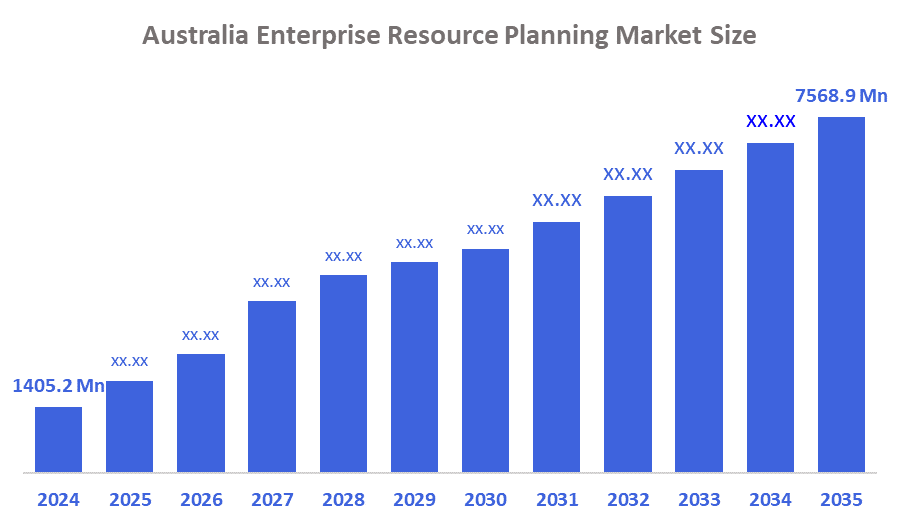

- The Australia Enterprise Resource Planning Market Size Was Estimated at USD 1405.2 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16.54% from 2025 to 2035

- The Australia Enterprise Resource Planning Market Size is Expected to Reach USD 7568.9 Million by 2035

According to a research report published by Decision Advisor & Consulting, the Australia enterprise resource planning market size is anticipated to reach USD 7568.9 million by 2035, growing at a CAGR of 16.54% from 2025 to 2035. The enterprise resource planning market in Australia is driven by rapid digital transformation, cloud adoption by SMEs and major businesses, the need for real-time data analytics, regulatory compliance requirements, and the integration of AI-enabled business process automation across industries.

Market Overview

The Australia enterprise resource planning (ERP) market encompasses the integrated software solutions that help in streamlining and managing core business functions like finance, human resources, supply chain, production, and customer management. ERP systems have gained wide acceptance amongst various sectors like retail, healthcare, manufacturing, government, and BFSI, wherein they play important roles in enhancing operational efficiency, data accuracy, decision making, and compliance with regulations by means of centralized management of real-time information.

With the introduction of the new APS ERP strategy and the signing of a Whole-of-Government SAP ERP contract worth approximately AUD 152 million, the Australian government is enhancing its digital systems, thereby facilitating the use of cloud ERP in the public sector. The BuyICT Software Marketplace now includes ERP products/services, which create opportunities for local suppliers. SME adoption of business software is being encouraged, and ERP is consequently being used more widely due to grants and advisory programs for digital transformation.

Australian ERP vendors are making advancements through the use of AI-enabled automation, predictive analytics, and cloud-native solutions up to the point of business performance enhancement. Real-time reporting, mobile access, and workflow automation to the highest level are being integrated by MYOB and Pronto Software, for instance. AI-driven decision support, tailored ERP solutions for different industries, and a larger cloud footprint among SMEs and enterprise customers are some of the future opportunities.

Report Coverage

This research report categorizes the market for the Australia enterprise resource planning market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia enterprise resource planning market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia enterprise resource planning market.

Driving Factors

The enterprise resource planning market in Australia is driven by the digital transformation trend in the business sector, the growing use of cloud ERP solutions, and the desire for better efficiency and access to data. One of the main factors in the continuous growth of the market is the requirement from both small and big businesses to simplify their finance, supply chain, and human resources processes. Moreover, meeting the regulatory requirements, incorporating AI and analytics, and the worldwide shift towards remote and hybrid working further speed up the ERP implementation process in various sectors.

Restraining Factors

The enterprise resource planning market in Australia is mostly constrained by the high costs of installation and customization, difficult integration with existing systems, concerns over data security and user privacy, a lack of sufficient IT skills in-house within SMEs, and, indeed, the resistance to change from the organization during ERP adoption.

Market Segmentation

The Australia enterprise resource planning market share is classified into deployment type and application.

- The SaaS and cloud segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia enterprise resource planning market is segmented by deployment type into SaaS and cloud, and on-premise. Among these, the SaaS and cloud segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because cloud-based ERP solutions are very appealing to both small and large businesses looking for adaptable and affordable software solutions since they provide flexibility, cheaper upfront costs, remote accessibility, faster implementation, and automated upgrades.

- The manufacturing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia enterprise resource planning market is segmented by application into BFSI, manufacturing, healthcare, government and utilities, retail and distribution, aerospace & defence, construction, IT and telecom, and others. Among these, the manufacturing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because manufacturing operations have a strong demand for process automation, supply chain optimization, inventory management, and real-time production monitoring. This leads to widespread ERP adoption to boost productivity, cut expenses, and support digital transformation projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia enterprise resource planning market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TechnologyOne Ltd

- MYOB

- Accentis Enterprise

- Barawave

- Simpro Group

- Reckon Limited

- Walker Scott

- Agilyx ERP

- Go Transit / Alpen

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, TechnologyOne introduced its entire company AI platform named “PLUS” that merges natural language and predictive analytics throughout its ERP suite to ease operation for both the public and private sector users.

- In August 2025, AusNet and Wipro conducted a SAP S/4HANA Cloud ERP implementation at the biggest energy network of Victoria, thus transforming the old systems by the use of a cloud platform that is expandable with the help of a scalable cloud platform.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Australia enterprise resource planning market based on the below-mentioned segments:

Australia Enterprise Resource Planning Market, By Deployment Type

- SaaS and Cloud

- On-Premise

Australia Enterprise Resource Planning Market, By Application

- BFSI

- Manufacturing

- Healthcare

- Government and Utilities

- Retail and Distribution

- Aerospace & Defence

- Construction

- IT and Telecom

- Others

FAQ’s

Q: What is the Australia enterprise resource planning market size?

A: Australia enterprise resource planning market size is expected to grow from USD 1405.2 million in 2024 to USD 7568.9 million by 2035, growing at a CAGR of 16.54% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the digital transformation trend in the business sector, the growing use of cloud ERP solutions, and the desire for better efficiency and access to data. One of the main factors in the continuous growth of the market is the requirement from both small and big businesses to simplify their finance, supply chain, and human resources processes.

Q: What factors restrain the Australia enterprise resource planning market?

A: Constraints include the high costs of installation and customization, difficult integration with existing systems, concerns over data security and user privacy, a lack of sufficient IT skills in-house within SMEs, and, indeed, the resistance to change from the organization during ERP adoption.

Q: How is the market segmented by application?

A: The market is segmented into BFSI, manufacturing, healthcare, government and utilities, retail and distribution, aerospace & defence, construction, IT and telecom, and others.

Q: Who are the key players in the Australia enterprise resource planning market?

A: Key companies include TechnologyOne Ltd, MYOB, Accentis Enterprise, Barawave, Simpro Group, Reckon Limited, Walker Scott, Agilyx ERP, Go Transit / Alpen, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |