Australia Home Decor Market

Australia Home Decor Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, and Others), By Distribution Channel (Home Decor Stores, Supermarkets and Hypermarkets, Online Stores, Gift Shops, and Others), and Australia Home Decor Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Home Decor Market Insights Forecasts to 2035

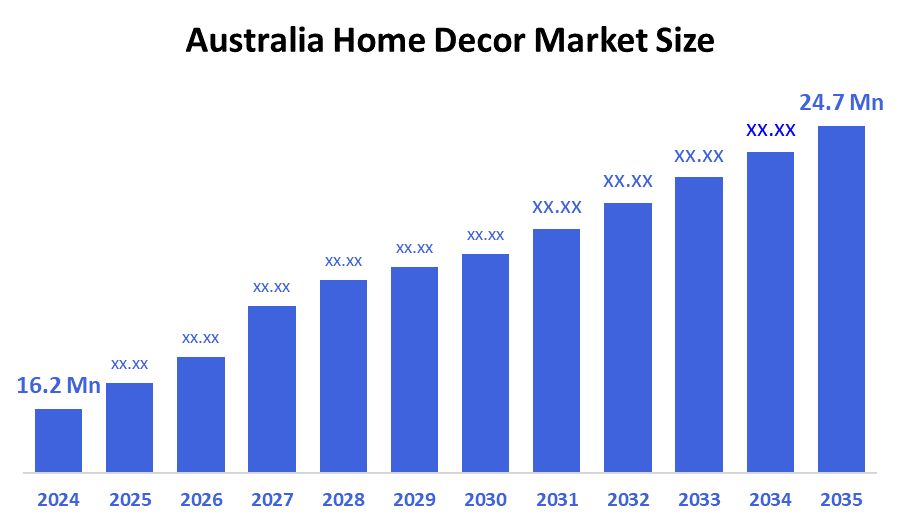

- The Australia Home Decor Market Size Was Estimated at USD 16.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.91% from 2025 to 2035

- The Australia Home Decor Market Size is Expected to Reach USD 24.7 Million by 2035

According to a research report published by Decision Advisors & Consulting, The Australia home decor market size is anticipated to reach USD 24.7 million by 2035, growing at a CAGR of 3.91% from 2025 to 2035. The home decor market in Australia is driven by rising consumer interest in customized living spaces, urbanization, increasing disposable incomes, and the influence of interior design trends promoted by digital and social media platforms.

Market Overview

Home decor includes a range of products and styles intended to enhance, function, and simplify living environments. Examples of home decor products and style extend to various genres of wall art, flooring, furniture, textiles, lighting, and hard and soft accessory designs. The willingness of customers to spend more money on spaces in their home to socialize, work remotely, or lounge is creating an even greater demand for stylish, versatile, sustainable decor. The changing preferences of consumer lifestyles, increasing populations in urban centers, and advancing technology, where, now with only the click of a button, you can access and design home decor products and styles, mean greater demand for ideal homes. Consumers of all levels will continue to demand improvement of their living spaces with well-designed home decor products that are functional, meaningful, and aesthetic. The Australian home decor market captures the modern design, diverse cultures, and relaxed living. The Australian home decor brand in the Australian market is fresh with coastal, urban, and outback styles with quality, sustainability, and seamless indoor and outdoor living at the forefront of design. The Australian home decor market is a great home decor landscape, including a range of opportunities from sustainable materials, technology improvements, e-commerce platforms, modular designs, and locally credentialed design fabricators. Increasing urbanization and renovations require eco-friendly, tech-enabled, and space-saving home solutions.

Report Coverage

This research report categorizes the market for the Australia home decor market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia home decor market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia home decor market.

Driving Factors

The home decor market in Australia is driven by urbanization, disposable income growth, and a shift towards attractive and functional living environments. Furthermore, the increased construction of residential homes and apartment living will support demand for new solutions in decor. There has been increased consumer demand for sustainable and eco-friendly materials, reflecting a national transition towards environmental responsibility. The rapid growth of e-commerce platforms also enhances access and the variety of product offerings, and encourages online purchasing. Moreover, lifestyle changes, early working trends, and the heightened interest in home renovation projects have increased interest in beautifying homes. Essentially, all of these factors will ensure Australia's home decor market continues to expand and innovate in the coming years.

Restraining Factors

The home decor market in Australia is mostly constrained by the increasing costs of raw materials, transportation, and skilled hires are enhancing the cost of goods sold and impacting product pricing and affordability. Disruptions across the supply chain and over-reliance on special addressable import sources, particularly for elite furnishings, often add to the delay and considerably reduce product availability. The intensity of competition presented by local and international brands compromises cost structure, the product pricing, and potentially reduces consumer discretionary spend on temporary utility décor products as a result of economic variability, such as interest rate increases and inflation, impacting extra spending behaviors.

Market Segmentation

The Australia home decor market share is classified into product type and distribution channel.

- The home furniture segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia home decor market is segmented by product type into home furniture, home textiles, flooring, wall decor, lighting, and others. Among these, the home furniture segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to trends in refurbishment, urbanization, and robust housing expansion, the home furniture segment is leading. Customers are looking for designs that are fashionable, practical, and sustainable; demand is also being driven by growing incomes and the growth of e-commerce.

- The home decor stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia home decor market is segmented by distribution channel into home decor stores, supermarkets and hypermarkets, online stores, gift shops, and others. Among these, the home decor stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their extensive product selection, customized shopping experiences, and reliable brands like IKEA and Adairs, home decor stores are the industry leaders. By combining online accessibility with physical storefronts, omnichannel tactics improve convenience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia home decor market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adairs Limited

- Temple & Webster Group

- Harris Scarfe

- Freedom Furniture

- Lincraft Australia Pty Ltd

- Myer Holdings Limited

- Fantastic Furniture

- Amart Furniture Pty Ltd

- Harvey Norman Holdings Limited

- Kmart Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2025, Kmart Australia announced its new ‘Living Range’, designed to meet increasing consumer demand for affordable and stylish furniture and decor pieces in angular structures and earth tone colors (stone, olive, sand), made from sustainable fabrics and materials, providing versatility for compact living and urban environments. Kmart’s new collection saw strong online consumer engagement, with several items selling out following the initial launch date. Overall, the collection speaks volumes for Kmart's growing presence in the affordable home decor space in Australia

- In June 2024, Adairs Limited launched an environmentally friendly bedding and home decor range using sustainable materials like organic cotton and recycled fabrics to align with the sustainability movement in Australia. The new range, which was launched under the "Adairs Earth" name, highlights durability, natural textures, and low-impact dyes. This will further support Adairs' environmental strategy and respond to an increasing number of consumers moving towards ethical, swag-friendly home decor solutions

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia home decor market based on the below-mentioned segments:

Australia Home Decor Market, By Product Type

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

Australia Home Decor Market, By Distribution Channel

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Stores

- Gift Shops

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |