Australia Grain Production Market

Australia Grain Production Market Size, Share, and COVID-19 Impact Analysis, By Grain Type (Wheat, Barley, Canola, Pulses, and Others), By End Use (Food, Feed, and Industrial Use), and Australia Grain Production Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Grain Production Market Size Insights Forecasts to 2035

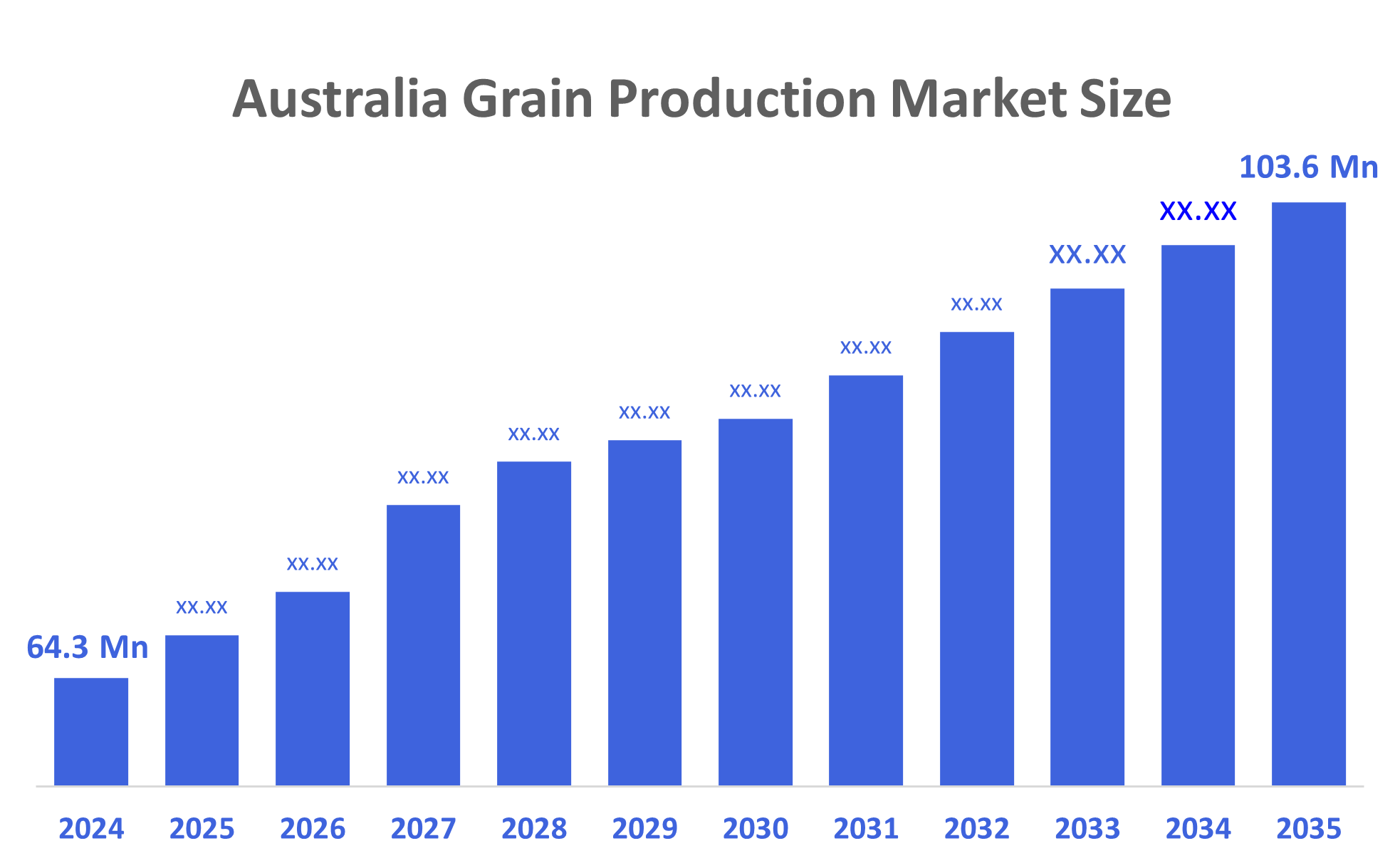

- The Australia Grain Production Market Size Was Estimated at 64.3 million Tons in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.43% from 2025 to 2035

- The Australia Grain Production Market Size is Expected to Reach 103.6 million Tons by 2035

According to a research report published by Decisions Advisors, The Australia Grain Production Market Size is Anticipated to Reach 103.6 Million Tons by 2035, Growing at a CAGR of 4.43% from 2025 to 2035. The grain production market in Australia is driven by favorable climatic conditions, adoption of advanced agricultural technologies, strong global export demand, supportive government policies, innovative farming practices, and improved supply chain efficiency, enhancing productivity and output.

Market Overview

The grain production market is all about the activities related to the growing, gathering, processing, and marketing of cereal and pulse crops like wheat, barley, corn, rice, oats, and sorghum that are produced and used as food, feed for animals, biofuel, and industrial purposes. The market for grain production in Australia is of great importance to the national agricultural economy and comprises the production of different crops such as wheat, barley, oats, pulses, and sorghum.

The Australian authorities support grain production via programs like the Grains Research and Development Corporation, research with an annual investment of over AUD 200 million, the AUD 5 billion Future Drought Fund, risk-wise projects, soil health initiatives, farm management deposits, and favorable biosecurity and export support policies.

The use of technology such as precision agriculture, AI, and drones, as well as digital farm management systems, is making it possible to have high output and to be environmentally friendly at the same time. The future looks bright for the Australian grain market in terms of expanding its exports to Asia and Africa, selling grains of higher quality with added value, and being able to practice low-emission farming that is climate-smart.

Report Coverage

This research report categorizes the market for the Australia grain production market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia grain production market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia grain production market.

Driving Factors

The grain production market in Australia is driven by the favorable climate conditions in the main growing areas, the already established position of the country as a leading exporter, and the strong global demand for wheat and other grains. Therefore, the use of modern agricultural technologies, precision farming, and new varieties of seeds all contribute to the productivity increase. The governments’ policies that are in favor of the sector, funds that are being directed into research and development, the efficiency of the supply chain infrastructure, and the emphasis on sustainable and climate-resilient farming practices are other factors that ensure the market's growth and stability in the long run.

Restraining Factors

The grain production market in Australia is mostly constrained by climate extremes and droughts, global commodity prices that are prone to fluctuation, and high input costs for fertilizers and fuels, as well as labor shortages, water scarcity, and the constantly increasing regulatory and sustainability compliance requirements, all of which affect farm profitability.

Market Segmentation

The Australia grain production market share is classified into grain type and end use.

- The wheat segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia grain production market is segmented by grain type into wheat, barley, canola, pulses, and others. Among these, the wheat segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its large cultivation area, high output quantities, substantial export demand, especially from Asia and the Middle East, and strong local consumption. In addition, wheat enjoys favorable government backing, well-established infrastructure, and stable international prices.

- The food segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia grain production market is segmented by end use into food, feed, and industrial use. Among these, the food segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is caused by the high demand for food-grade grains in foreign markets as well as the high domestic use of grains like wheat and barley for flour, baked goods, and staple foods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia grain production market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GrainCorp Limited

- CBH Group

- Viterra Australia

- Australian Agricultural Company

- SunRice Group

- Elders Limited

- AgriFutures Australia

- InterGrain

- Warakirri Cropping

- Lawson Grains

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Australia had a great time exporting wheat and sent 1.75 Mt in October, which was a 55% increase from last year, and the strong demand was coming from Vietnam, China, Indonesia, and other countries.

- In November 2025, Australia had a great year in grain export with approximately 39.62 Mt of major grain exports (wheat, barley, sorghum, canola) in 2024-25, which is among the highest on record.

- In August 2025, GRDC merged AEGIC functions into Grains Australia to facilitate the flow of innovation and support for the grain sector.

- In July 2025, a breakthrough in oat oil research at the University of South Australia might open new markets for oats.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia grain production market based on the below-mentioned segments:

Australia Grain Production Market, By Grain Type

- Wheat

- Barley

- Canola

- Pulses

- Others

Australia Grain Production Market, By End Use

- Food

- Feed

- Industrial Use

FAQ’s

Q: What is the Australia grain production market size?

A: Australia grain production market size is expected to grow from 64.3 million tons in 2024 to 103.6 million tons by 2035, growing at a CAGR of 4.43% during the forecast period 2025-2035

Q: What are the key growth drivers of the market?

A: Market growth is driven by the favorable climate conditions in the main growing areas, the already established position of the country as a leading exporter, and the strong global demand for wheat and other grains. Therefore, the use of modern agricultural technologies, precision farming, and new varieties of seeds all contribute to the productivity increase. The governments’ policies that are in favor of the sector, funds that are being directed into research and development, the efficiency of the supply chain infrastructure, and the emphasis on sustainable and climate-resilient farming practices are other factors that ensure the market's growth and stability in the long run.

Q: What factors restrain the Australia grain production market?

A: Constraints include the climate extremes and droughts, global commodity prices that are prone to fluctuation, and high input costs for fertilizers and fuels, as well as labor shortages, water scarcity, and the constantly increasing regulatory and sustainability compliance requirements, all of which affect farm profitability.

Q: How is the market segmented by grain type?

A: The market is segmented into wheat, barley, canola, pulses, and others.

Q: Who are the key players in the Australia grain production market?

A: Key companies include GrainCorp Limited, CBH Group, Viterra Australia, Australian Agricultural Company, SunRice Group, Elders Limited, AgriFutures Australia, InterGrain, Warakirri Cropping, Lawson Grains, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |