Australia Fitness App Market

Australia Fitness App Market Size, Share, and COVID-19 Impact Analysis, By Type (Exercise & Weight Loss, Diet & Nutrition, and Activity Tracking), By Devices (Smartphones, Tablets, and Wearable Devices), and Australia Fitness App Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Fitness App Market Insights Forecasts to 2035

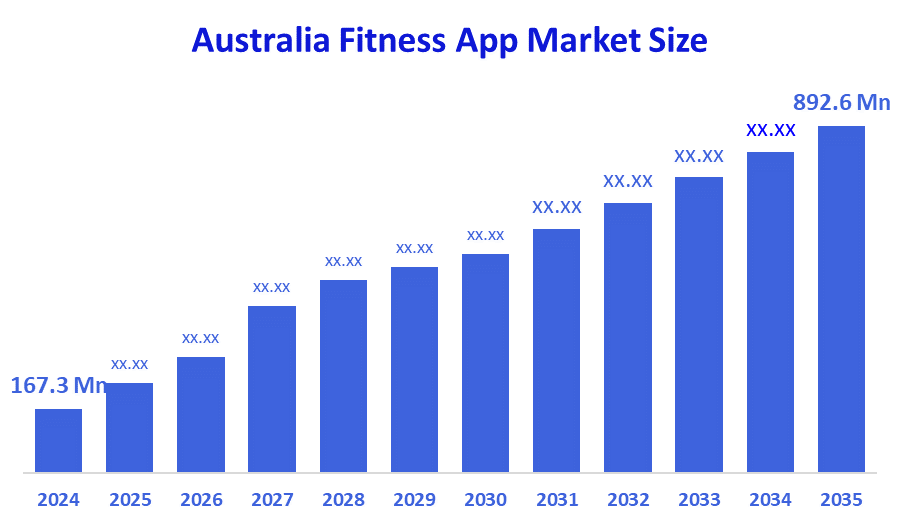

- The Australia Fitness App Market Size Was Estimated at USD 167.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16.44% from 2025 to 2035

- The Australia Fitness App Market Size is Expected to Reach USD 892.6 Million by 2035

According to a research report published by Decision Advisors, The Australia Fitness App Market Size Is Anticipated To Reach USD 892.6 Million By 2035, Growing At A CAGR Of 16.44% From 2025 To 2035. The Fitness App market in Australia is driven by growing health consciousness, wearable and smartphone usage, the need for customized and on-demand fitness solutions, the growth of digital wellness platforms, and government programs encouraging active and healthy lives.

Market Overview

The market for fitness apps in Australia includes mobile applications that assist users in different aspects, such as tracking their physical activity, checking health metrics, scheduling workouts, and controlling their diet. These applications are very popular and mainly used for personal fitness management, weight loss, muscle training, wellness monitoring, and preventive healthcare among individuals and fitness enthusiasts.

The Australian government is pushing digital health toward growth or improvement by means of financial support with several initiatives such as A$503 million for digital health systems transformation and A$301.8 million for the My Health Record modernization, that is, the latter one will improve the integration that will be advantageous for fitness and wellness apps. eHealth incentives and technology research grants from the Medical Research Future Fund (MRFF) are provided to practices, and continuous funding from the MRFF for tech research is provided to practices. Increased industry offerings also include more than A$2 million for digital tools in allied health, which promotes app development and adoption.

Australian fitness technology firms are developing new solutions with AI-based physiotherapy applications, such as Universal Practice's virtual physio platform, which significantly enhances the reduction of pain and local apps such as FitMate and Transform by Fitaz, that together provide personalized training and socializing capabilities. AI personalization, wearables, relaxed connectivity, enjoyable and interactive workouts, and a stronger engagement with virtual coaching in health outcomes are all promising futures.

Report Coverage

This research report categorizes the market for the Australia fitness app market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia fitness app market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia fitness app market.

Driving Factors

The fitness app market in Australia is driven by the growing health & wellness consciousness, the rising usage of smartphones and wearable gadgets, and the increasing acceptance of digital health technologies. The hectic life of people leads to the demand for on-demand/home workouts at a higher level, and it also opens up more opportunities for gym and personal trainer alternatives. The introduction of AI, data analytics, and personalized training features has significantly increased user engagement.

Restraining Factors

The fitness app market in Australia is mostly constrained by strong competition from global apps, low long-term user engagement, and differing levels of digital literacy among users. Moreover, subscription fatigue and insufficient personalization regarding motivation hinder the long-term use of fitness apps in Australia.

Market Segmentation

The Australia fitness app market share is classified into type and devices.

- The exercise & weight loss segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia fitness app market is segmented by type into exercise & weight loss, diet & nutrition, and activity tracking. Among these, the exercise & weight loss segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because consumers place a lot of emphasis on structured training programs, at-home workouts, and weight management. Compared to other segments, these applications generate higher downloads, engagement, and subscription revenues because they provide individualized exercises, video assistance, and progress monitoring.

- The smartphones segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia fitness app market is segmented by devices into smartphones, tablets, and wearable devices. Among these, the smartphones segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because smartphones are the main platform for app downloads, are widely used, and are reasonably priced. They are the most practical and widely used gadgets for using fitness apps because of their seamless internet access, integrated sensors, and wearable compatibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia fitness app market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Transform by Fitaz

- FitMate Australia

- 28 by Sam Wood

- Kic App Pty Ltd

- Sweat

- PixelForce

- Kedra Digi

- DigiGround

- Banao Technologies (AU)

- Trideca

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, the AI-based virtual physiotherapy application developed by Universal Practice was launched, and it provided individualized physiotherapy treatment without requiring admissions to clinics. Besides, it made a significant contribution to the area of digital fitness and recovery.

- In September 2025, the newly renamed Transform by Fitaz (previously FitazFK) app comes with a fresh look and functionality aimed at making it more appealing to a wider audience and additionally, taking it to international markets.

- In July 2025, the Active Locals fitness meet-up application, created by HCF and Palo IT, which uses AI to link up users with common fitness interests, was launched.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia fitness app market based on the below-mentioned segments:

Australia Fitness App Market, By Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

Australia Fitness App Market, By Devices

- Smartphones

- Tablets

- Wearable Devices

FAQ’s

Q: What is the Australia fitness app market size?

A: Australia fitness app market size is expected to grow from USD 167.3 million in 2024 to USD 892.6 million by 2035, growing at a CAGR of 16.44% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by health & wellness awareness, an increase in smartphone and wearable device use, and an increase in the adoption of digital health technologies. Busy lifestyles create a greater demand for on-demand/home workouts, while also increasing opportunities for gym and personal trainer alternatives. The development of artificial intelligence, data analytics, and customised personal training features has resulted in greater user engagement.

Q: What factors restrain the Australia fitness app market?

A: Constraints include strong competition from global apps, low long-term user engagement, and differing levels of digital literacy among users. Moreover, subscription fatigue and insufficient personalization regarding motivation hinder the long-term use of fitness apps in Australia.

Q: How is the market segmented by type?

A: The market is segmented into smartphones, tablets, and wearable devices.

Q: Who are the key players in the Australia fitness app market?

A: Key companies include Transform by Fitaz, FitMate Australia, 28 by Sam Wood, Kic App Pty Ltd, Sweat, PixelForce, Kedra Digi, DigiGround, Banao Technologies (AU), Trideca, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |