Australia Generative AI In Financial Services Market

Australia Generative AI In Financial Services Market Size, Share, And COVID-19 Impact Analysis, By Type (Machine Learning Solutions, Fraud Detection Agents, Customer Service Agents, Risk Management Agents, And Others), By Deployment (On-Premises, And Cloud), By End Use (Retail Banking, Corporate Banking, Insurance Companies, Investment Firms, FinTech Companies, And Others), By Application (Risk Management, Fraud Detection, Credit Scoring, Forecasting & Reporting, And Customer Service & Chatbots), And Australia Generative AI In Financial Services Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

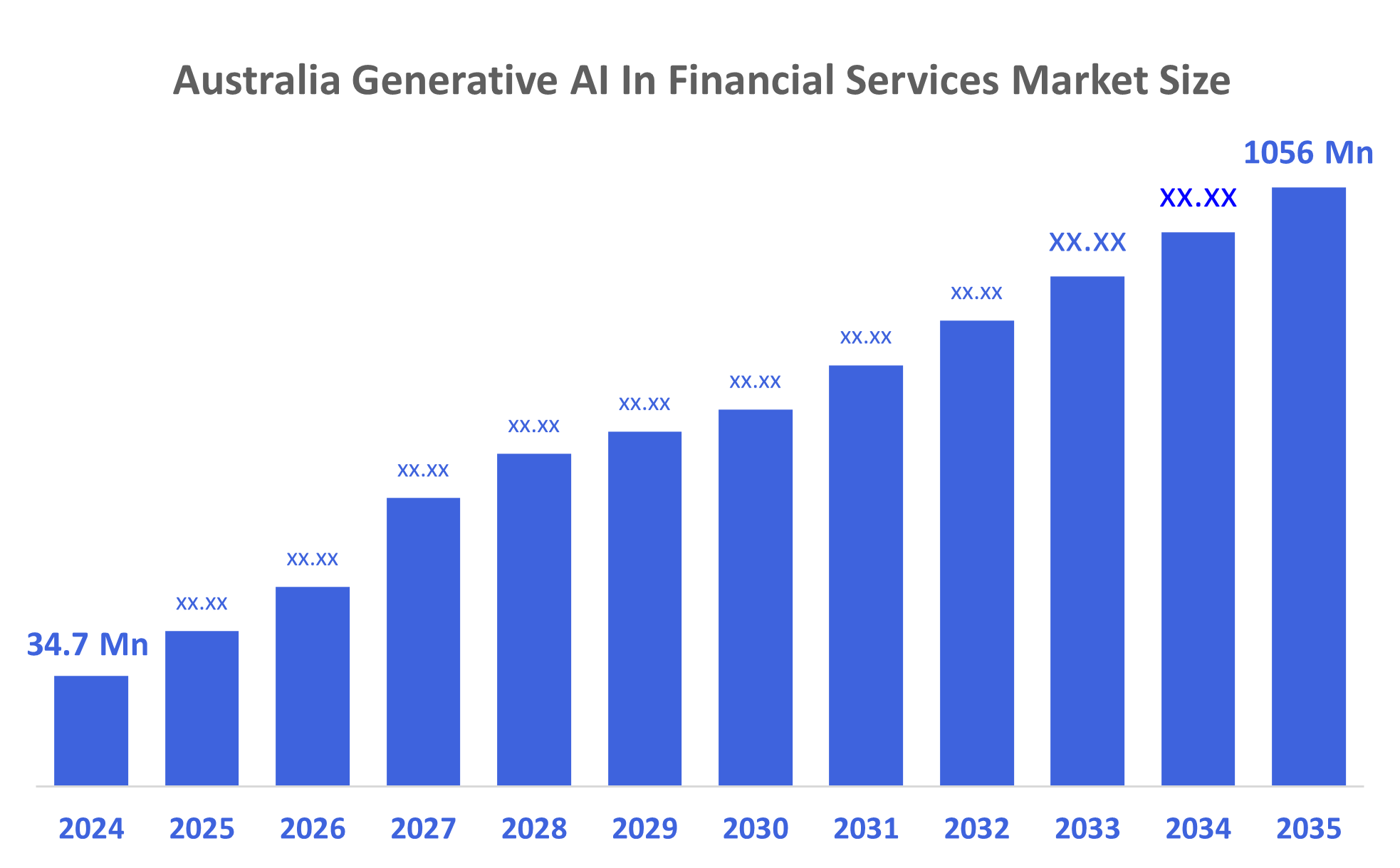

Australia Generative AI In Financial Services Market Size Insights Forecasts to 2035

- Australia Generative AI In Financial Services Market Size Was Estimated at USD 34.7 million in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 36.41% from 2025 to 2035.

- Australia Generative AI In Financial Services Market Size is Expected to Reach USD 1056 million by 2035.

According to a research report published by Decisions Advisors, The Australia Generative AI In Financial Services Market Size is Anticipated to Reach USD 1056 Million by 2035, Growing at a CAGR of 36.41% from 2025 to 2035. The Australia Generative AI In Financial Services Market is driven by an increased demand for automation, need for efficiency and cost reduction, enhanced data analytics capabilities to utilize AI-driven analytics tools, and raise in cyber security concerns ensuring customer data protection and regulatory compliance.

Market Overview

Generative AI is a specific area of AI within financial services that produces new things instead of just predicting or classifying based on previous financial data, as it generates text, insights, simulations and other human-like content from large amounts of financial data. By understanding how to interpret complex Financial Markets and Financial Language, Generative AI can produce outputs from that data. The Australia generative AI in financial services market relates to the business activity, use of technology, and services related to AI that produce content such as text, code or data in the financial services sector of Australia and includes personalised advice, fraud detection, automated reporting, synthetic data generation for risk modelling, and robo-advisors. The Australian generative AI in financial services market is under strict guidelines established by various regulatory authorities, including the Australian Prudential Regulation Authority (APRA), in order to ensure that Generative AI is being used efficiently and effectively to deliver improved customer experiences while remaining compliant with all applicable laws and regulations.

The Australia generative AI in financial services market in is driven by increasing adoption of AI technology by the financial services sector, which is being used by organisations in this industry to provide better operational efficiencies, and customer service experiences and mitigate risk. It includes fraud detection, customer service automation, and risk management. The Department of Industry, Science, and Resources released the Government and Public Sector's AI strategy in Australia in 2023, which puts a strategic approach to the development, implementation, and deployment of AI technologies into industries and organisations, including financial services. By establishing a set of operational guidelines around the ethical use of AI, this strategy will allow for increased transparency and improved consumer trust and regulatory compliance within the financial services sector by ensuring that all AI-driven products and services are developed with consideration for the inherent risks associated with AI technology.

Report Coverage

This research report categorizes the market for the Australia generative AI in financial services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia generative AI in financial services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia generative AI in financial services market.

Driving Factors

The Australia generative AI in financial services market in Australia are driven by a operational efficiency leading to cost reduction, hyper-personalized customer experiences enhancing customer satisfaction and loyalty, advanced risk management, quick detection of fraudulent activities, robust digital infrastructure providing conductive environment for the development and scaling of AI solutions, and regulatory compliance which ensures adherence to evolving regulatory standards and reduces the risk of penalties.

Restraining Factors

High implementation and operational costs, data privacy and security concerns, regulatory uncertainty and compliance challenges, unskilled AI professionals may be challenging for financial firms, Generative AI models can perpetuate biases present in their training data, and integration with legacy systems restrains the Australia generative AI in financial services market in Australia.

Market Segmentation

Australia generative AI in financial services market share is classified into type, deployment, end use, and application.

- The fraud detection agents segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Australia generative AI in financial services market is segmented by type into machine learning solutions, fraud detection agents, customer service agents, risk management agents, and others. Among these, the fraud detection agents segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the escalating sophistication of scams, massive potential financial losses, and increasing consumer demand for AI-powered security, with generative AI agents offering real time, autonomous, and data-driven defence against evolving threats, leading to heavy investment in these technologies.

- The cloud segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Australia generative AI in financial services market is segmented by deployment into on-premises, and cloud. Among these, the cloud deployment segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to its scalability, cost effectiveness, flexibility that meet strict financial regulations, making it ideal for handling vast financial data and complex AI models. Cloud deployment shows scalability, and flexibility and it is cost efficient.

- The retail banking segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Australia generative AI in financial services market is segmented by end use into retail banking, corporate banking, insurance companies, investment firms, FinTech companies, and others. Among these, the retail banking segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by providing 24/7 customer service, enhancing digital customer interactions, operational efficiency by generative AI to automate high and low value tasks common in retail banking which includes loan processing, fraud detection, and personalization.

- The fraud detection segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Australia generative AI in financial services market is segmented by application into risk management, fraud detection, credit scoring, forecasting & reporting, and customer service & chatbots. Among these, the fraud detection segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to immediate detection of unusual patterns and suspicious activities crucial for preventing significant financial losses before they occur, continuous learning and adaptation of generative AI models, and reduces the need for manual intervention and minimizes human error, making the process more efficient and reliable.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Australia generative AI in financial services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Microsoft

- Amazon Web Services (AWS)

- Google LLC

- IBM Corporation

- Deloitte Australia

- OpenAI

- Xero

- Q3 Technologies

- Kodora

- Relevance AI

- Makeintellix AI

- Ernst & Young AI

- KPMG Australia

- PwC Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In December 2025, The Commonwealth Bank of Australia launched a national initiative with OpenAI. The initiative provides AI, cyber security, and digital capability masterclasses for one million small businesses. Earlier in December, CommBank was featured at an AWS event for using “agentic AI” to modernize legacy systems, reducing assessment times.

• In October 2025, Broadridge reported that Australian financial services firms are early adopters of AI and GenAI compared to 31% globally. The focus is on building trust and data quality. Deloitte agreed to a partial refund for an Australian government report in October after admitting AI use in a document that contained errors.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2025 to 2035. Decisions Advisors has segmented the Australia generative AI in financial services market based on the below-mentioned segments:

Australia Generative AI In Financial Services Market, By Type

- Machine Learning Solutions

- Fraud Detection Agents

- Customer Service Agents

- Risk Management Agents

- Others

Australia Generative AI In Financial Services Market, By Deployment

- On Premises

- Cloud

Australia Generative AI In Financial Services Market, By End Use

- Retail Banking

- Corporate Banking

- Insurance Companies

- Investment Firms

- FinTech Companies

- Others

Australia Generative AI In Financial Services Market, By Application

- Risk Management

- Fraud Detection

- Credit Scoring

- Forecasting & Reporting

- Customer Service & Chatbots

FAQ’s

Q. What is the projected market size & growth rate of the Australia generative AI in financial services market?

A. Australia generative AI in financial services market was valued at USD 34.7 million in 2024 and is projected to reach USD 1056 million by 2035, growing at a CAGR of 36.41% from 2025 to 2035.

Q. What are the key driving factors for the growth of the Australia generative AI in financial services market?

A. The Australia generative AI in financial services markets in Australia are driven by a operational efficiency leading to cost reduction, hyper-personalized customer experiences enhancing customer satisfaction and loyalty, advanced risk management, quick detection of fraudulent activities, robust digital infrastructure providing conductive environment for the development and scaling of AI solutions, and regulatory compliance which ensures adherence to evolving regulatory standards and reduces the risk of penalties.

Q. What are the top players operating in the Australia generative AI in financial services market?

A. Amazon Web Services (AWS), Microsoft, Google LLC, IBM Corporation, Deloitte Australia, OpenAI, Xero, Q3 Technologies, Kodora, Relevance AI, Makeintellix AI, Ernst & Young AI, KPMG Australia, PwC Australia, and Others.

Q. What segments are covered in the Australia generative AI in financial services market report?

A. Australia generative AI in financial services market is segmented based on Type, Deployment, End Use, and Application.

Q. What are the restraining factors of Australia generative AI in financial services market report?

A. High implementation and operational costs, data privacy and security concerns, regulatory uncertainty and compliance challenges, unskilled AI professionals may be challenging for financial firms, Generative AI models can perpetuate biases present in their training data, and integration with legacy systems restrains the Australia generative AI in financial services market in Australia

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |