Australia Equine Health Market

Australia Equine Health Market Size, Share, and COVID-19 Impact Analysis, By Product (Drugs, Vaccines, Supplemental Feed Additives), By Disease (West Nile Virus, Equine Rabies, Equine Influenza, Equine Herpes Virus, Potomac Horse Fever, Tetanus, Others), By Distribution Channel (Veterinary Hospitals and Clinics, Retail Pharmacies & Drug Stores, Others), and Australia Equine Health Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Equine Health Market Insights Forecasts to 2035

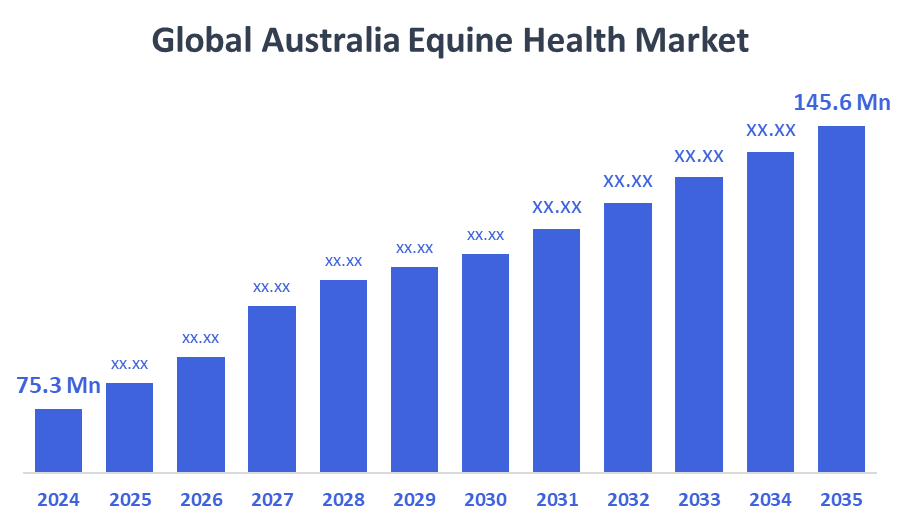

- The Australia Equine Health Market Size Was Estimated at USD 75.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.18% from 2025 to 2035

- The Australia Equine Health Market Size is Expected to Reach USD 145.6 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Australia Equine Health Market Size is anticipated to reach USD 145.6 Million by 2035, growing at a CAGR of 6.18% from 2025 to 2035. The equine health market in Australia is driven by growing knowledge of preventive healthcare, improvements in veterinary diagnoses and treatment, rising investments in equine research, and increased horse ownership for sports, recreation, and racing.

Market Overview

The equine health industry is the segment of the economy that focuses on protecting and enhancing horses' health, performance, and welfare. The equine health market entails all products and services served to horses, including vaccines, pharmaceuticals, nutritional supplements, diagnostic tools, educational tools, and veterinary care. This industry includes preventing, diagnosing, and treating diseases and conditions in horses. The Australian equine health market is growing consistently due to increasing ownership of horses for racing, sport, and leisure purposes, as well as an awareness of preventive healthcare by horse owners. Innovations such as digital diagnostics, tele-veterinary services, and wearable health monitoring devices are improving disease detection and treatment efficacy. Government initiatives aimed at improving animal welfare, biosecurity, and veterinary research (including support from the Department of Agriculture, Fisheries and Forestry (DAFF)) are strengthening the market framework. Moreover, opportunities for growth in the equine health market include increased treatment through advanced therapeutics, nutraceuticals, and regenerative treatment therapies, as well as increasing equine insurance coverage and investment in rural veterinary infrastructure. Various aspects will position Australia as a center for innovation and development in equine health management going forward.

Report Coverage

This research report categorizes the market for the Australia equine health market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia equine health market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia equine health market.

Driving Factors

The equine health market in Australia is driven by a growing horse population and increasing participation in racing, sports, and recreational activities, which fuel demand for veterinary products and services. Rising awareness of preventative health care, such as vaccination, as well as nutrition management, offers significant opportunities for the market to expand. Advances in technologies such as monitoring via telemedicine, digital imaging, and wearables also make diagnostics more efficient for veterinarians. Furthermore, government support for animal welfare and biosecurity, along with expanding coverage for equine insurance and research into nutrition and regenerative medicine, are also driving new opportunities for growth within the equine healthcare market.

Restraining Factors

The equine health market in Australia is mostly constrained by high costs of treatment, a lack of access to veterinarians trained and with experience in equine care, and regulatory approval processes that slow the introduction of products. There is also limited awareness of available solutions in rural areas, and price fluctuations associated with feed and veterinary supplies, which restrict access and the adoption of better equine healthcare solutions.

Market Segmentation

The Australia equine health market share is classified into product, disease, and distribution channel.

- The drugs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia equine health market is segmented by product into drugs, vaccines, and supplemental feed additives. Among these, the drugs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This mainly results from the high incidence of equine conditions and injuries associated with racing, sport, and breeding activities, which produce high demand for anti-inflammatories, antiparasitics, and pain management medications.

- The equine influenza segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia equine health market is segmented by disease into West Nile virus, equine rabies, equine influenza, equine herpes virus, Potomac horse fever, tetanus, and others. Among these, the equine influenza segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because equine influenza is one of the most common and highly contagious respiratory diseases of horses in Australia, which is associated with severe economic losses to racing and breeding. Continuous demand for preventive and therapeutic solutions is due to regular vaccination programs, the biosecurity measures implemented by the government, and the heightened awareness of horse owners.

- The veterinary hospitals and clinics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia equine health market is segmented by distribution channel into veterinary hospitals and clinics, retail pharmacies & drug stores, and others. Among these, the veterinary hospitals and clinics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because most equine treatments, vaccinations, and diagnostic procedures require oversight from a licensed veterinarian and specialized equipment only found in a clinical environment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia equine health market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stable Care Pty Ltd

- Equine Health Science (EHS)

- Hygain Group

- Apiam Animal Health Ltd

- Abbey Labs

- Zamira Australia Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, the Abbey Labs presented its equine line of products manufactured in Australia ("Horse Product Range") on its website, whilst promoting R&D and local registration of veterinary/OTC products. The product line consists of both OTC and veterinarian-only equine therapies, signaling a commitment to its status as a 100 % Australian-owned manufacturer of horse health.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia equine health market based on the below-mentioned segments:

Australia Equine Health Market, By Product

- Drugs

- Vaccines

- Supplemental Feed Additives

Australia Equine Health Market, By Disease

- West Nile Virus

- Equine Rabies

- Equine Influenza

- Equine Herpes Virus

- Potomac Horse Fever

- Tetanus

- Others

Australia Equine Health Market, By Distribution Channel

- Veterinary Hospitals and Clinics

- Retail Pharmacies & Drug Stores

- Others

FAQ’s

Q: What is the Australia equine health market size?

A: Australia equine health market size is expected to grow from USD 75.3 million in 2024 to USD 145.6 million by 2035, growing at a CAGR of 6.18% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by a growing horse population and increasing participation in racing, sports, and recreational activities, which fuel demand for veterinary products and services. Rising awareness of preventative health care, such as vaccination, as well as nutrition management, offers significant opportunities for the market to expand.

Q: What factors restrain the Australia equine health market?

A: Constraints include the high costs of treatment, a lack of access to veterinarians trained and with experience in equine care, and regulatory approval processes that slow the introduction of products.

Q: How is the market segmented by product type?

A: The market is segmented into drugs, vaccines, and supplemental feed additives.

Q: Who are the key players in the Australia equine health market?

A: Key companies include Stable Care Pty Ltd, Equine Health Science (EHS), Hygain Group, Apiam Animal Health Ltd, Abbey Labs, and Zamira Australia Pty Ltd.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |