Australia Helicopter Services Market

Australia Helicopter Services Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Light, Medium, and Heavy), By Application (Offshore, Air Ambulance, Business and Corporate Travel, Disaster and Humanitarian Aid, Transport, Leisure Charter, and Others), and Australia Helicopter Services Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Helicopter Services Market Insights Forecasts to 2035

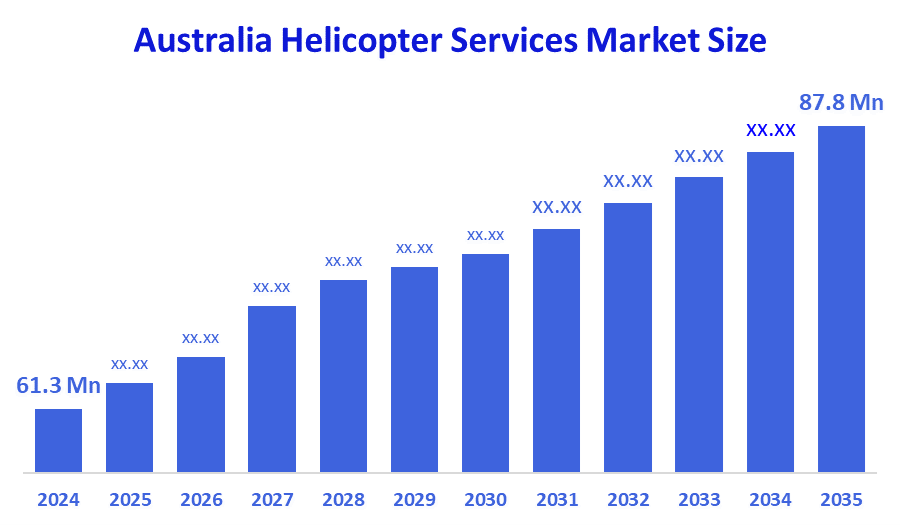

- The Australia Helicopter Services Market Size Was Estimated at USD 61.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.32% from 2025 to 2035

- The Australia Helicopter Services Market Size is Expected to Reach USD 87.8 Million by 2035

According to a research report published by Decision Advisor & Consulting, the Australia helicopter services market size is anticipated to reach USD 87.8 million by 2035, growing at a CAGR of 3.32% from 2025 to 2035. The helicopter services market in Australia is driven by rising demand for rapid medical evacuation, disaster response, and firefighting operations, alongside advancing helicopter technology and expanding tourism applications across Australia.

Market Overview

The Helicopter Services Market is the sector that provides helicopter-based transportation, along with operational solutions applicable across a wide range of markets. The helicopter services market comprises helicopter operators, maintenance companies, leasing companies, and technology companies that operate within the helicopter services market to provide safe, efficient, and flexible airborne mobility solutions for commercial, government, and military applications. The market for helicopter services in Australia is growing, driven by increasing necessities for fast medical evacuation, disaster relief, offshore logistics, aerial firefighting, and tourism purposes. Government programs aimed at boosting operational capacity across remote and high-risk areas have endured all occasions, including subsidies to the Royal Flying Doctor Service, national aerial firefighting programs, and other regional passenger aviation subsidies. Fleet renewal in helicopters (utilizing light twin helicopters) and initial steps towards eVTOL certification continue to enhance operational efficiency and safety. A stronger pathway of developing opportunities remains for aeromedical collaborative efforts, heavy lift firefighting capacity, mining, and tourism in an experience-based and high-need area, adding helicopter operators as an important pillar of Australia’s emergency response and civil aviation systems.

Report Coverage

This research report categorizes the market for the Australia helicopter services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia helicopter services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia helicopter services market.

Driving Factors

The helicopter services market in Australia is driven by the increased demand for quick medical evacuation and emergency response in remote areas, a rising reliance on aerial firefighting because of growing bushfire seasons, and high requirements for offshore logistics in the oil, gas, and mining industries. Tourism activities that continue to grow, such as scenic flights and luxury tourism, are also factors of growth for the market. Additionally, improvements in helicopter technology and mission-ready fleets will also create efficiencies for service delivery across the country.

Restraining Factors

The helicopter services market in Australia is mostly constrained by elevated operational and maintenance expenses, stringent aviation safety regulations, and weather conditions that cause flight cancellations. Limited access to skilled pilots and rising fuel costs restrict the fleet growth and increase service expenses in isolated areas.

Market Segmentation

The Australia helicopter services market share is classified into product type and application.

- The light segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia helicopter services market is segmented by product type into light, medium, and heavy. Among these, the light segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its lower operating costs, excellent fit for medical evacuation, tourism, and regional transport, as well as its flexibility and frequent deployment throughout Australia's rural and metropolitan areas, the light helicopter market is dominated.

- The air ambulance segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia helicopter services market is segmented by application into offshore, air ambulance, business and corporate travel, disaster and humanitarian aid, transport, leisure charter, and others. Among these, the air ambulance segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to Australia's large remote areas and heavy reliance on quick medical evacuation services, as well as substantial government investment and fleet expansion to support emergency and rural healthcare access, the air ambulance market is dominated.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia helicopter services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LifeFlight Australia

- Heliwest Group

- Babcock Mission Critical Services Australasia

- Elite Helicopters

- Valhalla Helicopters Pty Ltd

- Integrated Helicopter Services

- Frontier Helicopters

- McDermott Aviation/Heli?Lift Australia

- Professional Helicopter Services (PHS)

- HeliSpirit

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2024, Airbus Helicopters provided PHI Aviation with two H175 helicopters for the offshore, search & rescue, and med-evac missions in Australia.

- In June 2024, the Australian Helicopter Industry Association (AHIA) launched its redesigned website and also announced apprenticeship scholarships to support workforce development in the sector.

- In May 2023, Bell Textron delivered seven Bell 407GXi helicopters to Australia in the 12 months to May 2023, signalling strong demand for light-helicopters.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035.Decision Advisor has segmented the Australia helicopter services market based on the below-mentioned segments:

Australia Helicopter Services Market, By Product Type

- Light

- Medium

- Heavy

Australia Helicopter Services Market, By Application

- Offshore

- Air Ambulance

- Business and Corporate Travel

- Disaster and Humanitarian Aid

- Transport

- Leisure Charter

- Others

FAQ’s

Q: What is the Australia helicopter services market size?

A: Australia helicopter services market size is expected to grow from USD 61.3 million in 2024 to USD 87.8 million by 2035, growing at a CAGR of 3.32% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increased demand for quick medical evacuation and emergency response in remote areas, a rising reliance on aerial firefighting because of growing bushfire seasons, and high requirements for offshore logistics in the oil, gas, and mining industries. Tourism activities that continue to grow, such as scenic flights and luxury tourism, are also factors of growth for the market.

Q: What factors restrain the Australia helicopter services market?

A: Constraints include the elevated operational and maintenance expenses, stringent aviation safety regulations, and weather conditions that cause flight cancellations.

Q: How is the market segmented by product type?

A: The market is segmented into light, medium, and heavy.

Q: Who are the key players in the Australia helicopter services market?

A: Key companies include LifeFlight Australia, Heliwest Group, Babcock Mission Critical Services Australasia, Elite Helicopters, Valhalla Helicopters Pty Ltd, Integrated Helicopter Services, Frontier Helicopters, McDermott Aviation/Heli?Lift Australia, Professional Helicopter Services (PHS), and HeliSpirit.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 184 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |