Australia Fruit Juice Market

Australia Fruit Juice Market Size, Share, and COVID-19 Impact Analysis, By Product Type (100% Fruit Juice, Nectars, Juice Drinks, Concentrates, Powdered Juice, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, and Others), and Australia Fruit Juice Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Fruit Juice Market Size Insights Forecasts to 2035

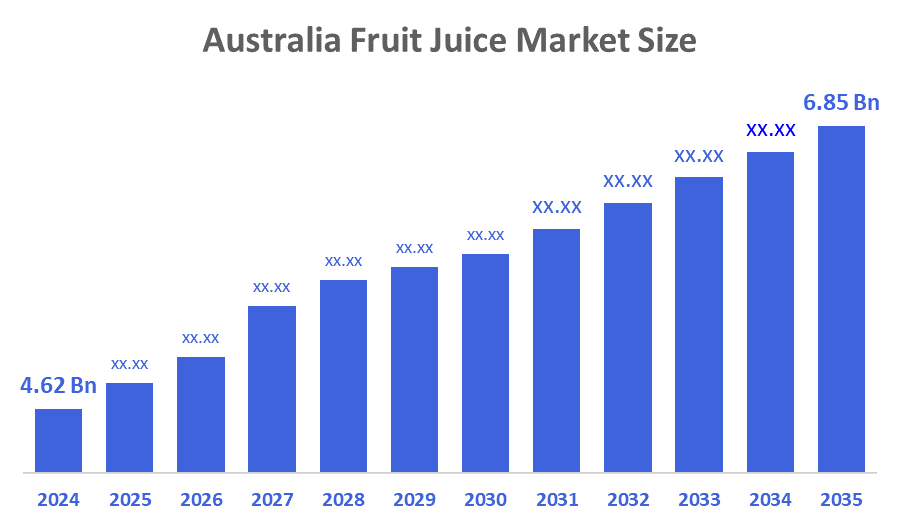

- The Australia Fruit Juice Market Size Was Estimated at USD 4.62 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.65% from 2025 to 2035

- The Australia Fruit Juice Market Size is Expected to Reach USD 6.85 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Fruit Juice Market Size is anticipated to Reach USD 6.85 Billion by 2035, Growing at a CAGR of 3.65% from 2025 to 2035. The fruit juice market in Australia is driven by customer preferences for easy, ready-to-drink fruit-based products, increased urbanization, growing demand for natural and functional beverages, and growing health consciousness.

Market Overview

The Australian fruit juice market consists of the entire range of activities necessary to produce, process, and sell beverages that are made from fresh, concentrated, or blended fruits. These products are most often consumed for refreshment, nutrition, and hydration and are present in households, foodservice outlets, and retail channels. Fruit juices, besides that, are included in smoothies, cocktails, baked goods, and functional drinks, which is a consequence of the growing health consciousness and the demand for natural ingredients.

The Australian government assists the fruit juice market through financial support for agriculture and various trade measures. The total fruits and vegetables production was estimated to be around AUD 6.8 billion in 2023-24. Grants like innovation and export assistance programs offer funding in amounts that range from AUD 250,000 to over AUD 1 million, while container deposit schemes that pay out AUD 0.10 per container are backing up eco-friendly beverage packaging.

Recent developments and innovations in the Australian fruit juice market are highlighted by the merger, which transformed The Original Juice Company, SPC Global, and Nature One Dairy to enhance the domestic juice production capacity and market competitiveness. The premium product releases, such as Bickford's Peach & Strawberry flavor, indicate the producers' emphasis on innovation in the areas of taste and health. The adoption of the high-pressure processing (HPP) technology by Preshafood is a big step forward in having the juices with both a longer shelf life and better quality. New avenues like value-added juices, sustainable processing, and international market penetration of Australian juice brands will be a source of future opportunities.

Report Coverage

This research report categorizes the market for the Australia fruit juice market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia fruit juice market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia fruit juice market.

Driving Factors

The fruit juice market in Australia is driven by the growing awareness of health, along with the trend toward more natural, nutritious drinks. The increase in the popularity of functional juices, fortified juices, and juice drinks, as well as urbanisation and busy lifestyles of urban Australians have caused a surge in the purchasing of fruit juices. The expansion of new retail formats and stores, including supermarkets and convenience stores, new flavour options, premium organic juices, and increased requests for low or no sugar and no added chemicals have all contributed to the continued expansion and success of the Australian Fruit Juice Market.

Restraining Factors

The fruit juice market in Australia is mostly constrained by the high prices for raw fruits, the high production and logistics costs, the consumers being more concerned about the sugar content in the juices, and the increasing preference for fresh whole fruits, besides the strict food safety and labeling regulations.

Market Segmentation

The Australia fruit juice market share is classified into product type and distribution channel.

- The 100% fruit juice segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia fruit juice market is segmented by product type into 100% fruit juice, nectars, juice drinks, concentrates, powdered juice, and others. Among these, the 100% fruit juice segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to customers' growing preference for natural, clean-label, and additive-free beverages, the 100% fruit juice sector dominates the Australian fruit juice market. Compared to nectars, juice drinks, and concentrates, higher consumption is supported by growing health consciousness, the desire for quality and organic juices, and their widespread availability through retail channels.

- The supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia Fruit Juice market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, specialty food stores, online retail, and others. Among these, the supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to their extensive product selection, competitive pricing, robust private-label presence, and easy one-stop shopping, supermarkets and hypermarkets dominate the Australian fruit juice market. Compared to convenience, specialized, and internet retail channels, their broad national reach, regular promotions, and high customer foot traffic generate higher sales volumes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia fruit juice market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Original Juice Company

- SPC Global

- Nippy’s

- Juice & Co.

- Australian Pure Fruits

- Berri Ltd

- Tru Blu Beverages

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2024, the Original Juice Company revealed a merger with SPC Global and Nature One Dairy to create a larger Australian food and beverage company, thereby increasing the scale of juice production and market penetration.

- In August 2024, Bickford's introduced a new premium juice flavor, Peach & Strawberry with vitamins and packaging, which was done for summer sales.

- In June 2024, Citrus Australia guaranteed that there would be a constant supply of fresh Australian juice despite the global concentration shortages, which was a comfort to both producers and consumers.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia fruit juice market based on the below-mentioned segments:

Australia Fruit Juice Market, By Product Type

- 100% Fruit Juice

- Nectars

- Juice Drinks

- Concentrates

- Powdered Juice

- Others

Australia Fruit Juice Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

FAQ’s

Q: What is the Australia fruit juice market size?

A: Australia fruit juice market size is expected to grow from USD 4.62 billion in 2024 to USD 6.85 billion by 2035, growing at a CAGR of 3.65% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by growing awareness of health, along with the trend toward more natural, nutritious drinks. The increase in the popularity of functional juices, fortified juices, and juice drinks, as well as urbanisation and busy lifestyles of urban Australians have caused a surge in the purchasing of fruit juices.

Q: What factors restrain the Australia fruit juice market?

A: Constraints include the high prices for raw fruits, the high production and logistics costs, the consumers being more concerned about the sugar content in the juices, and the increasing preference for fresh whole fruits, besides the strict food safety and labeling regulations.

Q: How is the market segmented by product type?

A: The market is segmented into 100% fruit juice, nectars, juice drinks, concentrates, powdered juice, and others.

Q: Who are the key players in the Australia fruit juice market?

A: Key companies include The Original Juice Company, SPC Global, Nippy’s, Juice & Co., Australian Pure Fruits, Berri Ltd, Tru Blu Beverages, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |