Australia Home Fragrance Market

Australia Home Fragrance Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Scented Candles, Sprays, Essential Oils, Incense Sticks, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online, and Others), and Australia Home Fragrance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Home Fragrance Market Size Insights Forecasts to 2035

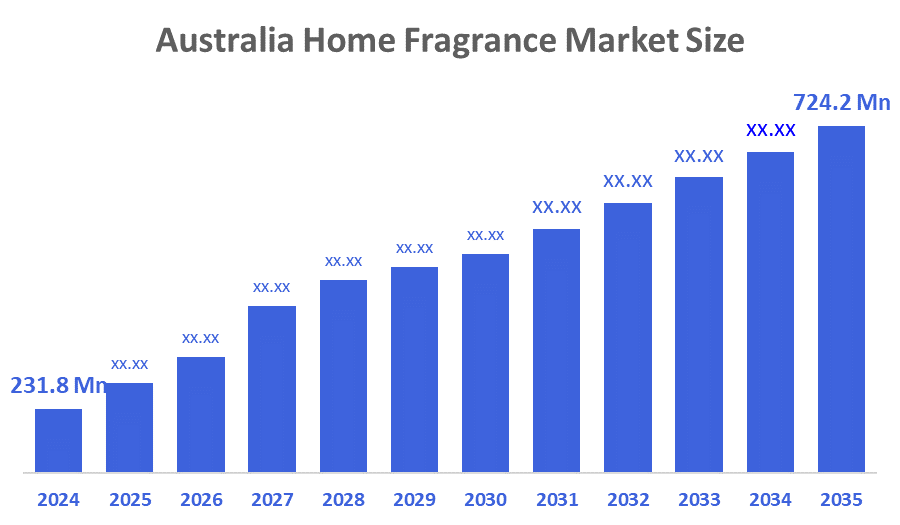

- The Australia Home Fragrance Market Size Was Estimated at USD 231.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.91% from 2025 to 2035

- The Australia Home Fragrance Market Size is Expected to Reach USD 724.2 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Australia Home Fragrance Market Size is anticipated to Reach USD 724.2 Million by 2035, Growing at a CAGR of 10.91% from 2025 to 2035. The home fragrance market in Australia is driven by rising demand for luxury and premium products, growing consumer focus on wellness and self-care, and increasing preference for eco-friendly and ethically produced fragrances.

Market Overview

The home fragrance market is the industry responsible for making and selling products to improve the scent of a home, which may include candles, scented oils and sprays, incense, aromatherapy products, and anything else used to create an inviting atmosphere or to help relax, improve mood, or eliminate/unpleasant fragrance such as smoke or food odors. The growth of this sector in Australia is being driven by growing demand from consumers for 'affordable luxuries', the rise of the wellness/self-care culture, and an increase in the number of consumers who prefer to buy products made from ethically and sustainably sourced raw materials. Many government initiatives that support small businesses and the use of grants for developing sustainable products also help to stimulate growth in the Home Fragrance market. Emerging technologies such as smartphone app-based diffusers, clean-label products, and recyclable packaging have also revolutionised the home fragrance industry. The Home Fragrance market is offering opportunities to companies creating high-end gift ranges, subscription-based models of fragrance, using sustainably sourced and produced ingredients, and creating export opportunities within the Asia-Pacific Economic Cooperation markets (APEC). Recent highlights in this category are an increase in the amount of retailer space allotted to luxury home fragrance brands, new smart diffuser technology being offered for consumers, and continued support from the Australian Government for small and locally manufactured consumer products.

Report Coverage

This research report categorizes the market for the Australia home fragrance market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia home fragrance market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia home fragrance market.

Driving Factors

The home fragrance market in Australia is driven by the growing popularity of health and self-care practices that incorporate aromatherapy and mood-enhancing ambient smells, along with consumers' growing preference for luxury and high-end scented items. Demand is still rising because of consumers' growing preference for non-toxic, ethically sourced, and environmentally friendly formulations. Additionally, the growth of online and omnichannel retail networks has made products more accessible and convenient to buy, and influencer-driven lifestyle trends and social media visibility have a big impact on market-wide brand awareness, seasonal gift culture, and repeat purchase behavior. Innovation within the category, including the development of smart diffusers and personalized and individual scent experiences, has also stimulated further adoption of home fragrance products.

Restraining Factors

The home fragrance market in Australia is mostly constrained by relatively high costs of natural and premium ingredients, an increase in competition from low-cost imports, growing concern over the use of synthetic fragrances in allergens, and volatile pricing of raw materials that make consistent product costs and brand differentiation challenging.

Market Segmentation

The Australia home fragrance market share is classified into product type and distribution channel.

- The scented candles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia home fragrance market is segmented by product type into scented candles, sprays, essential oils, incense sticks, and others. Among these, the scented candles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This leadership is fueled by a significant customer desire for candles as both a home ambiance enhancer and a decor piece, making them ideal for gifting and seasonal purchases. Scented candles are perceived as luxury, experiential products that complement wellness and self-care routines, which aligns with major lifestyle trends in Australia.

- The specialty stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia home fragrance market is segmented by distribution channel into supermarkets and hypermarkets, specialty stores, convenience stores, online, and others. Among these, the specialty stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Customers' strong need for high-end, carefully chosen fragrance experiences, which specialized stores offer through knowledgeable advice, wide smell selections, and branded in-store displays, is credited with this leadership. These stores enable increased spending per purchase by providing high-end candles, diffusers, and wellness-focused fragrances that aren't often offered in mass retail channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia home fragrance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Glasshouse Fragrances

- Home Fragrance Co.

- Ivy & Wood

- ECOYA Australia

- Palm Beach Collection

- Cloud Nine Fragrances

- Meeraboo

- Urban Rituelle

- A?sop

- Goldfield & Banks

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, A trending article in Homes to Love rounded up the best luxury candles, diffusers, and room sprays Australia offers in 2025, showcasing that the home fragrance category has premiumised in Australia.

- In February 2025, Leading candle manufacturers expand eco-friendly lines with more soy and beeswax options.

- In June 2023, Dusk Group reported strong growth with a key pillar on omnichannel expansion (physical + online), developing their own designed premium diffusers, candles, and essential oils.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Australia home fragrance market based on the below-mentioned segments:

Australia Home Fragrance Market, By Product Type

- Scented Candles

- Sprays

- Essential Oils

- Incense Sticks

- Others

Australia Home Fragrance Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

FAQ’s

Q: What is the Australia home fragrance market size?

A: Australia home fragrance market size is expected to grow from USD 231.8 million in 2024 to USD 724.2 million by 2035, growing at a CAGR of 10.91% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the growing popularity of health and self-care practices that incorporate aromatherapy and mood-enhancing ambient smells, along with consumers' growing preference for luxury and high-end scented items. Demand is still rising because of consumers' growing preference for non-toxic, ethically sourced, and environmentally friendly formulations. Additionally, the growth of online and omnichannel retail networks has made products more accessible and convenient to buy, and influencer-driven lifestyle trends and social media visibility have a big impact on market-wide brand awareness, seasonal gift culture, and repeat purchase behavior.

Q: What factors restrain the Australia home fragrance market?

A: Constraints include the relatively high costs of natural and premium ingredients, an increase in competition from low-cost imports, growing concern over the use of synthetic fragrances in allergens, and volatile pricing of raw materials that make consistent product costs and brand differentiation challenging.

Q: How is the market segmented by product type?

A: The market is segmented into scented candles, sprays, essential oils, incense sticks, and others.

Q: Who are the key players in the Australia home fragrance market?

A: Key companies include Glasshouse Fragrances, Home Fragrance Co., Ivy & Wood, ECOYA Australia, Palm Beach Collection, Cloud Nine Fragrances, Meeraboo, Urban Rituelle, A?sop, and Goldfield & Banks.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 158 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |