Australia Hydrogen Energy Storage Market

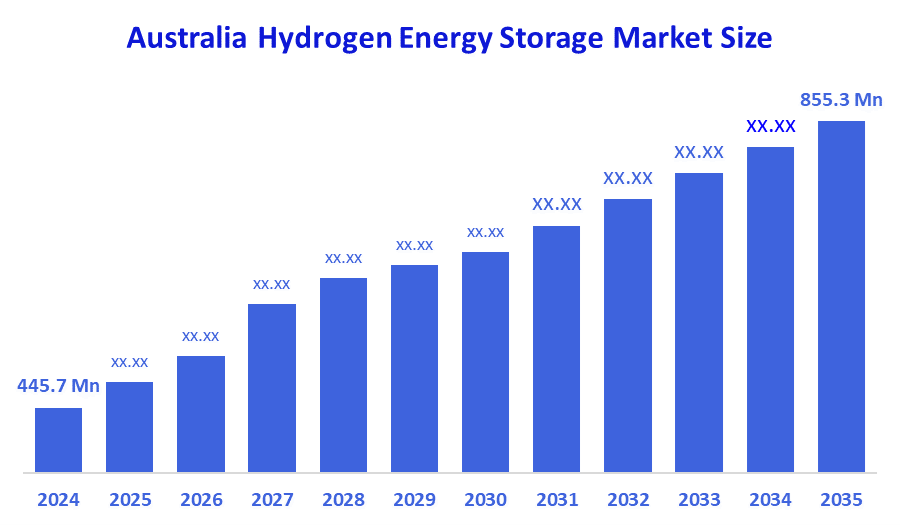

Australia Hydrogen Energy Storage Market size is Expected to Grow from USD 445.7 Million in 2024 to USD 855.3 Million by 2035, rowing at a CAGR of 6.1% during the forecast period 2025-2035.

Report Overview

Table of Contents

Australia Hydrogen Energy Storage Market Insights Forecasts to 2035

- The Australia Hydrogen Energy Storage Market Size Was Estimated at USD 445.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Australia Hydrogen Energy Storage Market Size is Expected to Reach USD 855.3 Million by 2035

According to a research report published by Decision Advisors & Consulting, the Australia hydrogen energy storage market size is anticipated to reach USD 855.3 million by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The hydrogen energy storage market in Australia is driven by rising renewable energy investments, government decarbonization initiatives, hydrogen export potential, growing clean energy demand, and the expansion of hydrogen hubs supporting storage in remote and off-grid regions.

Market Overview

The hydrogen energy storage market is the industry that produces, stores, and uses hydrogen as an energy carrier to manage excess renewable power, improve grid stability, and support sustainable energy applications in the industrial, commercial, and transportation sectors. Renewable energy sources are growing rapidly in Australia, which has enabled them to develop a strong hydrogen energy storage market. Major factors driving the growth of this sector are increased funding for large-scale solar and wind projects, increasing needs for clean energy, and increasing interest from industry in using low-carbon fuels. Furthermore, the Australian Renewable Energy Agency (ARENA) and the Clean Energy Finance Corporation (CEFC) are providing finance for renewable hydrogen projects on a pilot and commercial scale. For example, the government is enacting a Hydrogen Production Tax Incentive. The incentive will pay $2 per kilogram of certified renewable hydrogen produced over ten years, from July 1, 2027, to June 30, 2040. Innovations in electrolysis and the compression, liquefaction, and transportation of hydrogen have enabled great advances in the efficiency of these systems while also reducing the costs associated with producing hydrogen. Export markets and long-duration storage are potential opportunities for the Australian hydrogen sector, and many players are currently looking to develop new hydrogen hubs, increase production of electrolyser systems, and take advantage of the new Federal funding available for hydrogen projects.

Report Coverage

This research report categorizes the market for the Australia hydrogen energy storage market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia hydrogen energy storage market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia hydrogen energy storage market.

Driving Factors

The hydrogen energy storage market in Australia is driven by excess electricity available for conversion into hydrogen. Accelerating growth within this industry is further enhanced by various government initiatives, including funding opportunities, decarbonisation policies, and updated national Hydrogen Strategy initiatives. Increasing demand for low-emission fuels (a product of Hydrogen) from the mining, transport, and chemical sectors is creating further opportunities for hydrogen uptake. Technological progress in both electrolysers and storage solutions continues to drive down prices, combined with the expected strong markets for exporting hydrogen throughout Asia, augmenting long-term investment into hydrogen storage infrastructure.

Restraining Factors

The hydrogen energy storage market in Australia is mostly constrained by high levels of capital required for producing and installing infrastructure, limited commercial-level hydrogen energy storage deployments across large geographical areas, the uncertainty of long-term demand for hydrogen energy storage solutions, and an ever-evolving regulatory environment governing the hydrogen sector.

Market Segmentation

The Australia hydrogen energy storage market share is classified into storage form and application.

- The gas segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia hydrogen energy storage market is segmented by storage form into solid, liquid, and gas. Among these, the gas segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The gas storage category leads the market because compressed hydrogen is the most affordable, technically mature, and frequently used storage technology. It allows for better integration with electrolysers, refueling stations, and hydrogen hubs, making it the favored alternative for large-scale deployment.

- The industrial segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia hydrogen energy storage market is segmented by application into residential, commercial, and industrial. Among these, the industrial segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Industrial users, such as mining, chemicals, steel, and heavy transport, require huge, continuous energy loads and low-emission fuel alternatives, resulting in larger hydrogen storage demand than the residential and commercial sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia hydrogen energy storage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pure Hydrogen

- Hazer Group

- Provaris Energy

- Fortescue

- Frontier Energy Ltd

- Elixir Energy

- Woodside Energy

- Viva Energy

- Hydrexia

- AGL Energy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, the Federal Government of Australia will host Round 2 of Hydrogen Headstart to encourage large-scale commercialisation of Australian hydrogen projects made with the aid of renewables.

- In March 2025, Trafigura announced that it would be discontinuing its work on its Port Pirie hydrogen plant (AUD 750 million proposed green hydrogen facility) due to the constraints and the challenges it faced concerning the cost of production, as well as a lack of demand for its hydrogen.

- In September 2024, Australia and Germany will host an auction for a green hydrogen supply chain that will provide Australian-produced hydrogen to the European markets for a total of AUD 660 million.

- In February 2024, the Australian and Queensland governments announced that a Townsville Renewable Hydrogen Hub had been jointly funded. The funding will go towards developing a renewable hydrogen production capability to support the industries, transport sector, and export market.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Australia hydrogen energy storage market based on the below-mentioned segments:

Australia Hydrogen Energy Storage Market, By Storage Form

- Solid

- Liquid

- Gas

Australia Hydrogen Energy Storage Market, By Application

- Residential

- Commercial

- Industrial

FAQ’s

Q: What is the Australia hydrogen energy storage market size?

A: Australia hydrogen energy storage market size is expected to grow from USD 445.7 million in 2024 to USD 855.3 million by 2035, growing at a CAGR of 6.1% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by excess electricity available for conversion into hydrogen. Accelerating growth within this industry is further enhanced by various government initiatives, including funding opportunities, decarbonisation policies, and updated national Hydrogen Strategy initiatives. Increasing demand for low-emission fuels (a product of Hydrogen) from the mining, transport, and chemical sectors is creating further opportunities for hydrogen uptake.

Q: What factors restrain the Australia hydrogen energy storage market?

A: Constraints include the high levels of capital required for producing and installing infrastructure, limited commercial-level hydrogen energy storage deployments across large geographical areas, the uncertainty of long-term demand for hydrogen energy storage solutions, and an ever-evolving regulatory environment governing the hydrogen sector.

Q: How is the market segmented by application?

A: The market is segmented into residential, commercial, and industrial.

Q: Who are the key players in the Australia hydrogen energy storage market?

A: Key companies include Pure Hydrogen, Hazer Group, Provaris Energy, Fortescue, Frontier Energy Ltd, Elixir Energy, Woodside Energy, Viva Energy, Hydrexia, and AGL Energy.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 155 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |