Australia Household Kitchen Appliances Market

Australia Household Kitchen Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Refrigerator, Cooking Appliances, and Dishwasher Range Hood), By Technology (Conventional, and Smart Appliances), and Australia Household Kitchen Appliances Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Australia Household Kitchen Appliances Market Insights Forecasts to 2035

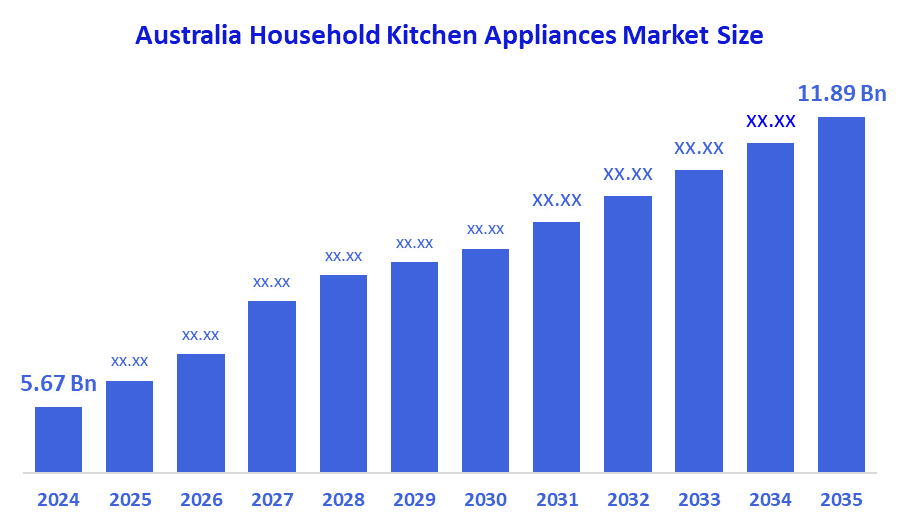

- The Australia Household Kitchen Appliances Market Size Was Estimated at USD 5.67 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.96% from 2025 to 2035

- The Australia Household Kitchen Appliances Market Size is Expected to Reach USD 11.89 Billion by 2035

According to a research report published by Decision Advisors, The Australia Household Kitchen Appliances Market Size Is Anticipated To Reach USD 11.89 Billion By 2035, Growing At A CAGR Of 6.96% From 2025 To 2035. The household kitchen appliances market in Australia is driven by rising disposable incomes, urbanization, the growing usage of smart and energy-efficient appliances, shifting lifestyles, the need for convenience cooking, and an increase in residential building and remodeling projects.

Market Overview

In the Australia household kitchen appliances market, various electrical and gas-operated devices, intended for the preparation, cooking, storage, and cleaning of food, are included for residential kitchens. The main purpose is to make life easier, to use less energy, and to maintain higher cleanliness levels in the kitchen and so on, with the demand for such appliances growing due to urban lifestyles, smart home implementation, and the rapidly advancing technology in sustainable kitchen solutions.

The GEMS/E3 Program is the Australian government’s way of encouraging and promoting energy-efficient home appliances, which is why it is setting the minimum efficiency standards higher and thereby cutting down the energy usage and emissions. One of the state rebates that stimulates appliance purchases is the Queensland appliance rebate ($300–$1000) that is offered for buying efficient refrigerators, dishwashers, and cooktops. The Energy Bill Buster program (A$128 million) facilitates the transition to energy-efficient appliances, thus reducing the yearly energy expenses by about A$600.

Brands and retailers of kitchen appliances in Australia are moving on with their smart, connected, and energy-efficient products, which include IoT-enabled ovens and induction cooktops with app control, and enhanced inverter fridge compressors for reduced power consumption. The local innovation is all about sustainability and usability. On the horizon are the AI-driven cooking assistants, smart home integration, and eco-friendly materials and recycling programs as future opportunities.

Report Coverage

This research report categorizes the market for the Australia household kitchen appliances market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia household kitchen appliances market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia household kitchen appliances market.

Driving Factors

The household kitchen appliances market in Australia is driven by the consumers' higher purchasing power, urban expansion, and the growing preference for convenience and solutions that save time. One of the main driving forces behind this trend is the increasing acceptance of technologically advanced, eco-friendly, and smart appliances. In addition, the growth of the market is being supported by the increase in the number of residential buildings, home improvement projects, and the increasing preference for modular kitchens. Furthermore, the establishment of new e-commerce platforms and the provision of promotional offers have both aided in making the products more accessible; thus, the market growth is sustained in both urban and suburban households.

Restraining Factors

The household kitchen appliances market in Australia is mostly constrained by the high costs of products and installation, the price sensitivity of consumers, the rising energy prices, supply chain issues, and the aggressive competition from low-cost imported products that are cutting into profit margins and lowering adoption rates.

Market Segmentation

The Australia household kitchen appliances market share is classified into product and technology.

- The refrigerator segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia household kitchen appliances market is segmented by product into refrigerator, cooking appliances, and dishwasher range hood. Among these, the refrigerator segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its vital nature, high replacement demand, growing preference for energy-efficient and smart models, and ongoing improvements motivated by shifting household needs, the refrigerator category leads the Australian market for household kitchen appliances.

- The conventional segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia household kitchen appliances market is segmented by technology into conventional, and smart appliances. Among these, the conventional segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to their affordability, widespread availability, convenience of use, and strong demand among price-conscious consumers, particularly in mid-income and rural families, the conventional appliances category dominates the Australian domestic kitchen appliances market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia household kitchen appliances market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Breville Group

- Mistral Appliances

- Kleenmaid

- Dreamfarm

- Hills Limited

- Electrolux Home Products

- Arisit Pty. Limited

- Betta Home Living

- Harris Scarfe

- Anko (Kmart private label)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, the Eye Q Auto Toaster, a product of Breville, was introduced, and it utilized color-sensing technology, which made it a smart small kitchen appliance.

- In April 2025, the 15-Place QuadWash dishwasher by LG Electronics Australia was launched with a promise of ultra-quiet operation (40 dBA) and new advanced washing zones.

- In May 2025, LG made a partnership deal with MasterChef Australia to demonstrate in-house the novel kitchen appliances such as the InstaView Full Steam Oven and smart refrigerators, hence increasing customer engagement.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia household kitchen appliances market based on the below-mentioned segments:

Australia Household Kitchen Appliances Market, By Product

- Refrigerator

- Cooking Appliances

- Dishwasher Range Hood

Australia Household Kitchen Appliances Market, By Technology

- Conventional

- Smart Appliances

FAQ’s

Q: What is the Australia household kitchen appliances market size?

A: Australia household kitchen appliances market size is expected to grow from USD 5.67 billion in 2024 to USD 11.89 billion by 2035, growing at a CAGR of 6.96% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by consumers' higher purchasing power, urban expansion, and the growing preference for convenience and solutions that save time. One of the main driving forces behind this trend is the increasing acceptance of technologically advanced, eco-friendly, and smart appliances.

Q: What factors restrain the Australia household kitchen appliances market?

A: Constraints include the high costs of products and installation, the price sensitivity of consumers, the rising energy prices, supply chain issues, and the aggressive competition from low-cost imported products that are cutting into profit margins and lowering adoption rates.

Q: How is the market segmented by product?

A: The market is segmented into refrigerator, cooking appliances, and dishwasher range hood.

Q: Who are the key players in the Australia household kitchen appliances market?

A: Key companies include Breville Group, Mistral Appliances, Kleenmaid, Dreamfarm, Hills Limited, Electrolux Home Products, Arisit Pty. Limited, Betta Home Living, Harris Scarfe, Anko (Kmart private label), and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |